Introduction

- India has made significant strides in tax reforms over the years, broadening the tax base.

- However, the country continues to face challenges in generating sufficient revenue to fund essential public services and social sectors.

- According to the Union Budget 2024-25, the Centre’s tax collection is projected to reach 11.78% of GDP, with direct taxes contributing just 7%. These figures are lower than global averages, limiting investment in key sectors such as education, healthcare, and infrastructure.

- This has led to a growing demand for wealth redistribution and the reintroduction of a wealth tax in India to address inequality.

Constitutional Provisions for Wealth Redistribution

- India’s Constitution lays the foundation for wealth redistribution through several key provisions aimed at promoting economic and social justice:

- Preamble: The Preamble of the Constitution emphasizes securing social and economic justice, liberty, and equality for all citizens, with a focus on reducing disparities and promoting inclusive development.

- Fundamental Rights: Part III guarantees liberty and equality for every citizen, ensuring that no one is deprived of their rights due to caste, gender, or economic status. These provisions support policies that promote equitable wealth distribution.

- Directive Principles of State Policy (DPSP): Articles 39(b) and (c) of the DPSP call for the ownership and control of material resources to be distributed in a way that serves the common good. This aims to prevent wealth from concentrating in the hands of a few at the expense of society as a whole.

Read also: Delimitation Exercise in India – Key Facts for UPSC Preparation

Measures for Wealth Redistribution After Independence

- Since Independence, India has implemented several measures aimed at wealth redistribution, though challenges persist:

- Curtailment of the Right to Property: The Right to Property, originally a fundamental right under Article 19(1)(f), was altered to provide the government with greater flexibility in acquiring land for public welfare. This was done to facilitate land reforms and help redistribute wealth more effectively. Key Amendments Include:

- Article 31A (1st Amendment, 1951): This amendment ensured that laws related to the acquisition of estates or property would not be deemed invalid merely because they violated fundamental rights, including the right to property.

- Article 31B (1st Amendment, 1951): This amendment granted immunity to laws placed under the Ninth Schedule from being challenged on the grounds of violating fundamental rights. However, in the Coelho Case (2007), the Supreme Court clarified that laws added to the Ninth Schedule after April 24, 1973 (following the Kesavananda Bharati case) could be contested if they violated fundamental rights or the basic structure of the Constitution.

- Article 31C (25th Amendment, 1971): This amendment prioritized the Directive Principles of State Policy (DPSP), particularly Articles 39(b) and 39(c), stating that laws made to implement these principles would not be invalid simply because they violated fundamental rights, including the right to property.

- In the Kesavananda Bharati case (1973), the Supreme Court affirmed the validity of Article 31C but subjected it to judicial scrutiny.

- In the Minerva Mills case (1980), the Supreme Court emphasized that the Constitution maintains a harmonious balance between Fundamental Rights and Directive Principles of State Policy (DPSP).

- 44th Amendment Act (1978): The 44th Amendment of 1978 removed the Right to Property from the list of Fundamental Rights and redefined it as a Constitutional Right under Article 300A. This change was implemented to reduce the burden of excessive litigation in the Supreme Court by property-owning individuals and to provide the government with greater flexibility in dealing with matters related to land acquisition and public welfare.

- Adoption of Socialistic Economic Policies: Post-Independence, India embraced a socialistic economic model, implementing policies like nationalization of banks, high income tax rates (up to 97%), estate duties on inheritance, and the Monopolies and Restrictive Trade Practices (MRTP) Act of 1969. These measures aimed to reduce inequality, but they also led to economic stagnation and concealed income, limiting their effectiveness.

Shift Towards a Market-Driven Economy Post-Liberalisation

- In the post-liberalisation era, India adopted a modern liberal welfare economic model, shifting towards a market-driven economy. This transition involved opening up the economy to private players, generating resources through taxation, and redistributing them through a welfare-oriented approach.

- Shift to Liberalisation, Globalisation, and Privatisation: In the 1990s, India transitioned from a closed economy to one driven by liberalisation, globalisation, and privatisation. This shift aimed to integrate India more deeply into the global market and enhance economic growth.

- Adoption of the 1991 Industrial Policy: The 1991 Industrial Policy was introduced to empower market forces, improve efficiency, and address structural inefficiencies in India’s industrial sector. This policy marked a significant change, promoting competition and reducing government control over industries.

- Repeal of the MRTP Act and Introduction of the Competition Act (2002): The Monopolies and Restrictive Trade Practices (MRTP) Act was repealed and replaced with the Competition Act in 2002, promoting fair competition and reducing regulatory burdens on businesses. Additionally, income tax rates were significantly reduced to encourage investment and economic activity.

- Abolition of Estate Duty and Wealth Tax: Estate duty was abolished in 1985, followed by the removal of wealth tax in 2016. These measures were aimed at simplifying tax administration but also led to the concentration of wealth among the wealthy.

- The market-driven economy has helped the government generate additional resources, which have been used to alleviate poverty. For instance, India has seen a notable reduction in multidimensional poverty, with the rate falling from 29.17% in 2013-14 to 11.28% in 2022-23.

- However, despite these gains, these policies have not adequately addressed the growing inequality in India. The concentration of wealth in the hands of a few continues to be a major challenge.

Why Wealth Redistribution and Wealth Tax are Crucial for India

- Decreased Inclusive Growth: Despite impressive economic growth, India’s development has not been inclusive. The Gini coefficient for wealth has increased significantly, from 81.3% in 2013 to 85.4% in 2017, indicating widening inequality. The benefits of economic progress have not been distributed equitably across all sections of society.

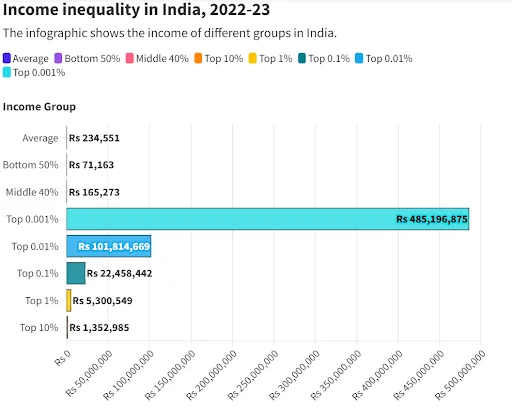

- Increasing Wealth and Income Inequality: Since liberalisation, wealth and income inequality in India have worsened. According to a report by the World Inequality Lab, the top 10% of India’s population controls 65% of the country’s wealth and 57% of its income. Meanwhile, the bottom 50% only have access to 6.5% of the wealth and 15% of the income. This extreme disparity underscores the urgent need for wealth redistribution.

- Redistribution of Wealth: Redistribution of wealth is crucial to breaking the cycle of inherited advantage, promoting a meritocratic society where individuals rise based on their abilities rather than family wealth. By redistributing initial endowments, India can build a fairer and more inclusive society.

- Lowering Intra-Generational Inequality: Inheritance taxes can reduce the concentration of wealth within a few families, promoting intergenerational equity. By preventing the accumulation of excessive wealth over generations, inheritance tax can contribute to a more equitable distribution of resources.

- World Inequality Report: The World Inequality Lab (WIL) released a study in March 2024 that found that India’s economic inequality is at its highest since British rule.

Challenges to Wealth Redistribution in India

- Large Informal Economy: A significant portion of India’s workforce remains in the informal sector, where workers earn low wages, have limited job security, and lack access to social protection. This makes it difficult to implement redistributive policies effectively and address income inequality.

- Lack of Political Motivation: Redistributive policies face significant opposition from powerful interest groups, including wealthy individuals and corporations. For example, land reforms were met with resistance from the landholding classes, making wealth redistribution difficult to achieve.

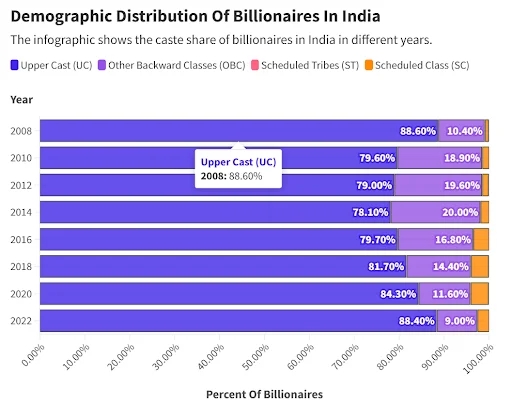

- Social Inequalities: India’s caste, gender, religious, and ethnic inequalities perpetuate economic disparities. Marginalized groups often face barriers in accessing resources, hindering the effectiveness of redistributive policies.

- Institutional Capacity Constraints: India faces challenges in the effective implementation of redistributive policies due to bureaucratic inefficiencies, corruption, and inadequate infrastructure. Welfare schemes often suffer from leakages, which limit their impact.

See more: Understanding Jet Streams: Formation, Types, Distribution, and Effects | UPSC

Way Forward

- Strengthening Governance and Institutional Capacity: Effective delivery of welfare services requires strengthening governance mechanisms and reducing corruption. By plugging leakages and improving institutional capacity, the government can ensure that the benefits of welfare schemes reach those who need them the most.

- Building a Socio-Political Consensus: A broader socio-political consensus is essential to ensure the successful implementation of wealth redistribution policies. Political leaders, business groups, and civil society must work together to support progressive taxation policies and welfare programs that promote equitable wealth distribution.

- Balancing Growth and Redistribution: Government policies must strike a balance between fostering innovation and economic growth while ensuring that the benefits of growth are distributed equitably. Resource-based development policies that prioritize inclusivity and poverty alleviation should be implemented to ensure that marginalized groups benefit from economic progress.

- Introduction of Inheritance Tax: A moderate inheritance tax (10-15%) should be introduced to target the wealthiest individuals in India. For example, a tax on the combined wealth of India’s top 101 billionaires, who control ₹10.54 trillion, could create a substantial financial base for wealth redistribution.