Protection of Interests in Aircraft Objects Bill, 2025 Introduction

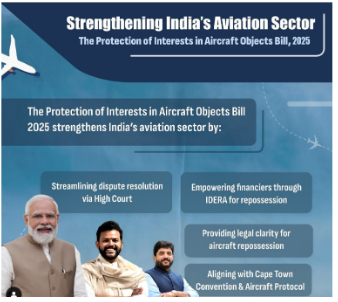

- India’s aviation sector is witnessing a monumental shift with the recent passing of the Protection of Interests in Aircraft Objects Bill, 2025, which addresses long-standing challenges in aircraft leasing and financing.

- The legislation was introduced to resolve recurring disputes over repossession of leased aircraft, highlighted by high-profile cases involving airlines such as Kingfisher, SpiceJet, and Go First.

- The Bill not only aims to provide legal clarity but also operationalizes the Cape Town Convention and Aircraft Protocol (CTC)—a crucial international agreement for the aviation sector. This reform aligns with India’s ambitions under India@2047 and is expected to make the country a global leader in aviation financing.

What is the Cape Town Convention and Aircraft Protocol?

- The Cape Town Convention and the Aircraft Protocol, adopted in 2001 by the International Civil Aviation Organization (ICAO), are international treaties designed to create a standardized legal framework for transactions involving aviation assets like aircraft, engines, and helicopters. The main objectives include:

- Standardized Transactions: It standardizes processes for asset transactions in the aviation sector, simplifying cross-border deals.

- Protection for Creditors and Lessors: The Convention protects the interests of creditors and lessors, ensuring their rights to repossess assets in case of default.

- Global Aircraft Registry: It establishes a global registry, allowing for a uniform approach to ownership and security rights across different jurisdictions.

- Efficiency in Repossession: The treaty provides remedies for lessors, enabling them to repossess assets efficiently, even overriding conflicting domestic insolvency laws.

- India signed the Convention in 2008, but implementation had been delayed due to a lack of legislative backing.

- The Protection of Interests in Aircraft Objects Bill, 2025 resolves this by giving statutory force to the CTC and Aircraft Protocol, bringing India in line with international norms.

Key Provisions of the Protection of Interests in Aircraft Objects Bill, 2025

- Statutory Implementation of Cape Town Convention: This provision officially incorporates the provisions of the Cape Town Convention and Aircraft Protocol into Indian law.

- DGCA as Registry Authority: The Directorate General of Civil Aviation (DGCA) will now manage the registration and de-registration of aircraft and issue directions to implement the Convention, providing greater regulatory oversight.

- Time-bound Repossession: Creditors can reclaim aircraft within two calendar months of default or a mutually agreed period. This ensures swift repossession, reducing delays seen in cases like GoFirst’s 2023 shutdown.

- Debtor Obligations: Airlines are mandated to maintain accurate records of dues and comply with DGCA’s directions, enhancing transparency and accountability.

- Overriding Effect: If any existing law contradicts the Bill, the provisions of this Bill will take precedence, ensuring uniformity in aircraft repossession cases, even over the Insolvency and Bankruptcy Code (IBC).

Why is This Bill Significant for India?

- Enhancing Investor Confidence: With a clearer legal framework for aircraft leasing, the Bill is expected to attract international financiers and help India compete with global leasing hubs like Dublin, Singapore, and Hong Kong. This will lower the perceived risks of leasing aircraft in India, positively impacting the financial sustainability of Indian airlines.

- Cost Reduction for Airlines: The Bill is anticipated to reduce leasing costs by 8–10%, which can facilitate fleet expansion and potentially lower airfares, benefiting customers.

- Support for Domestic Leasing Ecosystem: The Bill supports the development of GIFT City in Gujarat as a hub for aviation financing, aligning with the Indian government’s financial sector development goals.

- Support for Smaller Airlines: The Bill provides smaller airlines access to programs like EXIM Bank’s 10% interest rebate for leasing, giving them the financial flexibility to scale their operations.

- Pilot Training Hub: As the demand for pilots is projected to reach 30,000 over the next 15–20 years, the Bill complements India’s vision of becoming a global hub for pilot training, ensuring a steady supply of skilled professionals.

- Dispute Resolution: The Bill establishes a robust legal framework to resolve disputes between airlines and lessors over high-value assets like aircraft, engines, and helicopters. This reduces lengthy court procedures and enhances the efficiency of aircraft leasing in India.

- Global Integration: By aligning Indian aviation laws with international standards, the Bill helps integrate India’s aviation sector with global markets. It is expected to boost investor confidence, especially as Indian airlines like IndiGo and Air India expand their fleets.

- Streamlined Processes: The Bill enables quick repossession of aircraft by lessors, ensuring smoother operations for airlines and reducing delays in cases of default.

- Legal Clarity: The Bill provides much-needed legal clarity, particularly in the wake of delays in high-profile cases like those of GoFirst and SpiceJet, which faced considerable uncertainty in repossession proceedings.

Key Challenges in Aircraft Leasing & Repossession

- Prolonged Legal Battles:

- Kingfisher Airlines (2012): Lessors faced protracted legal battles to repossess aircraft, leading to prolonged financial uncertainty.

- GoFirst (2023): Insolvency proceedings under the Insolvency and Bankruptcy Code (IBC) imposed a moratorium, blocking lessors from reclaiming aircraft for months.

- SpiceJet and BBAM Dispute: A legal dispute over $132 million highlighted the prolonged settlement and operational uncertainties due to legal ambiguities.

- Conflict with Domestic Laws: Despite India’s signing of the Cape Town Convention (2008), conflicts between domestic laws like IBC and SARFAESI Act and international standards have led to significant challenges. For instance, during the GoFirst (2023) insolvency, lessors found it difficult to repossess their aircraft due to conflicting provisions in Indian law, exacerbating delays in aircraft recovery.

- Lag in Compliance with Global Standards: India’s compliance score on the Aviation Working Group’s (AWG) Cape Town Convention Index has improved from 50 to 62, but it still falls short of the target score of 90 required to match leading jurisdictions. This gap reflects the country’s struggle to align its domestic legal framework with global aviation standards.

- Challenges Faced by Lessors: The IBC moratorium often prevents lessors from recovering their assets in a timely manner. Moreover, operational dues to airports and oil companies are unfairly passed onto lessors, adding to the financial burden. The complex tax laws and inconsistent regulatory arrangements further contribute to an unpredictable business environment for lessors.

Key Concerns with the Protection of Interests in Aircraft Objects Bill, 2025

- Unsubstantiated Claims:

- Leasing Costs: Executives in the international leasing industry have questioned claims that the Bill will reduce leasing costs. They argue that the creditworthiness of airlines and the volume of orders are the real factors driving leasing costs, not the proposed legislation.

- Airfare Reduction: Airline executives believe that the proposed Bill’s impact on airfares may be exaggerated. They argue that ticket prices are driven by market forces, and not the costs incurred by airlines.

- Market Dominance Concerns: There are concerns regarding the dominance of IndiGo and Air India in the domestic aviation market. These two carriers hold significant market share, and unresolved issues like high aviation fuel costs and debt burdens continue to affect the competitiveness of the market.

- Lack of Comprehensive Arbitration Reform: Disputes in the aviation sector, including leasing disputes, continue to be resolved overseas due to a lack of robust domestic mechanisms. The Bharatiya Vayuyan Adhiniyam, 2024 lacks detailed arbitration provisions, and there is a pressing need for an effective, specialized aviation dispute resolution system.

- Taxation and Regulatory Burden: The current tax regime has been criticized for being inconsistent and difficult to navigate. Lessors often face income tax notices when using Special Purpose Vehicles (SPVs) for leasing aircraft, without a clear “permanent establishment” status, which reduces the ease of doing business in India.

Way Forward

- Simplify Taxation and SPV Norms: Align India’s tax structures with international leasing norms, removing ambiguities around SPVs and permanent establishments. Introducing ‘safe harbor’ tax rules for SPVs operating within the International Financial Services Centre (IFSC)-GIFT City could make the leasing process more attractive to lessors.

- Boost Domestic Leasing: India should incentivize domestic lessors and financial institutions to invest in aviation. Policy support, coupled with EXIM Bank rebates, can help scale up the domestic leasing ecosystem. The Japanese Operating Lease (JOL) scheme serves as an ideal model for such initiatives.

- Improve Compliance Ratings: India should work closely with the Aviation Working Group to improve its compliance score and reach a target score of 90. Achieving this would send a strong signal to international markets, similar to UAE, Malaysia, and New Zealand, which have maintained high scores through consistent implementation of CTC-based repossession timelines.

- Ratification Monitoring: Regular reviews of India’s compliance with the Cape Town Convention should be conducted, leveraging the AWG Compliance Index as a benchmark. A CTC Implementation Oversight Committee (CIOC) could be established to monitor the progress of the reforms and ensure alignment with international standards.

- Regulatory Integration: The government should implement recommendations from the High-Level Committee for Regulatory Reforms across aviation and financial domains, similar to the UK’s Better Regulation Task Force. This would ensure that regulations across sectors, including aviation, are coherent and supportive of the broader goal of making India a global hub for aircraft leasing.

- Harmonize with IBC: India should introduce a formal amendment or override clause in the Insolvency and Bankruptcy Code (IBC) to ensure smoother repossession rights for lessors. Drawing lessons from Ireland’s Cape Town Convention Act, 2005, India can streamline the repossession process.

- Comprehensive Arbitration Reform: A sector-specific dispute resolution mechanism should be implemented, potentially amending the Bharatiya Vayuyan Adhiniyam, 2024 to include specialized arbitration panels under the Directorate General of Civil Aviation (DGCA). The Singapore International Arbitration Centre (SIAC), with its specialized aviation dispute desk, serves as a global best practice for resolving such matters.