GS Paper 2

Simultaneous Elections: Arguments in Favour and Against Them

Context: The Law Commission may submit its report on simultaneous elections to the government next week in which it could recommend adding a new chapter to the Constitution on “one nation, one election” and holding the gigantic democratic exercise for Lok Sabha, State Assemblies and local bodies across the country by mid-2029.

| Relevance:

· Prelims: Elections in Polity · Mains: Parliament and State Legislatures |

Analysis

What are Simultaneous Polls?

- The terms of Legislative Assemblies and the Lok Sabha may not synchronise with one another.

- Currently, elections to the state assemblies and the Lok Sabha are held separately — that is whenever the incumbent government’s five-year term ends or whenever it is dissolved due to various reasons.

- But the idea of “One Nation, One Election” envisages a system where elections to all states and the Lok Sabha will have to be held simultaneously.

- This would mean that the voters will cast their vote for electing members of the LS and the state assemblies on a single day.

Background

- The first general elections to Lok Sabha and all State Legislative Assemblies were held together in 1951-52. That practice continued over three subsequent general elections held in the years- 1957, 1962 and 1967.

- However, due to the premature dissolution of some Legislative Assemblies in 1968 and 1969, the cycle got disrupted for the first time.

- After 1967, elections to State Assemblies and Parliament have been held separately.

Adverse Impacts of the Existing Electoral Cycle

- Impact on development programs and governance due to imposition of Model Code of Conduct by the Election Commission.

- Frequent elections lead to massive expenditures by Government and other stakeholders.

- It disrupts normal public life.

- It can perpetuate caste, religion and communal issues across the country.

- Engagement of security forces for significantly prolonged periods.

- Frequent elections adversely impact the focus of governance and policy making.

Why do Some Support?

- Simultaneous polls will reduce enormous costs involved in separate elections.

- The system will help ruling parties focus on governance instead of being constantly in election mode.

- Simultaneous polls will boost voter turnout.

What are the Arguments Against it?

- National and state issues are different, and holding simultaneous elections is likely to affect the judgment of voters.

- Since elections will be held once in five years, it will reduce the government’s accountability to the people. Repeated elections keep legislators on their toes and increases accountability.

- When an election in a State is postponed until the synchronised phase, President’s rule will have to be imposed in the interim period in that state. This will be a blow to democracy and federalism.

- Impact to voter behaviour: Indian voters are not mature / informed enough to differentiate between the voting choices for State Assembly and Lok Sabha in case simultaneous elections are held.

- As a result, voter behaviour gets influenced and he/she may vote for the same political party, which in most cases may be larger national parties.

Duties of Election Commission of India

- It is mandated to conduct elections for State Assemblies, Legislative Council, Lok Sabha, Rajya Sabha, President, Vice-President.

- Also, Enumeration of votes, verification of voters’ list and delimitation of constituencies is undertaken by Election Commission of India.

Key Draft Recommendations of the Law Commission

- The Law Commission of India (Chairman: Justice B.S. Chauhan) in its draft report on Simultaneous Elections noted that simultaneous elections cannot be held within the existing framework of the Constitution.

- Simultaneous elections may be conducted to Lok Sabha and state Legislative Assemblies through appropriate amendments to the Constitution, the Representation of the People Act 1951, and the Rules of Procedure of Lok Sabha and State Assemblies.

- The Commission also suggested that at least 50% of the states should ratify the constitutional amendments.

- The Commission noted that holding simultaneous elections will:

-

- save public money,

- reduce burden on the administrative setup and security forces,

- ensure timely implementation of government policies, and

- ensure that the administrative machinery is engaged in development activities rather than electioneering.

Immediate Challenges to Simultaneous Elections and Their Remedies

No-Confidence Motion

- The Commission noted that a no-confidence motion, if passed, may curtail the term of Lok Sabha/ state assembly.

- It recommended replacing the ‘no-confidence motion’ with a ‘constructive vote of no-confidence’, through appropriate amendments.

- In a constructive vote of no confidence, the government may only be removed if there is confidence in an alternate government.

- It further suggested the option of limiting the number of such motions during the term of the House/ Assembly.

Hung House/ Assembly

- If no party secures a majority to form the government, it may result in a hung House/ Assembly.

- In order to prevent this, the Commission recommended that the President/ Governor should give an opportunity to the largest party along with their pre or post-poll alliance to form the government.

- If the government can still not be formed, an all-party meeting may be called to resolve the stalemate. If this fails, mid-term elections may be held.

- The Commission recommended that appropriate amendments be made to provide that any new Lok Sabha/Assembly formed after mid-term elections, will be constituted only for the remainder of the previous term, and not the entire five years.

Amendment to Anti-Defection Laws

- The Commission recommended that appropriate amendments be made to anti-defection laws to ensure that all disqualification issues (arising from defection) are decided by the presiding officer within six months.

Read also: What is the difference between IAS and the IPS/IFS/ IRS?

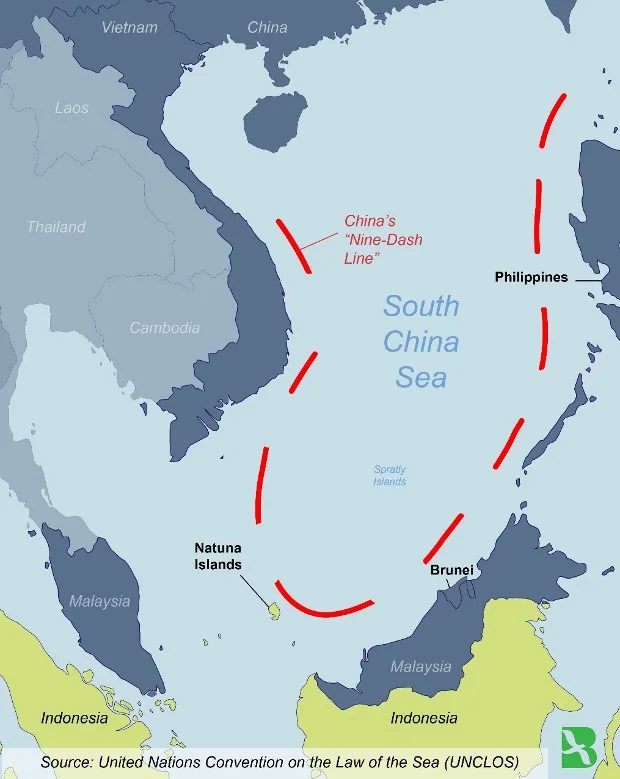

Philippine and Chinese Vessels Collide in Disputed South China Sea

Context: The coast guard vessels of the Philippine and Chinese navies collided in disputed South China Sea near Second Thomas Shoal.

The shoal has been the site of several tense skirmishes between Chinese and Philippine coast guard ships last year.

| Relevance:

· Prelims: Locations in Geography · Mains: International Relations |

Analysis

- Different parts of South China Sea are claimed by China, Taiwan, Vietnam, the Philippines, Malaysia, and Brunei.

- China’s claim to the South China Sea is based in history, dating back to records from the Xia and Han dynasties.

- Nine-dash line is the boundary of the South China Sea as claimed by China.

Why does China Want to Control the South China Sea?

- Control of the South China Sea would allow China to dominate a major trade route through which most of its imported oil flows.

- The floor of the South China Sea may contain massive oil and natural gas reserves.

- Sovereignty over the region could give China a level of energy security and independence far beyond what it currently possesses.

The Permanent Court of Arbitration (PCA) Award Against China

- The Philippines invoked the dispute settlement mechanism of the UN Convention on the Law of the Sea (UNCLOS) in 2013 to test the legality of China’s ‘nine-dash line’ regarding the disputed Spratlys.

- In response, the Permanent Court of Arbitration (PCA) at The Hague decreed in its July 2016 judgment that the line had “no legal basis.”

- The PCA award held that none of the features of the Spratlys qualified them as islands, and there was no legal basis for China to claim historic rights and to the resources within the ‘nine-dash line’.

- The UNCLOS provides that islands must sustain habitation and the capacity for non-extractive economic activity.

- Reefs and shoals that are unable to do so are considered low-tide elevations.

- China dismissed the judgment as “null and void.”

Right of Innocent Passage

- Under international law, the ships of all states enjoy the right of innocent passage through the territorial sea.

- By engaging in innocent passage without giving prior notification, the U.S. challenged these unlawful restrictions imposed by China in the South China Sea.

- The United States has rejected Beijing’s claims in the waters surrounding Vanguard Bank off Vietnam, Lucania and James Shoals off Malaysia, waters considered in Brunei’s exclusive economic zone and Natuna Besar off Indonesia.

- The United States contends that the South China Sea is international water, and sovereignty in the area should be determined by the United Nations Convention on Laws of the Sea (UNCLOS).

- UNCLOS states that countries can’t claim sovereignty over any land masses that are submerged at high tide, or that were previously submerged but have been raised above high tide level by construction.

- The United States, however, is one of the few countries that is not part of the UN Convention on the Law of the Sea, with conservatives opposing any loss of autonomy to a global body.

- The United Nations Convention on the Law of the Sea has been signed and ratified by China.

Indonesia and South China Sea dispute

- Indonesian in 2017 renamed the waters northeast of the Natuna Islands, at the far southern end of the South China Sea, the ‘North Natuna Sea’.

- Indonesia said that it wes not renaming the entire South China Sea, only the part that falls under their claimed exclusive economic zone.

- That exclusive economic zone (EEZ), however, overlaps with China’s infamous nine-dash line.

Some disputed islands in South China Sea that are frequently in news:

- Spratly Islands

- Thomas Shoal

- Woody Islands

- Paracel Islands (claimed by China, Taiwan and Vietnam)

Kuril Islands

- These islands are controlled by Russia and claimed by Japan.

- The dispute over this volcano-intensive archipelago of 56 islands is the primary reason Japan and Russia have never signed a peace treaty to formalize the end of World War II.

- At the end of the war, the Soviet Union invaded the Kuril Islands, some of which Imperial Russia had previously controlled.

- While the transfer of the islands to the Soviet Union was included in the Yalta agreements, Japan continued to claim historical rights to the southern-most islands.

- Note: Ties between China and Japan have been strained by a territorial row over a group of islands, known as the Senkaku islands in Japan and the Diaoyu islands in China located in the East China Sea.

GS Paper 3

Masala Bonds: Definition, Issuance, Benefits, and Concerns

Context: The Enforcement Directorate (ED) has issued fresh summons in connection with the issue of masala bonds by the Kerala Infrastructure Investment Fund Board (KIIFB).

| Relevance:

· Prelims: Foreign Exchange Market in Economy · Mains: Indian Economy and related issues |

What is a Bond?

- A bond is a fixed-income instrument that represents a loan made by an investor to a borrower (typically corporate or governmental).

- A bond is referred to as a fixed-income instrument since bonds traditionally paid a fixed interest rate to debt-holders.

What are Masala Bonds?

- Masala bonds are rupee-denominated bonds issued by Indian corporates to raise money from overseas investors and settled in US dollars.

- The peculiarity of rupee denominated bond is that buying of bonds, interest payments and repayment all are expressed in rupees.

- All payments are converted into corresponding dollar values at the time of payment. Thus, the bonds are issued in rupee terms and the interest and principal repayment happens in dollar terms based on the current exchange (conversion) rate.

- The term ‘Masala Bond’ is also used to describe ‘rupee denominated’ ever since the first issuer of rupee-denominated bonds used the name Masala Bonds in its first issue.

- RBI in its August 2016 regulations also used this name.

- One of the objectives to issue Masala Bonds is to internationalise the Indian currency; others being to fund infrastructure projects in India and to fuel internal growth through borrowings.

- Any corporate or body corporate in India can raise money abroad through Masala Bonds. Such bonds should have a minimum tenure of 5 years.

Conventional Foreign Currency Denominated Bonds Vs. Masala Bonds

- In the case of a traditional foreign currency bond issued by an Indian entity, the exchange rate risk is with the Indian issuer. In case of Masala Bonds, the risk should be borne by the foreign investor.

Why the Masala Bonds are attractive for foreign investors?

- For the foreign investor, the rupee denominated bonds are attractive as they will give him higher interest rate compared to the standard interest rate prevailing in their markets.

- On an average, the rupee denominated bonds have an interest rate of 2 to 3 % higher compared to the standard LIBOR (London Interbank Offer Rate).

- An additional benefit of rupee denominated bonds is that it will encourage foreign buyers to deal more in rupees (and products that help them to reduce exchange rate risks). Hence, internationalization of rupee can be promoted by rupee denominated bonds.

RBI Norms for Masala Bonds

- The International Finance Corporation (IFC) – a World Bank affiliate, is the first major issuer of rupee denominated bonds in the name tag of ‘Masala Bonds’.

- Later, in September 2015, the RBI came out with detailed regulatory guidelines for the issue of rupee denominated bonds.

- As per the RBI’s regulation on Masala Bonds, the money was to be used only for infrastructure financing purposes.

- In August 2016, the RBI allowed banks to issue Masala Bonds to procure money to meet their capital needs and to collect fund to finance infrastructure projects.

- The overall guidelines for rupee denominated bonds will be same as that for External Commercial Borrowings.

- Masala Bonds should have a minimum maturity of five years, and there is a $750 million per year limit for borrowers which can be exceeded with the RBI approval.

Who can Invest in Masala Bonds?

- Foreign investors who want to take exposure to Indian assets and are constrained from doing it directly in the Indian market or prefer to do so from their offshore locations can invest in Masala Bonds.

- The subscriber of these bonds can sell rupee bonds to a third party (domestic or offshore) but the proceeds from the issue can’t be used for real estate activities or capital market investment.

- However, the proceeds from these bonds can be utilised for development of integrated township/affordable housing project or any other infrastructural development project.

How Masala Bonds came into existence?

- The concept of Masala Bonds was introduced nearly 6-7 years ago by the government. And International Finance Corporation (IFC) to stem the record fall in rupee due to capital flight spurred by a severe current account deficit and the tapering of quantitative easing by the US Federal Reserve.

UPSC Daily News Analysis: Geography, Bribery, Science And More

Ecological Crises in the Red Sea

Context: The waters of the Red Sea are at an ‘environmental risk’ after a vessel Rubymar, carrying approximately 21,000 metric tons of ammonium phosphate sulfate fertilizer, sank in the southern part of the Sea.

The ship’s hull had been struck by an anti-ship ballistic missile fired by Yemen-based Houthi rebels.

| Relevance:

· Prelims: Environment and Biodiversity; Locations in Geography · Mains: Environment and Biodiversity |

Analysis

- Countries bordering the Red Sea are Saudi Arabia and Yemen in the east and Egypt, Sudan, Eritrea and Djibouti in the west. Israel has access to the Red Sea via its port in Eilat and Jordan via Aqaba on the Gulf of Aqaba.

- The Red Sea connects with the Mediterranean Sea and the Atlantic Ocean through the human-made Suez Canal and to the Gulf of Aden, Arabian Sea and Indian Ocean through the Strait of Bab el Mandeb.

- The sinking of the Rubymar could cause havoc in the sea, which is known to be rich in biodiversity that is endemic and not found anywhere else.

- The Red Sea gets its rich biodiversity due to the flow of nutrient-rich water from the Gulf of Aden through the Bab el Mandeb.

Value Addition

- The Socotra Archipelago, Dungonab Bay and Senganeeb Atoll are UNESCO Natural Heritage Sites in the Red Sea.

- The most famous work on the Red Sea from the ancient world is Periplus of the Erythraean Sea, attributed to an unknown Greek sailor and trader.

U.S. Dollar Index

Context: A stronger-than-expected United States economy is strengthening the dollar index, frustrating investors. Who had bet the currency would wilt under a barrage of interest rate cuts that have yet to materialize.

| Relevance:

· Prelims: Currency related concepts in Economy · Mains: Indian Economy and associated issues |

Analysis

- The U.S. Dollar Index tracks the strength of the dollar against a basket of major currencies, most of whom are US trade partners.

- DXY was developed by the U.S. Federal Reserve in 1973 to provide an external bilateral trade-weighted average value of the U.S. dollar against global currencies.

- The following six currencies are used to calculate the index:

-

- Euro 57.6% weight

- Japanese yen 13.6% weight

- Pound sterling 11.9% weight

- Canadian dollar 9.1% weight

- Swedish krona 4.2% weight

- Swiss franc 3.6% weight

Slide of Rupee and the U.S. Dollar Index

- S. Dollar Index goes up when the U.S. dollar gains “strength” (value), compared to other currencies.

- When the dollar index becomes stronger, investors tend to wind up their riskier investments and plough them back into the dollar.

- Most of their riskier investments are from emerging markets like India and others.

- The weakening of the Indian rupee is directly proportional to the strengthening of the Dollar Index.

- The US Dollar is appreciating against a bunch of other currencies as capital is leaving risky assets across the world and returning the US.

- The greenback also appreciates when interest rates rise on home ground.

Facts for Prelims

Gevra Mine Set to Become the Largest Coal Mine in Asia

- Chhattisgarh-based Coal India subsidiary South Eastern Coalfield Limited’s Gevra mine is set to become the largest coal mine in Asia.

- The mine has been granted environmental clearance to expand production capacity to 70 million tons per annum from the current 52.5 million tons.

- Gevra coal mine (in Korba, Chhattisgarh) is one of the megaprojects of South Eastern Coalfields Limited. And became the largest coal mine in the country last year with annual production for FY 22-23 reaching 52.5 million tons. And It has been contributing towards energy security of the country for more than 40 years.

One of the Five Strongest El Nino on Record

- According to the World Meteorological Organization (WMO). The 2023-24 El Nino phenomenon, experienced globally, is one of the five strongest on record.

- El Nino is the warmer phase of the El Nino-Southern Oscillation phenomenon. It occurs on average every two to seven years and persists for about nine to 12 months.

- It is associated with warming of the ocean surface in the central and eastern tropical Pacific Ocean, affecting weather and storm patterns in various parts of the world.

- The seasonal climate pattern usually has higher influence on the global climate during the second year of its development — in this instance 2024.

- An El Nino usually causes increased rainfall and floods in the Horn of Africa and southern parts of the United States.

- It influences unusually dry and warm conditions in Southeast Asia, Australia and South Africa.