Quick Commerce in India Introduction

- Quick commerce (Q-commerce) in India refers to ultra-fast delivery services that fulfill orders, often within 10-30 minutes.

- It primarily focuses on delivering essential goods like groceries, personal care items, and ready-to-eat food using hyper-local fulfillment networks and advanced logistics.

- This segment is rapidly expanding due to the growing demand for convenience and immediacy, especially in urban areas.

Key Differences: Traditional E-Commerce vs. Quick Commerce

| Feature | Traditional E-commerce | Quick Commerce |

| Delivery Speed | Typically, 1-7 days or more | Few minutes to 1-2 hours |

| Delivery Range | Wide geographical coverage (national, international) | Limited to a small, local area (city, neighborhood) |

| Product Focus | Wide range of products (electronics, apparel, home goods, etc.) | Primarily daily essentials, groceries, convenience items, and ready-to-eat food |

| Inventory Management | Centralized warehouses, distributed fulfillment centers | Localized micro-warehouses or dark stores |

| Order Size | Often larger, planned purchases | Smaller, immediate needs, impulse buys |

| Customer Needs | Planned purchases, variety, price comparison | Immediate gratification, convenience, urgent needs |

| Pricing Strategy | Competitive pricing, discounts, promotions | May have slightly higher prices for convenience and speed |

| Logistics | Long-haul transportation, standard delivery services | Hyperlocal delivery, bike couriers, dedicated delivery fleets |

| Technology Focus | Website/app-based ordering, standard logistics tracking | Real-time inventory management, route optimization, rapid delivery tracking |

| Operational Cost | Lower operational costs per unit | Higher operational costs per unit due to rapid delivery and hyperlocal logistics |

| Examples | Amazon, Flipkart, eBay | Zepto, Blinkit, Dunzo, Swiggy Instamart |

| Target Audience | Wide-spread audience | Urban, time-sensitive customers |

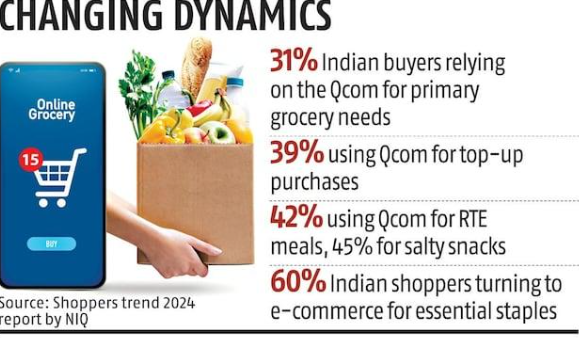

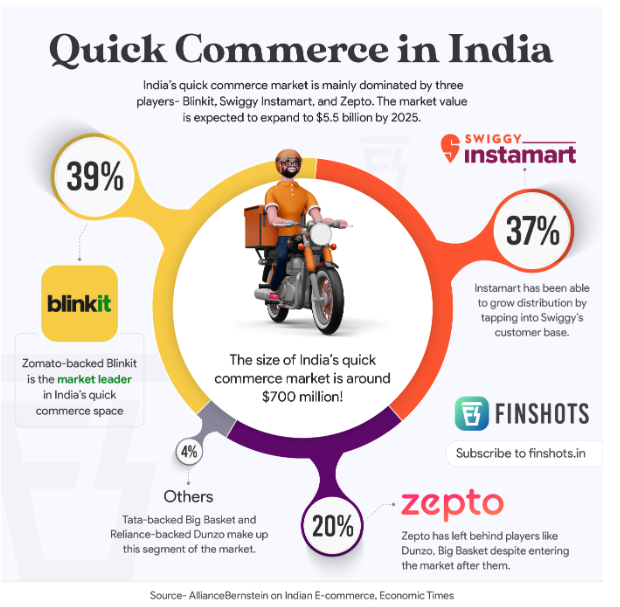

Market Size and Growth of Quick Commerce in India

- Market Growth: The Gross Merchandise Value (GMV) of Q-commerce surged from $0.5 billion in FY22 to $3.3 billion in FY24, a 280% increase in just two years (Chryseum Financial Services).

- Market Leaders: The leading platforms include Blinkit (46% market share), Zepto (29%), and Swiggy Instamart (25%) (Motilal Oswal, FY 2025 Q1).

- Consumer Base: Quick commerce primarily serves 20 million urban households in metro and Tier 1 cities.

- Market Size: The Indian Q-commerce market, valued at $3.34 billion in FY 2024, is projected to reach $9.95 billion by 2029, growing at a 76% year-on-year rate (Grant Thornton Bharat).

- FMCG Sales: Large FMCG brands have doubled their Q-commerce sales, which now account for 35% of their total online sales (Deloitte).

- Adoption Trends: Quick commerce platforms are expanding 20-25% faster than traditional e-commerce, signaling a shift in consumer behavior.

- Consumer Preferences: A Deloitte Consumer Survey (2024) found that 12% of urban consumers prefer Q-commerce, particularly for food and beverages, driven by impulse purchases and urgent needs.

Factors Driving Quick Commerce’s Success

- Dark Stores and Micro-Fulfillment Centers:

- These strategically located warehouses enable hyperlocal fulfillment, ensuring sub-20-minute deliveries.

- Companies like Zepto and Blinkit use machine learning to optimize inventory distribution, reducing stockouts and delivery failures.

- Data-Driven Demand Forecasting:

- Platforms analyze customer app activity, seasonal trends, and local demand to predict inventory needs and optimize order fulfillment.

- AI-driven personalization improves product recommendations, increasing average order value.

- Brand Awareness and Consumer Engagement:

- Q-commerce platforms enhance retailer visibility and drive impulse purchases, helping brands reach a wider audience.

- Promotional partnerships with FMCG brands boost in-app engagement and customer retention (IIM Ahmedabad).

- Employment Growth and Gig Economy Expansion:

- The sector is generating employment for millions of delivery personnel and warehouse workers.

- NITI Aayog projects 23.5 million gig workers by 2029-30, a major share of non-agricultural employment.

- Swiggy and Zepto offer micro-loans and insurance plans for their delivery partners, improving financial stability.

- Expansion to Tier-2 and Tier-3 Cities:

- Quick commerce is growing beyond metros, catering to smaller cities with rising digital penetration.

- Tier-2 and Tier-3 cities contributed 60% of India’s total e-commerce demand in 2023, with a projected 30% annual growth by 2025.

- Urban Convenience and Unaddressed Demand:

- Quick commerce provides round-the-clock availability, especially for late-night needs when traditional stores are closed.

- India’s internet user base is expected to exceed 900 million by 2025, further accelerating digital adoption and Q-commerce expansion (EY-Parthenon).

Challenges Faced by Quick Commerce

- Threat to Traditional Retailers:

- Millions of Kirana stores and distributors face revenue loss, as customers shift to Q-commerce platforms for quick deliveries and discounts.

- Worker Exploitation and Delivery Rider Risks:

- Gig workers report low wages, poor working conditions, and unsafe delivery targets.

- In cities like Bengaluru and Mumbai, delivery rider protests highlight the lack of social security and accident insurance.

- Unsustainable Business Model:

- Q-commerce relies on heavy cash burn and investor funding, making profitability uncertain.

- Zepto reportedly burned ₹1,200 crore in Q4 2024, averaging ₹400 crore per month.

- Environmental Impact:

- The sector contributes to carbon emissions and packaging waste.

- India’s e-commerce transportation emits 285g CO2 per parcel, accounting for 51% of total delivery emissions.

- Anti-Competitive Practices:

- Platforms face accusations of predatory pricing and deep discounting, which harm small retailers (AICPDF complaint to CCI).

- Traditional retailers argue that Q-commerce creates an uneven playing field, forcing small businesses to shut down.

- Algorithmic Price Manipulation and Differential Pricing:

- Platforms allegedly use customer data (location, device type, behavior) to implement differential pricing, raising concerns over fairness.

Way Forward

- Fair Competition and Regulatory Oversight:

- The Competition Commission of India (CCI) should monitor predatory pricing and enforce transparency.

- A National E-Commerce Regulatory Authority can oversee pricing, data protection, and monopolistic practices (similar to the EU Digital Markets Act).

- Hybrid Retail Models and MSME Integration:

- Q-commerce platforms should partner with Kirana stores and source inventory from MSMEs for fair market access.

- ONDC (Open Network for Digital Commerce) can help small retailers compete with established platforms.

- Stronger Gig Worker Protections:

- The Code on Social Security, 2020 should be enforced to mandate fair wages, insurance, and accident coverage.

- Delivery workers need fixed working hours and safety measures (like South Korea’s Delivery Speed Regulation).

- Sustainable Logistics and Green Supply Chains:

- Platforms must adopt eco-friendly packaging and EV-based delivery fleets under the FAME scheme.

- Germany’s DHL GoGreen Initiative serves as a model for reducing carbon emissions.

- Stronger Data Privacy and Consumer Protection:

- The Digital Personal Data Protection Act, 2023 should regulate customer data usage and pricing transparency.

- Improved grievance redressal systems can enhance consumer trust.