Introduction

- In a recent landmark judgment, a nine-judge bench of the Supreme Court has ruled that Indian states possess the authority to tax mining activities and that the collection of ‘royalties’ from mining leaseholders does not constitute a tax.

- This decision overturns the Supreme Court’s earlier stance from the 1989 case of India Cements Ltd. v. State of Tamil Nadu, which had previously categorized royalty as a form of tax.

What was the Case?

The Case:

- Mineral Area Development Authority v M/s Steel Authority of India, which had been pending for more than a quarter century, was decided by an 8-1 split in Supreme Court.

Royalty Tax:

- Royalties refer to the fees paid to the owner of a product in exchange for the right to use that product.

- For example, if a movie studio wants to use an existing piece of music by a specific artist in their new film, they will have to pay a royalty fee that goes to the artist.

- Section 9 of the Mines and Minerals (Development and Regulation) Act, 1957 (MMDRA) requires those who obtain leases to conduct mining activities to “pay royalty in respect of any mineral removed” to the individual or corporation who leased the land to them.

The Issue:

- If a state government is the entity leasing the land to a leaseholder, does this make royalties under the MMDRA a form of tax?

India Cement Ltd v State of Tamil Nadu (1989):

- In this case, the SC held that states only have the power to collect royalties, not to impose taxes on mining activities.

- It said that the Centre has overriding authority over “regulation of mines and mineral development” under Entry 54 of the Union List to the extent provided by law (MMDRA in this case), and that states do not have the power to impose further taxes on the subject.

- The court further said that royalty is a tax, and as such a cess on royalty being a tax on royalty, is beyond the competence of the State Legislature because s. 9 of the Central Act covers the field.

Read also: Indian Ocean Dipole (IOD): Meaning, Phases, Impacts | UPSC

What Is Recent Supreme Court’s Verdict on State’s Power To Tax Mining Activities?

- Power of State Legislatures to tax mining lands and quarries is not limited by the Parliament’s Mines and Minerals (Development and Regulation) Act of 1957.

- State Legislatures derive their power to tax mines and quarries under Article 246 read with Entry 49 (tax on lands and buildings) in the State List of the Seventh Schedule of the Constitution.

- The Parliament, through the MMDR Act, cannot limit the power of the State to legislate on the taxation of mines and quarries within their jurisdiction.

- Royalty is not a tax. Royalty is a contractual consideration paid by the mining lessee to the lessor for enjoyment of mineral rights.

Impact of SC Verdict

- The verdict will give a boost to mineral-rich states like Jharkhand, Odisha as they urged the top court to decide on recovery of tax thousands of crores rupees levied by the Centre on mines till now.

- The verdict is expected to strengthen fiscal federalism and boost government revenues, enabling increased investments in physical infrastructure, healthcare, education, human capacity, and research and development.

Status of Mining Sector in India

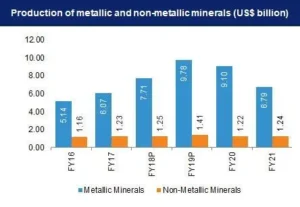

- Value of Mineral Production: The total value of mineral production (excluding atomic and fuel minerals) in 2021-22 was estimated at Rs. 2,11,857 crore, indicating robust growth.

- Index of Mineral Production: The increase in the Index of Mineral Production suggests a substantial rise in mining activities.

Major Minerals and Production Figures

- The economic reforms of 1991, along with the National Mining Policy of 1993, have significantly contributed to the expansion of India’s mining industry.

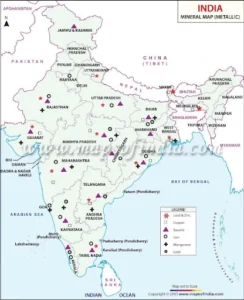

- India currently produces 95 different minerals, including 4 fuel minerals, 10 metallic minerals, 23 non-metallic minerals, 3 atomic minerals, and 55 minor minerals (which include building materials and other types).

- Coal: India is the second-largest coal producer globally, with a production of 777.31 MT in 2021-22. Coal India Limited is the world’s largest coal producer.

- Iron Ore: India is among the top iron ore producers, with the National Mineral Development Corporation (NMDC) being a key player.

- Other Major Minerals: India is a significant producer of chromium, bauxite, zinc, manganese, and lead.

- Non-Metallic Minerals: The country leads in the production of limestone, phosphorite, magnesite, and graphite.

Economic Significance of Mining

- GDP Contribution: The mining sector contributes 2.2-2.5% to India’s GDP, driving economic growth by fueling industries like infrastructure and automobiles. For example, the steel industry, reliant on iron ore mining, is crucial for infrastructure projects such as the Delhi-Mumbai Industrial Corridor.

- Employment: Mining generates significantly more employment than agriculture and manufacturing, per economic growth point. For instance, Coal India Limited employs over 270,000 people, providing jobs in remote areas with limited employment opportunities.

- Economic Diversification: Investment in mining diversifies the economy, reducing reliance on traditional sectors. The development of the Kolar Gold Fields in Karnataka illustrates this, transforming the local economy from agriculture-based to mining-based.

- Support for EV Industry: Mining of critical minerals like lithium supports the electric vehicle industry. The recent discovery of lithium reserves in Jammu and Kashmir is expected to boost the local EV manufacturing sector, reducing dependence on imports.

- FDI and FPI Inflows: Private sector participation and mining activities attract substantial FDI and FPI, reducing the import bill. Vedanta’s investment in zinc mining in Rajasthan has not only brought in FDI but also decreased the need for zinc imports.

- Renewable Energy Development: Minerals like aluminum and copper are essential for solar and wind power equipment. Hindalco’s aluminum production supports the manufacturing of solar panels and wind turbines, contributing to India’s renewable energy goals.

Government Initiatives

Policy Shifts:

- The National Mineral Policy of 1993 and subsequent reforms paved the way for private investment and auction-based mineral allocations. This policy shift aimed to increase transparency and efficiency in mineral resource management, leading to increased private sector participation and investment in mining.

MMDR Amendment Act 2015:

- Introduced auctions for mineral concessions, created the District Mineral Foundation (DMF) for people affected by mining, and the National Mineral Exploration Trust (NMET) to incentivize exploration. These measures aimed to ensure fair distribution of mining benefits and boost exploration activities across India.

National Mineral Exploration Policy 2019:

- Encourages private sector exploration, transfer of mining leases, and creation of mineral corridors. It also aims to develop a long-term import-export policy for minerals and harmonize taxes, levies, and royalty with world benchmarks to attract global investments.

FDI Policy:

- Allows 100% FDI under the automatic route in mining and exploration of various ores and minerals. This policy has significantly increased foreign investments, bringing in advanced technology and expertise to the Indian mining sector.

Minerals Security Partnership (MSP):

- India joined this US-led alliance to enhance critical minerals capability. The partnership focuses on securing supply chains for critical minerals like lithium and cobalt, essential for high-tech industries and renewable energy sectors.

Critical Minerals Mission:

- Announced to develop the country’s critical minerals capability. This mission focuses on ensuring the availability of essential minerals for strategic industries, including defense and renewable energy, reducing import dependence.

National Mineral Index (NMI):

- Introduced to track and benchmark mineral prices. The NMI aims to provide a transparent pricing mechanism, helping investors and stakeholders make informed decisions based on market trends.

Star Rating of Mines:

- Implemented to promote sustainable mining practices. Mines are rated based on their environmental and social performance, encouraging miners to adopt best practices and reduce their ecological footprint.

Single Window Clearance System:

- Launched to streamline the approval process for mining projects. This system integrates various regulatory clearances, reducing delays and improving the ease of doing business in the mining sector.

Mining Surveillance System (MSS):

- Developed to monitor illegal mining activities using satellite imagery. The MSS enhances regulatory oversight and ensures compliance with mining regulations, thereby promoting responsible mining practices.

Challenges in the Mining Sector

Import Dependency:

- High reliance on imports for critical minerals like lithium and cobalt. For instance, India imported lithium worth $22.15 million in 2021-22, highlighting its dependence on external sources for critical minerals essential for the burgeoning electric vehicle industry.

Government-led Exploration:

- Dominance of government agencies in exploration leads to inefficiencies. The Geological Survey of India and other PSUs often face delays and budget constraints, as seen in the slow progress of mineral exploration in the Northeast region.

Regulatory Hurdles:

- Despite amendments, the MMDR Act has not fully liberalized the sector. The act’s complex regulatory framework has deterred private investment, exemplified by the slow uptake of mining licenses in states like Jharkhand and Odisha.

Exploration Risks:

- High costs and risks associated with mineral exploration deter private investment. For example, the aerial surveys and geological mapping projects in the Deccan region often yield less than 1% commercially viable mines, making it a high-risk venture for private players.

Global Events Impact:

- Events like the Russia-Ukraine conflict affect mineral supply chains. The conflict has disrupted the supply of palladium, crucial for the automotive industry, causing significant production delays in India’s automobile sector.

Environmental Concerns:

- Mining activities pose significant environmental risks. The Damodar River in Jharkhand has been severely polluted by coal mining, affecting local communities and ecosystems.

Displacement Issues:

- Mining projects often lead to displacement and human rights violations. The protests against the Vedanta bauxite mining project in Niyamgiri Hills, Odisha, highlight the displacement of indigenous populations and the violation of their rights.

Bureaucratic and Judicial Delays:

- These cause long delays and losses for investors. The Supreme Court’s ban on iron ore mining in Karnataka in 2011 led to a significant loss of revenue and jobs in the region, illustrating the impact of judicial interventions.

Safety Concerns:

- Lack of adequate safety measures leads to mining accidents. The Ksan coal mine disaster in Meghalaya in 2018, where 15 miners were trapped and lost their lives, underscores the dire need for better safety protocols and equipment.

Read also: Planetary Boundaries Framework: Concept and Significance | UPSC

Way Forward

Increase Exploration:

- Expand exploration beyond the current 10% of India’s landmass. For instance, the Odisha government’s initiative to survey unexplored mineral-rich areas using drone technology has led to new mineral discoveries, boosting the state’s mining potential.

Strengthen Regulations:

- Implement robust environmental, labor, and land laws. The Rajasthan government’s strict enforcement of environmental norms in the Aravalli range has helped curb illegal mining activities and protect the region’s ecology.

Balance Environmental Concerns:

- Balance mining development with ecological conservation. The Goa government’s mining policy includes measures for reforestation and land reclamation, ensuring that mining operations do not irreparably harm the environment.

Transparency in Allocations:

- Use technology for transparent mineral exploration and surveillance. Karnataka’s use of Geographic Information Systems (GIS) for mineral mapping and allocation has improved transparency and reduced corruption in mining leases.

Minimal Societal and Environmental Damage:

- Conduct proper Environmental Impact Assessments (EIA) and Social Impact Assessments (SIA) before project allocations. The Kudremukh Iron Ore Company Ltd. (KIOCL) ensures comprehensive EIA and SIA reports, maintaining minimal environmental and societal impact during its operations.

Utilize DMF Effectively:

- Ensure DMF funds are used for constructing physical and social infrastructure for local communities. In Jharkhand, DMF funds have been used to build schools, hospitals, and roads, significantly improving the quality of life in mining-affected regions.

Adopt Global Best Practices:

- Implement global best practices to ensure safe working conditions and avoid occupational hazards. Tata Steel’s adoption of advanced safety protocols and training programs, in line with international standards, has reduced mining-related accidents and improved worker safety.