Introduction

-

- The Finance Minister Nirmala Sitharaman presented the Union Budget 2024-25 in the Parliament, marking her seventh consecutive budget.

- The Budget focused on supporting the poor, women, youth, and farmers, with significant emphasis on increasing government spending, generating jobs, and providing relief to the middle class.

Budget

-

- A budget is a financial plan that outlines the expected income and expenses for a defined period.

- The annual budget covers all aspects of government finances, including revenue generation, expenditure allocations, and policy announcements.

- In contrast, the interim budget focusses primarily on maintaining essential spending on ongoing schemes and critical public services until the new government takes charge.

- The Department of Economic Affairs in the Ministry of Finance prepares the Union Budget every year, which is then presented by the Finance Minister.

Constitutional Provisions

Article 77(3):

-

- The Union Finance Minister has been made responsible by the President to prepare the budget also called as the annual financial statement and pilot it through the parliament.

Article 112:

-

- The President shall in respect of every financial year cause to be laid before both the Houses of Parliament a statement of the estimated receipts and expenditure of the Government of India for that year, referred to as the “annual financial statement’.

- The term “budget” is not mentioned in the Constitution.

Article 113:

-

- No demand for a grant shall be made except on the recommendation of the President.

Article 114:

-

- No amount can be withdrawn from the Consolidated Fund of India(CFI) without authorization from the Parliament.

Article 266 :

-

- All revenues received by the government shall be credited to the “Consolidated Fund of India”. All other public money, such as provident fund, Postal insurance, etc, shall be credited to the Public Account of India.

Article 267:

-

- Parliament may by law establish a Contingency Fund of India to meet unexpected or unforeseen expenditures.

Classification of Budget

Union Budget is classified into Revenue Budget and Capital Budget.

Revenue Budget:

-

- Includes the government’s revenue receipts and expenditure.

- There are two kinds of revenue receipts – tax and non-tax revenue.

- Revenue expenditure is the expenditure incurred on day to day functioning of the government and on various services offered to citizens.

- If revenue expenditure exceeds revenue receipts, the government incurs a revenue deficit.

Capital Budget :

-

- Includes capital receipts and payments of the government.

- Loans from public, foreign governments and RBI form a major part of the government’s capital receipts.

- Capital expenditure is the expenditure on development of machinery, equipment, building, health facilities, education etc.

- Fiscal deficit is incurred when the government’s total expenditure exceeds its total revenue.

Budget Parts

Part A:

-

- Macroeconomic section announcing government schemes and priorities.

Part B:

-

- Involves the Finance Bill, containing taxation proposals such as income tax revisions.

- A Finance Bill is a Money Bill as defined in Article 110 of the Constitution.

- The Speaker has the final authority to determine whether a bill is a Money Bill.

Read also: Understanding Quantum Computing Technology | UPSC

Key Budget Documents:

- Documents mandated under the constitution of India:

-

- Annual Financial Statement: Under Art. 112

- Demands For Grants: Under Art. 113

- Finance Bill: Under Art. 110

- Documents presented as per the provisions of the Fiscal Responsibility and Budget Management Act, 2003:

-

- Macro-economic Framework Statement;

- Medium Term Fiscal Policy Statement;

- Fiscal Policy Strategy Statement.

What Are Some Important Terms Related To Budget?

Revenue Budget:

-

- The revenue budget consists of the government’s revenue receipts (Tax revenues and non-tax revenues) and revenue expenditures.

- Tax revenues comprise proceeds of taxes and other duties levied by the Union.

Revenue Expenditure:

-

- Revenue expenditure is for the normal running of Government Departments and for rendering of various services, making interest payments on debt, meeting subsidies, 11 grants in aid, etc.

- The expenditure which does not result in the creation of assets for the Government of India is treated as revenue expenditure.

Capital Budget:

-

- Capital receipts and capital expenditures together constitute the Capital Budget.

- The capital receipts are loans raised by the Government.

- Capital expenditure consists of the acquisition of assets like land, buildings, machinery, equipment, as well as investments in shares, etc., and loans and advances granted by the Central Government to the State and the Union Territory Governments, Government companies, Corporations, and other parties.

Fiscal Deficit:

-

- Fiscal Deficit is the difference between the Revenue Receipts plus Non-debt Capital Receipts (NDCR) and the total expenditure.

- Fiscal deficit is “reflective of the total borrowing requirements of Government”.

Demands for Grants:

-

- Article 113 of the Constitution mandates that the estimates of expenditure from the Consolidated Fund of India included in the Annual Financial Statement and required to be voted by the Lok Sabha, be submitted in the form of Demands for Grants.

Money Bill:

-

- Article 110 defines a “Money Bill” as one containing provisions dealing with taxes, regulation of the government’s borrowing of money, and expenditure or receipt of money from the Consolidated Fund of India, among others.

Finance Bill:

-

- At the time of presentation of the Annual Financial Statement before the Parliament, a Finance Bill is also presented in fulfillment of the requirement of Article 110 (1)(a) of the Constitution, detailing the imposition, abolition, remission, alteration or regulation of taxes proposed in the Budget.

- A major difference between money and Financial Bills is that while the latter has the provision of including the Rajya Sabha’s (Upper House) recommendations, the former does not make their inclusion mandatory.

- The Lok Sabha has the right to reject the Rajya Sabha’s recommendations when it comes to Money Bills.

Macro Highlights of the Budget

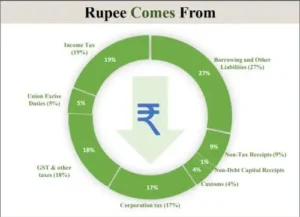

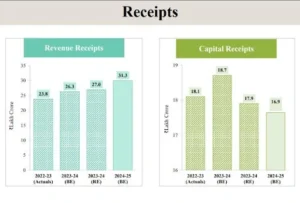

Total Receipts for FY 2024-25:

-

- The total receipts, excluding borrowings, are estimated to be Rs. 32.07 lakh crore.

- Gross market borrowings through dated securities are estimated at Rs. 14.01 lakh crore.

- Net market borrowings through dated securities are estimated at Rs. 11.63 lakh crore.

- Net tax receipts are estimated at Rs. 25.83 lakh crore.

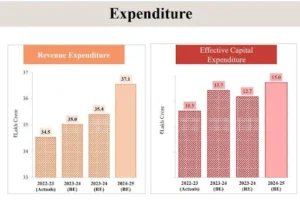

Total Expenditure for FY 2024-25:

-

- The total expenditure is estimated at Rs. 48.21 lakh crore.

Fiscal Deficit:

-

- The fiscal deficit is estimated at 4.9% of GDP.

Inflation Target:

-

- India’s inflation continues to be low, stable, and moving towards the 4% target. Core inflation (non-food, non-fuel) is currently at 3.1%.

India’s Economic Growth:

-

- India’s economic growth remains robust and is expected to continue being an exceptional performer in the coming years.

Stages in Enactment of Budget:

-

-

- Presentation of Budget

- General Discussion

- Scrutiny by Departmental Committees

- Voting on Demands for Grants

- Passing of Appropriation Bill

- Passing of Finance Bill

-

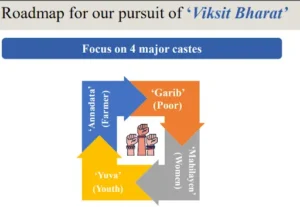

Focus Areas of the Budget 2024

4 Focus Areas:

-

- Union Finance Minister Nirmala Sitharaman highlighted the four main focus points of the first budget under the Modi 3.0 government. It includes:

- ‘Garib’ (Poor), ‘

- Yuva’ (Youth),

- ‘Annadata’ (Farmer) and

- ‘Nari’ (Women).

- Union Finance Minister Nirmala Sitharaman highlighted the four main focus points of the first budget under the Modi 3.0 government. It includes:

9 Priorities:

-

- The Finance Minister laid down nine priorities of the Budget:

- Productivity and resilience in agriculture

- Employment and skilling

- Inclusive Human resource development and social justice

- Manufacturing and services

- Support for promotion of MSMEs

- Urban development

- Energy security

- Infrastructure

- Innovation, research and development

Priority 1: Productivity and Resilience in Agriculture

- Transforming Agriculture Research:

-

- A comprehensive review of the agriculture research setup will be undertaken to focus on raising productivity and developing climate-resilient varieties.

- Funding will be provided in a challenge mode, including to the private sector.

- Domain experts from both the government and outside will oversee the conduct of such research.

- Release of New Varieties:

-

- New 109 high-yielding and climate-resilient varieties of 32 field and horticulture crops will be released for cultivation by farmers.

- Natural Farming:

-

- In the next two years, 1 crore farmers across the country will be initiated into natural farming supported by certification and branding.

- Implementation will be through scientific institutions and willing gram panchayats.

- 10,000 need-based bio-input resource centres will be established.

- Missions for Pulses and Oilseeds:

-

- A strategy is being put in place to achieve ‘atmanirbharta’ for oilseeds such as mustard, groundnut, sesame, soybean, and sunflower.

- Vegetable Production & Supply Chains:

-

- Large-scale clusters for vegetable production will be developed closer to major consumption centres.

- Farmer-Producer Organizations, cooperatives, and start-ups will be promoted for vegetable supply chains, including for collection, storage, and marketing.

- Digital Public Infrastructure for Agriculture:

-

- Implementation of the Digital Public Infrastructure (DPI) in agriculture for coverage of farmers and their lands will be facilitated in partnership with the states within 3 years.

- Digital crop survey for Kharif using the DPI will be taken up in 400 districts this year.

- Details of 6 crore farmers and their lands will be brought into the farmer and land registries.

- Issuance of Jan Samarth based Kisan Credit Cards will be enabled in 5 states.

- Shrimp Production & Export:

-

- Financial support for setting up a network of Nucleus Breeding Centres for Shrimp Broodstocks will be provided.

- Financing for shrimp farming, processing, and export will be facilitated through NABARD.

- National Cooperation Policy:

-

- A National Cooperation Policy will be brought out for the systematic, orderly, and all-round development of the cooperative sector.

- The policy goal will be fast-tracking the growth of the rural economy and generating employment opportunities on a large scale.

- Financial Provision

- A provision of ₹ 52 lakh crore for agriculture and allied sectors has been made this year.

Priority 2: Employment & Skilling

- Employment Linked Incentive:

- Three schemes under the Prime Minister’s package for ‘Employment Linked Incentive’ will be implemented, based on EPFO enrolment and focusing on first-time employees and support for employees and employers.

- Scheme A: First Timers:

- One month’s wage as subsidy (maximum `15,000)

- Applicable to all sectors

- First timers have a learning curve before they become fully productive; subsidy is to assist employees and employers in hiring of first timers.

- Applicable to all persons newly entering the workforce (EPFO) with wage/salary less than Rs. 1 lakh per month.

- Subsidy will be paid to the employee in three instalments

- Employee must undergo compulsory online Financial Literacy course before claiming the second instalment.

- Subsidy to be refunded by employer if the employment to the first timer ends within 12 months of recruitment.

- Expected to cover approximately one crore persons per annum.

- Scheme will be for 2 years

- Scheme B: Job Creation in Manufacturing

-

- Incentivizes additional employment in the manufacturing sector, linked to first-time employees.

- All employers which are corporate entities and those non-corporate entities with a three year track record of EPFO contribution will be eligible.

- Employer must hire at least the following number of previously non-EPFO enrolled workers: 50 or 25% of the baseline (previous year’s number of EPFO employees)

- Incentive will be paid for four years partly to the employee and partly to the employer as follows:

- Employer must maintain threshold level of enhanced employment throughout, failing which subsidy benefit will stop.

- Employee must be directly working in the entity paying salary/wage (i.e. in-sourced employee).

- Employees with a wage/ salary of up to `1 lakh per month will be eligible, subject to contribution to EPFO.

- For those with wages/salary greater than `25,000/month, incentive will be calculated at `25,000/month.

- Subsidy to be refunded by employer if the employment to first timer ends within 12 months of recruitment.

- Scheme will be for 2 years

- Scheme C: Support to Employers

-

- Additional employment within a salary of ₹ 1 lakh per month will be counted.

- Government will reimburse up to ₹ 3,000 per month for 2 years towards employers’ EPFO contribution for each additional employee.

- Expected to incentivize additional employment of 50 lakh persons.

- Applicable to an employer who:

- Increases employment above the baseline (previous year’s number of EPFO employees) by at least two employees (for those with less than 50 employees) or 5 employees (for those with 50 or more employees) and sustains the higher level, and

- For employees whose salary does not exceed `1,00,000/month

- New employees under this Part need not be new entrants to EPFO

- If the employer creates more than 1000 jobs:

- Reimbursement will be done quarterly for the previous quarter

- Subsidy will continue for the 3rd and 4th year on the same scale as Employer benefit in Part-B

- Scheme will be for 2 years

- Expected to incentivize additional employment of 50 lakh persons.

- Participation of Women in the Workforce:

-

- Setting up working women hostels in collaboration with industry and establishing creches.

- Skilling Programme:

-

- A new centrally sponsored scheme for skilling in collaboration with state governments and industry.

- 20 lakh youth to be skilled over a 5-year period.

- 1,000 Industrial Training Institutes will be upgraded in hub and spoke arrangements with outcome orientation.

- Total outlay of ` 60,000 crore over five years

- Government of India—` 30,000 crore

- State Governments—` 20,000 crore

- Industry—` 10,000 crore (including CSR funding)

- 200 hubs and 800 spoke ITIs –all with industry collaboration

- Re-design and review of existing courses

- New courses

- 1 to 2 year courses in all 1000 ITIs

- Short term specialised courses in Hub ITIs

- Capacity augmentation of 5 national institutes for training of trainers.

- Skilling Loans:

-

- The Model Skill Loan Scheme will be revised to facilitate loans up to ₹ 5 lakh with a guarantee from a government-promoted fund.

- Expected to help 25,000 students every year.

- Education Loans:

-

- Financial support for loans up to ₹ 10 lakh for higher education in domestic institutions.

- E-vouchers for annual interest subvention of 3 per cent of the loan amount will be given directly to 1 lakh students every year.

Read also: Explain Importance of Fiscal Federalism in India | UPSC

Priority 3: Inclusive Human Resource Development and Social Justice

- Saturation Approach:

-

- Adoption of a saturation approach to cover all eligible people through various programs for education and health.

- Empowerment by improving capabilities through schemes for craftsmen, artisans, self-help groups, scheduled caste, scheduled tribe, women entrepreneurs, and street vendors.

- Implementation of PM Vishwakarma, PM SVANidhi, National Livelihood Missions, and Stand-Up India will be stepped up.

- Purvodaya:

-

- Formulation of the Purvodaya plan for the all-round development of Bihar, Jharkhand, West Bengal, Odisha, and Andhra Pradesh.

- Coverage includes human resource development, infrastructure, and economic opportunities.

- Support for development on the Amritsar Kolkata Industrial Corridor, including an industrial node at Gaya.

- Development of road connectivity projects: Patna-Purnea Expressway, Buxar-Bhagalpur Expressway, Bodhgaya, Rajgir, Vaishali, and Darbhanga spurs, and an additional 2-lane bridge over river Ganga at Buxar.

- Power projects, including a new 2400 MW power plant at Pirpainti, will be undertaken.

- New airports, medical colleges, and sports infrastructure in Bihar will be constructed.

- Additional allocation for capital investments and expedited external assistance from multilateral development banks for Bihar.

- Andhra Pradesh Reorganization Act:

-

- Facilitation of special financial support for the state’s capital through multilateral development agencies.

- Arrangement of ₹ 15,000 crore in the current financial year, with additional amounts in future years.

- Commitment to financing and early completion of the Polavaram Irrigation Project.

- Promotion of industrial development with funds for essential infrastructure in Kopparthy node on the Vishakhapatnam-Chennai Industrial Corridor and Orvakal node on Hyderabad-Bengaluru Industrial Corridor.

- Additional allocation for capital investment and grants for backward regions of Rayalaseema, Prakasam, and North Coastal Andhra.

- PM Awas Yojana:

-

- Announcement of three crore additional houses under PM Awas Yojana in rural and urban areas, with necessary allocations.

- Women-Led Development:

-

- Allocation of more than ₹ 3 lakh crore for schemes benefitting women and girls, promoting women-led development.

- Pradhan Mantri Janjatiya Unnat Gram Abhiyan:

-

- Launch of Pradhan Mantri Janjatiya Unnat Gram Abhiyan to improve the socio-economic condition of tribal communities.

- Saturation coverage for tribal families in tribal-majority villages and aspirational districts, covering 63,000 villages and benefiting 5 crore tribal people.

- Bank Branches in North-Eastern Region:

-

- Establishment of more than 100 branches of India Post Payment Bank in the North East region to expand banking services.

- Rural Development Provision:

-

- A provision of ₹ 66 lakh crore for rural development, including rural infrastructure, has been made.

Priority 4: Manufacturing & Services

- Support for Promotion of MSMEs:

-

- Special attention will be given to MSMEs and labour-intensive manufacturing through financing, regulatory changes, and technology support.

- Credit Guarantee Scheme for MSMEs in the Manufacturing Sector:

-

- Term loans for MSMEs for machinery and equipment purchase without collateral.

- Operated through pooling credit risks of MSMEs.

- Self-financing guarantee fund to provide up to ₹ 100 crore guarantee cover per applicant.

- Borrower to provide an upfront guarantee fee and annual fee on the reducing loan balance.

- New Assessment Model for MSME Credit:

-

- Public sector banks to build in-house capability for MSME credit assessment.

- Development of a new credit assessment model based on MSME digital footprints.

- Model to include MSMEs without formal accounting systems.

- Credit Support to MSMEs during Stress Period:

-

- New mechanism for continuation of bank credit to MSMEs during stress periods.

- Support for credit availability through a government-promoted guarantee fund.

- Mudra Loans:

-

- Mudra loan limit increased to ₹ 20 lakh from ₹ 10 lakh for entrepreneurs who have successfully repaid previous loans under the ‘Tarun’ category.

- Enhanced Scope for Mandatory Onboarding in TReDS:

-

- Turnover threshold for mandatory onboarding on TReDS platform reduced from ₹ 500 crore to ₹ 250 crore.

- Inclusion of 22 more CPSEs and 7000 more companies.

- Medium enterprises included in the scope of suppliers.

- SIDBI Branches in MSME Clusters:

-

- SIDBI to open new branches to serve all major MSME clusters within 3 years.

- 24 branches to open this year, expanding service coverage to 168 out of 242 major clusters.

- MSME Units for Food Irradiation, Quality & Safety Testing:

-

- Financial support for setting up 50 multi-product food irradiation units in the MSME sector.

- Facilitation of 100 food quality and safety testing labs with NABL accreditation.

- E-Commerce Export Hubs:

-

- E-Commerce Export Hubs to be set up in PPP mode for MSMEs and traditional artisans.

- Hubs to facilitate trade and export-related services under one roof.

Measures for Promotion of Manufacturing & Services:

Internship in Top Companies:

-

- Launch of a scheme for internship opportunities in 500 top companies for 1 crore youth over 5 years.

- Interns to receive ₹ 5,000 per month allowance and ₹ 6,000 one-time assistance.

- Companies to cover training costs and 10% of internship costs from CSR funds.

- Applicable to those who are not employed and not engaged in full time education.

- Youth aged between 21 and 24 will be eligible to apply.

- Cost sharing (per annum):

- Government – `54,000 towards monthly allowance (plus `6,000 grant for incidentals)

- Company – Rs 6,000 from CSR funds towards monthly allowance

- Training cost to be borne by the Company from CSR funds.

- Administrative costs to be borne by respective parties (for the Company, reasonable administrative expenses can be counted as CSR expenditure)

- Participation of companies is voluntary.

- Ineligible candidates (indicative list)

- Candidate has IIT, IIM, IISER, CA, CMA etc as qualification

- Any member of the family is assessed to Income Tax

- Any member of the family is a government employee, etc.

- At least half the time should be in actual working experience/job environment, not in classroom.

- Phase 1 of the scheme will be for 2 years followed by Phase 2 for 3 years

Industrial Parks:

-

- Development of “plug and play” industrial parks in or near 100 cities in partnership with states and the private sector.

- Twelve industrial parks under the National Industrial Corridor Development Programme to be sanctioned.

Rental Housing:

-

- Facilitation of dormitory-type rental housing for industrial workers in PPP mode with VGF support and commitment from anchor industries.

Shipping Industry:

-

- Implementation of ownership, leasing, and flagging reforms to improve the Indian shipping industry’s share and generate employment.

Critical Mineral Mission:

-

- Establishment of a Critical Mineral Mission for domestic production, recycling, and overseas acquisition of critical minerals.

- Mandate includes technology development, skilled workforce, extended producer responsibility framework, and suitable financing mechanism.

Offshore Mining of Minerals:

-

- Launch of the first tranche of offshore blocks for mining, building on existing exploration.

Digital Public Infrastructure Applications:

-

- Development of DPI applications for productivity gains, business opportunities, and innovation in credit, e-commerce, education, health, law and justice, logistics, MSME, services delivery, and urban governance.

Integrated Technology Platform for IBC Ecosystem:

-

- Setup of an Integrated Technology Platform for improving outcomes under the Insolvency and Bankruptcy Code (IBC).

Voluntary Closure of LLPs:

-

- Extension of C-PACE services for voluntary closure of LLPs to reduce closure time.

National Company Law Tribunals:

-

- Reforms and strengthening of tribunals to speed up insolvency resolution.

- Establishment of additional tribunals, some to decide cases exclusively under the Companies Act.

Debt Recovery:

-

- Reforming and strengthening debt recovery tribunals.

- Establishment of additional tribunals to speed up recovery.

Priority 5: Urban Development

- Cities as Growth Hubs:

-

- Development of ‘Cities as Growth Hubs’ through economic and transit planning.

- Orderly development of peri-urban areas using town planning schemes in collaboration with states.

- Creative Redevelopment of Cities:

-

- Formulation of a framework for enabling policies, market-based mechanisms, and regulation for brownfield redevelopment of existing cities.

- Transit-Oriented Development:

-

- Formulation of Transit-Oriented Development plans for 14 large cities with a population above 30 lakh.

- Implementation and financing strategy to be included.

- Urban Housing:

-

- Addressing housing needs of 1 crore urban poor and middle-class families under PM Awas Yojana Urban 2.0.

- Investment of ₹ 10 lakh crore, with ₹ 2.2 lakh crore central assistance over the next 5 years.

- Provision of interest subsidy for affordable housing loans.

- Implementation of enabling policies and regulations for efficient and transparent rental housing markets.

- Water Supply and Sanitation:

-

- Promotion of water supply, sewage treatment, and solid waste management projects for 100 large cities in partnership with State Governments and Multilateral Development Banks.

- Street Markets:

-

- Scheme to support the development of 100 weekly ‘haats’ or street food hubs in select cities each year for the next five years, building on the PM SVANidhi Scheme.

- Stamp Duty:

-

- Encouragement for states with high stamp duty to moderate rates.

- Consideration of further lowering duties for properties purchased by women.

Priority 6: Energy Security

- Energy Transition:

-

- Policy on energy transition pathways balancing employment, growth, and environmental sustainability will be introduced.

- PM Surya Ghar Muft Bijli Yojana:

-

- Launched to install rooftop solar plants for 1 crore households to obtain free electricity up to 300 units per month.

- Scheme has generated 1.28 crore registrations and 14 lakh applications.

- Pumped Storage Policy:

-

- Promotion of pumped storage projects for electricity storage.

- Facilitation of smooth integration of renewable energy into the overall energy mix.

- Small and Modular Nuclear Reactors: Partnership with the private sector for:

-

- Setting up Bharat Small Reactors.

- Research & development of Bharat Small Modular Reactor.

- Research & development of newer technologies for nuclear energy.

- Advanced Ultra Super Critical Thermal Power Plants:

-

- Development of indigenous technology for AUSC thermal power plants completed.

- Joint venture between NTPC and BHEL to set up an 800 MW commercial plant using AUSC technology.

- Government to provide fiscal support.

- Development of indigenous capacity for high-grade steel and advanced metallurgy materials.

- Roadmap for ‘Hard to Abate’ Industries:

-

- Formulation of a roadmap for moving ‘hard to abate’ industries from ‘energy efficiency’ targets to ‘emission targets’.

- Implementation of regulations for transition from ‘Perform, Achieve and Trade’ mode to ‘Indian Carbon Market’ mode.

- Support to Traditional Micro and Small Industries:

-

- Facilitation of investment-grade energy audits in 60 clusters, including brass and ceramic.

- Provision of financial support for cleaner energy and energy efficiency measures.

- Replication of the scheme in another 100 clusters in the next phase.

Priority 7: Infrastructure

- Infrastructure Investment by Central Government:

- Fiscal Support: Commitment to maintain strong fiscal support for infrastructure over the next 5 years, balancing other priorities and fiscal consolidation.

- Capital Expenditure: Provision of ₹11,11,111 crore for capital expenditure, constituting 3.4% of GDP.

- Infrastructure Investment by State Governments:

- Support Encouragement: States encouraged to provide similar scale support for infrastructure, considering their development priorities.

- Long-term Loans: Provision of ₹5 lakh crore for long-term interest-free loans to support states’ resource allocation.

- Private Investment in Infrastructure:

- Promotion: Investment by the private sector promoted through viability gap funding, enabling policies, and regulations.

- Financing Framework: Introduction of a market-based financing framework.

- Pradhan Mantri Gram Sadak Yojana (PMGSY):

- Phase IV Launch: Launch of Phase IV to provide all-weather connectivity to 25,000 rural habitations with increased population.

- Irrigation and Flood Mitigation:

- Bihar Flood Control: Financial support for projects estimated at ₹11,500 crore, including Kosi-Mechi intra-state link and other schemes.

- Assam Flood Assistance: Assistance for flood management and related projects.

- Himachal Pradesh Rehabilitation: Assistance for reconstruction and rehabilitation through multilateral development assistance.

- Uttarakhand Cloud Burst Relief: Assistance for losses due to cloud bursts and landslides.

- Sikkim Flash Flood Relief: Assistance for recent flash floods and landslides.

- Tourism Development:

- Global Tourist Destination: Positioning India as a global tourist destination to create jobs, stimulate investments, and unlock economic opportunities.

- Bihar Temples: Comprehensive development of Vishnupad Temple Corridor and Mahabodhi Temple Corridor in Bihar, modelled on Kashi Vishwanath Temple Corridor.

- Rajgir Development: Comprehensive initiative for Rajgir, significant for Hindus, Buddhists, and Jains.

- Nalanda: Development of Nalanda as a tourist centre and revival of Nalanda University.

- Odisha Tourism: Assistance for development of Odisha’s temples, monuments, wildlife sanctuaries, natural landscapes, and beaches.

Priority 8: Innovation, Research & Development

- Research and Innovation:

- Anusandhan National Research Fund: Operationalization of the fund for basic research and prototype development.

- Private Sector Research: Establishment of a mechanism to spur private sector-driven research and innovation at a commercial scale with a financing pool of ₹1 lakh crore.

- Space Economy:

- Expansion Goal: Commitment to expanding the space economy by 5 times in the next 10 years.

- Venture Capital Fund: Creation of a venture capital fund of ₹1,000 crore to support this expansion.

Priority 9: Next Generation Reforms

- Economic Policy Framework:

- A new framework will be formulated to delineate the approach to economic development.

- Collaboration with States: Effective implementation of reforms will require collaboration between the Centre and states, promoting competitive federalism and incentivizing states for faster implementation of reforms through a significant portion of the 50-year interest-free loan.

- Rural Land Actions:

- Unique Land Parcel Identification Number (ULPIN) for all lands.

- Digitization of cadastral maps.

- Survey of map sub-divisions as per current ownership.

- Establishment of land registry.

- Linking to the farmers registry to facilitate credit flow and other agricultural services.

- Urban Land Actions:

- Digitization of land records with GIS mapping.

- Establishment of an IT-based system for property record administration, updating, and tax administration to improve the financial position of urban local bodies.

- Labour-Related Reforms:

- Services to Labour: Comprehensive integration of the e-shram portal with other portals for a one-stop solution for employment and skilling services.

- Open architecture databases for the labour market, skill requirements, and available job roles.

- Shram Suvidha & Samadhan Portal: Revamp of these portals to enhance ease of compliance for industry and trade.

- Capital and Entrepreneurship Reforms:

- Financial Sector Vision and Strategy: A document will be prepared to meet the financing needs of the economy, guiding the government, regulators, financial institutions, and market participants for the next 5 years.

- Climate Finance Taxonomy: Development of a taxonomy for climate finance to enhance capital availability for climate adaptation and mitigation, supporting the country’s climate commitments and green transition.

- Variable Capital Company Structure: Legislative approval will be sought for this structure to provide efficient and flexible financing for leasing aircrafts and ships, and pooled funds of private equity.

- FDI and Overseas Investment: Simplification of rules and regulations for Foreign Direct Investment and Overseas Investments to facilitate foreign investments, nudge prioritization, and promote the use of the Indian Rupee for overseas investments.

- NPS Vatsalya: Launch of a plan for parents and guardians to contribute to the National Pension Scheme for minors, with seamless conversion to a normal NPS account upon reaching adulthood.

- Ease of Doing Business:

- Jan Vishwas Bill 2.0: Further enhancement of the Ease of Doing Business.

- State Incentives: Incentives for states to implement their Business Reforms Action Plans and digitalization.

- Data and Statistics:

- Data Governance: Improvement of data governance, collection, processing, and management using technology tools and sectoral databases established under the Digital India mission.

- New Pension Scheme (NPS):

- NPS Review Committee: Progress by the committee to address relevant issues while maintaining fiscal prudence to protect the common citizens.

- Budget Estimates 2024-25:

- Receipts and Expenditure: Total receipts (excluding borrowings) estimated at ₹48.07 lakh crore and total expenditure at ₹48.21 lakh crore.

- Net Tax Receipts: Estimated at ₹25.83 lakh crore.

- Fiscal Deficit: Estimated at 4.9% of GDP.

- Borrowings: Gross and net market borrowings through dated securities estimated at ₹13.01 lakh crore and ₹11.63 lakh crore, respectively.

- Fiscal Consolidation: Commitment to reach a fiscal deficit below 4.5% next year and maintain a declining Central Government debt path as a percentage of GDP from 2026-27 onwards.

Indirect Taxes

- Medicines and Medical Equipment:

- Cancer Medicines: Full exemption from customs duties on three additional cancer medicines: Trastuzumab Deruxtecan, Osimertinib, Durvalumab.

- Medical X-ray Equipment: Changes in the Basic Customs Duty (BCD) on x-ray tubes and flat panel detectors for medical x-ray machines under the Phased Manufacturing Programme to synchronize with domestic capacity addition.

- Mobile Phone and Related Parts:

- Reduction in Basic Customs Duty (BCD): Reduction in BCD on mobile phones, mobile PCBA, and mobile chargers to 15% to benefit consumers.

- Critical Minerals:

- Customs Duty Exemptions: Full exemption on customs duties for 25 critical minerals, with reduced BCD on two of them (silicon quartz and silicon dioxide, BCD has been reduced from 5-7.5% to 2.5%.).

- Critical Mineral Mission: The government will set up a Critical Mineral mission for domestic production, recycling of critical minerals, and overseas acquisition of critical mineral assets.

- Solar Energy:

- Expanded Exemptions: Expansion of the list of exempted capital goods for manufacturing solar cells and panels.

- Customs Duty on Solar Glass and Tinned Copper: Non-extension of customs duty exemptions due to sufficient domestic manufacturing capacity.

- Marine Products:

- BCD Reduction: Reduction of BCD on certain broodstock, polychaete worms, shrimp, and fish feed to 5%.

- Customs Duty Exemptions: Customs duty on inputs for manufacture of shrimp, fish feed, leather goods, textile and apparel and footwear have also been exempted.

- Leather and Textile:

- Competitiveness Enhancement: Reduction of BCD on real down filling material from duck or goose.

- Exemptions: There will be no duty on wet white, crust, and finished leather for manufacture of garments, footwear and other leather products for exports.

- Duty Inversion Rectification: Reduction of BCD on methylene diphenyl diisocyanate (MDI) for manufacturing spandex yarn from 7.5% to 5%.

- Export Duty Structure: Simplification and rationalization of the export duty structure on raw hides, skins, and leather.

- Precious Metals:

- Gold and Silver: Reduction of customs duties on gold and silver to 6% and on platinum to 6.4% to enhance domestic value addition in gold and precious metal jewellery.

- Other Metals:

- Production Cost Reduction: Removal of BCD on ferro nickel and blister copper.

- Continuation of Nil BCD: Continuation of nil BCD on ferrous scrap and nickel cathode, and concessional BCD of 2.5% on copper scrap.

- Electronics:

- Value Addition: Removal of BCD on oxygen-free copper for manufacturing resistors, subject to conditions.

- Chemicals and Petrochemicals:

- BCD Increase: Increase in BCD on ammonium nitrate from 7.5% to 10% to support existing and new capacities in the pipeline.

- Plastics:

- BCD Increase: Increase in BCD on PVC flex banners from 10% to 25% to curb imports of non-biodegradable and hazardous materials.

- Telecommunication Equipment:

- BCD Increase: Increase in BCD from 10% to 15% on PCBA of specified telecom equipment to incentivize domestic manufacturing.

- Trade Facilitation:

- Export and Re-import Extensions: Extension of the export period for goods imported for repairs from six months to one year, and the time limit for re-import of goods for repairs under warranty from three to five years, to promote domestic aviation and boat & ship maintenance, repair, and overhaul (MRO).

Read also: India-Malaysia Relations: A Deep-Rooted Partnership | UPSC

Direct Taxes:

- Simplification for Charities and TDS:

- Merging Tax Exemption Regimes: Two tax exemption regimes for charities merged into one.

- Merging 5% TDS rate into 2% TDS rate.

- Withdrawal of 20% TDS rate on mutual funds or UTI repurchase.

- Reduction of TDS rate on e-commerce operators from 1% to 0.1%.

- Credit of TCS in the TDS deducted on salary.

- Decriminalization of delay in TDS payment up to the due date of filing statements.

- Simplification of Reassessment:

- Reopening and Reassessment: Reopening beyond three years if escaped income is ₹ 50 lakh or more, up to five years.

- In search cases, reducing the time limit from ten years to six years before the year of search.

- Simplification and Rationalization of Capital Gains:

- Short-term Gains: Short Term Capital Gains (STCG) tax on some assets will be increased from 15% to 20%

- Long-term Gains: Long Term Capital Gains (LTCG) tax on all financial and non-financial asset will be hiked from 10 to 12.5% Increased exemption limit on capital gains on certain financial assets to ₹ 1.25 lakh per year.

- Classification as long-term Gains: Listed financial assets held for more than a year, unlisted financial assets, and non-financial assets held for at least two years.

- Tax on capital gains at applicable rates for unlisted bonds, debentures, debt mutual funds, and market-linked debentures irrespective of holding period.

- Taxpayer Services:

- Digitalization: All major GST taxpayer services and most Customs and Income Tax services digitalized. Remaining services to be digitalized over the next two years.

- Litigation and Appeals:

- Reducing Pendency: Deploying more officers for first appeals, proposing Vivad Se Vishwas Scheme, 2024.

- Monetary Limits for Appeals: Increase monetary limits for filing appeals related to direct taxes, excise and service tax in the Tax Tribunals, High Courts and Supreme Court to Rs 60 lakh, Rs 2 crore and Rs 5 crore, respectively.

- Employment and Investment:

- Abolishing Angel Tax: For all classes of investors to bolster the start-up ecosystem.

- Cruise Tourism: Simpler tax regime for foreign shipping companies operating domestic cruises. Fixed profit and gains of cruise-ship operators to 20% of aggregate amount received.

- Diamond Industry: Safe harbour rates for foreign mining companies selling raw diamonds in India.

- Corporate Tax Rate: Tax rates for foreign companies will be slashed to 35% from current tax rate of 40%.

- Deepening the Tax Base:

- Security Transactions Tax: The government increased the STT on sale of security option from 0.0625% to 0.1%, while tax levied on futures was increased from 0.0125% to 0.02%, in Budget 2024.

- Increase to 0.02% on futures and 0.1% on options.

- Buyback Tax: Tax income received on buyback of shares in the hands of the recipient.

- Other Proposals:

- NPS Contributions: NPS limit for employers in the private sector is raised from 14% to 10% of the employee’s basic salary.

- Non-reporting Penalties: Indian professionals working in multinationals get ESOPs and invest in social security schemes and other movable assets abroad. De-penalizing non-reporting of movable assets abroad up to ₹ 20 lakh under the Black Money Act.

- Finance Bill Proposals:

- Withdrawal of equalization levy of 2%.

- Expansion of tax benefits to certain funds and entities in IFSCs.

- Immunity from penalty and prosecution for benamidar on full and true disclosure.

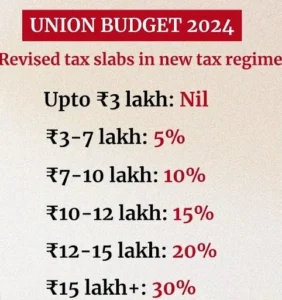

- Personal Income Tax:

- Standard Deduction: Standard deduction to salaried individuals and pensioners is proposed to be increased from ₹ 50,000 to₹ 75,000 under the new tax regime.

- Family Pension Deduction: Deduction from family pension of Rs. 15,000 is proposed to be increased to ₹ 25,000 under the new tax regime.

- Tax Rate Structure (New Regime):

- As a result of these changes, a salaried employee in the new tax regime stands to save up to ₹ 17,500/- in income tax.