UPSC GS 2

Union Budget

- News: Union Finance Minister Nirmala Sitharaman recently presented the first budget of the Narendra Modi government’s third term in Parliament.

- Key Focus Areas: The Finance Minister laid down nine priorities of the Budget:

-

- Productivity and resilience in agriculture

- Employment and skilling

- Inclusive Human resource development and social justice

- Manufacturing and services

- Support for promotion of MSMEs

- Urban development

- Energy security

- Infrastructure

- Innovation, research and development

Read also: Understanding Overview of Economic Survey | UPSC

Priority 1: Productivity and Resilience in Agriculture

- Transforming Agriculture Research:

-

- A comprehensive review of the agriculture research setup will be undertaken to focus on raising productivity and developing climate-resilient varieties.

- Funding will be provided in a challenge mode, including to the private sector.

- Domain experts from both the government and outside will oversee the conduct of such research.

- Release of New Varieties:

-

- New 109 high-yielding and climate-resilient varieties of 32 field and horticulture crops will be released for cultivation by farmers.

- Natural Farming:

-

- In the next two years, 1 crore farmers across the country will be initiated into natural farming supported by certification and branding.

- Implementation will be through scientific institutions and willing gram panchayats.

- 10,000 need-based bio-input resource centres will be established.

- Missions for Pulses and Oilseeds:

-

- A strategy is being put in place to achieve ‘atmanirbharta’ for oilseeds such as mustard, groundnut, sesame, soybean, and sunflower.

- Vegetable Production & Supply Chains:

-

- Large-scale clusters for vegetable production will be developed closer to major consumption centres.

- Farmer-Producer Organizations, cooperatives, and start-ups will be promoted for vegetable supply chains, including for collection, storage, and marketing.

- Digital Public Infrastructure for Agriculture:

-

- Implementation of the Digital Public Infrastructure (DPI) in agriculture for coverage of farmers and their lands will be facilitated in partnership with the states within 3 years.

- Digital crop survey for Kharif using the DPI will be taken up in 400 districts this year.

- Details of 6 crore farmers and their lands will be brought into the farmer and land registries.

- Issuance of Jan Samarth based Kisan Credit Cards will be enabled in 5 states.

- Shrimp Production & Export:

-

- Financial support for setting up a network of Nucleus Breeding Centres for Shrimp Broodstocks will be provided.

- Financing for shrimp farming, processing, and export will be facilitated through NABARD.

- National Cooperation Policy:

-

- A National Cooperation Policy will be brought out for the systematic, orderly, and all-round development of the cooperative sector.

- The policy goal will be fast-tracking the growth of the rural economy and generating employment opportunities on a large scale.

- Financial Provision

- A provision of ₹ 52 lakh crore for agriculture and allied sectors has been made this year.

Priority 2: Employment & Skilling

- Employment Linked Incentive:

-

- Three schemes under the Prime Minister’s package for ‘Employment Linked Incentive’ will be implemented, based on EPFO enrolment and focusing on first-time employees and support for employees and employers.

- Scheme A: First Timers:

-

- One month’s wage as subsidy (maximum `15,000)

- Applicable to all sectors

- First timers have a learning curve before they become fully productive; subsidy is to assist employees and employers in hiring of first timers.

- Applicable to all persons newly entering the workforce (EPFO) with wage/salary less than Rs. 1 lakh per month.

- Subsidy will be paid to the employee in three instalments

- Employee must undergo compulsory online Financial Literacy course before claiming the second instalment.

- Subsidy to be refunded by employer if the employment to the first timer ends within 12 months of recruitment.

- Expected to cover approximately one crore persons per annum.

- Scheme will be for 2 years

- Scheme B: Job Creation in Manufacturing

-

- Incentivizes additional employment in the manufacturing sector, linked to first-time employees.

- All employers which are corporate entities and those non-corporate entities with a three year track record of EPFO contribution will be eligible.

- Employer must hire at least the following number of previously non-EPFO enrolled workers: 50 or 25% of the baseline (previous year’s number of EPFO employees)

- Incentive will be paid for four years partly to the employee and partly to the employer as follows:

- Employer must maintain threshold level of enhanced employment throughout, failing which subsidy benefit will stop.

- Employee must be directly working in the entity paying salary/wage (i.e. in-sourced employee).

- Employees with a wage/ salary of up to `1 lakh per month will be eligible, subject to contribution to EPFO.

- For those with wages/salary greater than `25,000/month, incentive will be calculated at `25,000/month.

- Subsidy to be refunded by employer if the employment to first timer ends within 12 months of recruitment.

- Scheme will be for 2 years

- Scheme C: Support to Employers

-

- Additional employment within a salary of ₹ 1 lakh per month will be counted.

- Government will reimburse up to ₹ 3,000 per month for 2 years towards employers’ EPFO contribution for each additional employee.

- Expected to incentivize additional employment of 50 lakh persons.

- Applicable to an employer who:

- Increases employment above the baseline (previous year’s number of EPFO employees) by at least two employees (for those with less than 50 employees) or 5 employees (for those with 50 or more employees) and sustains the higher level, and

- For employees whose salary does not exceed `1,00,000/month

- New employees under this Part need not be new entrants to EPFO

- If the employer creates more than 1000 jobs:

- Reimbursement will be done quarterly for the previous quarter

- Subsidy will continue for the 3rd and 4th year on the same scale as Employer benefit in Part-B

- Scheme will be for 2 years

- Expected to incentivize additional employment of 50 lakh persons.

- Participation of Women in the Workforce:

-

- Setting up working women hostels in collaboration with industry and establishing creches.

- Skilling Programme:

-

- A new centrally sponsored scheme for skilling in collaboration with state governments and industry.

- 20 lakh youth to be skilled over a 5-year period.

- 1,000 Industrial Training Institutes will be upgraded in hub and spoke arrangements with outcome orientation.

- Total outlay of ` 60,000 crore over five years

- Government of India—` 30,000 crore

- State Governments—` 20,000 crore

- Industry—` 10,000 crore (including CSR funding)

- 200 hubs and 800 spoke ITIs –all with industry collaboration

- Re-design and review of existing courses

- New courses

- 1 to 2 year courses in all 1000 ITIs

- Short term specialised courses in Hub ITIs

- Capacity augmentation of 5 national institutes for training of trainers.

- Skilling Loans:

-

- The Model Skill Loan Scheme will be revised to facilitate loans up to ₹ 5 lakh with a guarantee from a government-promoted fund.

- Expected to help 25,000 students every year.

- Education Loans:

-

- Financial support for loans up to ₹ 10 lakh for higher education in domestic institutions.

- E-vouchers for annual interest subvention of 3 per cent of the loan amount will be given directly to 1 lakh students every year.

Priority 3: Inclusive Human Resource Development and Social Justice

- Saturation Approach:

-

- Adoption of a saturation approach to cover all eligible people through various programs for education and health.

- Empowerment by improving capabilities through schemes for craftsmen, artisans, self-help groups, scheduled caste, scheduled tribe, women entrepreneurs, and street vendors.

- Implementation of PM Vishwakarma, PM SVANidhi, National Livelihood Missions, and Stand-Up India will be stepped up.

- Purvodaya:

-

- Formulation of the Purvodaya plan for the all-round development of Bihar, Jharkhand, West Bengal, Odisha, and Andhra Pradesh.

- Coverage includes human resource development, infrastructure, and economic opportunities.

- Support for development on the Amritsar Kolkata Industrial Corridor, including an industrial node at Gaya.

- Development of road connectivity projects: Patna-Purnea Expressway, Buxar-Bhagalpur Expressway, Bodhgaya, Rajgir, Vaishali, and Darbhanga spurs, and an additional 2-lane bridge over river Ganga at Buxar.

- Power projects, including a new 2400 MW power plant at Pirpainti, will be undertaken.

- New airports, medical colleges, and sports infrastructure in Bihar will be constructed.

- Additional allocation for capital investments and expedited external assistance from multilateral development banks for Bihar.

- Andhra Pradesh Reorganization Act:

-

- Facilitation of special financial support for the state’s capital through multilateral development agencies.

- Arrangement of ₹ 15,000 crore in the current financial year, with additional amounts in future years.

- Commitment to financing and early completion of the Polavaram Irrigation Project.

- Promotion of industrial development with funds for essential infrastructure in Kopparthy node on the Vishakhapatnam-Chennai Industrial Corridor and Orvakal node on Hyderabad-Bengaluru Industrial Corridor.

- Additional allocation for capital investment and grants for backward regions of Rayalaseema, Prakasam, and North Coastal Andhra.

- PM Awas Yojana:

-

- Announcement of three crore additional houses under PM Awas Yojana in rural and urban areas, with necessary allocations.

- Women-Led Development:

-

- Allocation of more than ₹ 3 lakh crore for schemes benefitting women and girls, promoting women-led development.

- Pradhan Mantri Janjatiya Unnat Gram Abhiyan:

-

- Launch of Pradhan Mantri Janjatiya Unnat Gram Abhiyan to improve the socio-economic condition of tribal communities.

- Saturation coverage for tribal families in tribal-majority villages and aspirational districts, covering 63,000 villages and benefiting 5 crore tribal people.

- Bank Branches in North-Eastern Region:

-

- Establishment of more than 100 branches of India Post Payment Bank in the North East region to expand banking services.

- Rural Development Provision:

-

- A provision of ₹ 66 lakh crore for rural development, including rural infrastructure, has been made.

Priority 4: Manufacturing & Services

- Support for Promotion of MSMEs:

-

- Special attention will be given to MSMEs and labour-intensive manufacturing through financing, regulatory changes, and technology support.

- Credit Guarantee Scheme for MSMEs in the Manufacturing Sector:

-

- Term loans for MSMEs for machinery and equipment purchase without collateral.

- Operated through pooling credit risks of MSMEs.

- Self-financing guarantee fund to provide up to ₹ 100 crore guarantee cover per applicant.

- Borrower to provide an upfront guarantee fee and annual fee on the reducing loan balance.

- New Assessment Model for MSME Credit:

-

- Public sector banks to build in-house capability for MSME credit assessment.

- Development of a new credit assessment model based on MSME digital footprints.

- Model to include MSMEs without formal accounting systems.

- Credit Support to MSMEs during Stress Period:

-

- New mechanism for continuation of bank credit to MSMEs during stress periods.

- Support for credit availability through a government-promoted guarantee fund.

- Mudra Loans:

-

- Mudra loan limit increased to ₹ 20 lakh from ₹ 10 lakh for entrepreneurs who have successfully repaid previous loans under the ‘Tarun’ category.

- Enhanced Scope for Mandatory Onboarding in TReDS:

-

- Turnover threshold for mandatory onboarding on TReDS platform reduced from ₹ 500 crore to ₹ 250 crore.

- Inclusion of 22 more CPSEs and 7000 more companies.

- Medium enterprises included in the scope of suppliers.

- SIDBI Branches in MSME Clusters:

-

- SIDBI to open new branches to serve all major MSME clusters within 3 years.

- 24 branches to open this year, expanding service coverage to 168 out of 242 major clusters.

- MSME Units for Food Irradiation, Quality & Safety Testing:

-

- Financial support for setting up 50 multi-product food irradiation units in the MSME sector.

- Facilitation of 100 food quality and safety testing labs with NABL accreditation.

- E-Commerce Export Hubs:

-

- E-Commerce Export Hubs to be set up in PPP mode for MSMEs and traditional artisans.

- Hubs to facilitate trade and export-related services under one roof.

- Measures for Promotion of Manufacturing & Services:

- Internship in Top Companies:

-

- Launch of a scheme for internship opportunities in 500 top companies for 1 crore youth over 5 years.

- Interns to receive ₹ 5,000 per month allowance and ₹ 6,000 one-time assistance.

- Companies to cover training costs and 10% of internship costs from CSR funds.

- Applicable to those who are not employed and not engaged in full time education.

- Youth aged between 21 and 24 will be eligible to apply.

- Cost sharing (per annum):

- Government – `54,000 towards monthly allowance (plus `6,000 grant for incidentals)

- Company – Rs 6,000 from CSR funds towards monthly allowance

- Training cost to be borne by the Company from CSR funds.

- Administrative costs to be borne by respective parties (for the Company, reasonable administrative expenses can be counted as CSR expenditure)

- Participation of companies is voluntary.

- Ineligible candidates (indicative list)

- Candidate has IIT, IIM, IISER, CA, CMA etc as qualification

- Any member of the family is assessed to Income Tax

- Any member of the family is a government employee, etc.

- At least half the time should be in actual working experience/job environment, not in classroom.

- Phase 1 of the scheme will be for 2 years followed by Phase 2 for 3 years

- Industrial Parks:

-

- Development of “plug and play” industrial parks in or near 100 cities in partnership with states and the private sector.

- Twelve industrial parks under the National Industrial Corridor Development Programme to be sanctioned.

- Rental Housing:

-

- Facilitation of dormitory-type rental housing for industrial workers in PPP mode with VGF support and commitment from anchor industries.

- Shipping Industry:

-

- Implementation of ownership, leasing, and flagging reforms to improve the Indian shipping industry’s share and generate employment.

- Critical Mineral Mission:

-

- Establishment of a Critical Mineral Mission for domestic production, recycling, and overseas acquisition of critical minerals.

- Mandate includes technology development, skilled workforce, extended producer responsibility framework, and suitable financing mechanism.

- Offshore Mining of Minerals:

-

- Launch of the first tranche of offshore blocks for mining, building on existing exploration.

- Digital Public Infrastructure Applications:

-

- Development of DPI applications for productivity gains, business opportunities, and innovation in credit, e-commerce, education, health, law and justice, logistics, MSME, services delivery, and urban governance.

- Integrated Technology Platform for IBC Ecosystem:

-

- Setup of an Integrated Technology Platform for improving outcomes under the Insolvency and Bankruptcy Code (IBC).

- Voluntary Closure of LLPs:

-

- Extension of C-PACE services for voluntary closure of LLPs to reduce closure time.

- National Company Law Tribunals:

-

- Reforms and strengthening of tribunals to speed up insolvency resolution.

- Establishment of additional tribunals, some to decide cases exclusively under the Companies Act.

- Debt Recovery:

-

- Reforming and strengthening debt recovery tribunals.

- Establishment of additional tribunals to speed up recovery.

Priority 5: Urban Development

- Cities as Growth Hubs:

-

- Development of ‘Cities as Growth Hubs’ through economic and transit planning.

- Orderly development of peri-urban areas using town planning schemes in collaboration with states.

- Creative Redevelopment of Cities:

-

- Formulation of a framework for enabling policies, market-based mechanisms, and regulation for brownfield redevelopment of existing cities.

- Transit-Oriented Development:

-

- Formulation of Transit-Oriented Development plans for 14 large cities with a population above 30 lakh.

- Implementation and financing strategy to be included.

- Urban Housing:

-

- Addressing housing needs of 1 crore urban poor and middle-class families under PM Awas Yojana Urban 2.0.

- Investment of ₹ 10 lakh crore, with ₹ 2.2 lakh crore central assistance over the next 5 years.

- Provision of interest subsidy for affordable housing loans.

- Implementation of enabling policies and regulations for efficient and transparent rental housing markets.

- Water Supply and Sanitation:

-

- Promotion of water supply, sewage treatment, and solid waste management projects for 100 large cities in partnership with State Governments and Multilateral Development Banks.

- Street Markets:

-

- Scheme to support the development of 100 weekly ‘haats’ or street food hubs in select cities each year for the next five years, building on the PM SVANidhi Scheme.

- Stamp Duty:

-

- Encouragement for states with high stamp duty to moderate rates.

- Consideration of further lowering duties for properties purchased by women.

Priority 6: Energy Security

- Energy Transition:

-

- Policy on energy transition pathways balancing employment, growth, and environmental sustainability will be introduced.

- PM Surya Ghar Muft Bijli Yojana:

-

- Launched to install rooftop solar plants for 1 crore households to obtain free electricity up to 300 units per month.

- Scheme has generated 1.28 crore registrations and 14 lakh applications.

- Pumped Storage Policy:

-

- Promotion of pumped storage projects for electricity storage.

- Facilitation of smooth integration of renewable energy into the overall energy mix.

- Small and Modular Nuclear Reactors: Partnership with the private sector for:

-

- Setting up Bharat Small Reactors.

- Research & development of Bharat Small Modular Reactor.

- Research & development of newer technologies for nuclear energy.

- Advanced Ultra Super Critical Thermal Power Plants:

-

- Development of indigenous technology for AUSC thermal power plants completed.

- Joint venture between NTPC and BHEL to set up an 800 MW commercial plant using AUSC technology.

- Government to provide fiscal support.

- Development of indigenous capacity for high-grade steel and advanced metallurgy materials.

- Roadmap for ‘Hard to Abate’ Industries:

-

- Formulation of a roadmap for moving ‘hard to abate’ industries from ‘energy efficiency’ targets to ‘emission targets’.

- Implementation of regulations for transition from ‘Perform, Achieve and Trade’ mode to ‘Indian Carbon Market’ mode.

- Support to Traditional Micro and Small Industries:

-

- Facilitation of investment-grade energy audits in 60 clusters, including brass and ceramic.

- Provision of financial support for cleaner energy and energy efficiency measures.

- Replication of the scheme in another 100 clusters in the next phase.

Priority 7: Infrastructure

- Infrastructure Investment by Central Government:

- Fiscal Support: Commitment to maintain strong fiscal support for infrastructure over the next 5 years, balancing other priorities and fiscal consolidation.

- Capital Expenditure: Provision of ₹11,11,111 crore for capital expenditure, constituting 3.4% of GDP.

- Infrastructure Investment by State Governments:

-

- Support Encouragement: States encouraged to provide similar scale support for infrastructure, considering their development priorities.

- Long-term Loans: Provision of ₹5 lakh crore for long-term interest-free loans to support states’ resource allocation.

- Private Investment in Infrastructure:

-

- Promotion: Investment by the private sector promoted through viability gap funding, enabling policies, and regulations.

- Financing Framework: Introduction of a market-based financing framework.

- Pradhan Mantri Gram Sadak Yojana (PMGSY):

-

- Phase IV Launch: Launch of Phase IV to provide all-weather connectivity to 25,000 rural habitations with increased population.

- Irrigation and Flood Mitigation:

-

- Bihar Flood Control: Financial support for projects estimated at ₹11,500 crore, including Kosi-Mechi intra-state link and other schemes.

- Assam Flood Assistance: Assistance for flood management and related projects.

- Himachal Pradesh Rehabilitation: Assistance for reconstruction and rehabilitation through multilateral development assistance.

- Uttarakhand Cloud Burst Relief: Assistance for losses due to cloud bursts and landslides.

- Sikkim Flash Flood Relief: Assistance for recent flash floods and landslides.

- Tourism Development:

-

- Global Tourist Destination: Positioning India as a global tourist destination to create jobs, stimulate investments, and unlock economic opportunities.

- Bihar Temples: Comprehensive development of Vishnupad Temple Corridor and Mahabodhi Temple Corridor in Bihar, modelled on Kashi Vishwanath Temple Corridor.

- Rajgir Development: Comprehensive initiative for Rajgir, significant for Hindus, Buddhists, and Jains.

- Nalanda: Development of Nalanda as a tourist centre and revival of Nalanda University.

- Odisha Tourism: Assistance for development of Odisha’s temples, monuments, wildlife sanctuaries, natural landscapes, and beaches.

Priority 8: Innovation, Research & Development

- Research and Innovation:

- Anusandhan National Research Fund: Operationalization of the fund for basic research and prototype development.

- Private Sector Research: Establishment of a mechanism to spur private sector-driven research and innovation at a commercial scale with a financing pool of ₹1 lakh crore.

- Space Economy:

- Expansion Goal: Commitment to expanding the space economy by 5 times in the next 10 years.

- Venture Capital Fund: Creation of a venture capital fund of ₹1,000 crore to support this expansion.

Priority 9: Next Generation Reforms

- Economic Policy Framework:

-

-

- A new framework will be formulated to delineate the approach to economic development.

- Collaboration with States: Effective implementation of reforms will require collaboration between the Centre and states, promoting competitive federalism and incentivizing states for faster implementation of reforms through a significant portion of the 50-year interest-free loan.

- Rural Land Actions:

-

- Unique Land Parcel Identification Number (ULPIN) for all lands.

- Digitization of cadastral maps.

- Survey of map sub-divisions as per current ownership.

- Establishment of land registry.

- Linking to the farmers registry to facilitate credit flow and other agricultural services.

- Urban Land Actions:

-

- Digitization of land records with GIS mapping.

- Establishment of an IT-based system for property record administration, updating, and tax administration to improve the financial position of urban local bodies.

- Labour-Related Reforms:

- Services to Labour: Comprehensive integration of the e-shram portal with other portals for a one-stop solution for employment and skilling services.

-

- Open architecture databases for the labour market, skill requirements, and available job roles.

- Shram Suvidha & Samadhan Portal: Revamp of these portals to enhance ease of compliance for industry and trade.

- Capital and Entrepreneurship Reforms:

-

- Financial Sector Vision and Strategy: A document will be prepared to meet the financing needs of the economy, guiding the government, regulators, financial institutions, and market participants for the next 5 years.

- Climate Finance Taxonomy: Development of a taxonomy for climate finance to enhance capital availability for climate adaptation and mitigation, supporting the country’s climate commitments and green transition.

- Variable Capital Company Structure: Legislative approval will be sought for this structure to provide efficient and flexible financing for leasing aircrafts and ships, and pooled funds of private equity.

- FDI and Overseas Investment: Simplification of rules and regulations for Foreign Direct Investment and Overseas Investments to facilitate foreign investments, nudge prioritization, and promote the use of the Indian Rupee for overseas investments.

- NPS Vatsalya: Launch of a plan for parents and guardians to contribute to the National Pension Scheme for minors, with seamless conversion to a normal NPS account upon reaching adulthood.

- Ease of Doing Business:

-

- Jan Vishwas Bill 2.0: Further enhancement of the Ease of Doing Business.

- State Incentives: Incentives for states to implement their Business Reforms Action Plans and digitalization.

- Data and Statistics:

- Data Governance: Improvement of data governance, collection, processing, and management using technology tools and sectoral databases established under the Digital India mission.

- New Pension Scheme (NPS):

-

- NPS Review Committee: Progress by the committee to address relevant issues while maintaining fiscal prudence to protect the common citizens.

- Budget Estimates 2024-25:

-

- Receipts and Expenditure: Total receipts (excluding borrowings) estimated at ₹48.07 lakh crore and total expenditure at ₹48.21 lakh crore.

- Net Tax Receipts: Estimated at ₹25.83 lakh crore.

- Fiscal Deficit: Estimated at 4.9% of GDP.

- Borrowings: Gross and net market borrowings through dated securities estimated at ₹13.01 lakh crore and ₹11.63 lakh crore, respectively.

- Fiscal Consolidation: Commitment to reach a fiscal deficit below 4.5% next year and maintain a declining Central Government debt path as a percentage of GDP from 2026-27 onwards.

Indirect Taxes

- Medicines and Medical Equipment:

-

- Cancer Medicines: Full exemption from customs duties on three additional cancer medicines: Trastuzumab Deruxtecan, Osimertinib, Durvalumab.

- Medical X-ray Equipment: Changes in the Basic Customs Duty (BCD) on x-ray tubes and flat panel detectors for medical x-ray machines under the Phased Manufacturing Programme to synchronize with domestic capacity addition.

- Mobile Phone and Related Parts:

-

- Reduction in Basic Customs Duty (BCD): Reduction in BCD on mobile phones, mobile PCBA, and mobile chargers to 15% to benefit consumers.

- Critical Minerals:

-

- Customs Duty Exemptions: Full exemption on customs duties for 25 critical minerals, with reduced BCD on two of them (silicon quartz and silicon dioxide, BCD has been reduced from 5-7.5% to 2.5%.).

- Critical Mineral Mission: The government will set up a Critical Mineral mission for domestic production, recycling of critical minerals, and overseas acquisition of critical mineral assets.

- Solar Energy:

-

- Expanded Exemptions: Expansion of the list of exempted capital goods for manufacturing solar cells and panels.

- Customs Duty on Solar Glass and Tinned Copper: Non-extension of customs duty exemptions due to sufficient domestic manufacturing capacity.

- Marine Products:

-

- BCD Reduction: Reduction of BCD on certain broodstock, polychaete worms, shrimp, and fish feed to 5%.

- Customs Duty Exemptions: Customs duty on inputs for manufacture of shrimp, fish feed, leather goods, textile and apparel and footwear have also been exempted.

- Leather and Textile:

-

- Competitiveness Enhancement: Reduction of BCD on real down filling material from duck or goose.

- Exemptions: There will be no duty on wet white, crust, and finished leather for manufacture of garments, footwear and other leather products for exports.

- Duty Inversion Rectification: Reduction of BCD on methylene diphenyl diisocyanate (MDI) for manufacturing spandex yarn from 7.5% to 5%.

- Export Duty Structure: Simplification and rationalization of the export duty structure on raw hides, skins, and leather.

- Precious Metals:

-

- Gold and Silver: Reduction of customs duties on gold and silver to 6% and on platinum to 6.4% to enhance domestic value addition in gold and precious metal jewellery.

- Other Metals:

-

- Production Cost Reduction: Removal of BCD on ferro nickel and blister copper.

- Continuation of Nil BCD: Continuation of nil BCD on ferrous scrap and nickel cathode, and concessional BCD of 2.5% on copper scrap.

- Electronics:

-

- Value Addition: Removal of BCD on oxygen-free copper for manufacturing resistors, subject to conditions.

- Chemicals and Petrochemicals:

- BCD Increase: Increase in BCD on ammonium nitrate from 7.5% to 10% to support existing and new capacities in the pipeline.

- Plastics:

-

- BCD Increase: Increase in BCD on PVC flex banners from 10% to 25% to curb imports of non-biodegradable and hazardous materials.

- Telecommunication Equipment:

-

- BCD Increase: Increase in BCD from 10% to 15% on PCBA of specified telecom equipment to incentivize domestic manufacturing.

- Trade Facilitation:

-

- Export and Re-import Extensions: Extension of the export period for goods imported for repairs from six months to one year, and the time limit for re-import of goods for repairs under warranty from three to five years, to promote domestic aviation and boat & ship maintenance, repair, and overhaul (MRO).

See more: Budget 2024 For India By Finance Minister | UPSC

Direct Taxes:

- Simplification for Charities and TDS:

- Merging Tax Exemption Regimes: Two tax exemption regimes for charities merged into one.

-

- Merging 5% TDS rate into 2% TDS rate.

- Withdrawal of 20% TDS rate on mutual funds or UTI repurchase.

- Reduction of TDS rate on e-commerce operators from 1% to 0.1%.

- Credit of TCS in the TDS deducted on salary.

- Decriminalization of delay in TDS payment up to the due date of filing statements.

- Simplification of Reassessment:

-

- Reopening and Reassessment: Reopening beyond three years if escaped income is ₹ 50 lakh or more, up to five years.

- In search cases, reducing the time limit from ten years to six years before the year of search.

- Simplification and Rationalization of Capital Gains:

-

- Short-term Gains: Short Term Capital Gains (STCG) tax on some assets will be increased from 15% to 20%

- Long-term Gains: Long Term Capital Gains (LTCG) tax on all financial and non-financial asset will be hiked from 10 to 12.5% Increased exemption limit on capital gains on certain financial assets to ₹ 1.25 lakh per year.

- Classification as long-term Gains: Listed financial assets held for more than a year, unlisted financial assets, and non-financial assets held for at least two years.

- Tax on capital gains at applicable rates for unlisted bonds, debentures, debt mutual funds, and market-linked debentures irrespective of holding period.

- Taxpayer Services:

-

- Digitalization: All major GST taxpayer services and most Customs and Income Tax services digitalized. Remaining services to be digitalized over the next two years.

- Litigation and Appeals:

-

- Reducing Pendency: Deploying more officers for first appeals, proposing Vivad Se Vishwas Scheme, 2024.

- Monetary Limits for Appeals: Increase monetary limits for filing appeals related to direct taxes, excise and service tax in the Tax Tribunals, High Courts and Supreme Court to Rs 60 lakh, Rs 2 crore and Rs 5 crore, respectively.

- Employment and Investment:

-

- Abolishing Angel Tax: For all classes of investors to bolster the start-up ecosystem.

- Cruise Tourism: Simpler tax regime for foreign shipping companies operating domestic cruises. Fixed profit and gains of cruise-ship operators to 20% of aggregate amount received.

- Diamond Industry: Safe harbour rates for foreign mining companies selling raw diamonds in India.

- Corporate Tax Rate: Tax rates for foreign companies will be slashed to 35% from current tax rate of 40%.

- Deepening the Tax Base:

-

- Security Transactions Tax: The government increased the STT on sale of security option from 0.0625% to 0.1%, while tax levied on futures was increased from 0.0125% to 0.02%, in Budget 2024.

- Increase to 0.02% on futures and 0.1% on options.

- Buyback Tax: Tax income received on buyback of shares in the hands of the recipient.

- Other Proposals:

-

- NPS Contributions: NPS limit for employers in the private sector is raised from 14% to 10% of the employee’s basic salary.

- Non-reporting Penalties: Indian professionals working in multinationals get ESOPs and invest in social security schemes and other movable assets abroad. De-penalizing non-reporting of movable assets abroad up to ₹ 20 lakh under the Black Money Act.

- Finance Bill Proposals:

-

- Withdrawal of equalization levy of 2%.

- Expansion of tax benefits to certain funds and entities in IFSCs.

- Immunity from penalty and prosecution for benamidar on full and true disclosure.

- Personal Income Tax:

-

- Standard Deduction: Standard deduction to salaried individuals and pensioners is proposed to be increased from ₹ 50,000 to₹ 75,000 under the new tax regime.

- Family Pension Deduction: Deduction from family pension of Rs. 15,000 is proposed to be increased to ₹ 25,000 under the new tax regime.

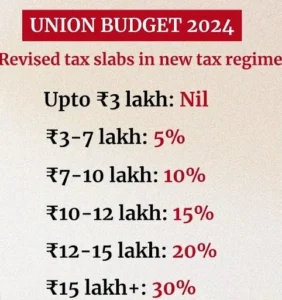

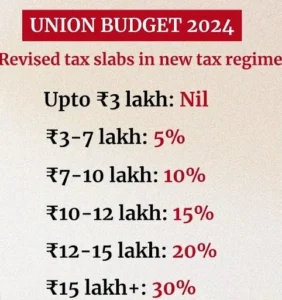

- Tax Rate Structure (New Regime):

-

-

- As a result of these changes, a salaried employee in the new tax regime stands to save up to ₹ 17,500/- in income tax.