GS Paper 1

Student Suicides in India

- News: Several recent student suicides in premier institutes have pointed to an underlying problem of student suicide that requires attention.

- Student Suicides in Higher Institutions:

-

- Student Suicides at Indian Institutes of Technology (IITs): In 2024, five student suicides have already been reported across various IIT campuses, including two at the Kanpur campus, and one each at Delhi, BHU, and Roorkee.

- This follows a trend of incidents in recent years.

- Suicide Trends in Central Educational Institutes: 98 student suicides were recorded in IITs, NITs, IIITs, IIMs, and IISERs, over the past five years.

- This data underscores the severity of the issue across a spectrum of institutions.

- Socioeconomic Factors and Student Suicides: Recent statistics presented by the Ministry of Education in Lok Sabha indicate that nearly half of the students who died by suicide in IITs since 2018 belonged to the SC, ST, and OBC communities.

- This highlights the intersection of socioeconomic factors and mental health challenges within educational settings.

- Student Suicides at Indian Institutes of Technology (IITs): In 2024, five student suicides have already been reported across various IIT campuses, including two at the Kanpur campus, and one each at Delhi, BHU, and Roorkee.

-

- Reasons behind Student Suicides:

-

- Academic Pressure: The intense competition and rigorous academic demands prevalent in institutes such as IITs are significant contributing factors to the challenges faced by students.

- Social Issues: Students from disadvantaged socioeconomic backgrounds or lower castes often face ostracism and alienation, exacerbating their mental health challenges.

- Challenges in Stream Changes and Internal Assessments: Students encounter additional pressure to change streams after their first year, with internal assessments serving as a determinant factor.

- Failure to qualify adds to the existing academic stress, further straining students’ mental well-being.

- Lack of Supportive Infrastructure: Despite the overwhelming pressure, IITs lack adequate support structures to address students’ mental health needs.

- The absence of proper counselling centers and limited opportunities for extracurricular activities deprive students of outlets to alleviate stress and foster holistic well-being.

- Escalation of Pressure: Without adequate avenues to release pressure, students find themselves overwhelmed by the cumulative effects of academic stress and social challenges.

- The absence of effective coping mechanisms exacerbates the risk of burnout and disillusionment among students.

-

- Initiatives For Addressing the Issue of Student Suicides At Central Educational Institutes:

-

- MANODARPAN: It is an initiative by the Government of India initiative. It provides psychological support to students, teachers and families for mental and emotional well-being.

-

- National Education Policy (NEP) 2020: The National Education Policy (NEP) 2020 provisions for counselling systems for handling stress and emotional adjustments in Institutions.

-

-

- It also provides opportunities for student’s participation in sports, culture/arts clubs, eco-clubs, activity clubs, community service projects, etc.

-

-

- Academic Progress Group (APG): It has been formed at IIT Delhi.

-

-

- The APG has so far identified 192 undergraduate students at the institute as “academically adrift”, emphasising that these students need academic help.

- In exceptional cases, students have been allowed to stay with a family member on campus, promoting emotional support.

-

-

- Mental Health Well-Being Initiatives: IIT-Madras, which has already seen four student suicides in 2023, started a series of wellness sessions for its students recently.

- UGC Guidelines: The UGC has also issued guidelines for the promotion of physical fitness, sports, student’s health, welfare, psychological and emotional well-being at HEIs (higher educational institutes).

Oceanic Niño Index

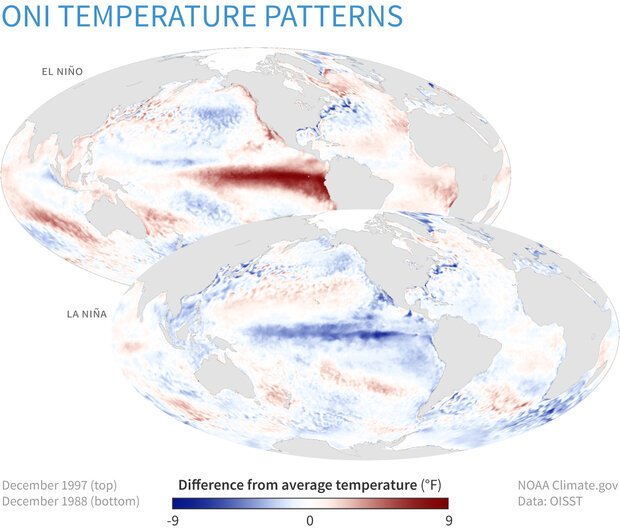

- News: According to forecasts from the US National Oceanic and Atmospheric Administration (NOAA), there is a strong likelihood, around 83%, that the Oceanic Niño Index (ONI) will transition to a neutral phase by April-June 2024. Consequently, it is anticipated that there won’t be an El Niño event occurring, as the ONI shifts into this neutral range.

- Oceanic Niño Index (ONI):

- It is NOAA’s primary index for tracking the ocean part of ENSO, the El Niño-Southern Oscillation climate pattern.

- It tracks the running 3-month average sea surface temperatures in the east-central tropical Pacific between 120°-170°W, near the International Dateline, and whether they are warmer or cooler than average.

- Index values of +0.5 or higher indicate El Niño.

- Values of -0.5 or lower indicate La Niña.

- El Niño:

- It brings warmer-than-average waters to the central and eastern tropical Pacific, sometimes all the way to the coast of South America.

- At the surface, the prevailing easterlies (the trade winds) slow down, or sometimes even reverse.

- Over the warm waters in the central-east tropical Pacific, rainfall increases, but it decreases over Indonesia and the western Pacific.

- La Niña:

- It brings cooler-than-average waters to the central and eastern tropical Pacific, again, sometimes all the way to South America.

- The prevailing easterlies (the trade winds) intensify over the cooler-than-average waters of the central-east tropical Pacific, rainfall decreases, but it increases over Indonesia and the western Pacific.

- El Niño and La Niña, both can have global effects on weather, wildfires, ecosystems and economics.

GS Paper 2

Digital Competition Law in India: Need and Concerns

- Introduction:

- The Competition Act of 2002 “intervenes after the occurrence of an anti-competitive conduct.”

- Such a framework was designed at a time when the extent and pace of digitalisation as is witnessed today could not be foreseen.

- The large digital enterprises and their concerned business models have prompted different anti-competitive concerns which have been brought forth before the Competition Commission of India (CCI).

- In this context, a Committee on Digital Competition Law, headed by the Secretary to the Ministry of Corporate Affairs, was appointed to regulate the market power of Big Tech firms like Google and Meta.

- The Committee recently submitted its report recommending the creation of a new law, the Digital Competition Act.

- The aim of the Act would be to address anti-competitive practices by pre-identified large digital enterprises i.e., Big Techs, with significant presence to proactively monitor their behaviour in the market.

- The Committee’s recommendations are largely modelled on the EU’s Digital Markets Act, with some India specific variations

- How Big Techs abuse their dominant position: The prevalence of anti-competitive practices among Big Tech companies underscores the necessity for the implementation of Digital Competition Law.

- Predatory Pricing: Selling goods or services below cost to drive competitors out of the market. Example: Amazon offering products at a loss to undercut local retailers.

- Exclusive Contracts: Imposing agreements that prevent suppliers from dealing with competitors. Example: Google requiring smartphone manufacturers to pre-install Google apps.

- Data Hoarding: Accumulating vast amounts of user data to maintain market dominance and hinder competition. Example: Facebook’s acquisition of WhatsApp and Instagram to consolidate user data.

- Algorithmic Bias: Manipulating algorithms to favour the company’s products or services over competitors’. Example: Google displaying its own services prominently in search results.

- Tying and Bundling: Forcing customers to purchase unwanted products or services along with the desired one. Example: Microsoft bundling Internet Explorer with Windows OS.

- Exclusionary Practices: Preventing competitors from accessing necessary resources or distribution channels. Example: Apple restricting third-party app stores on iOS devices.

- Collusive Behavior: Illegally collaborating with competitors to fix prices or divide markets. Example: Allegations of price-fixing among e-commerce platforms.

- Acquisition of Potential Competitors: Buying out potential rivals to maintain market dominance. Example: Facebook’s acquisition of emerging social media platforms like Instagram and WhatsApp.

- Interoperability Barriers: Creating products or services that are incompatible with competitors’ offerings. Example: Microsoft’s proprietary document formats limiting compatibility with other software.

- Restrictive Terms of Service: Imposing unfair terms that inhibit users’ ability to switch to competitors. Example: Social media platforms restricting users’ ability to export their data to other platforms.

- How BIG digital enterprises swiftly gain influence: The Committee noted that certain features of digital markets allow BIG digital enterprises to swiftly gain influence. These features include:

- (i) collection of user data which can allow large incumbent enterprises to enter related markets,

- (ii) network effects where utility of a service increases when number of users consuming the service increases, and

- (iii) economies of scale wherein incumbents can offer digital services at lower costs as compared to new entrants.

- Need for ex-ante regulation of digital competition:

- The Committee noted that the current ex-post framework (intervening after an event occurs) under the Competition Act, 2002, does not facilitate timely redressal of anti-competitive conduct by digital enterprises.

- It observed that the present framework may not be effective to address the irreversible tipping of markets in favour of large digital enterprises (permanent dominance of a firm in relevant market).

- The Committee recommended enacting the Digital Competition Act to enable the CCI to selectively regulate large digital enterprises in an ex-ante manner (intervening before an event occurs).

- The Committee found that the ex-post model of regulation under the current Competition Act, by design, involves fact-finding and inquiry processes which are time-consuming and hinder early detection and redressal.

- The proposed legislation should regulate only those enterprises that have a significant presence and the ability to influence the Indian digital market.

- Systemically Significant Digital Enterprises (SSDEs):

- The Committee recommended that India must identify the leading players in digital markets, to be categorised as Systemically Significant Digital Enterprises (SSDEs), that can negatively influence competitive conduct.

- To identify SSDEs, the Committee recommended the use of both quantitative (financial strength, number of business and end users of the core digital service in India) as well as qualitative (resources of the enterprise and volume of data aggregated by them) criteria.

- These SSDEs should annually submit a report to the Competition Commission of India (CCI) detailing the measures taken to comply with various mandatory obligations.

- Obligations of SSDEs:

- The draft Digital Competition Bill, 2024, as recommended by the Committee, prohibits SSDEs from carrying out certain practices. These include:

- (i) favouring their own products and services or those of related parties,

- (ii) use non-public data of business users operating on their core digital service to compete with those users,

- (iii) restrict users from using third-party applications on their core digital services, and

- (iv) requiring or incentivising users of an identified core digital service to use other products or services offered by the SSDE.

- Regulations may allow differential obligations for different SSDEs and ADEs based on factors like business models and user base.

- Enforcement of provisions:

- The draft Bill empowers the Director General, appointed under the 2002 Act, to investigate any contraventions when directed by the CCI.

- The Committee recommended that CCI should bolster its technical capacity including within the Director General’s office for early detection and disposal of cases.

- It also recommended constituting a separate bench of the National Company Law Appellate Tribunal for timely disposal of appeals.

- Penalties:

- The Committee recommended that contraventions under the draft Bill should be addressed by imposing civil penalties.

- For calculating the ceiling on penalties, the Committee recommended the use of global turnover of enterprises.

- The Committee also recommended capping the penalty at 10% of global turnover of SSDEs.

- Benefits of the proposed Digital Competition Act: Implementing a Digital Competition Act in India can offer several benefits in addressing the dominance of Big Tech companies:

- Creating a Level Playing Field: The act can establish clear guidelines and regulations to prevent anti-competitive behavior, ensuring fair competition for all players in the digital market.

- Promoting Innovation: By fostering a competitive environment, the act can encourage innovation among both large tech firms and smaller startups, leading to the development of new technologies and services.

- Protecting Consumers: Regulations under the act can safeguard consumer interests by preventing monopolistic practices that may lead to higher prices, limited choices, and compromised data privacy.

- Enforcing Accountability: The act can empower regulatory authorities to enforce compliance and hold Big Tech companies accountable for any violations, promoting ethical business practices and corporate responsibility.

- Concerns of such regulations: While a Digital Competition Act in India holds promise for regulating the behaviour of Big Tech companies and promoting fair competition, there are several concerns associated with its implementation:

- Impact on Investment: Some argue that stringent regulations may deter investment in the digital economy, as companies may perceive India as a less attractive market due to regulatory burdens.

- Enforcement Challenges: Implementing and enforcing a Digital Competition Act effectively may pose significant challenges, particularly given the complexity of digital markets and the rapid pace of technological change.

- Unintended Consequences: Such ex ante regulation could potentially stifle innovation by imposing burdensome regulations on tech companies. This could lead to unintended consequences, such as reduced consumer choice and higher prices.

- Way forward on the Digital Competition Act: The way forward on the Digital Competition Act in India should involve a balanced approach that addresses the benefits of regulation while mitigating the associated concerns. Here are some steps that could be taken:

- Stakeholder Consultation: Engage in extensive consultation with stakeholders, including industry representatives, consumer advocacy groups, legal experts, and academia, to gather diverse perspectives and insights on the proposed regulations.

- Impact Assessment: Conduct a thorough impact assessment to evaluate the potential effects of the Digital Competition Act on innovation, investment, market dynamics, consumer welfare, and global competitiveness.

- Capacity Building: Invest in building the capacity of regulatory authorities responsible for enforcing the Digital Competition Act, including providing training, resources, and expertise to effectively address complex issues in digital markets.

GS Paper 3

Monetary Policy in India

- News: The Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) recently announced the first monetary policy of the financial year 2024-25.

- The RBI decided to keep the key policy repo rate unchanged at 6.5% for the seventh consecutive time.

- The six-member MPC headed by Governor Das also decided to maintain the policy stance at ‘withdrawal of accommodation’.

- The monetary policy committee (MPC) is continuing with the “withdrawal of accommodation” stance since the headline inflation is not at the 4 per cent target and it wants to focus on disinflation.

- This policy stance “withdrawal of accommodation” means that the country’s financial system will resort to reducing the money supply, which will rein in inflation further.

- What is monetary policy and how is it different from fiscal policy?

- Monetary policy is the process of regulating either the cost of borrowing (typically of very short-term borrowing) or the money supply in an economy by the monetary authority, usually a central bank like the RBI in India.

- By contrast, fiscal policy refers to the government’s decisions about taxation and spending.

- While fiscal policy involves a trade-off between output stabilisation and distortions from tax and spending changes, monetary policy involves a trade-off between price and output stability.

- What are the goals of monetary policy?

- Both monetary and fiscal policies are used to regulate economic activity over time. The overarching goal of both monetary and fiscal policy is normally the creation of an economic environment where growth is stable and positive and inflation is stable and low.

- In addition, fiscal policy can be used to redistribute income and wealth.

- Conventionally, monetary policy aims at targeting the:

- desired level of output (and thereby the rate of growth) in the economy,

- maintenance of a stable price level and

- management of exchange rate (or the balance of payments).

- Both monetary and fiscal policies are used to regulate economic activity over time. The overarching goal of both monetary and fiscal policy is normally the creation of an economic environment where growth is stable and positive and inflation is stable and low.

- Which authority is responsible for conducting monetary policy in India?

- Under the Reserve Bank of India Act,1934, RBI is entrusted with the responsibility of conducting monetary policy in India with the primary objective of maintaining price stability (inflation target) while keeping in mind the objective of growth.

- Monetary Policy Committee (MPC)

- The RBI Act provides for the constitution of a six-member Monetary Policy Committee (MPC) to determine the policy rate required to achieve the inflation target with the following members:

- Governor of the Reserve Bank of India—Chairperson, ex officio;

- Deputy Governor of the Reserve Bank of India, in charge of Monetary Policy—Member, ex officio;

- One officer of the Reserve Bank of India to be nominated by the Central Board—Member, ex officio;

- Three independent members, experts in the field of economics, banking or finance, to be selected by the Government, will hold office for a period of four years or until further orders, whichever is earlier.

- The MPC is required to meet at least four times in a year and the quorum for the meeting of the MPC is four members.

- Each member of the MPC has one vote, and in the event of an equality of votes, the Governor of RBI has a second or casting vote.

- Functions of MPC

- MPC determines the benchmark policy interest rate (repo rate) required to achieve the inflation target.

- Another responsibility for the RBI is to publish a Monetary Policy Report every six months, elaborating inflation forecasts and inflation sources for the next six to eighteen months.

- MPC uses ‘headline inflation’ to make its decision. Headline inflation is the raw inflation figure reported through the Consumer Price Index (CPI).

- Inflation Target

- Under the RBI Act, the Central Government, in consultation with the RBI, determines the inflation target in terms of the Consumer Price Index (CPI), once in five years.

- Accordingly, the Central Government has notified 4 per cent Consumer Price Index (CPI) inflation as the target for the period from April 1, 2021 to March 31, 2026 with the upper tolerance limit of 6 per cent and the lower tolerance limit of 2 per cent.

- Failure to Maintain Inflation Target

- The Central Government has notified the following as the factors that constitute failure to achieve the inflation target:

- the average inflation is more than the upper tolerance level of the inflation target for any three consecutive quarters; or

- the average inflation is less than the lower tolerance level for any three consecutive quarters.

- Where the Bank fails to meet the inflation target, it shall set out in a report to the Central Government:

- the reasons for failure to achieve the inflation target;

- remedial actions proposed to be taken by the Bank; and

- an estimate of the time-period within which the inflation target shall be achieved.

- What are the various stances of a monetary policy?

- The stance of a monetary policy to avert the macroeconomic instabilities includes the following:

- Easy Monetary Policy or Dovish Stance: It is a policy stance favouring low interest rates, increased liquidity and easy access to credit aimed at stimulating real economic activity.

- Such a policy action is executed during the recessionary economic episodes wherein investment and employment are below normal levels.

- Tight Monetary Policy or Hawkish Stance: It is a restrictive policy stance intended to restrict the level of effective demand by inducing higher interest rates, constraining the money supply or credit access.

- This type of policy action is usually executed during boom periods in order to cool down the economy from overheating.

- Accommodative Monetary Policy: A monetary policy action wherein the supply of money is allowed to expand in line with the demand for it.

- Withdrawal of Accommodation: This policy stance “withdrawal of accommodation” means that the country’s financial system will resort to reducing the money supply, to rein in inflation further.

- Calibrated Tightening: It means during the current rate cycle, a cut in the repo rate is off the table. But, the rate hike will happen in a calibrated manner.

- This means the central bank may not go for a rate increase in every policy meeting but the overall policy stance is tilted towards a rate hike.

- What are the instruments of monetary policy?

- To ensure a stable price level together with a sustainable growth path, the central banks adopt two kinds of instruments. These can be broadly classified as:

- Quantitative Credit Control Methods: These methods are general, or indirect and include those policies which affect the total volume of credit into the entire economy; and

- Qualitative Credit Control Methods: These methods are selective or direct and include those policies which affect credit to specific areas of the economy or a particular use of credit.

| Instruments of Monetary Policy | |

| Quantitative Methods | Qualitative Methods |

| 1. Reserve ratios

a) Cash Reserve Ratio (CRR)

b) Statutory Liquidity Ratio (SLR)

|

1. Margin Requirement

|

2. Open Market Operations (OMO)

|

2. Moral Suasion

|

| 3. Policy Rates

a) Bank Rate

b) Repo Rate (or repurchase option)

c) Reverse Repo Rate

d) Marginal Standing Facility (MSF) Rate

|

3. Credit Rationing

|

4. Publicity

|

|

5. Direct Action

|

|

-

- How contractionary (tight) monetary policy is different from expansionary (loose) monetary policy?

- Monetary policies are seen as either expansionary or contractionary depending on the level of growth or stagnation within the economy.

- Contractionary (tight) Monetary Policy

- A contractionary policy increases interest rates and limits the outstanding money supply to slow growth and decrease inflation.

- It results in the increase in the prices of goods and services and decrease in the purchasing power of money.

- Expansionary (loose) Monetary Policy

- During times of slowdown or a recession, an expansionary policy grows economic activity.

- By lowering interest rates, saving becomes less attractive, and consumer spending and borrowing increase.

- An expansionary monetary policy decreases unemployment as a higher money supply and attractive interest rates stimulate business activities and expansion of the job market.

- The exchange rates between domestic and foreign currencies can be affected by monetary policy.

- With an increase in the money supply, the domestic currency becomes cheaper than its foreign exchange.

-

- Functions of monetary policy: The monetary policy has the following functions:

- It regulates the growth rate of money supply.

- It regulates the entire banking system of the economy.

- It determines the allocation of credit among different sectors.

- It provides incentives to promote savings.

- It ensures adequate availability of credit for growth.

- It tries to achieve price stability.

- Macroeconomic impacts of monetary policy: Monetary policy is primarily concerned with the price and exchange rate stability, along with promotion of economic growth. Further, it also helps in the following.

- Promotion of Savings and Investment: By regulating the interest rates and inflationary tendencies by applying the expansionary or contractionary policy stances, MP can help to influence savings and investment.

- Regulating Imports and Exports: By extending priority loans at low interest rates, MP helps to induce export-promotion and import substitution thereby helping to enhance the external account position of the economy.

- Managing Business Cycles: The upswings (boom) and downswings (recession) of a business cycle may be regulated by applying tight policy action during boom and easy policy action during recession. It helps in averting the destabilising ramifications of business cycle fluctuations.

- Regulation of Demand Conditions: By influencing the availability of credit and its cost, monetary policy acts as an effective tool to control the demand conditions according to the economic circumstances.

- Employment Generation: By influencing the level of savings, investment and aggregate demand, MP impacts favourably on employment creation.

- Infrastructural Development: By facilitating subsidised or concessional funding to priority sectors like small-scale industries, agriculture and other credit constrained sections, MP helps in infrastructural development.

- Managing and Developing the Financial Sector: The central bank manages the banking sector in order to ensure its smooth functioning and provision of financial services far and wide across the country.

- What are the limitations of monetary policy?

- Natural calamities like droughts and floods can result in unexpected shortfall in crop production resulting in inflation because of reduced supply.

- Geo-political problems also affect the achievement of the targets of monetary policy. For example, in the on-going Russia-Ukraine war, the world has seen an unusual rise in the prices of wheat and cooking oil.

- Besides, the indiscriminate announcement of freebees by the political parties in India in order to appease the voters without any knowledge of long-term implication of their promises also affects the transmission of the monetary policy.

Funding Winter

- News: In 2023, a significant decline of over 85 % in investments from major foreign venture capital (VC) firms, such as Tiger Global, Peak XV Partners, Accel, and SoftBank, was witnessed in India, amidst the startup ecosystem experiencing a funding winter.

- Funding Winter:

- It is a term used to describe a period when start-up companies experience a decrease in the amount of money they receive.

- This phenomenon has been occurring globally since 2022 and was anticipated to persist into 2023.

- Prior to the funding winter, many start-ups could easily raise money at higher valuations.

- However, investors worldwide have now adopted a conservative approach, drawing from their past experiences and growth.

- Despite the reduced opportunities for start-ups to secure investments, those with the best business ideas, strong teams, effective management, and robust compliance measures continue to attract funds.

- Impact of Funding Winter:

- Amid the funding winter, startups adopt strategies to preserve their working capital due to minimal expectations of investor funding.

- This includes pausing advertisement expenses, capital expenditures, and expansion plans to enhance the firm’s sustainability.

- Only essential expenditures vital for the firm’s survival are pursued, and measures are implemented to minimize unnecessary expenses.

Global Hepatitis Report 2024

- News: India is among nations with highest burden of viral hepatitis as per the Global Hepatitis Report 2024.

- Viral Hepatitis:

-

- Hepatitis is often caused by a virus.

- Viral hepatitis is an infection that causes liver inflammation and damage.

- Inflammation is swelling that occurs when tissues of the body become injured or infected. Inflammation can damage organs.

-

- Types & Spread: Hepatitis A, B, C, D, and E.

-

- Hepatitis A and hepatitis E: Typically spread through contact with food or water that has been contaminated by an infected person’s stool. People may also get hepatitis E by eating undercooked pork, deer, or shellfish.

- Hepatitis B, hepatitis C, and hepatitis D: Spread through contact with an infected person’s blood.

- Hepatitis B and D may also spread through contact with other body fluids.

- This contact can occur in many ways, including sharing drug needles or having unprotected sex.

-

- Symptoms: Fever, fatigue, loss of appetite, nausea, vomiting, yellowing of the eye, abdominal pain, dark urine, light-colored stools, joint pain, and jaundice.

- Risks:

-

- The hepatitis B, C, and D viruses can cause acute and chronic, or long-lasting, infections.

- Chronic hepatitis occurs when your body isn’t able to fight off the hepatitis virus and the virus does not go away.

- Chronic hepatitis can lead to complications such as cirrhosis, liver failure, and liver cancer.

-

- Cure:

-

- Hepatitis A treatment: There is no specific therapy for acute hepatitis A infection. Therefore, prevention is the key. An effective vaccine is available and recommended for anyone with liver disease.

- Hepatitis B treatment: About 25% of people with chronic hepatitis B can be cured with a drug called pegylated interferon-alpha, which is taken as a weekly injection for six months.

- Hepatitis C treatment: There is no vaccine for hepatitis C, but it can be treated with antiviral medications.

- Hepatitis D treatment: Hepatitis D infection can be prevented by hepatitis B immunization, but treatment success rates are low.

- Hepatitis E treatment: A vaccine to prevent hepatitis E virus infection has been developed and is licensed in China but is not yet available elsewhere.

-

- Global Hepatitis Report 2024:

- It is released by the WHO.

- This is the first consolidated WHO report on viral hepatitis epidemiology, service coverage and product access, with improved data for action.

- This report presents the latest estimates on the disease burden and the coverage of essential viral hepatitis services from 187 countries across the world.

- Key Facts:

- Viral Hepatitis Burden in India: India bears a significant burden of viral hepatitis, with 2.9 crore individuals living with Hepatitis B infection and 0.55 crore living with Hepatitis C infection.

-

- In 2022 alone, over 50,000 new Hepatitis B cases and 1.4 lakh new Hepatitis C cases were reported, resulting in 1.23 lakh deaths.

-

- Transmission of Hepatitis B and Hepatitis C: These infections are primarily transmitted from mother to child during delivery, through blood transfusion without proper screening, via contact with infected blood, or through needle-sharing among drug users.

- Global Impact of Viral Hepatitis: Globally, viral hepatitis kills approximately 1.3 million people annually. The worldwide prevalence of Hepatitis B and C stands at around 304 million people.

- Diagnosis and Treatment Coverage in India: Despite the high prevalence rates, the coverage of diagnosis and treatment for viral hepatitis in India remains alarmingly low.

-

- Only 2.4% of Hepatitis B cases and 28% of Hepatitis C cases are diagnosed, with treatment rates even lower at 0% and 21% respectively.

-

- Challenges in Viral Hepatitis Control: Limited reach of the national viral hepatitis control program contribute to the poor diagnosis and treatment coverage. Despite the availability of generic drugs and diagnostics at low cost, these resources remain underutilized.

- Efforts to Address Viral Hepatitis in India: Various Indian companies produce generic versions of hepatitis drugs and diagnostics, making treatment relatively affordable.

-

- However, challenges persist in ensuring widespread access and utilization of these resources.

-

- Progress and Limitations in Healthcare: While significant progress has been made in blood safety and vaccination coverage for healthcare workers, efforts to control viral hepatitis still face limitations, highlighting the need for further improvement in diagnosis and treatment coverage.

- Viral Hepatitis Burden in India: India bears a significant burden of viral hepatitis, with 2.9 crore individuals living with Hepatitis B infection and 0.55 crore living with Hepatitis C infection.

- Way Forward for India:

- National Viral Hepatitis Control Program:

-

- The aim of the program is to combat hepatitis and achieve countrywide elimination of Hepatitis C by 2030.

- It also offers the vaccine to high-risk adults such as healthcare workers as well.

- Treatment for both Hepatitis B and C is available under the programme.

-

- Universal Immunisation Programme: The Universal Immunization Programme provides life-saving vaccines to all children across the country free of cost to protect them against Tuberculosis, Diphtheria, Pertussis, Tetanus, Polio, Hepatitis B, Pneumonia and Meningitis due to Haemophilus Influenzae type b (Hib), Measles, Rubella, Japanese Encephalitis (JE) and Rotavirus diarrhoea.

- Havisure Vaccine: A Hyderabad-based Indian Immunologicals Ltd (IIL) a wholly owned subsidiary of National Dairy Development Board (NDDB) and a leading biopharmaceutical company in India recently launched India’s first indigenously developed Hepatitis A vaccine ‘Havisure’ in Hyderabad.

- The vaccine is effective in preventing the disease and is recommended for children in routine immunization.

- It is a two-dose vaccine wherein the first dose is administered at above 12 months of age and the second dose is given at least after 6 months of the first dose.

- The vaccine is also recommended for individuals who are at risk of exposure or travel to the regions with high hepatitis A prevalence.

- People with occupational risk of infection and suffering from chronic liver diseases also need Hepatitis A vaccination.

- National Viral Hepatitis Control Program:

Electronic Trading Platforms (ETP)

- News: The Reserve Bank of India (RBI) recently raised concerns over unauthorised Electronic Trading Platforms (ETP) and asked banks to maintain vigil against such illegal activities.

- Electronic Trading Platform (ETP):

-

- Electronic Trading Platform (ETP) are electronic system, other than a recognised stock exchange, on which transactions in eligible instruments like securities, money market instruments, foreign exchange instruments, derivatives, etc. are contracted.

-

- Issues with ETP:

-

-

- Misleading advertisements of unauthorized ETPs offering forex trading facilities to Indian residents are prevalent across various platforms, including social media, search engines, Over The Top (OTT) platforms, gaming apps, and others.

- There have been instances where these ETPs engage agents personally contact unsuspecting individuals, enticing them with promises of disproportionate or exorbitant returns through forex trading or investment schemes.

- There have been reports of fraudulent activities perpetrated by such unauthorized ETPs and portals, resulting in financial losses for many residents who engage in these trading schemes.

-

- Actions Taken by RBI:

-

- In 2018, the RBI announced a framework for authorisation of electronic trading platforms (ETPs) for financial market instruments regulated by it.

- The RBI has been issuing and updating an alert list of unauthorised forex trading platforms.

CISO Deep-Dive training programme

- News: The National e-Governance Division (NeGD) in collaboration with the Ministry of Electronics and Information Technology (MeitY) has organized the 43rd Batch of Chief Information Security Officers’ (CISOs) Deep Dive Training Programme.

- CISO Deep-Dive Training Programme:

- The 43rd edition of the CISO Deep-Dive training program is scheduled from April 8th to April 12th, 2024.

- It is being hosted at the prestigious Indian Institute of Public Administration in New Delhi.

- Participants: Assam, Jammu & Kashmir, Gujarat, Kerala, Karnataka, Uttar Pradesh, Madhya Pradesh, Maharashtra, and the National Capital Territory of Delhi.

- Inaugural Session: The inaugural session of the training program witnessed the presence of senior officials from MeitY, NeGD, and the Indian Institute of Public Administration.

- Training Objectives: The training curriculum is meticulously designed to provide comprehensive insights into cyber-attacks, acquaint participants with the latest technologies in cybersecurity, and enable them to develop robust strategies to safeguard digital infrastructures.

- Focus Areas: A key focus of the program is to familiarize CISOs with legal provisions pertaining to cybersecurity.

- PPP Model: CISO training program is a flagship initiative under the Public-Private Partnership (PPP) model, fostering collaboration between the government and industry consortium.

- Cyber Surakshit Bharat Initiative:

-

- The Cyber Surakshit Bharat initiative is an initiative by MeitY.

- It aims to create awareness about cyber threats and equip CISOs and IT personnel with the necessary skills to mitigate risks effectively.

- Through this initiative, government departments are empowered to defend their digital assets against cyber-attacks and adapt to the evolving landscape of cyber threats.

Dissolved Organic Carbon (DOC)

- Definition: Dissolved organic carbon (DOC) is defined as the organic matter that is able to pass through a filter (filters generally range in size between 0.7 and 0.22 um).

- Conversely, particulate organic carbon (POC) is that carbon that is too large and is filtered out of a sample.

- Importance:

-

- Dissolved and particulate organic carbon are important components in the carbon cycle and serve as a primary food sources for aquatic food webs.

- In addition, DOC alters aquatic ecosystem chemistries by contributing to acidification in low-alkalinity, weakly buffered, freshwater systems.

- DOC forms complexes with trace metals, creating water-soluble complexes which can be transported and taken up by organisms.

- Organic carbon, as well as other dissolved and particulate matter, can affect light penetration in aquatic ecosystems, which is important for the ecosystem’s phototrophs that need light to subsist.

NBFCs’ Co-Lending Book

- News: CRISIL Ratings anticipates that the co-lending book of non-banking finance companies (NBFCs) will surpass Rs one lakh crore by June 2024, driven by interest from partner banks and the advantages of funding access and diversification five years after its launch.

- Co Lending:

- Co-lending or co-origination is a set-up where banks and non-banks enter into an arrangement for the joint contribution of credit for priority sector lending.

- Introduction of Co-Origination Framework: In 2018, the Reserve Bank of India (RBI) introduced the co-origination framework, allowing collaboration between banks and NBFCs to co-originate loans.

- Transition to Co-Lending Models (CLM): The guidelines were amended in 2020, leading to the rechristening of the framework as co-lending models (CLM), which also included Housing Finance Companies and featured some alterations.

- Objectives and Mechanisms:

- Objective of CLM: The primary aim of the CLM is to enhance the accessibility of credit to the unserved and underserved segments of the economy at a reasonable cost.

- Joint Origination Process: Under the CLM, banks and NBFCs engage in joint origination, with NBFCs serving as the single point of interface for customers. Tripartite agreements are established between customers, banks, and NBFCs.

- Potential for Credit Delivery: Executed effectively, the co-lending model has the potential to facilitate credit delivery to underserved segments such as small and medium businesses, lower and middle-income groups, and rural areas.

- NBFC (Non-Banking Financial Company):

- Definition: An NBFC (Non-Banking Financial Company) is a financial institution that provides financial services similar to banks but does not hold a banking license.

- Aim: NBFCs play an important role in the economy by providing credit and other financial services to parties usually not served by traditional banks.

- The concept of an NBFC emerged in the early 1960s when the financial needs of the population were not being met by traditional banks.

- Example: Investment banks, mortgage lenders, money market funds, insurance companies, hedge funds, private equity funds, and P2P lenders are all examples of NBFCs.

- Regulation:

-

- NBFCs are regulated by the Reserve Bank of India (RBI), the central bank of India.

- The RBI has the authority to issue licenses to NBFCs, regulate their operations, and ensure that they adhere to the established norms and regulations.

-

- Difference between banks & NBFCs:

-

- NBFC cannot accept demand deposits;

- NBFCs do not form part of the payment and settlement system and cannot issue cheques drawn on itself;

- Deposit insurance facility of Deposit Insurance and Credit Guarantee Corporation is not available to depositors of NBFCs, unlike in case of banks.

Facts for Prelims

Glycaemic Index (GI)

- News: The findings of an international study suggest that consuming low glycaemic index and low glycaemic load diets might prevent the development of type 2 diabetes.

- Glycaemic Index (GI):

- The glycaemic index (GI) is a rating system for foods containing carbohydrates.

- It shows how quickly each food affects your blood sugar (glucose) level when that food is eaten on its own.

- High GI foods: Carbohydrate foods that are broken down quickly by the body and cause a rapid increase in blood glucose have a high GI rating. Some high GI foods are:

- sugar and sugary foods

- sugary soft drinks

- white bread

- potatoes

- white rice

- Low and medium GI foods: Low or medium GI foods are broken down more slowly and cause a gradual rise in blood sugar levels over time. Some examples are:

- some fruit and vegetables

- pulses

- wholegrain foods, such as porridge oats

- Findings in the Study:

-

- Individuals with the highest intake of Glycemic Load (GL) experienced elevated risks of diabetes compared to those with the lowest intake.

- The association between glycemic index (GI) and diabetes risk was particularly pronounced among individuals with higher body mass indexes (BMIs).