GS Paper 1

Health Insurance

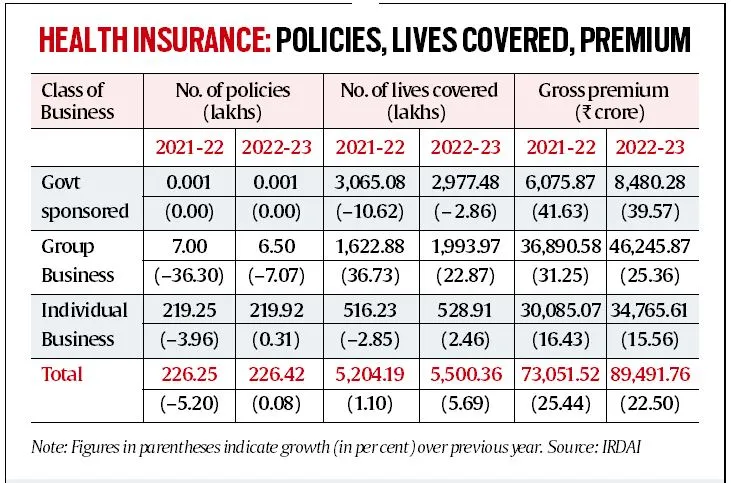

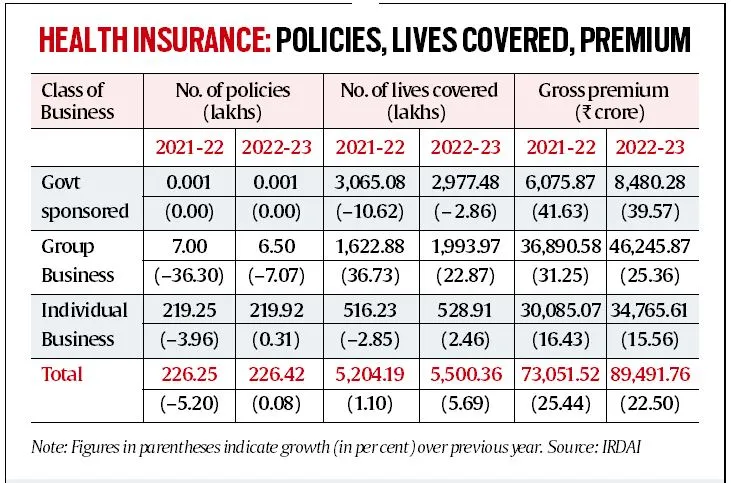

- News: No age limit to purchase health insurance from April 1.

-

- To widen access to healthcare coverage, the Insurance Regulatory and Development Authority of India (IRDAI) has removed the age cap of 65 years for individuals purchasing health insurance policies.

- IRDAI: It is a statutory body formed under the Insurance Regulatory and Development Authority Act, 1999.

- Enhanced Coverage and Accessibility:

-

- Inclusive Coverage for Pre-existing Conditions: Insurers are now mandated to provide coverage for individuals with various pre-existing medical conditions, ensuring accessibility to insurance without refusal, even for conditions like cancer or heart failure.

- Specialized Products for Diverse Demographics: Insurers have been directed to develop specialized insurance products tailored to specific demographics such as senior citizens, students, children, and maternity needs, enhancing accessibility and relevance.

- Expanded Coverage for AYUSH Treatments: Insurers are required to offer coverage for AYUSH treatments, including Ayurveda, Yoga, Naturopathy, Unani, Siddha, and Homeopathy, without imposing any caps, broadening the scope of available healthcare options.

- Importance:

- While India is presently characterized by a predominantly young population, projections indicate a significant shift, with the share of individuals aged 60 and above expected to rise to 20% by 2050.

-

- IRDAI’s directive allows insurers to create or upgrade products for comprehensive family coverage, moving away from limited plans for senior citizens.

- This change promotes inclusivity and broader insurance protection.

- These directives contribute to increasing insurance density by ensuring that individuals have access to comprehensive coverage regardless of their medical history, thereby enhancing per capita spending on insurance premiums.

Inflation: Concept, Types and Measurement | UPSC

GS Paper 2

Safeguard Measures under World Trade Organization (WTO)

- News: India and other members of the World Trade Organisation (WTO) have criticised a decision by the European Union (EU) to extend a safeguard measure on specific steel products.

- Definition:

- The WTO enables member nations to utilize temporary “safeguard” measures to safeguard specific domestic industries from unforeseen import surges causing or threatening serious harm.

- Types: These safeguard measures taken can be:

- Quantitative restrictions: Limiting the physical amount of a product that can be imported (quotas).

- Tariff increases: Raising customs duties on the imported product.

- Guiding Principles of WTO Safeguard Measures

-

-

- Temporary Nature: Safeguard measures must be temporary in nature, implying they are not intended to be permanent solutions.

- Serious Injury Requirement: These measures can only be imposed when imports are proven to cause or pose a serious threat of injury to a domestic industry that competes with the imported goods.

- Non-Selective Application: Safeguard measures are typically applied on a non-selective basis, often following the most-favored-nation (MFN) principle.

- Progressive Liberalization: There is an expectation that safeguard measures will be progressively liberalized while in effect, indicating a move towards reducing their impact over time.

- Compensation Requirement: Generally, the member imposing safeguard measures must provide compensation to other affected members, acknowledging the potential adverse effects on their trade.

- Conditions Under Which Safeguard Measures Are Applied:

-

- increased imports and

- serious injury: Significant overall impairment in the position of a domestic industry.

- Safeguard Measures Investigation Requirement: Before imposing safeguard measures, a member country must conduct an investigation to determine the presence of serious injury or a threat of serious injury to its domestic industries.

- Comparison with Other Trade Protection Measures: Safeguard measures constitute one of three primary trade protection measures available to WTO members, alongside anti-dumping and countervailing measures.

- Anti-dumping Measures: Implemented to counteract the practice of “dumping,” where a company sells its products at lower prices abroad than in its domestic market or below production costs, which is deemed unfair.

- Countervailing Measures: Imposed to offset the adverse effects of specific subsidies granted by foreign governments to their exporters.

- Absence of “Unfair” Practice Requirement: Unlike anti-dumping and countervailing measures, safeguard measures do not necessitate a finding of an “unfair” trade practice to be imposed, focusing instead on protecting domestic industries from sudden import surges.

Rashtriya Arogya Nidhi scheme

- News: The Delhi High Court recently commented that the income threshold required to qualify for benefits under the Rashtriya Arogya Nidhi (RAN) scheme appeared to be exceptionally low.

- Establishment and Nature: Established in 1997, RAN is a central sector scheme aimed at providing financial assistance to impoverished patients suffering from life-threatening diseases.

- Scope of Assistance: RAN offers one-time financial aid to patients living below the state/UT-wise poverty line, afflicted with severe illnesses like heart diseases, kidney disorders, liver ailments, cancer, etc., for treatment at Super Specialty Government hospitals/institutes.

- Notably, assistance is not extended for treatments at private healthcare facilities.

- Form of Assistance: Financial aid is disbursed solely in the form of a one-time grant under RAN, with a typical ceiling of up to Rs. 15.00 lakh per patient.

- However, a Technical Committee evaluates each case to recommend the appropriate quantum of financial aid.

- Eligibility Criteria: Employees of the Central/State Government or public sector units (PSUs) are ineligible for financial assistance.

- Moreover, diseases of a common nature or those covered by other health schemes/programs with free treatment options are not eligible for grants under RAN.

- Administration of Grants: Grants are directly disbursed to the Medical Superintendent of the hospital where the patient is undergoing treatment, rather than in the patient’s name.

- Tax Exemption and Contributions: Corporate entities in the private or public sectors, philanthropic organizations, and all contributions made to RAN are exempted from income tax under Section 80-G of the Income Tax Act, 1961.

Star Campaigners

- News: Sunita Kejriwal, wife of Delhi Chief Minister Arvind Kejriwal, was appointed as a ‘star campaigner’ by the Aam Aadmi Party (AAP) for its campaign in Gujarat.

- Legal Framework: The Representation of the People Act, 1951 (RP Act) governs expenditure regulations for ‘leaders of a political party’, commonly known as ‘star campaigners’.

- Identification and Role: Star campaigners, comprising top political party leaders and celebrities, are appointed by recognized political parties (National or State) for election campaigning.

- Appointment Limits: Recognized parties can nominate up to 40 star campaigners, while registered unrecognised parties can appoint a maximum of 20, as stipulated by the RP Act.

- Notification Protocol: Within seven days of election notification, the party must inform the Election Commission (EC) and Chief Electoral Officer (CEO) of the states about the list of star campaigners.

- Phased Election Consideration: For multi-phase elections, separate lists of star campaigners can be submitted by political parties for different election phases.

- Expense Allocation: Rally/meeting expenses are attributed to the election expenditure of candidates if star campaigners solicit votes for them or share platforms during events.

- Additionally, 50% of the star campaigner’s travel expenses are allocated to accompanying candidates.

- Prime Minister’s Role: Security expenses, including bullet-proof vehicles, for a Prime Minister or former Prime Minister serving as a star campaigner are covered by the government.

- However, if accompanied by another star campaigner, 50% of the security expenditure is borne by the candidate.

GS Paper 3

Geofencing

- News: Indian railways removes outer limit geo-fencing restrictions for paperless ticket booking.

- Understanding Geofencing Technology

- Creating Virtual Perimeters: Geofencing entails leveraging technology to establish virtual boundaries, resembling digital fences, around physical locations, facilitated through specialized applications or software.

- Utilizing Device Location Tracking: Geofencing applications or software rely on the GPS, Wi-Fi, or cellular data of devices to monitor their locations accurately, enabling the creation and management of digital geofences.

- Triggering Pre-programmed Actions: Upon the entry or exit of a device from the defined digital geofence, predetermined actions are automatically initiated by the geofencing system, facilitating various functionalities and responses.

- Common Applications of Geofencing

- Marketing Strategies: Geofencing is utilized by businesses to target consumers by sending tailored promotional offers or discount coupons when they enter specific geofenced areas, such as shopping centers.

- Enhanced Parental Controls: Parents employ geofencing to establish virtual perimeters around potentially hazardous locations, enabling them to receive alerts if their child’s device enters these areas, thus bolstering safety measures.

- Security and Access Management: Geofencing serves as a robust security measure to regulate access, allowing only authorized devices and personnel within designated areas, thereby enhancing overall security protocols.

50th year of Aryabhata Launch

- News: ISRO celebrated Satellite Technology Day (STD) to commemorate the 50th year of the Aryabhata Launch in 1975.

- Introduction: Aryabhata, India’s inaugural satellite, was named after the renowned Indian astronomer from the 5th century.

- Development and Launch: Constructed by ISRO, Aryabhata was launched into space aboard a Soviet Kosmos-3M rocket from Kapustin Yar, Russia.

- Scientific Objectives: The primary goals of Aryabhata were to conduct experiments in X-ray astronomy, aeronomy, and solar physics, marking India’s entry into space research.

- Operational Challenges: Unfortunately, Aryabhata’s mission was cut short by a power failure, which halted experiments after only four days in orbit. All communication signals were lost after five days of operation.

- Conclusion and Legacy: Despite its brief operational lifespan, Aryabhata’s pioneering mission laid the groundwork for the advancement of satellite technology and launch vehicles in India, setting the stage for future space exploration endeavors.

Inheritance Tax

- News: Inheritance tax has become a polarising topic in this Lok Sabha campaign.

- Understanding Inheritance Tax

- Definition and Purpose: Also known as estate tax, it is a levy imposed on the total value of money and property of a deceased person before distribution to their legal heirs.

- Its primary aims include generating revenue for the government and redistributing wealth within society.

- Advocates’ Perspective: Proponents view it as a way to prevent perpetual concentrations of wealth, fostering greater economic equity.

- Challenges and Criticisms:

-

-

- Opponents argue that inheritance tax amounts to double taxation since the assets were accumulated with after-tax income.

- Concerns also arise regarding:

- the potential exodus of high net worth individuals to countries without this tax,

- the establishment of family trusts to bypass taxation, and

- difficulties in assessing the value of inherited assets like family antiques.

- Global Variations in Inheritance Tax Rates

-

- Japan: Boasts one of the highest inheritance tax rates globally, standing at 55%.

- South Korea: Follows closely behind with a rate of 50%.

- France: Imposes an inheritance tax rate of 45%.

- United Kingdom and the United States: Both countries levy a rate of 40% on inherited wealth.

- India: Inheritance or Estate Tax was abolished in 1985, distinguishing it from several other nations with active inheritance tax systems.

Crystal Maze 2

- News: India’s Strategic Forces Command has successfully tested a new model of its Medium-Range Ballistic Missile, Crystal Maze 2.

- Origin: Also known as ROCKS, Crystal Maze 2 is an air-launched medium-range ballistic missile developed in Israel.

- Targeting High-Value Assets: Designed with precision, it aims to engage high-value stationary and relocatable assets, including long-range radars and air defense systems, belonging to potential adversaries.

- Operational Range: With a capability to strike targets over 250 kilometers away, Crystal Maze 2 poses a significant threat to enemy installations and strategic assets.

Compulsory Convertible Debentures (CCD)

- News: Compulsorily Convertible Debentures (CCDs), a hybrid instrument, has gained prominence in the last two decades.

- Understanding Convertible Cumulative Preference Shares (CCDs)

-

- Debt Instruments with Conversion Option: CCDs are initially structured as debt instruments, offering the option to convert into equity at a predetermined time or upon the occurrence of specified event(s).

- Long-Term Fundraising Tool for Companies: Often utilized by companies to secure long-term funds, CCDs allow them to raise capital without immediate dilution of equity ownership among existing investors.

- Benefits for Investors: Investors in CCDs receive fixed interest rate payments until the conversion date, ensuring a steady income stream until potential equity conversion occurs.