Trump’s 100% Tariff on Imported Medicines

- In a sweeping policy shift, U.S. President Donald Trump has announced 100% tariffs on imports of branded and patented medicines, effective October 1, 2025.

- The decision has sparked global concern, with healthcare analysts warning of spiraling drug costs, market disruptions, and limited patient access to life-saving therapies.

Key Features of the Tariff Policy

- Mandatory Domestic Manufacturing Requirement: Pharmaceutical companies can escape the 100% tariff if they are “actively building” manufacturing plants in the United States. According to the administration, this condition applies only to projects that have already “broken ground” or are “under construction”, forcing companies to localize production to retain access to the U.S. market.

- Exemptions for the EU and Japan: A softer tariff regime applies to imports from the European Union and Japan, capped at 15%. These two regions account for nearly three-fourths of U.S. pharmaceutical imports, highlighting their strategic importance in global supply chains.

- Heavy Burden on Other Pharma Hubs: Countries such as the United Kingdom, Switzerland, and Singapore, which serve as critical pharmaceutical manufacturing hubs, face the full 100% tariff burden. This will make their exports significantly costlier, putting pressure on both companies and patients.

-

- Impact on Danish Medicines: Popular weight-loss and anti-diabetes drugs such as Wegovy and Ozempic, manufactured in Denmark, are directly in the line of fire. With no exemptions, these high-demand drugs will become substantially more expensive for U.S. consumers.

- Parallel Tariff Announcements: Beyond pharmaceuticals, the Trump administration also imposed tariffs on a range of other products, including kitchen cabinets, bathroom vanities, upholstered furniture, and heavy trucks, signalling a broader protectionist push.

|

Immediate Impact of Trump’s Tariff on American Healthcare

-

- Rising Household Spending: Prescription drugs make up nearly 10% of total household medical expenditure in the United States. With tariffs doubling the cost of many imported medicines, American families will face higher out-of-pocket expenses, particularly for specialized treatments. This sharp increase will disproportionately affect middle-income and elderly households already managing chronic illnesses.

- Dependence on China: Industry representatives have cautioned that tariffs would drive the US to rely more heavily on China for life-saving medicines, undermining Washington’s own national security objectives.

- Impact on Insurance Sector: Health insurance companies will inevitably pass on the additional costs of specialty and patented medicines to policyholders. As insurers adjust their premium structures to accommodate higher drug prices, millions of Americans could see their insurance premiums rise, reducing affordability of healthcare coverage.

- $51 Billion Cost Projection: A study by Ernst & Young found that even a 25% tariff would increase annual drug costs by $51 billion. With tariffs now set at 100%, the financial burden could be several times higher, placing enormous stress on both public healthcare budgets and private spending.

- Patient Vulnerability: Patients reliant on specialized cancer drugs, rare disease treatments, and advanced biologics will be the hardest hit. For these individuals, cost increases may lead to treatment delays, reduced access, or even abandonment of essential therapy, directly affecting survival outcomes and quality of life.

- Shifts in the Generics Market: While generic medicines account for 90% of prescriptions dispensed in the U.S., they represent only 13% of overall drug spending. Since the tariff primarily targets branded and patented imports, the role of generics may expand. However, this shift cannot fully compensate for the loss of affordability and accessibility in critical treatment categories.

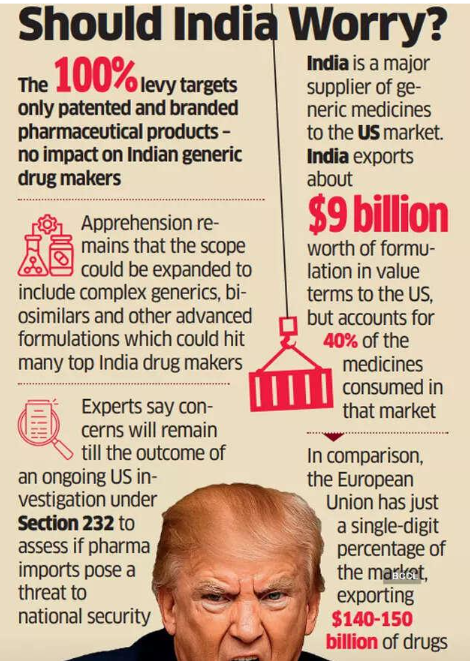

Implications For India’s Pharmaceutical Sector

- Temporary Relief for Generics: At present, India’s generic medicines—which make up 90% of prescriptions dispensed in the U.S. but account for only 13% of drug spending—are exempt from the tariff hike. This provides short-term relief, ensuring that Indian manufacturers remain critical suppliers of affordable medicines in America.

-

-

- A generic drug is a medication that is created to be the same as an already existing brand-name drug in dosage form, safety, strength, route of administration, quality, performance characteristics, and intended use. For example, Ibuprofen came out in 1967. Its Indian generic drug was made in 1973.

-

- Cushion for Indian Firms with U.S. Facilities: Several Indian pharmaceutical giants, such as Sun Pharma, Dr. Reddy’s, and Lupin, already operate manufacturing plants in the United States. These facilities could serve as a buffer, enabling them to continue operations without being directly impacted by tariff hikes. This strengthens their competitive edge compared to exporters without on-ground production bases.

- Risk of Future Vulnerability: The policy shift, however, highlights the fragile dependence on U.S. regulatory and political decisions. Should Washington expand tariffs to generics or biosimilars, it could severely disrupt one of India’s most successful export sectors. The ripple effects would extend beyond trade, affecting employment, foreign exchange earnings, and drug affordability worldwide.

- Market Dependence and Strategic Risks: India’s pharma industry is heavily reliant on U.S. demand, making it vulnerable to sudden trade policy changes. With growing U.S. emphasis on reshoring pharmaceutical supply chains, India risks losing its strategic advantage unless it diversifies markets and strengthens resilience.

- Need for Diversification and New Alliances: To mitigate risks, India must accelerate efforts to:

-

-

- Expand trade with emerging markets in Africa, Latin America, and Southeast Asia.

- Build stronger alliances with the EU, Japan, and Middle East, which are also reshaping healthcare supply chains.

- Promote domestic R&D in biosimilars and advanced therapies to maintain competitiveness.

-

- Global Supply Chain Disruptions: Post-World War II pharmaceutical supply chains are undergoing structural shifts due to geopolitical tensions, pandemic-era vulnerabilities, and climate change pressures. India’s dominance in generics may not be enough to secure its long-term position unless it adapts to these new realities.