Regulatory Reforms in India Introduction

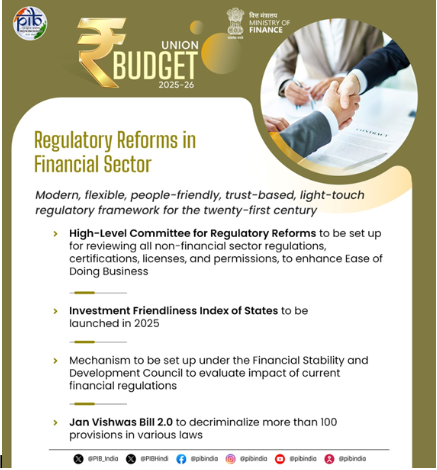

- Finance Minister Nirmala Sitharaman has announced the formation of a high-level committee dedicated to regulatory reforms.

- This committee will undertake a comprehensive review of all non-financial sector regulations, including certifications, licenses, and permissions. Its primary objective is to foster trust-based economic governance and implement transformative measures to improve the ease of doing business.

- A particular focus will be placed on streamlining inspections and compliance processes. The committee is expected to present its recommendations within a year.

Significance of Regulatory Reforms in India

- Economic Growth:

-

-

- India has witnessed record Foreign Direct Investment (FDI) inflows, reaching $84.8 billion in 2021-22.

- The Production-Linked Incentive (PLI) scheme, with an allocation of ₹2.5 lakh crore, has been introduced across 14 key sectors.

- Transactions through the Unified Payments Interface (UPI) crossed the 100-billion mark in 2023, showcasing the rapid digitalization of the economy.

-

- Strengthening the Financial Sector:

-

-

- The Indian banking system has shown significant improvement, with Non-Performing Assets (NPAs) reducing from 11.2% in 2018 to 5.0% in 2023.

- The Insolvency and Bankruptcy Code (IBC) has facilitated the recovery of ₹2.5 lakh crore in stressed assets.

- UPI has become a key financial enabler, handling over 8 billion transactions per month.

-

- Enhancing Ease of Doing Business:

-

-

- India’s ranking in the Ease of Doing Business index improved from 142 in 2014 to 63 in recent years.

- The time required to register a company has been reduced from over 30 days to less than 3 days.

- The Goods and Services Tax (GST) streamlined taxation by replacing 17 different taxes.

-

- Infrastructure Development:

-

-

- The National Infrastructure Pipeline, with an investment of $1.5 trillion, has accelerated infrastructure growth.

- The Real Estate (Regulation and Development) Act (RERA) has increased transparency in the real estate sector.

- Project delays have been reduced by 40%, as per NITI Aayog’s assessment.

-

- Boosting Manufacturing:

-

-

- The consolidation of 29 labor laws into 4 labor codes has simplified compliance.

- The manufacturing sector has consistently recorded growth exceeding 7%.

- India has strengthened its integration into global value chains.

-

- Advancements in the Digital Sector:

-

-

- The Digital India initiative has benefitted 1.2 billion individuals.

- The number of registered startups surpassed 100,000 by 2023.

- India’s ranking in the Global Innovation Index has improved, reflecting its growing digital ecosystem.

-

- Social Sector Reforms:

-

-

- Direct Benefit Transfers (DBT) have led to savings of ₹2.25 lakh crore.

- The Ayushman Bharat scheme has extended health benefits to 500 million citizens.

- The National Education Policy (NEP) 2020 has introduced transformative changes in the education sector.

-

- Sustainable Development Initiatives:

-

- India’s renewable energy capacity has exceeded 175 GW.

- Green bonds have attracted investments of over $10 billion.

- Emission intensity has been reduced by 15%, contributing to environmental sustainability.

Key Regulatory Reforms

- Simplification of Regulations:

-

-

- The Jan Vishwas Act 2023 decriminalized over 3,400 legal provisions and eliminated 39,000 compliance requirements.

- The SPICe+ portal integrated multiple registrations such as PAN, TAN, and DIN into a single platform, simplifying business incorporation.

- The Economic Survey 2024-25 emphasized the importance of removing redundant regulations under the philosophy of “minimum government, maximum governance.”

-

- Strengthening the Ease of Doing Business Framework:

-

-

- The Jan Vishwas Act 2023 eliminated imprisonment for minor procedural lapses such as delayed filings or calculation errors.

- The Economic Survey 2024-25 advocated for decriminalizing regulations unless they involve fraud, physical harm, or significant externalities.

-

- Implementation of Sunset Clauses:

-

-

- The Economic Survey 2024-25 recommended introducing sunset clauses to ensure that outdated regulations are automatically repealed unless explicitly renewed.

- The Insolvency and Bankruptcy Code (IBC) has set a precedent by mandating time-bound resolutions for financial distress cases.

-

- Consolidation of Legal Frameworks:

-

-

- The unification of 29 labor laws into 4 labor codes has simplified regulatory compliance for businesses.

- The introduction of GST replaced 8 central and 9 state-level taxes, significantly lowering compliance costs.

-

- Structured Implementation of Regulations:

-

-

- The Economic Survey 2024-25 proposed a structured notification schedule to ensure that regulatory changes are introduced in a predictable and phased manner.

- The GST Council holds quarterly meetings to announce tax changes, providing businesses with ample time for compliance adjustments.

-

- Risk-Based Inspections:

-

- The Shram Suvidha Portal has introduced a risk-based approach to labor inspections, minimizing unnecessary scrutiny of compliant businesses.

- Data analytics in the GST e-way bill system is being used to identify high-risk transactions for targeted inspections.

Challenges in Regulatory Reforms

- Excessive Regulatory Burden:

-

-

- India’s regulatory landscape includes over 85,000 compliance requirements and more than 5,000 provisions carrying imprisonment, creating difficulties for businesses, particularly small and medium enterprises (SMEs).

-

- Persisting Challenges in Ease of Doing Business:

-

-

- Although India’s global Ease of Doing Business ranking improved significantly, SMEs still struggle due to excessive penalties and subjective interpretation of regulations.

-

- Outdated Legislative Framework:

-

-

- Several laws, such as the Factories Act (1948) and the Shops and Establishments Act, do not align with modern business needs.

- India has over 1,000 central laws and 15,000 state laws, many of which overlap or create legal ambiguities.

- A report by TeamLease highlights how fragmented labor laws have hindered employment growth, underscoring the need for consolidation.

-

- Regulatory Uncertainty:

-

-

- Businesses, especially startups and SMEs, face difficulties due to frequent and unpredictable regulatory changes.

-

- Harassment Through Inspections:

-

- Traditional inspection mechanisms often involve manual processes that are susceptible to corruption and create hurdles for businesses.

Recommendations for the High-Level Committee

- Modernizing the Regulatory Framework:

-

-

- Introduce sunset clauses to ensure that outdated regulations are periodically reviewed and repealed if necessary.

- Adopt a risk-based compliance model to focus on high-risk sectors while reducing burdens on businesses with a clean compliance record.

-

- Reforming Penal Provisions:

-

-

- Restrict imprisonment to offenses involving deliberate fraud or physical harm.

- Establish a National Employer Compliance Grid (NECG) to streamline compliance filings and reduce subjective interpretations.

-

- Periodic Review of Regulations:

-

-

- Mandate a review of all regulations every five years to ensure their continued relevance.

- The Telecom Regulatory Authority of India (TRAI) already follows this model by regularly updating policies to reflect technological advancements.

-

- Consolidation of Laws:

-

-

- Develop umbrella codes for specific sectors, such as an Environmental Code or Energy Code, to replace fragmented laws.

- The Companies Act, 2013 simplified corporate governance by replacing the outdated 1956 Act.

-

- Introduction of a Regulatory Calendar:

-

-

- Establish a structured regulatory calendar where all ministries pre-announce dates for notifications and amendments, ensuring policy predictability.

- The Reserve Bank of India (RBI) follows a monetary policy calendar that provides clarity on interest rate changes, reducing market uncertainty.

-

- Adoption of AI and Data Analytics:

-

-

- Expand the use of AI and data analytics to facilitate risk-based regulatory inspections.

- The Food Safety and Standards Authority of India (FSSAI) already employs risk-based assessments to prioritize inspections for high-risk food businesses.

-

- Learning from Global Best Practices:

-

- Implement successful international regulatory models, such as the US Regulatory Flexibility Act, which mandates periodic reviews of business regulations.

- Adopt Singapore’s Pro-Enterprise Panel approach, which minimizes inspections for businesses with strong compliance records.

Way Forward

- Gradual Deregulation Strategy: The Economic Survey 2024-25 likened deregulation to peeling an onion—each layer removed simplifies the next, making long-term reforms more effective.

- Digital Infrastructure for Compliance: The introduction of PAN 2.0 and Entity Digilocker could enable a paperless, presence-less, and cashless compliance ecosystem.

- Small Reforms with Large Impact: Even minor regulatory simplifications can create a “butterfly effect,” leading to significant improvements in the business environment.

- Reducing Regulatory Burdens: Lowering excessive regulations is crucial to unlocking India’s entrepreneurial potential and fostering high-wage job opportunities.

- Vision for 2047: To sustain an 8% GDP growth rate over the next decade, India must focus on regulatory simplification, innovation, and fostering a business-friendly environment.