MSMEs in India Introduction

-

- Micro, Small, and Medium Enterprises (MSMEs) form the backbone of India’s economy.

- These businesses are crucial not just for industrial output but also for providing employment, contributing to rural development, and promoting exports.

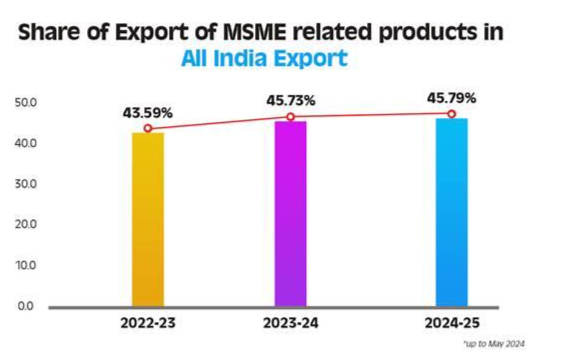

- In the financial year 2023-24, MSME-related products accounted for a significant 45.73% of India’s total exports, underscoring their importance.

- MSMEs are central to achieving the vision of Atmanirbhar Bharat (Self-Reliant India) and driving the nation’s growth.

- MSMEs, or Micro, Small, and Medium Enterprises, are businesses engaged in the production, processing, or preservation of goods and services.

- These enterprises are classified based on their investment in plant and machinery (for manufacturing businesses) or equipment (for service industries), alongside their annual turnover. These businesses are often the driving force in local economies, offering crucial goods and services across various sectors and industries.

Regulation of MSMEs in India

- In India, MSMEs are regulated under the Micro, Small & Medium Enterprises Development (MSMED) Act, 2006.

- In 2007, the Ministry of Small Scale Industries and the Ministry of Agro and Rural Industries were merged to form the Ministry of Micro, Small & Medium Enterprises. This Ministry oversees various statutory bodies that support MSME development across the country.

Statutory Bodies Supporting MSMEs

- The Ministry of Micro, Small, and Medium Enterprises (MSME) supervises several key statutory bodies that play a critical role in the growth and development of MSMEs:

- Khadi and Village Industries Commission (KVIC): Focuses on the promotion and development of khadi and village industries, providing rural employment and strengthening the rural economy.

- Coir Board: Supports the growth of the coir industry and works to improve the living conditions of coir workers.

- National Small Industries Corporation (NSIC): Provides commercial support to MSMEs, helping them with marketing and technological needs.

- National Institute for Micro, Small, and Medium Enterprises (NI-MSME): Plays a key role in entrepreneurship development, policy research, and MSME promotion.

- Additionally, the Mahatma Gandhi Institute for Rural Industrialisation (MGIRI) accelerates rural industrialization, supports traditional artisans, and fosters innovation through local resource utilization.

Key Measures for MSMEs in Union Budget 2025-26

- The Union Budget 2025-26 has introduced several significant initiatives aimed at expanding the MSME sector:

- Revised Classification Criteria:

- To help MSMEs scale operations and access better resources, the investment and turnover limits for classification have been increased by 2.5 times and 2 times, respectively. This is expected to improve efficiency, technological adoption, and employment generation.

- Enhanced Credit Availability:

- The credit guarantee cover for micro and small enterprises has been increased from ₹5 crore to ₹10 crore, enabling additional credit of ₹1.5 lakh crore over five years.

- Startups will see their guarantee cover double from ₹10 crore to ₹20 crore, with a reduced fee of 1% for loans in 27 priority sectors.

- Exporter MSMEs will benefit from term loans up to ₹20 crore with enhanced guarantee cover.

- Credit Cards for Micro Enterprises:

- A new customised Credit Card scheme will provide ₹5 lakh in credit to micro enterprises registered on the Udyam portal, with 10 lakh cards set to be issued in the first year.

- Support for Startups and First-Time Entrepreneurs

- A new Fund of Funds with ₹10,000 crore will be established to expand support for startups.

- A scheme for 5 lakh first-time women, Scheduled Caste, and Scheduled Tribe entrepreneurs will provide term loans up to ₹2 crore over five years, incorporating lessons from the Stand-Up India scheme.

- Focus on Labour-Intensive Sectors:

- A Focus Product Scheme for the footwear and leather sector will support design, component manufacturing, and non-leather footwear production, expected to create 22 lakh jobs and generate a turnover of ₹4 lakh crore.

- A new scheme for the toy sector will promote cluster development and skill-building, positioning India as a global toy manufacturing hub.

- A National Institute of Food Technology, Entrepreneurship and Management will be established in Bihar to boost food processing industries in the eastern region.

- Manufacturing and Clean Tech Initiatives:

- A National Manufacturing Mission will provide policy support and roadmaps f or small, medium, and large industries under the Make in India initiative.

- Special emphasis will be given to clean tech manufacturing, fostering domestic production of solar PV cells, EV batteries, wind turbines, and high-voltage transmission equipment.

The Role of MSMEs in India’s Economic Growth

- Job Creation & Livelihood Opportunities:

- MSMEs are the largest non-agricultural employers in India, providing jobs to millions, particularly in rural and semi-urban areas. Government programs like PM Vishwakarma and Mudra Yojana have expanded self-employment opportunities.

- Over 1 crore registered MSMEs currently employ around 7.5 crore people across the country, providing vital economic support in local communities.

- Contribution to GDP & Industrial Development:

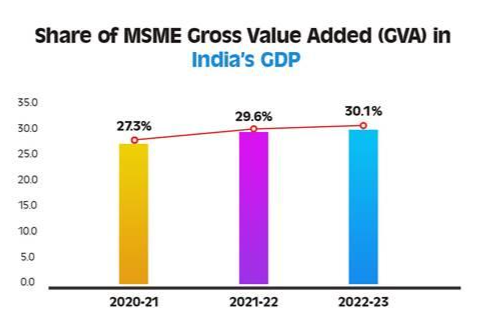

- In recent years, the sector has displayed remarkable resilience, with its share in the country’s Gross Value Added (GVA) increasing from 27.3% in 2020-21 to 29.6% in 2021-22 and 30.1% in 2022-23, highlighting its growing role in national economic output.These enterprises are also essential to the supply chains of larger industries by providing raw materials and intermediates.

- The Udyam portal has made it easier for MSMEs to formalize their operations, streamlining the registration process and improving their access to resources.

- Boosting Exports & Foreign Exchange Reserves:

- Their contribution to India’s total exports has steadily grown, reaching 43.59% in 2022-23, 45.73% in 2023-24, and 45.79% in 2024-25 (up to May 2024). Initiatives like the Government e-Marketplace (GeM) and the Production-Linked Incentive (PLI) program have integrated MSMEs into global supply chains, boosting their export potential.

-

- Promoting Digital Transformation and Technological Innovation:

- Digital initiatives, including the Open Network for Digital Commerce (ONDC) and Digital MSME 2.0 have helped MSMEs transition to online platforms, improving efficiency and market access. Currently, 72% of MSME transactions occur digitally, enabling better financial inclusion and operational agility. Also, a study by the Small Industries Development Bank of India (SIDBI) revealed that MSMEs using digital tools saw a 20% increase in their productivity and 30% improvement in revenue growth.

- Programs like Digital Udyami and GeM (Government e-Marketplace) have also made it easier for MSMEs to access government procurement opportunities, ensuring that they have a level playing field with larger companies.

- Promoting Women and Social Entrepreneurship:

- Women-led MSMEs are not only contributing to gender equality but are also playing an instrumental role in empowering women economically. As of 2023, 14% of India’s total MSMEs are women-owned, and this percentage is steadily growing as more women become entrepreneurs.

- Initiatives like the Mudra Yojana have been particularly impactful in this regard. Through the scheme, over ₹32.36 lakh crore worth of loans have been disbursed, supporting 51.41 crore entrepreneurs, with 68% of the loans being awarded to women entrepreneurs. This has significantly enhanced women’s participation in the formal economy. An example of this is Ujjwala, a women-led MSME that produces eco-friendly sanitary pads.

- Promoting Digital Transformation and Technological Innovation:

- Driving Rural Development and Reducing Regional Disparities:

-

-

- MSMEs have a crucial role in reducing regional economic disparities by fostering industrial growth in rural and semi-urban areas. One notable example is the food processing industry in rural Madhya Pradesh, where local MSMEs have added value to agricultural products like wheat, rice, and pulses, which are then processed into packaged goods for retail. In 2022-23, around 60% of MSMEs were located in rural and semi-urban areas, contributing significantly to local economies by creating jobs and improving livelihoods in regions that otherwise have limited industrial activity.

-

- Fostering Innovation and Supporting Traditional Sectors:

-

-

- MSMEs are at the forefront of driving innovation in traditional industries, providing solutions that enable them to modernize and compete in global markets. For instance, the handloom and textile MSMEs in Odisha have embraced digital tools to market traditional weaves like Ikat on e-commerce platforms. This has opened global markets for these crafts, resulting in a significant boost in revenue. MSMEs in this space have increased exports by up to 25% in the last 5 years, bringing traditional art forms into modern-day commerce.

- Similarly, in furniture manufacturing, MSMEs in regions like Jaipur and Chennai have adopted computer-aided design (CAD) technology, improving production accuracy and design innovation, making Indian products more competitive in international markets.

-

- Contributing to Sustainability and Green Economy Initiatives:

-

-

- MSMEs are increasingly contributing to sustainable economic practices and the green economy. In Gujarat, MSMEs in the renewable energy sector are part of the growing solar power industry, contributing to India’s goal of achieving 500 GW of non-fossil fuel capacity by 2030. MSMEs here have significantly lowered production costs, making solar energy more accessible for small businesses and households in rural areas.

- According to a report by Frost & Sullivan, the green technology sector in India, largely driven by MSMEs, is expected to reach a market size of ₹1.25 lakh crore by 2025, further illustrating the sector’s role in promoting sustainability.

-

- Enhancing Local Manufacturing Capabilities and Reducing Import Dependency:

-

- The government’s Make in India initiative, aimed at transforming India into a global manufacturing hub, has seen MSMEs become key players in producing goods that were traditionally imported. This is particularly evident in the electronics and auto parts sectors. For example, MSMEs in Tamil Nadu and Karnataka have been instrumental in developing the auto parts supply chain, producing components like engines, electrical systems, and batteries for Indian automobile giants such as Tata Motors and Mahindra & Mahindra. This has helped reduce India’s reliance on foreign imports, improving the country’s trade balance.

- According to the Ministry of Commerce and Industry, MSMEs accounted for 45% of the total domestic manufacturing output in 2023, a vital contribution to India’s efforts to reduce its trade deficit and bolster local industries.

Key Government Initiatives for MSMEs

- PM Vishwakarma:

-

-

- The PM Vishwakarma scheme was launched to enhance the quality and market reach of products and services offered by artisans and craftspeople.

- Introduced in the 2023-24 Budget, it was officially launched on September 17, 2023.

- The scheme is fully funded by the Government of India with an initial allocation of ₹13,000 crores for the period 2023-24 to 2027-28.

- Since its inception, over 2.65 crore applications have been submitted, with 27.13 lakh applications successfully registered.

- Registered applicants undergo a five-day Basic Training program, and those opting for financial support receive collateral-free credit, facilitating business expansion.

-

- Udyam Registration Portal:

-

-

- Launched on July 1, 2020, the Udyam Registration Portal simplifies enterprise registration in India.

- The process is free, paperless, and self-declaratory, eliminating the need for document uploads.

- To integrate informal micro-enterprises into the formal economy, the Udyam Assist Platform was introduced on November 11, 2023.

- This initiative provides benefits such as Priority Sector Lending, crucial for enterprise growth.

-

- Prime Minister’s Employment Generation Programme (PMEGP):

-

- PMEGP is a credit-linked subsidy scheme aimed at promoting employment through micro-enterprises in the non-farm sector.

- Beneficiaries receive Margin Money (Subsidy) when availing loans from banks to establish businesses.

- The maximum project cost allowed is ₹50 lakh for manufacturing and ₹20 lakh for the service sector.

- Subsidy rates under PMEGP:

- Special Categories (SC, ST, OBC, Minorities, Women, Ex-Servicemen, Transgenders, Differently-abled, NER, Aspirational Districts, Hill and Border areas):

- 25% subsidy in urban areas

- 35% subsidy in rural areas

- General Category:

- 15% subsidy in urban areas

- 25% subsidy in rural areas

- Scheme of Fund for Regeneration of Traditional Industries (SFURTI):

-

-

- SFURTI was launched in 2005-06 to organize traditional artisans into clusters for enhanced product development, diversification, and value addition.

- Since 2014-15, 513 clusters have been approved, with 376 clusters fully functional.

- A total grant of ₹1,336 crore has been extended to support these clusters.

- Sustainable employment opportunities have been generated for around 2,20,800 artisans in 376 functional clusters (as on 12 Dec 2024).

-

- Public Procurement Policy for Micro and Small Enterprises (MSEs):

-

- Introduced in 2012 by the Ministry of MSME, this policy mandates that 25% of annual procurement by Central Ministries, Departments, and CPSEs must be sourced from MSEs. Within this 25%:

- 4% is reserved for SC/ST-owned MSEs.

- 3% is reserved for women-owned MSEs.

- In 2023-24, Central Ministries, Departments, and CPSEs procured a total of ₹74,717 crore worth of goods and services from MSEs, which constituted 43.71% of their total procurement.

- This policy benefitted 2,58,413 MSEs, ensuring they had access to significant business opportunities and support through government procurement.

Challenges Faced by MSMEs

- Limited Access to Market Linkages and Distribution Networks: Despite their potential, many MSMEs struggle to access larger markets, both domestically and internationally. For example, in the textile industry in Tamil Nadu, MSMEs often have to rely on intermediaries for distribution, which reduces their profit margins and limits their control over sales channels. A report from the Textile Industry Development Council (TIDC) found that nearly 45% of MSMEs in this sector face difficulties in entering large retail chains or securing shelf space in domestic and international markets.

- Complex Registration Processes: The lengthy registration procedures and inefficient clearance systems delay the formalization of MSMEs. For example, in Uttar Pradesh, a SIDBI (Small Industries Development Bank of India) study revealed that around 30% of MSMEs experienced delays in the registration process due to the need for multiple approvals and lack of clarity in the documentation requirements. These delays can hinder access to important government schemes such as MUDRA loans and subsidies. As per SIDBI, formal registration under Udyam could reduce operating costs by 15-20% for MSMEs by improving access to institutional credit and government schemes.

- Inadequate Infrastructure Support: A significant barrier to the growth of MSMEs in India is the lack of adequate infrastructure, including logistics, transportation, power supply, and technological support. A report by the Federation of Indian Micro and Small Enterprises (FISME) noted that 60% of MSMEs in rural India experience power-related issues, leading to delays and increased operational costs. Similarly, logistics inefficiencies have a significant impact on MSMEs engaged in manufacturing. According to the India Brand Equity Foundation (IBEF), logistics costs in India account for about 13% of GDP, compared to a global average of 8-10%. This makes MSME products less competitive in both domestic and international markets.

- Lack of Awareness About Government Schemes: Many MSMEs lack knowledge about available schemes and face challenges in accessing them. An example is the PMEGP (Prime Minister’s Employment Generation Programme), which offers credit-linked subsidies to micro-enterprises. Despite its potential to support MSMEs, a report by the National Small Industries Corporation (NSIC) highlighted that 60% of MSMEs in rural areas are unaware of such schemes. Similarly, the GeM (Government e-Marketplace) initiative, which aims to provide MSMEs with access to government procurement opportunities, has been underutilized due to insufficient awareness among small businesses. As of 2023, only 20% of MSMEs had registered on the GeM platform, despite its vast potential.

- Financial Constraints: Limited access to finance, high-interest rates, and stringent collateral requirements make it difficult for MSMEs to scale up and modernize. For instance, National Institute for Micro, Small and Medium Enterprises (NI-MSME) reported that 70% of MSMEs do not have access to institutional credit and rely on informal lenders, leading to high-interest burdens. MSMEs typically face interest rates that can be up to 3-4% higher than large enterprises due to their perceived higher risk.

- Rising Competition from Larger Enterprises: The growing presence of large corporations and global players in various industries has put increasing pressure on MSMEs, which find it challenging to compete on pricing, technology, and brand recognition. For instance, MSMEs in the electronics sector, such as those in Noida, are facing tough competition from multinational companies that can manufacture products at lower costs due to bulk production. According to a 2022 report by the National Association of Software and Service Companies (NASSCOM), 50% of MSMEs in the Indian electronics sector reported a reduction in their market share due to aggressive competition from both domestic giants and global players like Samsung and LG.

- Dependence on Traditional Markets: Many MSMEs in India still operate in traditional markets that limit their growth potential. For instance, MSMEs in the handicraft sector in Kashmir have relied heavily on traditional markets for their sales. However, limited exposure to e-commerce platforms and modern retail networks has hindered their ability to expand. Kashmir Handicraft Development Corporation (KHDC) reported that 40% of small handicraft businesses faced challenges in marketing their products outside of traditional markets. Without the adoption of digital tools, these MSMEs struggle to scale and compete in a broader marketplace.

- Export-Related Challenges: Poor infrastructure and difficulties in meeting international standards like ESG criteria hinder MSMEs’ global competitiveness. In Maharashtra, for example, MSMEs in the handicraft sector have struggled to meet ESG standards, despite their potential in global markets. A report by India’s Ministry of Commerce stated that only 30% of MSMEs in India are involved in export activities, and 30% of those exports face delays or rejections due to non-compliance with international standards.

- Labour Shortages and Skill Gaps: A shortage of skilled labor and inefficient training centers affects the productivity and competitiveness of MSMEs. For example, in the auto manufacturing sector in Gurugram, MSMEs have struggled to find trained technicians and engineers, with only 50% of the workforce possessing the necessary skills. The National Skill Development Corporation (NSDC) has been working to bridge this gap through initiatives like the Skill India program, but the training offered is often not aligned with the specific needs of MSMEs. The National Sample Survey Office (NSSO) highlighted that 40% of MSMEs in the manufacturing sector have reported difficulties in finding skilled labor, which hampers productivity and reduces their ability to scale operations.

Way Forward for MSMEs

- Strengthening Credit Access & Financial Support:

- Expanding access to collateral-free lending and enhancing financial literacy will improve MSMEs’ access to credit. The MUDRA and SIDBI programs should play a larger role in supporting MSMEs.

- Streamlining payment timelines through the MSME Samadhan portal will ensure timely payments from large corporations and government entities.

- Reducing Regulatory Bottlenecks:

- Implementing single-window clearance systems and simplifying GST registration will reduce the compliance burden on MSMEs.

- Establishing MSME facilitation councils at the state level will provide faster grievance resolution and improve policy implementation.

- Encouraging Digital & Technological Adoption:

- Promoting AI, IoT, and automation technologies will help MSMEs enhance their productivity. Programs like Digital MSME 2.0 can help MSMEs secure better cybersecurity and digital marketing capabilities.

- Workforce Development & Skilling:

- Ensuring fair wages and affordable labor insurance will improve worker welfare and productivity.

- Aligning skill development programs under Skill India with MSME needs will equip workers with relevant skills to enhance output.

- Infrastructure Development & Cluster-Based Growth:

- Strengthening MSME clusters and encouraging Public-Private Partnerships (PPPs) for the development of MSME parks will improve operational efficiencies and support growth.