Introduction

- E-waste recycler Attero has announced entry into the D2C sector with the launch of an integrated e-waste Consumer Take-Back platform– Selsmart.

- The platform aims to transform the e-waste recycling landscape and combat India’s burgeoning e-waste crisis, projected to reach 14 million tonnes by 2030.

What is E-waste?

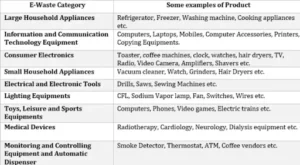

- Definition: E-waste consists of all waste from Electronic and Electrical Equipments (EEE) which have reached their end- of- life period or are no longer fit for their original intended use and are destined for recovery, recycling or disposal.

- Categories: It covers the three broad categories of electronic goods:

-

- White: Refrigerators, washing machines and air-conditioners

- Grey: Desktop computers, laptops, cellphones and printers and

- Brown: Television sets, cameras and recorders.

- Half of the e-waste these products generate is iron and steel, 21% plastic and 13% copper, aluminium and precious metals.

-

- Composition: The composition of e-waste is diverse and falls under ‘hazardous’ and ‘non-hazardous’ categories.

-

- The hazardous and toxic substances found in e-waste include lead (Pb) and cadmium (Cd) in printed circuit boards (PCBs).

- Aluminum found in electronic goods, copper and gold in computer parts are considered to be non- hazardous. Plastic and glass parts are generally not hazardous as well.

-

Why is There Need to Manage E- waste?

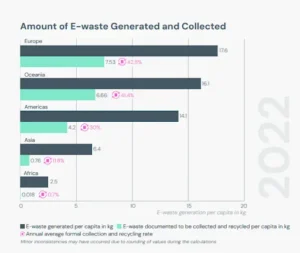

- Global Situation: According to Global E-waste Monitor 2024, the world’s generation of electronic waste is rising five times faster than documented e-waste recycling.

-

- Worldwide, the annual generation of e-waste is rising by 2.6 million tonnes annually, on track to reach 82 million tonnes by 2030, a further 33% increase from the 2022 figure.

- Countries in Asia generate almost half of the world’s e-waste (30 billion kg) but have made limited advances in e-waste management and relatively few of them have enacted legislation or established clear e-waste collection targets.

-

- Ecological Imperative: Recycling and management of e waste can shield living beings and the environment from toxic substances, such as brominated flame retardants (BFR) and chlorofluorocarbons (CFCs), found in many electronic devices.

- Economic Value: The world produces as much as 50 million tonnes of electronic and electrical waste (e-waste) a year. Only 20% of this is formally recycled.

-

- Improper management of e-waste is resulting in a significant loss of scarce and valuable raw materials, such as gold, platinum, cobalt and rare earth elements.

- The Global E-waste Monitor describes e-waste as an ‘urban mine’ because the critical and non-critical metals in it can be recycled as secondary raw materials.

-

- Security Reasons: For security reasons, it is important not to dispose of your electronic gadgets carelessly, as personal data may still remain even after deletion.

-

- Before a device is disposed of, it can be thoroughly cleaned by recycling businesses, making it difficult for cybercriminals to access any remaining information.

-

- Impacts Human Health: Polychlorinated biphenyl found in capacitors and transformers is known to be highly toxic, impacting the immune and reproductive systems and possibly even causes cancer.

-

- Open burning of circuit boards and polyvinyl chloride-insulated copper cables, releases pollutants, causing respiratory damage.

-

- Environmental Hazard: Open incineration and acid leeching often used by informal workers are directly impacting the environment and posing serious health risks.

-

- The informal disposal of e-waste contaminates water, soil and air and eventually reaches our food streams too.

-

Read also: Explained India-Bangladesh Relations | UPSC

Global Initiatives for E-waste Management

- Basel Convention: The Basel Convention on the Control of Transboundary Movements of Hazardous Wastes and their Disposal is the most comprehensive global environmental agreement.

-

- It was signed on 22 March 1989 and entered into force on 5 May 1992. The Convention. India is a member of the Basel Convention.

- It aims to protect human health and the environment against the adverse effects resulting from the generation, transboundary movements and management of hazardous wastes and other wastes.

- The Nairobi Declaration was adopted at COP9 of the Basel Convention on the Control of the Trans-boundary Movement of Hazardous Waste. It aimed at creating innovative solutions for the environmentally sound management of electronic wastes.

-

- Bamako Convention: The Bamako Convention is a treaty of African nations prohibiting the import into Africa of any hazardous (including radioactive) waste. The convention came into force in 1998.

- Rotterdam Convention: It regulates trade in hazardous wastes but contains no commitment to reduce their use and release.

-

- Adopted in September, 1998, the Rotterdam Convention came into force in February, 2004. India acceded to the Convention in 2006.

-

- Waste Electrical and Electronic Equipment (WEEE) Directive of the European Union: The objective of the Directive is to promote re-use, recycling and other forms of recovery of WEEE.

- Global E-waste Monitor: The Global E-waste Monitor is a collaborative effort between the International Telecommunication Union (ITU), the Sustainable Cycles (SCYCLE) Programme currently co-hosted by the United Nations University. It provides the most comprehensive overview of global e-waste statistics, including an overview of the magnitude of the e-waste challenges in different regions.

E-waste in India

E-Waste in India:

-

-

- E-waste has become a significant toxic waste stream in India, which is both an emerging economy and the second most populous country globally.

- The rapid growth of India’s IT sector has led to an increase in the use of electronic products.

- Technological advancements have also shortened the life cycle of these products.

- According to the Global E-waste Monitor 2020, India is now the world’s third-largest source of e-waste, following China and the US.

- The Electronics System Design & Manufacturing (ESDM) Industry Report 2021 projects that India’s electronics industry will grow at a Compound Annual Growth Rate (CAGR) of 16.6%, rising from USD 215 billion in FY19 to USD 540 billion by FY25, contributing to higher volumes of e-waste.

-

Generation of E-Waste

-

-

- According to the Central Pollution Control Board (CPCB), India generated over 10 lakh tonnes of e-waste in 2019-20, up from 7 lakh tonnes in 2017-18.

- Despite this increase, the e-waste dismantling capacity has remained at 7.82 lakh tonnes since 2017-18.

-

Waste Importation:

-

-

- India is one of the largest importers of waste globally.

- Various types of waste, including hazardous and toxic materials, are imported as cheap raw materials.

-

E-Waste Management:

-

-

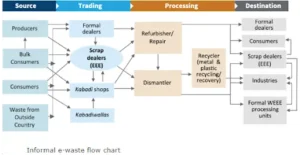

- E-waste in India is primarily managed by two sectors:

- Formal Sector: Regulated and organized sector.

- Informal Sector: Unregulated and often involves informal practices.

-

E-waste Recycling in India: Informal and Formal Sectors

Informal Sector

- Overview: E-waste management in India is predominantly handled by the informal sector, which primarily operates in the urban slums of major cities and mini-metros.

-

- Over 95% of e-waste is recycled by scrap dealers who engage in unscientific disposal methods, posing health and environmental risks and reducing the recovery of precious metals.

- Non-formal e-waste recycling units are scattered across India, with significant clusters in Delhi, Tamil Nadu, Uttar Pradesh, Karnataka, Maharashtra, Gujarat, Kerala, Andhra Pradesh, West Bengal, Rajasthan, and others.

- These units typically collect e-waste from rag pickers, disassemble products to retrieve usable parts, and then chemically treat the remaining materials to recover valuable metals.

- Inadequate treatment methods can lead to the leaching of hazardous substances into air, soil, and water.

- The recycling process is less efficient, recovering only valuable metals like gold, silver, aluminum, and copper, while other materials such as tantalum, cadmium, zinc, and palladium are often not recovered.

-

Formal Sector

- Overview: The formal e-waste management sector in India consists of government-authorized companies or agencies responsible for environmentally safe collection, recycling, and disposal of e-waste.

-

- These entities use modern equipment and ensure a safe and healthy environment for workers, promoting efficient recycling and disposal practices.

- Advanced processes and technologies are employed for effective metal recovery.

- The high cost of capital equipment and techniques is offset by the volume of e-waste processed, making the recovery economically viable.

- The efficiency of recovery in the formal sector is high, with capabilities to recover metals at trace levels and some technologies employing a zero-landfill approach.

- Clients of formal recyclers include multinational companies that seek to maintain an environmentally friendly image and prevent their products from entering the grey market and competing with new products.

- These entities use modern equipment and ensure a safe and healthy environment for workers, promoting efficient recycling and disposal practices.

-

Government Initiatives in India

E-Waste (Management) Rules, 2022

-

-

- Applicability: Effective from 1 April 2023, these rules apply to all entities involved in the manufacturing, sale, transfer, purchase, refurbishing, dismantling, recycling, and processing of e-waste and electronic equipment.

- Restrictions: The rules mandate the reduction of harmful substances such as lead, mercury, and cadmium in electronic equipment to protect human health and the environment.

- EPR Certificates: Companies are required to secure Extended Producer Responsibility (EPR) certificates, which certify the amount of e-waste collected and recycled annually. Companies can trade surplus quantities to help others meet their obligations.

- Strict Monitoring: The Central Pollution Control Board (CPCB) will conduct random sampling of electrical and electronic equipment to ensure compliance with hazardous substance reduction provisions.

- Reuse and Recycling: Manufacturers must use technology that makes products recyclable and ensure compatibility of components from different manufacturers to reduce e-waste.

- Disposal: Manufacturers are responsible for collecting and ensuring the recycling or disposal of e-waste generated during production. However, this does not apply to waste batteries, packaging plastics, micro enterprises, and radioactive waste.

-

Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors (SPECS)

-

-

- Incentive: Provides a 25% financial incentive on capital expenditure for establishing modern recycling facilities that extract precious metals from e-waste.

-

E-Waste Awareness Programme

-

-

- Objective: Run by the Ministry of Electronics and Information Technology, this program aims to raise awareness about the environmental and health impacts of polluting recycling technologies used in the unorganized sector.

-

Department of Information Technology (DIT) Initiatives

-

-

- Focus: Encourages research and development to create cost-effective and eco-friendly e-waste management methods.

-

Hazardous Wastes Amendment Rules, 2019

-

-

- Regulation: Prohibits the import of solid plastic waste into India within Special Economic Zones (SEZ).

-

E-Waste Recyclers

-

-

- Notable Recycler: E-Parisaraa in Bengaluru is India’s first government-authorized electronic waste recycler, focusing on eco-friendly handling, recycling, and reusing of e-waste. There are currently 567 authorized recyclers operating across the country.

-

Producer Responsibility Organisations (PRO)

-

-

- Role: Established under the E-waste (Management) Rules, 2016, PROs act as intermediaries between electronic goods manufacturers and formal recycling units, equipped to recycle end-of-life electronic goods safely and efficiently.

-

Read also: Urban Flooding in India: Causes, Impacts, and Mitigation Strategies | UPSC

Challenges in E-waste Management in India

Health Hazard

-

-

- Informal workers, often known as ‘waste pickers,’ face significant health risks due to inadequate access to healthcare, food security, and fair wages.

- These workers often operate without protective gear, such as gloves or masks, leading to dangerous working conditions.

-

Inefficient Legislation

-

-

- The unorganized sector lacks clear guidelines for handling e-waste, leaving informal e-waste workers without legal rights and adequate social protection, such as pensions and health insurance.

- Despite their substantial contribution to the labor market and economy, informal sector workers are not regulated by the government, contributing to the sector’s status as a grey labor market.

-

Lack of Clarity

-

-

- There is confusion regarding the differentiation between banned e-waste and permissible second-hand electronic goods, leading to the continued influx of restricted e-waste into the informal sector.

-

Lack of Incentives

-

-

- There are no incentives to encourage informal sector workers to transition to formal e-waste handling practices.

-

Gender and Waste Nexus

-

-

- Women represent a significant portion of waste pickers in lower-tier roles, such as collectors and crude separators at landfill sites. Men predominantly hold skilled positions, including managers, machinery operators, truck drivers, scrap dealers, repair workers, and recycling traders.

-

E-Waste Imports

-

-

- A major challenge is the cross-border flow of e-waste, with 80% of e-waste from developed countries being sent to developing nations like India, China, Ghana, and Nigeria for recycling.

-

Security Implications

-

-

- End-of-life computers often contain sensitive personal information and bank details, which can pose security risks if not properly deleted.

-

Reluctance of Authorities

-

-

- There is a lack of coordination among authorities responsible for e-waste management and disposal, including limited involvement of municipalities.

-

Lack of Capital

-

-

- The absence of a robust e-waste collection chain in India hampers recycling efforts. Recycling is largely conducted by the informal sector using manual dismantling, open burning, melting, and uncontrolled leaching methods.

-

Poor Infrastructure

-

-

- India has limited infrastructure capacity for large-scale e-waste management, with government-approved recycling centers handling only about one-fifth of the total e-waste generated annually.

-

Lack of Awareness

-

-

- Public awareness of e-waste hazards is low in India, resulting in minimal recycling efforts.

-

Way Forward

Circular Economy (CE)

-

-

- Concept: The Circular Economy is a sustainable alternative to the traditional linear economic model (take-make-dispose). It focuses on reducing waste by reusing, repairing, refurbishing, and recycling materials and products.

- India’s Context: Although India has abundant iron ore and bauxite, it relies on imports for essential materials like copper, nickel, cobalt, and rare earths needed for electronics production.

- Advantages: Adopting a Circular Economy approach can help manage e-waste effectively while fostering growth in the domestic electronics manufacturing sector. End-of-life electronics contain valuable secondary materials such as precious metals, steel, aluminum, copper, and plastics.

- Outcomes: Transitioning to a circular electronics sector could benefit producers, consumers, society, and the environment.

-

Need to Increase Collection

-

-

- Investment: Greater investment in environmentally friendly waste-recycling technologies is needed to develop the domestic recycling industry through blended financing options.

- Innovation: This will encourage innovation, create new business models, and integrate the informal sector into formal recycling efforts.

-

Engaging the Consumers

-

-

- Awareness: Educate consumers about their role in safe e-waste management.

- Incentives: Implement incentive systems for consumers to return e-waste to authorized collectors.

- Convenience: Make e-waste collection easy and hassle-free by offering home-collection services.

- Policy: Develop an Electronic Upgradation Policy that mandates manufacturers to receive, upgrade, donate, or resell their products.

-

Infrastructure

-

-

- Development: Build sustainable infrastructure for e-waste management, including disposal zones, green transport in the supply chain, and warehouses for e-waste storage.

- Manufacturing: Enhance manufacturing capabilities to produce durable products with longer lifespans and effective end-of-life procurement.

-

Technology

-

-

- Advancement: Invest in or develop technology for the sustainable extraction of valuable metals from e-waste to prevent wastage.

-

Monitoring

-

-

- Accountability: Implement accountability and transparency in the reverse supply chain and recycling processes.

- Feedback Loop: Establish a feedback and monitoring system for all stakeholders, including consumers, producers, and repairers.

- Tracking: Ensure that each electronic device’s unique product number is tracked throughout its lifecycle and recycling process.

-

Partners

-

-

- Network of Networks: Given the dominance of the informal sector in e-waste recycling, a network of networks approach is suitable. This includes collaborating with NGOs, rag-pickers associations, and Urban Local Bodies (ULBs) experienced in solid waste collection from initiatives like the Swachh Bharat Mission.

-

Policy

-

-

- Holistic Approach: Develop a comprehensive e-waste policy that defines a sustainable reverse supply chain and regulates the informal sector.

- Incentives for Training: Incentivize producers and companies to provide training and certification for informal sector players involved in repairing, recycling, and reselling electronic products.

-