UPSC GS 2

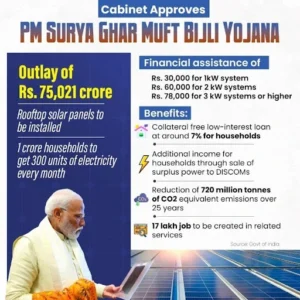

PM Surya Ghar Muft Bijli Yojana

- News: In line with the Interim Budget announcement, Union Finance Minister Nirmala Sitharaman has announced the launch of Pradhan Mantri-Surya Ghar Muft Bijli Yojana (PM Free Electricity scheme).

- Definition: It is a government scheme launched on February 15, 2024, aiming to provide free electricity to households in India.

- Aim: Under the scheme, households will receive a subsidy to install solar panels on their roofs.

- Budget: The scheme has an outlay of Rs. 75,021 crore and is to be implemented till FY 2026-27.

- Features:

-

- The subsidy will cover up to 40% of the cost of the solar panels.

- The scheme is expected to benefit 1 crore households across India.

-

- Eligibility Criteria:

-

- The household must be an Indian citizen.

- The household must own a house with a roof suitable for installing solar panels.

- The household must have a valid electricity connection.

- The household must not have availed any other subsidy for solar panels.

-

- Role of DISCOMs:

-

- DISCOMs are designated as State Implementation Agencies (SIAs) responsible for facilitating various measures, including net meter availability, timely inspection, and commissioning of installations.

- DISCOMs will receive incentives based on their achievement in the installation of additional grid-connected rooftop solar capacity beyond a baseline level.

- The total financial outlay for the ‘Incentives to DISCOMs’ component is Rs. 4,950 crore.

-

- Importance: It is estimated that the scheme will save the government Rs. 75,000 crore per year in electricity costs.

MSME TEAM Initiative

- News: The Central Government has launched a sub-scheme under RAMP namely “MSME Trade Enablement and Marketing Initiative” (MSME-TEAM Initiative).

- Definition: It is a sub-scheme under the Central Sector Scheme “Raising and Accelerating MSME Performance” (RAMP).

- Ministry: Launched by Ministry of Micro, Small and Medium Enterprises

- Implementing Agency: National Small Industries Corporation (NSIC)

- Aim: Support MSMEs to help them access different markets by integrating them with e-commerce platforms.

- Initiative outlay: Rs. 277.35 Cr

- Time Period: The scheme is valid from 2024 to 2027.

- Target beneficiaries: 5 lakh MSEs (50% will be women owned MSEs)

- Features:

-

- Assist 5 lakh MSMEs to on board the Open Network Digital Commerce (ONDC) platform, through awareness workshops which will include hand-holding assistance for on boarding onto ONDC.

- Provide financial assistance to MSEs through Seller Network Participants, for catalogue preparation, account management, logistics and packaging material & design.

- Awareness workshops will be conducted preferably in Tier 2 and Tier 3 cities and MSME Clusters for greater outreach, especially among women and SC/ ST owned MSMEs.

-

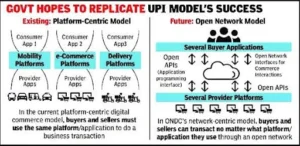

- What is Open Network for Digital Commerce (ONDC) ?

-

- Definition: It is a network based on open protocol and will enable local commerce across segments, such as mobility, grocery, food order and delivery, hotel booking and travel, among others, to be discovered and engaged by any network-enabled application.

- Aim: To create new opportunities, curb digital monopolies and by supporting micro, small and medium enterprises and small traders and help them get on online platforms.

-

-

-

- Ministry: It is an initiative of the Department for Promotion of Industry and Internal Trade (DPIIT) under the Ministry of Commerce and Industry.

- Features:

- ONDC, a UPI of e-commerce, seeks to democratise digital or electronic commerce, moving it from a platform-centric model to an open-network.

- Through ONDC, merchants will be able to save their data to build credit history and reach consumers.

- ONDC enables sellers and buyers to be digitally visible and transact through an open network, regardless of what platform or application they use.

-

Read also: Explain Importance of Fiscal Federalism in India | UPSC

DIGIPIN

- News: The Department of Post has released a beta version of the National Addressing Grid — DIGIPIN (Digital Postal Index Number) — to take public feedback until September 22.

- Overview:

-

- The Digital Postal Index Number (DIGIPIN) is an initiative aimed at establishing a standardized, geo-coded addressing system in India.

- It ensures simplified addressing solutions for citizen-centric delivery of public and private services.

- The Department has collaborated with IIT Hyderabad for developing this National Addressing Grid.

-

- Benefits:

-

- This system will enhance public service delivery, ensure faster emergency response, and significantly boost logistics efficiency.

- DIGIPIN will act as the addressing reference system for logically locating addresses with directional properties due to its logical naming pattern.

- It will serve as a strong and robust pillar of Geospatial Governance.

- DIGIPIN can also be used for emergency rescue operations and national disasters such as floods.

-

- Accessibility:

-

- The DIGIPIN Grid system is proposed to be fully available in the public domain and can be easily accessed by everyone.

- It can be used as the base layer for other ecosystems, including various service providers and utilities, where addressing is part of the workflow.

-

- Impact on Digital Transformation:

-

- The advent of DIGIPIN will mark a revolutionary step in India’s journey towards digital transformation by bridging the crucial gap between physical locations and their digital representation.

-

- Current Status:

-

- The Department has released a beta version of the National Addressing Grid ‘DIGIPIN’ for public feedback.

-

- How will the DIGIPIN code be assigned?

-

- DIGIPIN will use one of the 16 alphanumeric symbols (2,3,4,5,6,7,8,9,G,J,K,L,M,P,W,X).

- The entire country will first be divided into 16 regions (4X4), including the maritime EEZ (up to 200 nautical miles from the coastline).

- The first character for the DIGIPIN will identify that one of these 16 regions.

- India, under this scheme, is covered only by eight regions and thus can be labelled by digits 2-9, and the ‘level 1’ grid lines will not cut through cities with very large populations.

- Each of these 16 regions will be divided into 16 units to get ‘level 2’ partition to create 256 subregions.

- The second character in DIGIPIN will give the location of this ‘level 2’ partition in the first region.

- This process will be done eight more time to get 16^10 DIGIPINs for the 4 metre by 4 metre unit.

- This means that the geographical coordinates of the place can be calculated from the DIGIPIN.

-

Vatsalya Scheme

- News: A new pension scheme named ‘Vatsalya’ has been proposed for minors by Union Government in the Union Budget 2024-25.

- Introduction:

-

- This scheme is part of the National Pension Scheme (NPS) and is designed to help parents and guardians plan for their children’s future financial needs.

-

- Features:

-

- NPS Vatsalya is designed to help families ensure their children’s financial security as they grow.

- Parents can contribute to this scheme, and the funds will accumulate until the child turns 18.

- Once the child reaches adulthood, the accumulated amount will be transferred to the standard NPS account.

- The plan can be seamlessly converted into a non-NPS plan when the child becomes an adult.

-

- Importance:

-

- The scheme offers a systematic approach for future financial planning for children.

- It operates similarly to the existing NPS, which helps individuals build a retirement corpus by making regular contributions throughout their careers.

- NPS contributions are invested in market-linked instruments such as stocks and bonds, providing the potential for higher returns compared to traditional fixed-income options.

-

International Mathematical Olympiad

- News: A six-member student team from India have secured the country its best performance ever in the International Mathematical Olympiad (IMO) 2024.

- Overview:

-

- The IMO is the World Championship Mathematics Competition for high school students.

- It is held annually in a different country.

- The first IMO took place in 1959 in Romania, with 7 countries participating. It has since expanded to over 100 countries from 5 continents.

- The IMO Board oversees the competition each year, ensuring that host countries follow the regulations and traditions of the IMO.

- Although the IMO is a self-governing autonomous organization, it is affiliated with UNESCO.

- Its Council, known as the IMO Advisory Board, is elected by participating countries.

- The IMO Foundation is a charitable organization that accepts donations from supporters of the IMO.

-

- Recent Event:

-

- The 65th IMO was held this year in Bath, United Kingdom.

-

- India’s Performance:

-

- This year marked the best performance by India in IMO since its debut in 1989, both in terms of the number of Gold medals won and the rank achieved.

- The Indian contingent of high school students secured the fourth rank globally, winning four Gold medals, one Silver medal, and one Honourable Mention.

- Prior to 2024, India’s best rank was 7th, achieved at IMO 1998 and IMO 2001.

-

Electric Mobility Promotion Scheme

- News: Ministry of Heavy Industries has launched the Electric Mobility Promotion Scheme (EMPS) – 2024.

- Aim: To provide further impetus to the green mobility and development of electric vehicle (EV) manufacturing eco-system in the country.

- Duration & Budget: The Scheme duration is 4 months i.e. April 01, 2024 till July 31, 2024 with an outlay of Rs. 500 crore.

- Applicability:

-

- The scheme is introduced for faster adoption of electric two-wheeler (e-2W) and electric three-wheeler (e-3W – including registered e-rickshaws & e-carts and L5).

-

- Features:

-

- Limited Fund and Specific Duration: The scheme provides subsidies for electric two-wheelers (e-2w) and electric three-wheelers (e-3w) until the funds are exhausted or until July 31, 2024, whichever comes first.

- Eligibility for Incentives: Electric vehicles (EVs) eligible for incentives must be manufactured and registered within the EMPS 2024 validity period.

- Promotion of Advanced Technologies: Incentives will only apply to vehicles equipped with advanced batteries.

- First-Come, First-Served Basis: If funds for the scheme deplete before July 31, 2024, it will be closed, and no further claims will be accepted under EMPS 2024.

-

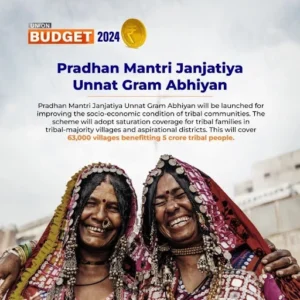

Pradhan Mantri Janjatiya Unnat Gram Abhiyan

- News: Finance Minister Nirmala Sitharaman recently announced the Pradhan Mantri Janjatiya Unnat Gram Abhiyan.

- Aim: To improve the socio-economic conditions of tribal communities in the country.

- Features:

-

- The scheme will adopt saturation coverage for tribal families in tribal-dominated villages and aspiring districts.

- This will cover 63,000 villages benefiting 5 crore tribal people.

- The scheme aims at improving infrastructural development in aspirational districts, (districts affected by poor socio-economic indicators) majorly inhabited by tribal families.

-

International Organisation of Securities Commission

- News: The International Organisation of Securities Commissions (IOSCO) is currently focused on enhancing the reporting framework for Sustainability and Environment, Social, and Governance (ESG) issues.

- Definition:

-

- It is the international body that brings together the world’s securities regulators.

- Recognized as the global standard setter for financial markets regulation.

-

- Establishment: Established in 1983.

- Objectives:

-

- Enhance Investor Protection: Ensuring that investors are safeguarded.

- Ensure Markets are Fair and Efficient: Promoting fairness and efficiency in financial markets.

- Promote Financial Stability: Reducing systemic risk to maintain financial stability.

-

- Endorsements:

-

- IOSCO’s objectives and Principles of Securities Regulation are endorsed by both the G20 and the Financial Stability Board (FSB).

-

- Membership:

-

- IOSCO is a standard-setting body with over 200 members representing 95% of the world’s securities regulators. Membership is divided into three categories:

- Ordinary Members:

- Include primary futures markets and securities regulators in a given jurisdiction.

- Each ordinary member has one vote.

- Associate Members:

- Consist of additional futures and securities regulators in jurisdictions with multiple regulatory bodies.

- Do not have a vote and are not eligible for the Executive Committee, but are members of the Presidents’ Committee.

-

- Affiliate Members:

-

- Include self-regulatory organizations, stock exchanges, and stock market industry associations.

- Do not have a vote and are not eligible for the Executive Committee or the Presidents’ Committee, but may be members of the Self-Regulatory Organizations (SRO) Consultative Committee.

-

- Indian Membership: The Securities and Exchange Board of India (SEBI) is a member of IOSCO.

- Secretariat: Located in Madrid, Spain.

Credit Guarantee Scheme

- News: The Finance Minister Nirmala Sitharaman has announced a credit guarantee scheme for the micro, small and medium enterprises (MSMEs) in the manufacturing sector.

- Introduction of Scheme:

-

- A new credit guarantee scheme has been introduced for purchasing machinery and equipment without requiring collateral or third-party guarantees.

-

- Guarantee Cover:

-

- The scheme will pool credit risks of Micro, Small, and Medium Enterprises (MSMEs) and provide a guarantee cover of up to Rs 100 crore per applicant through a self-financing guarantee fund.

-

- Fee Structure:

-

- Borrowers are required to pay an upfront guaranteed fee and an annual fee based on the reducing loan balance.

-

- Measures to Boost Micro, Small, and Medium Enterprises (MSMEs)

-

- Public Sector Banks (PSBs) Assessment: Public Sector Banks will now assess credit eligibility for MSMEs internally, eliminating the need for external assessments.

- Digital Footprints Model: The new model will rely on the digital footprints of MSMEs, offering a significant improvement over traditional methods based on asset or turnover criteria.

- Inclusion of MSMEs Without Formal Accounting Systems: The model will also cover MSMEs that do not have formal accounting systems, thus broadening the scope of eligible enterprises.

- Increase in Mudra Loans: The limit for Mudra loans under the PM Mudra Yojana has been increased from Rs 10 lakh to Rs 20 lakh for entrepreneurs who have successfully repaid previous loans under the ‘Tarun’ category.

-