Introduction

- The Union Cabinet has recently sanctioned the Unified Pension Scheme (UPS), which is scheduled to come into effect on April 1, 2025. This new scheme is intended to ensure that government employees receive a guaranteed pension upon retirement.

- Recently, there has been growing unease among government employees about the National Pension Scheme (NPS), commonly known as the New Pension Scheme. The main concern has been the absence of assured returns under the NPS. In response to increasing calls for a return to the Old Pension Scheme, the Union government appointed a committee, headed by Finance Secretary TV Somanathan, to examine the comparison between the Old Pension Scheme and the National Pension System.

- The Unified Pension Scheme (UPS) has been introduced to address these concerns by providing retirees with a fixed pension, which the NPS does not offer. Despite this, the UPS retains the employee contribution aspect that is characteristic of the NPS.

Different Pension Schemes in India

Old Pension Scheme (OPS):

-

- Applicability: Applicable to all government employees appointed before January 1, 2004.

- Features:

- Defined Benefit Scheme: This scheme provides a pension that is 50% of the last drawn salary plus Dearness Allowance (DA) after retirement.

- Government Funded: The entire pension amount is funded by the government, with employees contributing to the General Provident Fund (GPF), which guarantees fixed returns.

Read also: How Dark Patterns Harm Consumers | UPSC

National Pension System (NPS):

-

- Applicability:

- Introduced on January 1, 2004.

- Mandatory for central government employees joining after this date.

- Voluntary for state governments, with most states except West Bengal and Tamil Nadu opting in.

- Some states, like Rajasthan and Chhattisgarh, have reverted to OPS.

- Features:

- Defined Contribution Scheme: Employees contribute 10% of basic pay and DA, with a matching contribution from the government. The pension amount depends on the accumulated corpus and market performance.

- Market-Linked: Pension is subject to market risks, with no predefined pension amount. The final pension depends on the returns generated by the investment portfolio chosen by the employee.

- Flexibility: Offers investment choices, allowing employees to select from a range of options including equities, government bonds, and other instruments based on their risk tolerance and retirement goals.

Unified Pension Scheme (UPS):

-

- Applicability:

- To be implemented from April 1, 2025, for all those who retired under NPS since 2004.

- Employees have the option to remain under NPS.

- Initially targeted at central government employees, with the option for states to adopt.

- Features:

- Assured Pension: Combines elements of both OPS and NPS, offering a guaranteed pension along with employee contributions.

- Employee Contribution: A contributory scheme where employees contribute 10% of basic pay and DA, similar to NPS, but with enhanced government contributions.

- Hybrid Model: Provides the security of OPS with the flexibility of NPS, offering both stability and growth potential for retirement savings.

Comparative Analysis of Pension Schemes

| Feature | Old Pension Scheme (OPS) | National Pension System (NPS) | Unified Pension Scheme (UPS) |

| Pension Amount | 50% of last drawn salary | Market-linked, variable pension | 50% of average basic pay from the last 12 months |

| Inflation Indexation | Adjusted via DA | Not applicable | Indexed to AICPI-IW |

| Employee Contribution | No contribution | 10% of basic pay and DA | 10% of basic pay and DA |

| Government Contribution | Fully funded | 14% of basic pay and DA | 18.5% of basic pay and DA |

| Family Pension | Yes, continues after retiree’s death | Corpus dependent | Yes, 60% of employee’s pension |

| Risk | No market risk | Subject to market risks | Lower risk than NPS |

| Flexibility | Low, fixed benefits | High, investment choice flexibility | Limited, with assured pension |

Salient Features of the Unified Pension Scheme (UPS)

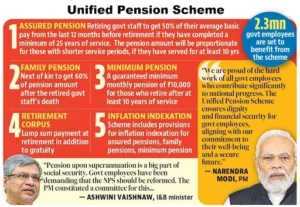

- Assured Pension: Provides 50% of the average basic pay drawn over the last 12 months before retirement, with a minimum qualifying service of 25 years. For shorter service periods, the pension is proportionately reduced, with a minimum requirement of 10 years.

- Assured Family Pension: Ensures 60% of the employee’s pension is provided to their family upon the employee’s demise.

- Assured Minimum Pension: Guarantees a minimum pension of ₹10,000 per month after a minimum of 10 years of service.

- Inflation Indexation: Pension, family pension, and minimum pension are indexed to inflation based on the All India Consumer Price Index for Industrial Workers (AICPI-IW).

- Lump Sum Payment at Superannuation: Provides a lump sum payment in addition to gratuity, calculated as 1/10th of monthly emoluments (pay + DA) for every completed six months of service. This does not reduce the quantum of the assured pension.

Reasons for the Introduction of NPS

- Limited Coverage of OPS: The OPS covered only government employees, approximately 12% of the workforce. The NPS was introduced to extend pension coverage to the unorganized sector, making it accessible to a broader segment of the population.

- Fiscal Burden on Governments: OPS imposed a growing fiscal burden on the government due to rising salaries and pension liabilities. The increasing pension costs were unsustainable, prompting the shift to a contributory system under NPS.

- Future Generational Impact: OPS transferred the pension burden to future taxpayers, creating long-term fiscal pressures. NPS was designed to mitigate this by ensuring that employees contribute towards their own retirement.

- Disincentive for Early Retirement: OPS discouraged early retirement, as employees were incentivized to stay until the full pension benefit was realized. This led to inefficiencies in workforce management.

- Flexibility of NPS: NPS provides flexibility in investment choices, allowing employees to select their investment portfolios based on risk tolerance and retirement goals.

- Simplicity and Portability: NPS offers simplicity and portability with a Permanent Retirement Account Number (PRAN), which remains valid throughout the subscriber’s life, even if they change jobs or locations.

- Well-Regulated Scheme: NPS is a well-regulated scheme with oversight by the NPS Trust, ensuring transparency, security, and accountability in fund management.

Issues with National Pension System (NPS)

- Market Volatility/Uncertainty: The returns under NPS are market-linked, making them vulnerable to market fluctuations and economic downturns. This unpredictability can lead to concerns about retirement security.

- Increased Burden on Employees: Unlike OPS, NPS requires employees to contribute a portion of their salary towards their pension, reducing their disposable income during their working years.

- No General Provident Fund (GPF) Benefits: NPS lacks the fixed returns provided by the General Provident Fund (GPF) under OPS, which guaranteed a certain level of savings for employees.

- No Assured Family Pension: Unlike OPS, NPS does not guarantee a fixed family pension, leaving dependents reliant on the pension corpus accumulated by the employee.

- No Inflation Indexation: NPS does not include provisions for inflation adjustment, potentially eroding the real value of pensions over time.

Significance of the Unified Pension Scheme (UPS)

- Assured Pension: UPS provides a fixed and assured pension amount, offering financial security and predictability in retirement.

- Higher Government Contribution: UPS increases the government’s contribution to 18.5%, compared to 14% under NPS, enhancing the overall pension corpus.

- Inflation Indexation: The scheme includes provisions for inflation-linked increments, ensuring that the pension retains its purchasing power over time.

- Assured Family Pension: UPS includes a guaranteed family pension, providing financial stability to the employee’s dependents.

- Combination of Defined Benefits and Contributions: UPS merges the guaranteed benefits of OPS with the contributory model of NPS, offering both security and potential for growth in retirement savings.

Concerns with the Unified Pension Scheme (UPS)

- Increased Fiscal Burden: The introduction of a defined pension under UPS could significantly increase the financial burden on the government, potentially impacting other areas of public spending.

- Potential for Unsustainable Liabilities: The combination of OPS and NPS features in UPS could lead to long-term liabilities that may be difficult to sustain, particularly in the face of economic challenges.

- Inequitable Benefits: The scheme primarily benefits central government employees, with limited applicability to the broader workforce, potentially leading to disparities in retirement security.

- Transition from NPS: The transition from NPS to UPS raises questions about the management of the existing NPS corpus and the impact on employee participation and retirement planning.

Way Forward

- Regular Assessments: Conduct periodic evaluations to ensure that UPS remains financially viable and sustainable. Adjust government contributions and scheme parameters as needed to balance employee benefits with fiscal responsibility.

- Stakeholder Consultations: Engage regularly with government employees, unions, and other stakeholders to gather feedback, address concerns, and refine the scheme.

- Performance Metrics: Establish clear performance metrics to evaluate the effectiveness of UPS in achieving its objectives. Monitor these metrics regularly to make informed decisions about necessary adjustments.