Money Laundering in India Introduction

- A recent report submitted by the Finance Minister of India in the Rajya Sabha stated that 5,892 cases have been taken up by the Enforcement Directorate (ED) under the Prevention of Money Laundering Act (PMLA) 2002 since 2015. Of these cases, only 15 convictions have been ordered by special courts.

- It is claimed by the government that investigations have been initiated in almost all cases, and Enforcement Case Information Reports (ECIRs) have been issued to initiate proceedings.

- However, these figures raise two important aspects: first, that the number of convictions compared to the total cases is far from satisfactory, and secondly, that money laundering cases have been rising, indicating that financial crimes have not been effectively checked by the government.

What is Money Laundering?

- According to Section 3 of the Prevention of Money Laundering Act (PMLA), money laundering is the process through which the proceeds of criminal activities are concealed, acquired, or used in ways that project them as untainted, legitimate property. In essence, money laundering involves turning “dirty” money into “clean” money by disguising its illicit origins.

- The term “money laundering” is believed to have originated in the United States, where criminal syndicates used laundromats as a cover for their illegal activities, washing money in a literal and figurative sense to mask its criminal source.

- Money laundering primarily aims to make illicit money appear legitimate, allowing criminals to use it without arousing suspicion. It can take many forms, including through investments, real estate, or business operations.

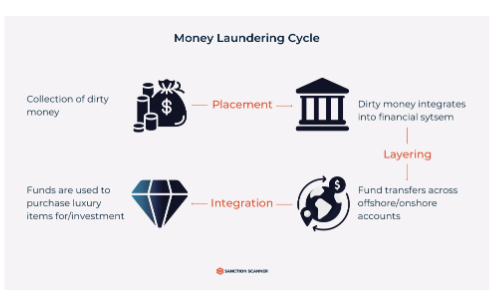

The Three Key Stages of Money Laundering

-

- Money laundering is typically carried out in three stages, each designed to distance the illicit funds from their criminal origins. These stages are placement, layering, and integration, each playing a critical role in the laundering process.

- Placement: Introducing ‘Dirty’ Money into the System: The first stage of money laundering is placement, where illicit funds (often in large, cash amounts) are introduced into the legitimate financial system. The goal of this stage is to move the money away from its direct criminal source and integrate it into a financial institution or legitimate business.

-

- Techniques Used in Placement:

- Smurfing: Breaking up large sums of money into smaller, less suspicious amounts to avoid detection.

- Bank Deposits: Depositing illicit money into banks or financial institutions.

- Currency Exchanges: Converting large amounts of cash into other currencies to disguise its origin.

- At this stage, the illicit money is still easily traceable, so criminals attempt to hide it by integrating it into the financial system through these methods.

- Techniques Used in Placement:

- Layering: Obscuring the Origins of Illicit Funds: Once the money has been placed in the financial system, the next stage is layering. This phase involves creating multiple layers of complex financial transactions to obscure the audit trail and make it extremely difficult for authorities to trace the funds back to their illicit origins.

-

- Techniques Used in Layering:

- Transfer of Funds: Moving money across various bank accounts, especially international accounts, to confuse the audit trail.

- Shell Companies and Offshore Accounts: Using fake companies or offshore banks to hide ownership and control of the money.

- Investing in Complex Financial Products: Purchasing high-value assets like stocks, bonds, or commodities to further distance the money from its criminal source.

- The goal of layering is to create a maze of financial transactions that are hard to trace back to their original, illegal source.

- Techniques Used in Layering:

- Integration: Making Illicit Funds Appear Legitimate: The final stage of money laundering is integration, where the “cleaned” money is reintroduced into the financial system in such a way that it appears legitimate. At this point, the laundered money is virtually indistinguishable from legal funds and can be used freely by the criminals who laundered it.

- Techniques Used in Integration:

- Real Estate Investment: Purchasing properties or land with illicit funds to create a legal appearance of wealth.

- Business Investments: Using the laundered money to invest in legitimate businesses or financial markets.

- Asset Formation: Converting funds into luxury goods, artworks, or other high-value items that can be sold or resold to appear legitimate.

- By the time the money reaches this stage, it has been fully integrated into the legal financial system, and authorities find it challenging to distinguish between legitimate funds and criminal proceeds.

Key Initiatives in India to Combat Money Laundering

- The Prevention of Money Laundering Act (PMLA), 2002: The Prevention of Money Laundering Act (PMLA), enacted in 2002, is the cornerstone of India’s anti-money laundering (AML) efforts.

-

- PMLA was introduced to prevent money laundering and provide for the confiscation of property derived from illegal activities. It covers crimes such as drug trafficking, terrorism financing, and smuggling, ensuring that illicit gains are not allowed to circulate in the economy.

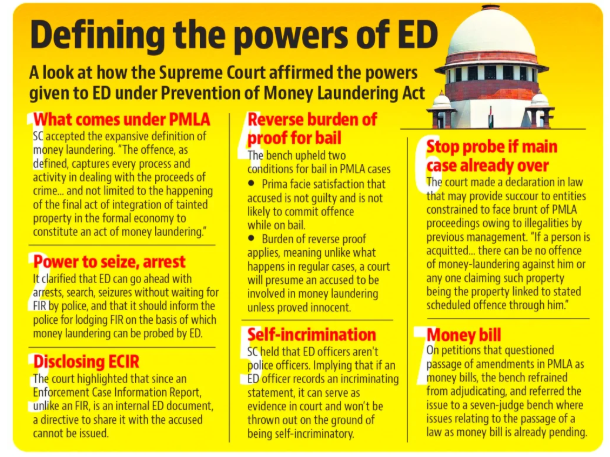

- Under the PMLA, an Enforcement Case Information Report (ECIR) is sufficient to initiate proceedings against money laundering activities, without the need for an FIR (First Information Report).

- As mandated by the Supreme Court, a scheduled offense must be involved for money laundering charges to apply. This law allows authorities to act swiftly in freezing and confiscating illicit assets.

- Financial Intelligence Unit – India (FIU-IND): Established in November 2004, the Financial Intelligence Unit – India (FIU-IND) plays a critical role in the fight against money laundering.

-

-

- It serves as the central agency responsible for receiving, analyzing, and disseminating information related to suspicious financial transactions. Key Functions of FIU-IND:

- Collection of Data: It receives reports like Cash Transaction Reports (CTRs), Suspicious Transaction Reports (STRs), and Cross Border Wire Transfer Reports (CBWTRs) from reporting entities such as banks and financial institutions.

- Analysis of Information: FIU-IND processes the collected data to identify patterns and trends indicative of money laundering and related criminal activities.

- Sharing Intelligence: The unit shares its findings with national agencies, such as the Enforcement Directorate (ED) and the Reserve Bank of India (RBI), as well as international financial intelligence units.

- Centralized Database: FIU-IND maintains a national database to track financial transactions and detect illicit flows.

-

- The Role of Enforcement Directorate (ED): The Enforcement Directorate (ED), a key agency under India’s Ministry of Finance, plays a vital role in investigating and prosecuting money laundering offenses. It enforces the provisions of the PMLA and is responsible for:

-

-

- Investigation of Financial Crimes: The ED traces assets derived from criminal activities and seeks to identify and seize property connected to illicit gains.

- Asset Attachment: The ED has the authority to provisionally attach assets involved in money laundering cases.

- Prosecution and Confiscation: The agency ensures the prosecution of offenders and works closely with Special Courts to confiscate the proceeds of crime.

- Enforcement of Other Acts: The ED also enforces the Foreign Exchange Management Act (FEMA) and the Fugitive Economic Offenders Act (FEOA), which overlap with money laundering activities.

-

- Regulatory Measures by Financial Authorities: Financial regulators like the Reserve Bank of India (RBI), Securities and Exchange Board of India (SEBI), and Insurance Regulatory and Development Authority of India (IRDAI) have introduced robust anti-money laundering (AML) guidelines for entities under their jurisdiction. These guidelines include:

-

-

- Know Your Customer (KYC) Norms: Mandatory KYC procedures help identify and verify the identity of clients, preventing the use of anonymous or fake identities for money laundering.

- Customer Due Diligence (CDD): Financial institutions are required to carry out enhanced due diligence, especially for high-risk customers.

- Ongoing Transaction Monitoring: Institutions are required to continuously monitor transactions for suspicious activity, which helps identify potential laundering cases early.

-

- International Cooperation: India’s efforts to combat money laundering are further strengthened through active international cooperation. The country is a member of the Financial Action Task Force (FATF), which sets global standards for combating money laundering, terrorist financing, and the proliferation of weapons of mass destruction.

-

- FATF Compliance: India became a member of FATF in 2010 and has implemented its 40 recommendations to build a strong AML/CFT framework.

- Mutual Legal Assistance Treaties (MLATs): India engages in international cooperation via MLATs, facilitating the exchange of information and assistance in investigations of money laundering cases across borders.

- Double Taxation Avoidance Agreements (DTAAs): India has signed DTAAs with over 85 countries, which enable the exchange of financial and tax-related information. These agreements help detect and prevent cross-border money laundering activities.

Concerns Regarding the Prevention of Money Laundering Act (PMLA)

- Dilution of Original Intent: One of the key concerns with the PMLA is the inclusion of minor and less serious offences in the schedule of offences. Over the years, the Act’s schedule has expanded to include offences that, while important, are not inherently connected to serious economic crimes. For example, copyright and trademark infringements are now included in the schedule, which critics argue dilutes the original intent of the law, which was designed to tackle high-profile crimes like drug trafficking, smuggling, and terrorism financing.

- Equal Punishment for Minor and Major Crimes: Another criticism of the PMLA is that it equates the punishment for minor and non-economic crimes with that of serious economic offences. For instance, under the PMLA, public servants charged with corruption can face the same stringent legal proceedings as hardcore criminals like drug traffickers. This raises concerns about fairness, as it treats less severe offences with the same level of rigor as high-stakes financial crimes, thereby questioning the proportionality of penalties.

- Vague Definition of ‘Proceeds of Crime’: The PMLA includes a broad and somewhat vague definition of “proceeds of crime,” which grants significant discretion to the authorities in determining what constitutes illicit wealth. This flexibility can lead to potential misuse, where investigating authorities may interpret the term too broadly, potentially targeting individuals or entities without substantial grounds. Critics argue that this could lead to unwarranted harassment or wrongful prosecution.

- Strict Bail Provisions: Under the PMLA, bail can only be granted when a judge is satisfied that the accused is innocent, which is in stark contrast to the Anglo-Saxon legal principle that a person is presumed innocent until proven guilty. This deviation from established jurisprudence has raised concerns about fairness and the right of accused persons to be treated fairly within the legal system.

- A Hindrance to Justice: The PMLA places the burden of proving innocence on the accused, which is a major concern for ensuring a fair trial. In most legal systems, the burden of proof lies with the prosecution, not the accused. By shifting this burden, the Act potentially violates the principles of natural justice and creates a challenge for individuals to defend themselves in court.

- Central Overreach in State Matters: One of the most significant concerns regarding the PMLA is its potential violation of the federal structure of India. Under the Act, the Enforcement Directorate (ED) can investigate and take action without the prior consent of the concerned state government. This provision bypasses the principle of federalism, as it allows a central agency to operate without state approval, unlike other central agencies like the Central Bureau of Investigation (CBI), which require state consent before initiating investigations.

- Legal and Constitutional Issues: Several provisions of the PMLA are seen as infringing upon the fundamental rights guaranteed under the Constitution of India. These include:

- Article 21 (Right to Life and Personal Liberty): The ED is not required to disclose the Enforcement Case Information Report (ECIR), which contains the allegations against the accused. This lack of transparency goes against the accused’s right to be informed of the charges against them.

- Article 14 (Right to Equality): The PMLA equates punishments for minor and serious economic offences, violating the right to equality under Article 14, as it treats offenders disproportionately.

- Article 20(3) (Right Against Self-Incrimination): The power granted to authorities to summon any person, including the accused, to provide evidence or produce documents during an investigation is seen as violating the right against self-incrimination.

- Risk of Misuse: The PMLA grants extensive powers to the Enforcement Directorate (ED), including the authority to issue summons, make arrests, and conduct raids. While these powers are necessary for investigating complex financial crimes, critics argue that such extensive authority could be misused. The Supreme Court has highlighted concerns about the misuse of these powers, particularly in politically motivated cases. Additionally, authorities can initiate property attachment proceedings without a pre-registered criminal case, further amplifying the potential for misuse.

- A Major Concern for Effectiveness: Despite the rigorous measures under the PMLA, the Act’s effectiveness has been called into question due to its low conviction rate. According to the Union Finance Minister’s report in the Rajya Sabha, since 2015, 5,892 cases were pursued under the PMLA, but only 15 convictions were ordered by special courts. This raises doubts about the Act’s ability to deliver justice and effectively prosecute money laundering cases.

Key Observations of the Supreme Court on the Prevention of Money Laundering Act (PMLA)

- Judicial Scrutiny and Constitutional Concerns One of the most contentious aspects of the PMLA has been its strict bail provisions. Under the Act, an accused can be denied bail unless the judge is satisfied that the accused is innocent. This provision has faced legal challenges on the grounds that it contradicts established principles of jurisprudence, which presume a person’s innocence until proven guilty.

-

-

- Nikesh Tarachand Shah vs Union of India (2018): In a landmark ruling, the Supreme Court declared that the strict bail conditions under the PMLA were unconstitutional. The Court held that these provisions violated Article 14 (Right to Equality) and Article 21 (Right to Life and Personal Liberty) of the Indian Constitution. The judgment emphasized the principle of “presumption of innocence,” which is central to criminal law.

- Restoration of Provisions by Parliament: Following the Court’s verdict, Parliament amended the PMLA and restored the strict bail provisions, albeit with certain modifications. This move sparked debates over the balance between the need for strong anti-money laundering laws and the protection of individual rights.

- Vijay Madanlal Choudhary vs Union of India (2022): The Supreme Court revisited the issue of bail provisions under the PMLA in this case and upheld their constitutionality. The Court ruled that the strict bail conditions were reasonable and aligned with the objectives of the PMLA. The Court emphasized that these provisions serve the larger public interest of preventing money laundering and maintaining the integrity of the financial system.

-

- Calls for Fairness and Transparency: The Enforcement Directorate (ED), empowered by the PMLA, plays a critical role in investigating and prosecuting money laundering cases. However, the ED has often been accused of overreach in its actions, including misuse of its powers and lack of transparency.

-

-

- Pankaj Bansal vs Union of India (2020): In this case, the Supreme Court raised concerns about the ED’s actions, particularly pointing out inconsistencies and a lack of transparency in its investigations. The Court emphasized the need for the ED to act with fairness and ensure that its powers are not misused for political or personal gain. The judgment called for greater accountability in the ED’s operations, urging the need for clearer guidelines on its conduct.

-

- Ensuring Adherence to Legal Standards: Another issue that has drawn judicial attention is the procedural violations committed by authorities while enforcing the PMLA. Critics argue that the ED and other agencies involved in the enforcement of the Act often overlook legal standards, which can lead to arbitrary actions and violations of the rights of the accused.

-

- Pavana Dibbur vs The Directorate of Enforcement (2023): In this case, the Supreme Court pointed out several procedural violations in the handling of cases under the PMLA. The Court observed that the ED and other authorities had failed to strictly adhere to the legal standards prescribed under the Act. The judgment called for a more rigorous approach to ensure that due process is followed and that the rights of individuals are protected during investigations. The Court also underscored the need for transparency in the handling of cases, urging authorities to avoid arbitrary decisions.

What is the Impact of Money Laundering?

- A Threat to Integrity and Stability: Money laundering can severely undermine the integrity and stability of financial systems. When illicit funds flow through legitimate financial institutions, they distort market functions, causing economic imbalances. This disruption can lead to systemic risks, where the market becomes susceptible to crashes or financial crises. It weakens the foundations of financial systems, leaving economies vulnerable to fluctuations and instability.

- Erosion of Government Resources: One of the most detrimental effects of money laundering is the loss of tax revenues. By hiding illicit income, individuals and businesses avoid paying taxes, which significantly reduces the government’s revenue base. This has serious consequences for public spending on essential services, such as healthcare, education, infrastructure development, and social welfare programs. The inability of the government to collect adequate taxes hinders national development and increases the fiscal deficit.

- Impact on Currency and Exchange Rates: The movement of large sums of illicit money in and out of the financial system can cause unpredictable fluctuations in money supply, currency values, and international capital flows. These erratic shifts in market dynamics can lead to instability in exchange rates and financial markets. Such volatility undermines the overall monetary stability of a country and makes it difficult for businesses to plan long-term investments, impacting economic growth.

- A Backbone for Organized Crime: Money laundering serves as a critical enabler for criminal enterprises. It allows the proceeds from activities like drug trafficking, human trafficking, arms dealing, and corruption to flow undetected, making them appear legitimate. This perpetuates organized crime, fosters violence, and contributes to a rise in social issues such as drug abuse and human rights violations. By sanitizing the profits of criminals, money laundering makes it easier for these organizations to thrive and expand their operations.

- A Breeding Ground for Inefficiency: Money laundering is often tied to widespread corruption within both public and private sectors. It can involve bribery, embezzlement, and manipulation of financial systems, eroding public trust in institutions and governance. Over time, this corruption weakens the rule of law, leading to inefficiency and ineffective governance. Citizens may feel disillusioned with the state’s ability to uphold justice, which creates instability and dissatisfaction in society.

- A Threat to National Security: In recent years, money laundering has increasingly been used to finance terrorism. Criminals and terrorist groups use illicit financial flows to fund attacks, recruit, and sustain operations. By masking the true source of these funds, they can evade detection and carry out their plans with impunity. The use of laundered money for terrorism poses a significant threat to national and global security, making it imperative for governments to take strong action against such practices.

Way Forward

- A Step Towards Fairness: One of the primary concerns with the PMLA is the vague definition of ‘proceeds of crime,’ which leaves room for potential abuse. To mitigate this, the law must incorporate a precise and clear definition of what constitutes illicit funds. This will ensure that authorities do not exploit the term to target individuals or entities unjustly. A clearer definition would also provide greater legal certainty and reduce the risk of arbitrary prosecution.

- Rebalancing the Burden of Proof: Currently, the PMLA places the burden of proof on the accused, which contradicts the legal principle that a person is presumed innocent until proven guilty. This shift in the burden of proof is a significant concern and needs to be reformed. Reassessing the burden of proof and making it more equitable between the prosecution and the accused would ensure that individuals are not wrongfully convicted without adequate evidence. Such a change would uphold the principles of natural justice and fairness in the judicial process.

- Establishing Safeguards to Prevent ED Overreach: While the Enforcement Directorate (ED) is responsible for investigating financial crimes, there are growing concerns about overreach and the misuse of its powers. To address this, an independent oversight mechanism should be established to review and monitor the actions of law enforcement agencies like the ED. This body should ensure that the ED operates within the bounds of the law and does not act arbitrarily or for politically motivated reasons. This will not only help maintain public trust but also ensure the accountability of the investigating agencies.

- Protecting Fundamental Rights: One of the most controversial provisions of the PMLA is its strict bail conditions. These conditions, particularly for minor or non-serious economic offences, have been criticized for violating the constitutional right of individuals to be presumed innocent until proven guilty. Reviewing and revising these bail conditions, especially for lesser crimes, is essential. Bail should be granted based on reasonable grounds and should not be denied solely because of the seriousness of the offence or the accused’s potential flight risk.

- Streamlining Legal Frameworks: The effectiveness of the PMLA can be enhanced by ensuring better harmonization between it and other relevant laws, such as the FEMA (Foreign Exchange Management Act), Income Tax Act, Black Money Act, and the Fugitive Economic Offenders Act. This will create a more cohesive and integrated legal framework for tackling financial crime. Streamlining the interaction between these laws will reduce redundancies, avoid legal loopholes, and ensure a more efficient process for addressing money laundering and related offences.

- Strengthening Capacity Building of Enforcement Agencies: Given the complexity of modern money laundering activities, there is a pressing need to build the capacity of enforcement agencies. The following steps can help improve the effectiveness of agencies such as the Enforcement Directorate (ED), Financial Intelligence Unit (FIU-IND), and the CBI:

-

-

- Specialized Training: Investigators, prosecutors, and forensic auditors should receive advanced training in financial forensics, cyber forensics, blockchain analysis, and international legal cooperation. This would enable them to handle the increasing complexity of financial crimes.

- Adequate Staffing: It is essential to ensure that agencies are adequately staffed to handle the growing volume of money laundering cases. Increased staffing will help streamline investigations and ensure that no case is neglected due to resource constraints.

- Technological Upgradation: Agencies must be equipped with cutting-edge technology such as artificial intelligence (AI), data analytics, and cyber intelligence tools to trace complex financial transactions and cross-border money flows. This technological advancement would greatly enhance the investigative capabilities of these agencies.

-

- Promoting Enhanced Independence and Transparency of the Enforcement Directorate: To prevent the politicization of the Enforcement Directorate (ED), it is crucial to enhance its independence and transparency. Regular reporting, case disclosures, and public updates on convictions will ensure that the ED operates transparently and does not misuse its powers. Accountability measures should be put in place to prevent any undue influence from external factors and maintain the integrity of the institution.

- Ensuring AML Compliance: Financial regulators like the Reserve Bank of India (RBI), Securities and Exchange Board of India (SEBI), and Insurance Regulatory and Development Authority of India (IRDAI) play a crucial role in enforcing anti-money laundering (AML) and combating the financing of terrorism (CFT) measures. These regulators should be empowered to impose stricter penalties and conduct more frequent audits of reporting entities. Increased regulatory oversight will ensure better compliance with AML and CFT guidelines, making it more difficult for illegal money to flow through the financial system.

- A Modern Approach to Financial Crime Detection: Technology is becoming increasingly important in detecting and preventing money laundering. The following measures can enhance the role of technology in combating financial crimes:

-

- Advanced Analytics and AI: Financial institutions should be encouraged to use artificial intelligence and machine learning to monitor real-time transactions, profile customers’ risk levels, and detect unusual financial patterns that may indicate money laundering.

- Blockchain Forensics: With the growing use of cryptocurrencies and blockchain networks, developing expertise and forensic tools to trace illicit transactions on blockchain platforms is crucial. This would help authorities tackle new-age money laundering activities that take place in decentralized systems.

- Data Standardization and Sharing: Promoting standardization of financial data across various entities will facilitate easier data analysis and sharing among regulatory bodies. This would enhance the efficiency of investigations while respecting data privacy regulations.