GS Paper 1

1. Theyyam: Rituals and Form

- Theyyam is a special kind of performance that happens in Kerala and some parts of Karnataka.

- It’s a way of telling important stories from Kerala’s history and culture.

- Theyyam means “God” or “God’s form,” and it’s an old tradition that mixes acting, mime (the theatrical technique of suggesting action, character, or emotion without words, using only gesture, expression, and movement), and worship.

- There are over 400 separate Theyyams, each with their own music, style and choreography.

- Theyyam is a male-dominated event, even female gods are portrayed by male characters.

- Performers (kolams) adorned with brightly coloured paste and elaborate headdresses dance themselves into a trance-like state as they seek to become the gods they portray.

- Each artist represents a hero with great power. Performers wear heavy make-up and adorn flamboyant costumes.

- From December to April, there are Theyyam performances in many temples across Kerala, with their timing determined in consultation with astrologers who identify auspicious dates using the local Malayalam calendar.

- While each event is free and open to the public, theyyams aren’t tourist spectacles but sacred and deeply felt shows of history and faith.

GS Paper 2

2. North Atlantic Treaty Organization (NATO): Origin and Mandate

- Context: Sweden has become the 32nd member of NATO – the U.S.-led defence alliance. The move to join the security alliance was precipitated by the Russian invasion of Ukraine.

Analysis

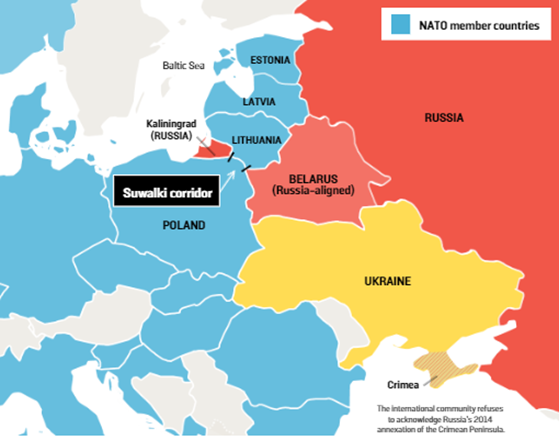

- After Finland joined last year, Sweden’s membership means all the countries surrounding the Baltic Sea, except Russia, will be part of the NATO; that has led some to label the sea a “NATO lake.”

- But just across the water Russia has its own vital outpost — the exclave of Kaliningrad – an isolated western pocket of Russia well removed from the rest of the country.

- Wedged between Poland and Lithuania, Moscow has in recent years turned the region into one of the most militarised in Europe, with nuclear-capable missiles stationed there.

- NATO’s Baltic states, Estonia, Latvia and Lithuania, are particularly happy over the entry of Sweden and Finland as war planners have struggled to work out how to stop them being cut off if Russian land troops seized the 65-kilometre Suwalki Gap – thestretch of NATO territory separating Belarus (a Russian ally) from the Russian exclave Kaliningrad.

North Atlantic Treaty Organization (NATO)

- NATO was formed in 1949 with the signing of the Washington Treaty.

- Its purpose was to ensure collective security of its members against the Soviet Union through political and military means.

- At the heart of the treaty that established the alliance is Article 5, which says an attack on one NATO member will be considered by the allies as an attack on all.

- It is a security alliance of 32 countries from North America and Europe.

- In 1949, there were 12 founding members of the Alliance: Belgium, Canada, Denmark, France, Iceland, Italy, Luxembourg, the Netherlands, Norway, Portugal, the United Kingdom and the United States.

- The other member countries are: Greece and Turkey, Germany, Spain, the Czech Republic, Hungary and Poland, Bulgaria, Estonia, Latvia, Lithuania, Romania, Slovakia and Slovenia, Albania and Croatia, Montenegro, North Macedonia (2020), Norway (2023) and Sweden (2024).

- NATO Headquarters is the political and administrative centre of the Alliance. It is located in Brussels, Belgium.

3. Directorate of Enforcement (ED): Structure and Mandate

- Context: The state government of Tamil Nadu has appealed to the Supreme Court that the ED had no jurisdiction under the Prevention of Money Laundering Act (PMLA) to investigate sand mining.

Analysis

- The Directorate of Enforcement is a specialized financial investigation agency under the Department of Revenue, Ministry of Finance.

- It is mandated with investigation of offence of money laundering and violations of foreign exchange laws.

- The statutory functions of the Directorate include enforcement of the following Acts:

a) The Prevention of Money Laundering Act, 2002 (PMLA)

- It is a criminal law enacted to prevent money laundering and to provide for confiscation of property derived from, or involved in, money-laundering and for matters connected therewith or incidental thereto.

- ED has been given the responsibility to enforce the provisions of the PMLA by conducting investigation to trace the assets derived from proceeds of crime, to provisionally attach the property and to ensure prosecution of the offenders and confiscation of the property by the Special court.

b) The Foreign Exchange Management Act, 1999 (FEMA)

- It is a civil law enacted to consolidate and amend the laws relating to facilitate external trade and payments and to promote the orderly development and maintenance of foreign exchange market in India.

- ED has been given the responsibility to conduct investigation into suspected contraventions of foreign exchange laws and regulations, to adjudicate and impose penalties on those adjudged to have contravened the law.

c) Sponsoring agency under COFEPOSA

- Under the Conservation of Foreign Exchange and Prevention of Smuggling Activities Act, 1974 (COFEPOSA), this Directorate is empowered to sponsor cases of preventive detention with regard to contraventions of FEMA.

d) The Fugitive Economic Offenders Act, 2018 (FEOA)

- This law was enacted to deter economic offenders from evading the process of Indian law by remaining outside the jurisdiction of Indian courts.

- It is a law whereby Directorate is mandated to attach the properties of the fugitive economic offenders who have escaped from the India warranting arrest and provide for the confiscation of their properties to the Central Government.

Departments of Ministry of Finance

- The Finance Ministry was recently expanded with the addition of a new department – the Department of Public Enterprises (DPE), which so far was part of the Ministry of Heavy Industries and Public Enterprises. With this, the Finance Ministry now has six departments.

- The Finance Ministry already has five departments –

- Department of Economic Affairs,

- Department of Expenditure,

- Department of Revenue,

- Department of Investment and Public Asset Management (DIPAM) and

- Department of Financial Services.

4. Central Armed Police Forces (CAPFs)

- Context: Union Home Minister Amit Shah said on Monday that in the past five years 2.43 lakh Central Armed Police Force (CAPF) personnel had been recruited.

Analysis

- Under the Indian Constitution, police and public order are state subjects.

- However, the Ministry of Home Affairs (MHA) assists state governments by providing them support of the Central Armed Police Forces.

- The Ministry maintains seven CAPFs:

- (i) the Central Reserve Police Force (CRPF), which assists in internal security and counterinsurgency,

- (ii) the Central Industrial Security Force (CISF), which protects vital installations (like airports, Delhi Metro Rail Corporation, sensitive Government buildings and ever heritage monuments) and public sector undertakings,

- (iii) the National Security Guards (NSG), which is a special counterterrorism force, and

- (iv) four border guarding forces, which are the Border Security Force, Indo-Tibetan Border Police, Sashastra Seema Bal, and Assam Rifles.

GS Paper 3

5. Scientists have unravelled anatomy that allows baleen whales to sing

- Context: The “singing” of baleen whales like the humpback can be heard over vast distances in the oceans and seas. Now scientists have finally figured out how these filter-feeding marine mammals do it.

Analysis

- To communicate and find each other in murky and dark oceans, baleen whales depend critically on the production of sound.

- For example, humpback females and their calves communicate with each other by voice, and humpback males sing to attract females.

- All baleen whales make very-low frequency calls barely audible to humans.

- A few species including the humpback and bowhead produce the higher-pitched sounds that people are more familiar with as whale songs.

- Baleen whales — a group that includes the blue whale, the largest animal — use a larynx, or voice box, anatomically modified to enable underwater vocalisation, researchers said.

- That means baleen whales make their sounds with their larynx, as do humans, while toothed whales — including dolphins, porpoises, killer whales and sperm whales — evolved a different mechanism employing a special organ in their nasal passages.

- Note: Baleen whales do not echolocate but they do make sounds to communicate with one another, display and attract mates, repel rivals and establish territories.

Baleen Vs Toothed Whales

- There are two types of whale; baleen and toothed. The key difference between them is the way they feed and what they have inside their mouth.

- Baleen whales have baleen plates, or sheets, which sieve prey from seawater.

- Toothed whales have teeth and they actively hunt fish, squid and other sea creatures.

- Dolphins and porpoises all have teeth and rather confusingly are known as ‘toothed whales’ too!

- Another obvious difference between baleen and toothed whales is the number of blowholes on top of their head; baleen whales have two whereas toothed whales have one.

- Baleen whales are generally huge; the largest is the biggest creature to have ever lived on Earth- the blue whale.

- There are about 15 baleen whale species and they are generally larger than the 77 odd species of toothed whales – except for the mighty sperm whale, the largest toothed whale.

Knowledge Corner

- Right whales and bowheads are skimmers or grazers and gather food by swimming slowly, open-mouthed through dense patches of it.

- Humpbacks, blue whales and fin whales are gulpers; their throats are expandable and enable them to take enormous mouthfuls of seawater and sieve out their prey;

- Gray whales are bottom feeders and sift prey from mouthfuls of mud on the seabed.

6. Government Securities Market in India

- Context: The government has completed Government Securities (G-Sec) borrowing for the current fiscal.

Analysis

What is a Bond?

- A bond is a debt instrument in which an investor loans money to an entity (typically corporate or government) which borrows the funds for a defined period of time at a variable or fixed interest rate.

What is a Government Security (G-Sec)?

- A Government Security (G-Sec) is a tradeable instrument issued by the Central Government or the State Governments which acknowledges the Government’s debt obligation.

- Such securities are short term (usually called treasury bills, with original maturities of less than one year) or long term (usually called Government bonds or dated securities with original maturity of one year or more).

- In India, the Central Government issues both, treasury bills and bonds or dated securities while the State Governments issue only bonds or dated securities, which are called the State Development Loans (SDLs).

- Dated securities are so named as the date of maturity is expressed explicitly in these securities.

- G-Secs carry practically no risk of default and, hence, are called risk-free gilt-edged instruments.

- Gilt-edged securities are high-grade (safer to invest) investment bonds offered by governments and large corporations as a method of borrowing funds.

- The Public Debt Office (PDO) of the Reserve Bank of India acts as the registry / depository of G-Secs and deals with the issue, interest payment and repayment of principal at maturity.

- Most of the dated securities are fixed coupon securities. A fixed-rate bond is a debt instrument that yields the same level of interest through its entire term, with regular interest payments known as coupons.

Types of Government Securities (G-Secs)

a) Treasury Bills (T-bills)

- Treasury bills, which are money market instruments, are short term debt instruments issued by the Government of India and are presently issued in three tenors, namely, 91 days, 182 days and 364 days.

- These are usually issued by the Reserve Bank of India on behalf of the Central Government.

- T-bills are zero coupon (interest payment) securities and pay no interest. Instead, they are issued at a discount and redeemed at the face value at maturity.

- For example, a 91 days Treasury bill of ₹100/- (face value) may be issued at say ₹ 98.20, that is, at a discount of say, ₹1.80 and would be redeemed at the face value of ₹100/-.

- Treasury bills are zero-coupon securities, issued at a discount to investors. Hence, total returns generated by such instruments remain constant through the tenure of bond, irrespective of economic conditions and business cycle fluctuations.

- T-bills are issued by the Government through an auction which is open for individual investors, banks, trusts and other institutions.

- Because of the low investments involved, they also cater to small and new investors.

- T-bills are highly liquid (that are converted into cash or Cash Equivalents very easily) negotiable (tradeable) instruments available in both Financial Markets, i.e., primary and secondary markets.

- As these are issued by RBI on behalf of the Government, the risk factor involved in T-bills is almost negligible.

- T-bills are issued through non-competitive bidding, which allows individual and retail investors to freely participate in the bidding process.

- Non- competitive bidding is a practice where a bidder does not have to quote the yield or price in the bid.

- Not only that, these are also issued in the open market to regulate the inflation level of the economy and the spending/ borrowing habits of individuals.

- During a boom when the cash flow in the economy is on the higher side, the Government issues these bills in order to encourage individuals to save and also curb the money supply.

- Contrarily, during the phase of depression, the money supply is lower. So, the bills issued are redeemed in order to correct the situation.

- The primary disadvantage of government treasury securities is that they are known to generate relatively lower returns when compared to standard stock market investment tools.

- A drawback of T-bills is that the short-term capital gains (STCG) earned on these securities is taxable under the Income Tax law.

b) Cash Management Bills (CMBs)

- Cash Management Bills (CMBs) are short-term instruments introduced to meet the temporary mismatches in the cash flow of the Government of India.

- The CMBs have the generic character of T-bills but are issued for maturities less than 91 days.

c) Inflation Indexed Bonds (IIBs)

- IIBs are bonds wherein both coupon flows (rate of interest) and Principal amounts are protected against inflation.

- The inflation index used in IIBs may be Whole Sale Price Index (WPI) or Consumer Price Index (CPI).

d) State Development Loans (SDLs)

- State Governments also raise loans from the market which are called SDLs.

- SDLs are dated securities issued through normal auction similar to the auctions conducted for dated securities issued by the Central Government.

- Like dated securities issued by the Central Government, SDLs issued by the State Governments also qualify for Statutory Liquidity Ratio (SLR).

- Banks must invest a certain portion of their deposits in government securities with the RBI. This percentage is known as SLR.

- Banks can earn return on these investments.

- They are also eligible as collaterals for borrowing through market repo as well as borrowing by eligible entities from the RBI under the Liquidity Adjustment Facility (LAF) and special repo conducted under market repo by CCIL.

Why should one invest in G-Secs?

- Besides providing a return in the form of coupons (interest), G-Secs offer the maximum safety as they carry the Sovereign’s commitment for payment of interest and repayment of principal.

- They can be held in book entry, i.e., dematerialized/ scripless form, thus, obviating the need for safekeeping. They can also be held in physical form.

- G-Secs are available in a wide range of maturities from 91 days to as long as 40 years to suit the duration of varied liability structure of various institutions.

- G-Secs can be sold easily in the secondary market to meet cash requirements.

- G-Secs can also be used as collateral to borrow funds in the repo market.

- Securities such as State Development Loans (SDLs) and Special Securities (Oil bonds, UDAY bonds etc.) provide attractive yields.

- The settlement system for trading in G-Secs, which is based on Delivery versus Payment (DvP), is a very simple, safe and efficient system of settlement.

- The DvP mechanism ensures transfer of securities by the seller of securities simultaneously with transfer of funds from the buyer of the securities, thereby mitigating the settlement risk.

- G-Sec prices are readily available due to a liquid and active secondary market and a transparent price dissemination mechanism.

- Besides banks, insurance companies and other large investors, smaller investors like Co-operative banks, Regional Rural Banks, Provident Funds are also required to statutory hold G-Secs.

- States are paying a high cost for market borrowings, while the Centre’s cost is lower at about 6%. It would have been better for the Centre to borrow from the market and transfer to the States.

Knowledge Section: Various types of financial markets

a) Money Market Vs Capital Market

- The financial markets can broadly be divided into money and capital market.

- Money market is a market for the trading and issuance of short term non equity debt instruments (usually less than one year) including treasury bills, commercial papers, bankers’ acceptance, certificates of deposits, etc.

- Capital market is a market for the trading and issuance of long-term debt and equity shares.

- This also includes private placement sources of debt and equity as well as organized markets like stock exchanges.

- Capital market can be further divided into primary and secondary markets.

b) Primary Market Vs Secondary Market

- In the primary market, securities are offered to public for subscription for the purpose of raising capital or fund.

- Secondary Market refers to a market where securities are traded after being initially offered to the public in the primary market and/or listed on the Stock Exchange.

- Majority of the trading is done in the secondary market. Secondary market comprises of equity markets and the debt markets.

- Secondary market could be either auction or dealer market. While stock exchange is the part of an auction market, Over-the-Counter (OTC) is a part of the dealer market.

Facts for Prelims

8. Farmers’ Protest in Europe

- Farmers across many countries of the European Union are protesting on the streets.

- The protesting farmers’ concerns include cheap imports from neighbouring Ukraine, delayed subsidy payments, taxation on vehicles, and EU green regulations on how much land is used or how much nitrogen is emitted in the air.

- Governments are reducing food prices due to inflation, even as the cost of producing food is increasing, stoking fears about how to sustain a livelihood.

9. European Green Deal

- The European Green Deal is a package of policy initiatives, which aims to set the EU on the path to a green transition, with the ultimate goal of reaching climate neutrality by 2050.

- It supports the transformation of the EU into a fair and prosperous society with a modern and competitive economy.

- The package includes initiatives covering the climate, the environment, energy, transport, industry, agriculture and sustainable finance – all of which are strongly interlinked.

10. Garbhini-GA2

- It is an India-specific artificial intelligence model to precisely determine the gestational age of a foetus in the second and third trimester of pregnancy.

11. Bharat Tex

- It is one of the largest textile value-chain exhibition exhibitions globally.

- It aims to showcase India’s prowess in the textile sector and to reaffirm India’s position as a global textile powerhouse.

12. Mission Utkarsh

- Mission Utkarsh is an initiative to improve nutrition among approximately 95,000 adolescent girls in anaemia prone districts using Ayurveda.

- It will be a joint public health initiative by the Ministries of Ayush and Women and Child Development.

- In the first phase, the focus will be on improving the anaemic status of adolescent girls (14-18 years) in five aspirational districts of five states namely Assam (Dhubri), Chhattisgarh (Bastar), Jharkhand (Paschimi Singhbhum), Maharashtra (Gadchiroli), and Rajasthan (Dhaulpur).

13. Extreme cold kills 2 million livestock in Mongolia

- More than two million animals have died in Mongolia so far this winter, as the country endures extremely cold temperatures and snow.

- The landlocked country is no stranger to severe weather from December to March, when temperatures plummet as low as minus 50°C in some areas.

- But this winter has been more severe than usual, with lower than normal temperatures and very heavy snowfall.

- The extreme weather in Mongolia is known as dzud and typically results in the deaths of huge numbers of livestock.

14. Badwater Basin

- Badwater Basin, at the Death Valley National Park in California, is a salt flat which is the lowest point in North America at 282 feet below sea level.

15. Public Stockholding Programme of WTO

- India urged the World Trade Organisation (WTO) members at the 13th ministerial conference (MC13) in Abu Dhabi to find a permanent solution to the long-pending public food stockpile issue.

- Public stockholding programme is a policy tool under which the government procures crops like rice and wheat from farmers at ‘administered’ prices, then stores and distributes foodgrains to the poor.

- While India and some other countries argue that food security is a legitimate policy objective, several WTO members have been opposing the stockholding programmes on the ground that it distorts trade.

- Note: Ministerial conference is the highest decision-making body of the WTO.

16. Carbon Border Adjustment Mechanism (CBAM)

- The European Union’s (EU) Carbon Border Adjustment Mechanism (CBAM) is the EU’s tool to put a fair price on the carbon emitted during the production of carbon intensive goods that are entering the EU, and to encourage cleaner industrial production in non-EU countries.

- CBAM will apply in its definitive regime from 2026, while the current transitional phase lasts between 2023 and 2026.

- In its transitional phase, CBAM will only apply to imports of cement, iron and steel, aluminium, fertilisers, electricity and hydrogen.

17. What is the Bitcoin Halving?

- Bitcoin (BTC) halving refers to the 50% reduction in the reward paid to Bitcoin miners who successfully process other people’s cryptocurrency transactions so that they can be added to the public digital ledger known as the blockchain.

- In order to “grow” Bitcoin’s blockchain and keep the ecosystem running, Bitcoin miners rely on advanced computer equipment to solve a complex mathematical puzzle through a process known as ‘Proof of work.’

- This intense activity is the reason Bitcoin transactions result in huge carbon footprints and require vast amount of electricity. No real mining is carried out.

- Bitcoin mining increases the supply of BTC in circulation while Bitcoin halving reduces the rate at which these coins are released, making the asset more scarce.

- While there can only ever be 21 million BTC in the world, over 19 million have already been “mined” or released.

- A halving takes place after 2,10,000 blocks are mined, and has happened so far in 2012, 2016, and 2020 — every four years.

18. Permanent Commission Vs Short Service Commission

- The Supreme Court urged the Indian Coast Guard to ensure that women are granted permanent commission.

- Permanent Commission (PC) Officers continue to serve till the age of superannuation. A Short Service Commission (SSC) means a limited period career which usually lasts for 10 years.

- All the three Indian Armed Forces namely – Indian Army, Indian navy and Indian Air Force (was first among the three services) grant PC to SSC women officers.