Monetary Policy in India | UPSC

| Prelims: Economic Developments: RBI, Monetary vs Fiscal Policy, Inflation, Quantitative and Qualitative Controls

Mains: Indian Economy and issues relating to Planning, Mobilization of Resources, Growth, Development and Employment, Inclusive Growth and issues arising from it. |

What is monetary policy and how is it different from fiscal policy?

- Monetary policy is the process of regulating either the cost of borrowing (typically of very short-term borrowing) or the money supply in an economy by the monetary authority, usually a central bank like the RBI in India.

-

- By contrast, fiscal policy refers to the government’s decisions about taxation and spending.

- While fiscal policy involves a trade-off between output stabilisation and distortions from tax and spending changes, monetary policy involves a trade-off between price and output stability.

-

What are the goals of monetary policy?

- Both monetary and fiscal policies are used to regulate economic activity over time. The overarching goal of both monetary and fiscal policy is normally the creation of an economic environment where growth is stable and positive and inflation is stable and low.

-

- In addition, fiscal policy can be used to redistribute income and wealth.

-

- Conventionally, monetary policy aims at targeting the:

-

- desired level of output (and thereby the rate of growth) in the economy,

- maintenance of a stable price level and

- management of exchange rate (or the balance of payments).

-

Which authority is responsible for conducting monetary policy in India?

- Under the Reserve Bank of India Act,1934, RBI is entrusted with the responsibility of conducting monetary policy in India with the primary objective of maintaining price stability (inflation target) while keeping in mind the objective of growth.

a) Monetary Policy Committee (MPC)

- The RBI Act provides for the constitution of a six-member Monetary Policy Committee (MPC) to determine the policy rate required to achieve the inflation target with the following members:

-

- 1. Governor of the Reserve Bank of India—Chairperson, ex officio;

- 2. Deputy Governor of the Reserve Bank of India, in charge of Monetary Policy—Member, ex officio;

- 3. One officer of the Reserve Bank of India to be nominated by the Central Board—Member, ex officio;

- 4. Three independent members, experts in the field of economics, banking or finance, to be selected by the Government, will hold office for a period of four years or until further orders, whichever is earlier.

-

- The MPC is required to meet at least four times in a year and the quorum for the meeting of the MPC is four members.

- Each member of the MPC has one vote, and in the event of an equality of votes, the Governor of RBI has a second or casting vote.

b) Functions of MPC

- MPC determines the benchmark policy interest rate (repo rate) required to achieve the inflation target.

- Another responsibility for the RBI is to publish a Monetary Policy Report every six months, elaborating inflation forecasts and inflation sources for the next six to eighteen months.

- MPC uses ‘headline inflation’ to make its decision. Headline inflation is the raw inflation figure reported through the Consumer Price Index (CPI).

c) Inflation Target

- Under the RBI Act, the Central Government, in consultation with the RBI, determines the inflation target in terms of the Consumer Price Index (CPI), once in five years.

- Accordingly, the Central Government has notified 4 per cent Consumer Price Index (CPI) inflation as the target for the period from April 1, 2021 to March 31, 2026 with the upper tolerance limit of 6 per cent and the lower tolerance limit of 2 per cent.

d) Failure to Maintain Inflation Target

- The Central Government has notified the following as the factors that constitute failure to achieve the inflation target:

-

- (a) the average inflation is more than the upper tolerance level of the inflation target for any three consecutive quarters; or

- (b) the average inflation is less than the lower tolerance level for any three consecutive quarters.

-

- Where the Bank fails to meet the inflation target, it shall set out in a report to the Central Government:

-

- (a) the reasons for failure to achieve the inflation target;

- (b) remedial actions proposed to be taken by the Bank; and

- (c) an estimate of the time-period within which the inflation target shall be achieved.

-

What are the various stances of a monetary policy?

- The stance of a monetary policy to avert the macroeconomic instabilities includes the following:

- Easy Monetary Policy or Dovish Stance: It is a policy stance favouring low interest rates, increased liquidity and easy access to credit aimed at stimulating real economic activity.

-

-

- Such a policy action is executed during the recessionary economic episodes wherein investment and employment are below normal levels.

-

-

- Tight Monetary Policy or Hawkish Stance: It is a restrictive policy stance intended to restrict the level of effective demand by inducing higher interest rates, constraining the money supply or credit access.

-

-

- This type of policy action is usually executed during boom periods in order to cool down the economy from overheating.

-

-

- Accommodative Monetary Policy: A monetary policy action wherein the supply of money is allowed to expand in line with the demand for it.

- Calibrated Tightening: It means during the current rate cycle, a cut in the repo rate is off the table. But, the rate hike will happen in a calibrated manner.

-

-

- This means the central bank may not go for a rate increase in every policy meeting but the overall policy stance is tilted towards a rate hike.

-

-

What are the instruments of monetary policy?

- To ensure a stable price level together with a sustainable growth path, the central banks adopt two kinds of instruments. These can be broadly classified as:

-

-

- (i) Quantitative Credit Control Methods: These methods are general, or indirect and include those policies which affect the total volume of credit into the entire economy; and

- (ii) Qualitative Credit Control Methods: These methods are selective or direct and include those policies which affect credit to specific areas of the economy or a particular use of credit.

-

-

|

Instruments of Monetary Policy |

|

|

Quantitative Methods |

Qualitative Methods |

| 1. Reserve ratios

a) Cash Reserve Ratio (CRR) ● It is the cash required to be kept with the RBI as a percentage of a bank’s total deposits. ● The bank can neither lend this portion to anyone nor can it earn interest or profits on it. 1. RBI uses this tool to increase or decrease the reserve requirement depending on whether it wants to affect a decrease or an increase in the money supply. b) Statutory Liquidity Ratio (SLR) ● It represents the percentage of a bank’s total deposits that are required to be invested in government approved securities. ● SLR restricts funds available for lending. ● The bank earns interest on SLR funds. ● The RBI can increase the SLR to contain inflation, suck liquidity in the market to tighten the measures to safeguard the customers money. |

1. Margin Requirement

● It is the difference between market value of the security and the amount of loan advanced against the security. ●The margin requirement is increased when flow of credit is to be restricted in the economy and vice versa. |

| 2. Open Market Operations (OMO)

● These are policy actions of buying and selling of government securities to regulate the short-term money supply. ● If additional liquidity is needed in the economy, RBI will buy the government securities and pump in funds. ● In case of excess liquidity, RBI sells the securities to suck out excess money circulating in the economy. ● In particular, OMO is applied to avoid temporary liquidity mismatches in the market caused by foreign capital flows. |

2. Moral Suasion

● Also known as ‘moral persuasion’, it refers to RBI’s convincing the commercial banks to follow its directives on the flow of credit. ● RBI persuades the banks to put a cap on credit supply during high inflation episodes and be liberal in lending during economic downturn. |

| 3. Policy Rates

a) Bank Rate ● It refers to the rate of interest at which a central bank lends long-term funds to commercial banks. ● The Bank Rate acts as the penal rate charged on banks for shortfalls in meeting their reserve requirements such as cash reserve ratio and statutory liquidity ratio. ● Bank rate is closely linked with the marginal standing facility (MSF) rate, thus changes as and when the MSF rate changes.

b) Repo Rate (or repurchase option) ● It is the interest rate at which banks are allowed to borrow money from RBI by selling securities to it with an agreement to repurchase the same at a predetermined rate and date. ● Repo operations inject liquidity into the system. c) Reverse Repo Rate ● It involves the borrowing of RBI from commercial banks against the securities. ● The interest rate paid by RBI in this case is called the reverse repo rate. ● The reverse repo transactions enable banks to park excess money with the RBI thereby absorbing excess liquidity. d) Marginal Standing Facility (MSF) Rate ● It is the rate at which banks are allowed to borrow overnight funds from the RBI in case of an emergency situation. ● This is extended against government securities when the inter-bank liquidity is not forthcoming. |

3. Credit Rationing

● It is also a maximum cap placed on the loans and advances made by the commercial banks. ● The credit ceiling is applied in situations (or sectors) where credit needs to be checked especially where it is used for speculative investments.

|

|

4. Publicity ● It is a tool used by the central bank to disseminate its views on the current economic affairs and its likely directions to ensure stability. |

|

| 5. Direct Action

● It is the power vesting with the RBI to undertake a strict course of action against commercial banks which decline to follow the orders or directives from the central bank. |

|

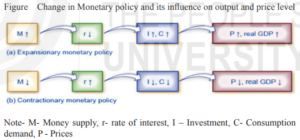

How contractionary (tight) monetary policy is different from expansionary (loose) monetary policy?

Monetary policies are seen as either expansionary or contractionary depending on the level of growth or stagnation within the economy.

a) Contractionary (tight) Monetary Policy

- A contractionary policy increases interest rates and limits the outstanding money supply to slow growth and decrease inflation.

- It results in the increase in the prices of goods and services and decrease in the purchasing power of money.

b) Expansionary (loose) Monetary Policy

- During times of slowdown or a recession, an expansionary policy grows economic activity.

- By lowering interest rates, saving becomes less attractive, and consumer spending and borrowing increase.

- An expansionary monetary policy decreases unemployment as a higher money supply and attractive interest rates stimulate business activities and expansion of the job market.

- The exchange rates between domestic and foreign currencies can be affected by monetary policy.

-

-

- With an increase in the money supply, the domestic currency becomes cheaper than its foreign exchange.

-

-

What are the functions of monetary policy?

The monetary policy has the following functions:

- It regulates the growth rate of money supply.

- It regulates the entire banking system of the economy.

- It determines the allocation of credit among different sectors.

- It provides incentives to promote savings.

- It ensures adequate availability of credit for growth.

- It tries to achieve price stability.

What are macroeconomic impacts of monetary policy?

Monetary policy is primarily concerned with the price and exchange rate stability, along with promotion of economic growth. Further, it also helps in the following.

- Promotion of Savings and Investment: By regulating the interest rates and inflationary tendencies by applying the expansionary or contractionary policy stances, MP can help to influence savings and investment.

- Regulating Imports and Exports: By extending priority loans at low interest rates, MP helps to induce export-promotion and import substitution thereby helping to enhance the external account position of the economy.

- Managing Business Cycles: The upswings (boom) and downswings (recession) of a business cycle may be regulated by applying tight policy action during boom and easy policy action during recession. It helps in averting the destabilising ramifications of business cycle fluctuations.

- Regulation of Demand Conditions: By influencing the availability of credit and its cost, monetary policy acts as an effective tool to control the demand conditions according to the economic circumstances.

- Employment Generation: By influencing the level of savings, investment and aggregate demand, MP impacts favourably on employment creation.

- Infrastructural Development: By facilitating subsidised or concessional funding to priority sectors like small-scale industries, agriculture and other credit constrained sections, MP helps in infrastructural development.

- Managing and Developing the Financial Sector: The central bank manages the banking sector in order to ensure its smooth functioning and provision of financial services far and wide across the country.

What are the limitations of monetary policy?

- Natural calamities like droughts and floods can result in unexpected shortfall in crop production resulting in inflation because of reduced supply.

- Geo-political problems also affect the achievement of the targets of monetary policy. For example, in the on-going Russia-Ukraine war, the world has seen an unusual rise in the prices of wheat and cooking oil.

- Besides, the indiscriminate announcement of freebees by the political parties in India in order to appease the voters without any knowledge of long-term implication of their promises also affects the transmission of the monetary policy.

Previous Year Questions:

Mains:

- Do you agree with the view that steady GDP growth and low inflation have left the Indian economy in good shape? Give reasons in support of your arguments. (Answer in 250 words) (2019)

- Among several factors for India’s potential growth, savings rate is the most effective one. Do you agree? What are the other factors available for growth potential? (Answer in 250 words) (2017)

Prelims:

(2020)

Q. If the RBI decides to adopt an expansionist monetary policy, which of the following would it not do?

- Cut and optimise the Statutory Liquidity Ratio

- Increase the Marginal Standing Facility Rate

- Cut the Bank Rate and Repo Rate

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 2 only

(c) 1 and 3 only

(d) 1, 2 and 3

Answer: c

(2017)

Q. Which of the following statements is/are correct regarding the Monetary Policy Committee (MPC)?

- It decides the RBI’s benchmark interest rates.

- It is a 12-member body including the Governor of RBI and is reconstituted every year.

- It functions under the chairmanship of the Union Finance Minister.

Select the correct answer using the code given below:

(a) 1 only

(b) 1 and 2 only

(c) 3 only

(d) 2 and 3 only

Answer: a

(2015)

Q . With reference to Indian economy, consider the following:

- Bank rate

- Open market operations

- Public debt

- Public revenue

Which of the above is/are component/components of Monetary Policy?

(a) 1 only

(b) 2, 3 and 4

(c) 1 and 2

(d) 1, 3 and 4

Answer: c

Keywords:

- What is Quantitative Easing (QE)?

- Quantitative easing is often implemented when interest rates hover near zero and economic growth is stalled. Central banks have limited tools, like interest rate reduction, to influence economic growth.

- To execute quantitative easing, central banks buy government bonds and other securities, injecting bank reserves into the economy.

-

-

- Increasing the supply of money lowers interest rates further and provides liquidity to the banking system, allowing banks to lend with easier terms.

-

-

- Quantitative easing is incorrectly referred to as money printing since no hard cash is actually printed.

-

-

- The central bank issues credit to the central bank’s reserves to buy bonds. When the economy recovers, the central bank sells these assets and sterilizes the cash it receives from the sales. So, there is no additional money remaining in the system.

-

-

- Hence, the goal of quantitative easing is to inject liquidity into the banking system, so that banks are able to lend money to boost economic activity.

What are the differences between core inflation and headline inflation?

- Headline inflation is the raw inflation figure reported through the Consumer Price Index (CPI).

-

-

- The Monetary Policy Committee of the RBI uses ‘headline inflation’ to take its decision.

-

- Core inflation removes the CPI components that can exhibit large amounts of volatility from month to month, which can cause unwanted distortion to the headline figure.

-

-

- The most commonly removed factors are those relating to the cost of food and energy.

-

-

References:

- NCERTs New and Old

- https://www.cfainstitute.org/en/membership/professional-development/refresher-readings/monetary-fiscal-policy#:~:text=and%20fiscal%20policy.-,Monetary%20policy%20refers%20to%20central%20bank%20activities%20that%20are%20directed,the%20economy%20via%20different%20mechanisms.

- https://www.moneycontrol.com/news/business/explained-accommodative-neutral-and-hawkish-stances-in-rbi-monetary-policy-8066221.html

- https://www.thehindu.com/business/calibrated-tightening-is-the-appropriate-stance/article25138073.ece

- https://egyankosh.ac.in/bitstream/123456789/59920/3/Unit-21.pdf

- https://www.cfainstitute.org/en/membership/professional-development/refresher-readings/monetary-fiscal-policy

- https://www.investopedia.com/terms/m/monetarypolicy.asp#:~:text=Contractionary%20monetary%20policy%20is%20used,amount%20of%20money%20in%20circulation.

- https://economictimes.indiatimes.com/markets/stocks/news/a-deep-dive-into-monetary-policy-in-india-its-evolution-and-impact/articleshow/104573377.cms?from=mdr