Introduction

- Following the long-standing debate of ‘food versus fuel,’ a new dilemma has arisen: ‘food vs. cars.

- The ‘food versus fuel’ debate focused on the conflict between using agricultural crops such as sugarcane, rice, maize, palm, and soybeans for the production of ethanol and biodiesel, as opposed to using these crops for food production.

- The ‘food vs. cars’ dilemma highlights the increasing diversion of phosphoric acid. Traditionally used in the production of di-ammonium phosphate (DAP) fertilizer, phosphoric acid is now being redirected toward electric vehicle (EV) battery production.

- This shift creates a conflict between maintaining agricultural productivity and supporting the growth of the electric vehicle industry.

What is the Food vs Cars Dilemma?

- Food vs Cars Dilemma: This dilemma revolves around the competition for phosphorus between two critical sectors: agriculture and electric vehicles. The increasing demand for lithium-iron-phosphate (LFP) batteries in electric vehicles (EVs) is diverting phosphoric acid, traditionally used in fertilizers, towards battery production.

- Manufacture of Phosphoric Acid: Phosphoric acid is produced by treating rock phosphate ore with sulfuric acid. This acid is vital for both fertilizer production and battery development.

Read also: Explore Public Health Sector Challenges & Advancements | UPSC

Uses of Phosphorus

Fertilizer Production:

-

-

- Di-ammonium Phosphate (DAP): Phosphorus plays a crucial role in agriculture, particularly in the production of DAP, which is India’s second-most consumed fertilizer after urea. It supplies 46% phosphorus (P), an essential nutrient for early-stage plant development, supporting root and shoot growth in key crops like mustard, wheat, and pulses.

- Other Fertilizers: In addition to DAP, phosphorus is used in other fertilizers such as Monoammonium Phosphate (MAP), which contains 52% phosphorus and is particularly suited for crops needing a higher phosphorus intake. Another is Triple Superphosphate (TSP), which provides 44-48% phosphorus, widely used for soil health improvement and plant development in countries with less fertile soils. Globally, approximately 85% of mined phosphate rock is used to make fertilizers, highlighting the dominant role of phosphorus in agriculture.

-

Battery Manufacturing:

-

-

- Lithium-Iron-Phosphate (LFP) Batteries: Phosphorus is a key component of LFP batteries used in electric vehicles (EVs). These batteries have gained popularity due to their lower cost, longer lifespan, and enhanced safety compared to nickel-based batteries. The global market share of LFP batteries has increased significantly, rising from 6% in 2020 to 40% in 2023. China, a leading producer of EVs, has driven this growth, with over 65% of its EVs powered by LFP batteries in 2023.

-

Pharmaceutical Industry:

-

-

- Phosphorus is used in the pharmaceutical industry to produce various medicinal compounds, including phosphorus-based drugs like phosphates, which are used in treating conditions such as hypophosphatemia (low phosphate levels). Phosphates are also essential in producing intravenous (IV) solutions, acting as stabilizers and buffering agents. According to industry reports, the global pharmaceutical market uses approximately 5% of the total phosphorus supply.

-

Animal Feed Supplements:

-

-

- Phosphorus is also a critical component in animal feed supplements, which help improve livestock health and productivity. It is estimated that 5-7% of phosphorus consumption globally is dedicated to animal feed production, contributing to the meat and dairy industries by improving the growth and well-being of livestock.

-

Water Treatment:

-

-

- Phosphate compounds, such as sodium phosphate and zinc orthophosphate, act as corrosion inhibitors, protecting pipelines from damage and improving water quality. The global water treatment industry consumes around 3-4% of phosphorus production annually.

-

Food Industry:

-

-

- Phosphorus is commonly used in the food processing industry, particularly in the form of food-grade phosphates. These compounds are added to food products to improve texture, retain moisture, and extend shelf life. Examples include sodium phosphate in processed meats, calcium phosphate in baked goods, and phosphoric acid in soft drinks. The food industry accounts for around 1-2% of the total phosphorus demand, reflecting its significance in food preservation and quality enhancement.

-

Global Trend in the Food vs Cars Dilemma

- Rising Popularity of LFP Batteries: As the demand for EVs increases, LFP batteries are gaining prominence due to their reduced reliance on critical minerals like cobalt. This shift has fueled the phosphoric acid demand for batteries, competing with its agricultural use.

- Switch in the U.S. and Europe: EV manufacturers in the U.S. and Europe are increasingly adopting LFP batteries to avoid dependence on limited cobalt resources, of which over half are found in the Democratic Republic of the Congo.

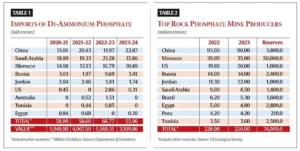

- China’s Shift: With a large share of its EVs using LFP batteries, China’s consumption of phosphorus for battery production is rising, which reduces its availability for fertilizer production. As China is a major exporter of DAP to India, this shift contributes to the dilemma.

- Investment in Phosphorus-Rich Nations: Countries with abundant phosphorus deposits, such as Morocco, are attracting investments in LFP battery production, further intensifying the diversion of phosphorus from agricultural fertilizers.

Implications for India

Dependency on DAP Fertilizer:

-

-

- India consumes around 10.5-11 million tonnes (MT) of Di-ammonium Phosphate (DAP) annually, making it the second-most consumed fertilizer after urea. The diversion of phosphorus to the battery industry worsens the existing fertilizer shortages.

- For instance, during the 2021 global supply chain disruptions, India experienced significant delays and shortages in DAP supplies, leading to a reliance on costly imports, which affected Indian farmers who depend on timely and affordable fertilizer for crop cycles.

-

Phosphate Import Dependency:

-

-

- India has limited domestic reserves of phosphate rock, holding approximately 31 MT, which is insufficient to meet its annual agricultural demand.

- As a result, the country imports nearly 90% of its phosphate needs, primarily from nations like China, Saudi Arabia, and Morocco. In 2020-21, China accounted for nearly 48% of India’s phosphate imports.

- The increasing demand for LFP batteries in these countries reduces the availability of phosphorus for fertilizers, making India more vulnerable to global supply fluctuations.

-

Increased Dependence on China:

-

-

- As China shifts more phosphoric acid towards LFP battery production, its DAP exports are likely to decline.

- In 2021, China temporarily halted the export of fertilizers, including DAP, to meet its domestic needs, which severely impacted countries like India that rely heavily on Chinese fertilizer imports.

- This trend could exacerbate shortages in key planting seasons, such as rabi (winter) crops, when DAP is essential for growing wheat, mustard, and pulses.

-

Impact on Crop Production:

-

-

- Reduced availability of DAP fertilizer is likely to have a significant impact on India’s agricultural output.

- For example, in 2021-22, a delay in DAP availability affected the sowing of mustard crops in Rajasthan, one of India’s largest mustard-producing states.

- A shortage in DAP could lead to lower yields of essential crops such as potato, chickpea, and wheat, particularly in regions like Punjab, Haryana, and Uttar Pradesh, where these crops are staples for millions.

-

Rising Costs:

-

-

- The global diversion of phosphorus towards LFP battery production has already led to a sharp increase in DAP prices.

- As of mid-2023, the landing cost of DAP in India surged to Rs 61,000 per tonne, up from around Rs 25,000 per tonne in 2020.

- This price escalation has strained Indian fertilizer manufacturers, with government subsidies required to keep prices affordable for farmers.

- For instance, in 2022, the Indian government increased its subsidy for DAP by 140% to cushion farmers from the global price rise.

-

Read also: Arrest of Telegram CEO Sparks Global Debate on Digital Privacy | UPSC

Way Forward

- Promoting Complex Fertilizers: Encouraging the use of fertilizers with lower phosphorus content, such as 20:20:0:13 or 12:32:16:0, can reduce reliance on DAP, promoting sustainability given India’s limited phosphorus reserves.

- Securing Phosphate Resources: India should pursue joint ventures with phosphate-rich nations like Morocco, Jordan, and Senegal to secure a stable supply of raw materials for fertilizer production. Indian companies should also invest in phosphoric acid production facilities in these regions.

- Improving Nutrient Efficiency: The government should promote technologies that enhance the nutrient use efficiency of fertilizers, reducing the quantity of nitrogen, phosphorus, potassium, and sulfur required without compromising crop yields.

- Supporting DAP Producers: India should offer financial assistance or incentives to DAP fertilizer manufacturers to offset the rising costs caused by global phosphorus demand, ensuring the availability of affordable fertilizers to farmers.