Pradhan Mantri Jan Dhan Yojana Introduction

- The launch of the Pradhan Mantri Jan Dhan Yojana on August 28, 2014, marked a pivotal effort by the government to integrate the unbanked segments of the population into the formal financial system.

- As the scheme recently celebrated its 10th anniversary, Prime Minister Narendra Modi lauded its ‘momentous’ achievements.

- He emphasized that the scheme has played a crucial role in advancing financial inclusion and uplifting the dignity of millions, particularly women, youth, and marginalized communities.

Pradhan Mantri Jan Dhan Yojana Features

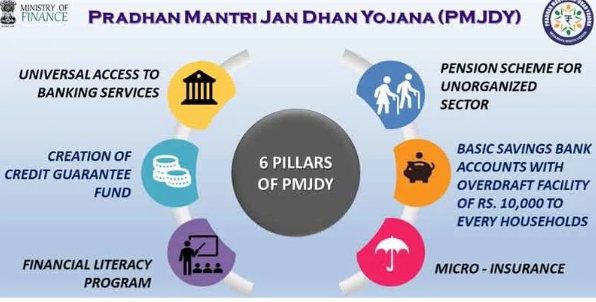

- National Mission for Financial Inclusion: PMJDY is a nationwide mission aimed at providing affordable access to essential financial services, including savings accounts, credit, insurance, and pensions, particularly for underprivileged sections of society.

- Zero Balance Accounts: Accounts under PMJDY can be opened without the need for a minimum balance. This feature is particularly beneficial for low-income individuals, enabling them to access banking services without financial pressure. These accounts also earn interest like regular savings accounts.

- Overdraft Facility: Account holders under PMJDY are eligible for an overdraft facility of up to ₹10,000, with a focus on women account holders. This facility offers a safety net for emergencies or unexpected expenses.

- Accident Insurance Cover: PMJDY accounts come with an accident insurance cover of ₹1 lakh, provided through the RuPay card issued to account holders. Accounts opened after August 28, 2018, receive an enhanced insurance cover of ₹2 lakh.

- Direct Benefit Transfers (DBT): PMJDY accounts are integrated with the Direct Benefit Transfer (DBT) system, ensuring that subsidies and benefits from government schemes reach beneficiaries directly. This reduces leakage and improves efficiency.

- Promotion of Financial Literacy: The scheme emphasizes the importance of financial literacy, aiming to educate account holders about banking services, savings, insurance, and investment options, thereby promoting informed financial decision-making.

- Use of Bank Mitras: To extend banking services to rural and remote areas, the scheme employs Bank Mitras (business correspondents). These representatives offer branchless banking services, enhancing the accessibility of the scheme across the country.

Pradhan Mantri Jan Dhan Yojana Progress and Achievements

- Massive Account Openings: As of the latest data, over 53.1 crore bank accounts have been opened under PMJDY, with approximately 29.56 crore accounts belonging to women. This scale of financial inclusion is unprecedented and highlights the success of the scheme.

- Distribution Across Banking Sectors: The majority of PMJDY accounts are held with public sector banks (41.42 crore accounts), followed by regional rural banks (9.89 crore accounts), private sector banks (1.64 crore accounts), and rural cooperative banks (0.19 crore accounts).

- State-wise Distribution: Uttar Pradesh leads in the number of PMJDY accounts with 9.45 crore accounts, while Lakshadweep has the fewest, with just 9,256 accounts. Fifteen other states, including Bihar, West Bengal, and Maharashtra, also have over 1 crore PMJDY accounts each.

Pradhan Mantri Jan Dhan Yojana Impact

- Financial Inclusion: The scheme has significantly contributed to financial inclusion, with 78% of Indian adults having a bank account in 2021, up from 53% in 2014. This growth highlights the role of PMJDY in expanding access to formal banking services.

- Bridging the Rural-Urban Gap: With 67% of accounts opened in rural and semi-urban areas, PMJDY has played a critical role in narrowing the gap between rural and urban financial access, promoting equitable economic growth.

- Gender Parity in Banking: Approximately 56% of the accounts under PMJDY are held by women, helping to bridge the gender gap in financial access and empowering women economically.

- Expansion of Banking Infrastructure: The demand generated by over 53 crore new accounts has led to a significant expansion of banking infrastructure. For example, the number of scheduled commercial bank branches increased by 46% between 2013 and 2023.

- Facilitation of Direct Benefit Transfers: PMJDY is a key component of the JAM trinity (Jan Dhan, Aadhaar, and Mobile), which has streamlined the transfer of government benefits. This system has facilitated cumulative transfers of ₹38.5 lakh crore, reducing inefficiencies and corruption.

- Prevention of Financial Leakages: By using PMJDY accounts for DBT, the government has minimized financial leakages, saving approximately ₹3.48 lakh crore by eliminating ineligible beneficiaries in schemes like MG-NREGS and PM-Kisan.

- Support During Crisis: The JAM architecture enabled the government to provide timely financial assistance during the COVID-19 pandemic, such as the transfer of ₹500 to 20 crore women Jan Dhan account holders, demonstrating the scheme’s role in crisis management.

- Promotion of Digital Economy: The integration of PMJDY with the Unified Payments Interface (UPI) has promoted digital transactions, making formal financial services more accessible to low-income households and contributing to the growth of the digital economy.

Pradhan Mantri Jan Dhan Yojana Challenges

- Dormant Accounts: Despite the opening of over 53 crore accounts under PMJDY, approximately 13.7% remain inactive. This indicates that around 7.3 crore accounts are not regularly used by account holders. The lack of regular transactions suggests that a significant portion of beneficiaries may not be fully integrated into the banking system, reducing the overall impact of the scheme.

- Misuse as Mule Accounts: There have been reports of PMJDY accounts being misused for fraudulent activities, particularly post-demonetization in 2016. For example, during this period, large sums of money were deposited into many dormant accounts, raising concerns about these accounts being used as ‘mule accounts’ for money laundering or storing black money. According to reports, over ₹42,000 crore were deposited into Jan Dhan accounts within the first few weeks post-demonetization.

- Infrastructural Gaps: In rural areas, especially in states like Bihar and Uttar Pradesh, the lack of adequate banking infrastructure poses a significant challenge. For instance, many villages lack even a single bank branch or functional ATM. As of 2023, there are still several districts in these states where the bank-to-population ratio remains far below the national average, severely limiting access to banking services under PMJDY.

- Technological Barriers: Poor internet connectivity and outdated banking technology continue to hinder the effective management of PMJDY accounts, particularly in remote and rural areas. For example, several villages in the Northeastern states, such as in Arunachal Pradesh and Mizoram, struggle with intermittent internet service, making it difficult for residents to conduct digital transactions or access banking services.

- Low Financial Literacy: A significant portion of PMJDY account holders lacks awareness about the benefits available under the scheme, such as overdraft facilities and insurance coverage. For instance, a survey conducted in 2022 found that nearly 60% of rural account holders were unaware of the ₹2 lakh accident insurance cover available through the RuPay card. This lack of financial literacy limits their ability to fully utilize the scheme’s offerings.

- Duplication of Accounts: The opening of multiple Jan Dhan accounts under different schemes by the same individuals has led to data management issues. For example, during a review by the Ministry of Finance, it was found that a significant number of the 53 crore accounts were duplications, leading to challenges in accurately assessing the scheme’s reach and effectiveness. This issue complicates the government’s ability to track and manage the actual number of unique beneficiaries.

- Exclusion of Marginalized Groups: Despite the wide reach of PMJDY, certain marginalized populations, particularly those in remote or tribal regions, remain excluded from the scheme. For example, in the tribal regions of Chhattisgarh and Jharkhand, banking penetration is still low, with many villages not having a single bank branch. A 2021 study showed that only 37% of the population in these regions had access to formal banking services, compared to the national average of 78%.

- Gender Disparity in Account Use: In conservative rural areas, social norms often restrict women from using their PMJDY accounts independently. For instance, in parts of Rajasthan and Uttar Pradesh, studies have shown that despite women holding over 56% of PMJDY accounts, many rely on male family members to conduct transactions on their behalf. This limits the scheme’s effectiveness in promoting women’s financial autonomy.

Pradhan Mantri Jan Dhan Yojana Way Forward

- Enhancing Financial Literacy: Implement widespread financial literacy campaigns in partnership with local leaders, NGOs, and educational institutions to promote better use of Jan Dhan accounts and ensure beneficiaries understand the available services.

- Incentivizing Account Activity: Link PMJDY accounts with more government schemes, subsidies, and benefits to encourage active usage. For example, offer interest on savings, overdraft facilities, or cashback for digital transactions to motivate account holders.

- Integrating Financial Services: Expand the range of services available through Jan Dhan accounts, including microcredit, pension, and insurance products, to encourage more frequent and meaningful use of these accounts.

- Improving Banking Infrastructure: Expand the banking network in underserved rural and remote areas by setting up more branches, ATMs, and digital banking touchpoints. Encourage the use of Business Correspondents (BCs) and mobile banking units to reach remote populations.

- Regular Monitoring and Feedback: Establish a robust system for monitoring the scheme’s progress and collecting feedback from beneficiaries. This will help identify and address challenges, ensuring PMJDY adapts to changing needs and remains effective.