India Health Insurance Approach Introduction

- India’s health insurance landscape has expanded dramatically over the past decade, with schemes such as Pradhan Mantri Jan Arogya Yojana (PMJAY) and various State Health Insurance Programs (SHIPs) providing millions with coverage.

- While this growth signals a step toward universal healthcare, structural and operational flaws continue to undermine the potential benefits. Simply expanding coverage does not guarantee improved access, affordability, or equity in healthcare delivery.

Universal Health Care and State-Sponsored Health Insurance in India

- Universal health care (UHC) is a global benchmark for equitable health systems, ensuring that every individual has access to quality medical services, irrespective of financial capacity. In India, the Bhore Committee report of 1946 laid down this vision, emphasizing accessible healthcare for all citizens:

- Healthcare as a right: Every member of the community should have access to quality care, irrespective of their ability to pay.

- Comprehensive services: Beyond hospitalization, the focus should include preventive, promotive, and primary care, emphasizing long-term population health.

- Equity and fairness: Publicly funded healthcare must prioritize marginalized and vulnerable groups, ensuring no one is excluded due to financial or social barriers.

State-Sponsored Health Insurance in India

- Pradhan Mantri Jan Arogya Yojana (PMJAY):

-

-

- Launched in 2018 under Ayushman Bharat, PMJAY is the largest health insurance scheme in India, designed to provide financial protection for hospitalization.

- It covers up to ₹5 lakh per household annually, focusing on secondary and tertiary care.

- In FY 2023-24, PMJAY covered 58.8 crore individuals, with an annual budget allocation of around ₹12,000 crore.

-

- State Health Insurance Programs (SHIPs):

-

- Each major state operates its own SHIP, often modeled after PMJAY, ensuring regional adaptations in coverage and administration.

- SHIPs are crucial in supplementing PMJAY, with a combined budget of at least ₹16,000 crore in FY 2023-24.

- Together, PMJAY and SHIPs form the primary safety net for low-income households, aiming to reduce out-of-pocket medical expenses.

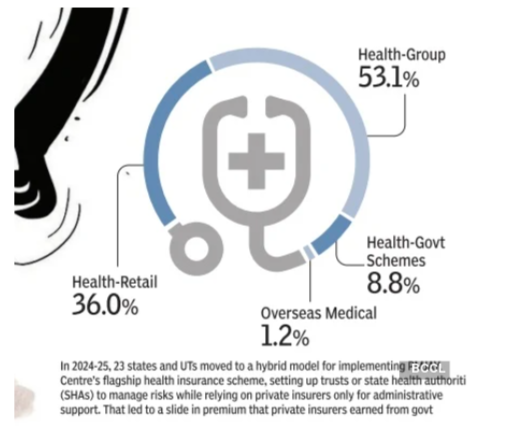

Profit Orientation in Public Health Investment

-

- A significant portion of India’s health insurance expenditure benefits profit-driven private hospitals rather than strengthening public healthcare infrastructure.

- In 2023–24, PMJAY provided coverage to approximately 58.8 crore individuals with an annual budget of around ₹12,000 crore, with States contributing roughly 40% as mandated.

- Combined with SHIPs, which covered a similar number of beneficiaries, the total budget allocation exceeded ₹16,000 crore.

- Despite this massive outlay, public hospitals remain underfunded and overburdened, leaving the system skewed toward private profit rather than equitable health access.

- Low Utilization of Insurance Benefits:

-

-

- Despite widespread coverage, a large percentage of insured patients cannot fully use their benefits.

- According to 2022–23 survey data, only 35% of insured hospital patients were able to utilize their insurance effectively.

- This gap reflects administrative challenges, awareness deficits, and complex claim procedures, limiting the practical impact of insurance coverage.

-

- Discrimination in Healthcare Access:

-

-

- Insurance-driven dynamics have introduced biases in patient selection, affecting equitable access.

- Private hospitals tend to prefer uninsured patients who can pay higher fees, while public hospitals prioritize insured patients to secure reimbursements.

- This selective treatment undermines the equity goals of public insurance schemes and perpetuates systemic disparities.

-

- Delays in Payments and Financial Instability:

-

-

- Timely reimbursements remain a critical challenge, jeopardizing hospital participation.

- Pending dues under PMJAY reached a staggering ₹12,161 crore, exceeding the scheme’s entire annual budget.

- These delays have caused several hospitals to withdraw from the program, reducing access to covered populations and straining the delivery system.

-

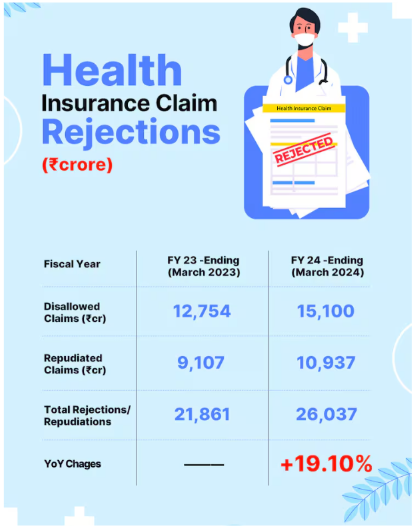

- Corruption and Fraudulent Practices:

-

-

- Insurance expansion has also opened avenues for fraud and financial misconduct.

- The National Health Authority (NHA) recommended action against 3,200 hospitals for fraudulent activities, including unnecessary procedures and billing irregularities.

- These malpractices erode trust in government programs and siphon resources away from genuine patients.

-

- Persistent Out-of-Pocket Expenditure:

-

- Despite the apparent rise in coverage, households continue to bear substantial healthcare costs.

- Evidence shows no significant reduction in direct medical spending for families, highlighting that insurance expansion alone does not alleviate financial burden.

- The current model does not address hidden costs, such as transportation, diagnostics, and medications, which remain a major barrier for lower-income populations.

India’s Public Health Spending in Global Perspective

-

- India’s government health expenditure is significantly below global averages, reflecting a chronic underinvestment in the sector:

- In 2022, public health expenditure stood at only 1.3% of GDP, compared to a world average of 6.1%, leaving India with one of the lowest government health budgets among major economies.

- Several countries demonstrate that universal coverage is achievable through integrated approaches:

- Canada: Provides single-payer, publicly funded healthcare with a strong non-profit hospital system. Patients access services without direct charges at the point of care.

- Thailand: Achieved UHC via social health insurance, combining universal coverage with government-regulated providers, focusing on non-profit and community health facilities. India can adapt these models to balance insurance with strong public provision and regulation of private providers.

- Despite ambitious insurance schemes, public funding remains limited, restricting the expansion of critical services like primary healthcare, preventive care, and rural health infrastructure.

- Budgetary Scale of Health Insurance Programs:

-

-

- Even combined budgets for national and state health schemes remain relatively small in the context of total public health spending:

- The combined annual allocation for PMJAY and SHIPs is approximately ₹28,000 crore, a substantial figure in absolute terms, but modest relative to the healthcare needs of over 1.4 billion citizens.

-

- Coverage vs. Actual Utilization: The Illusion of Reach:

-

-

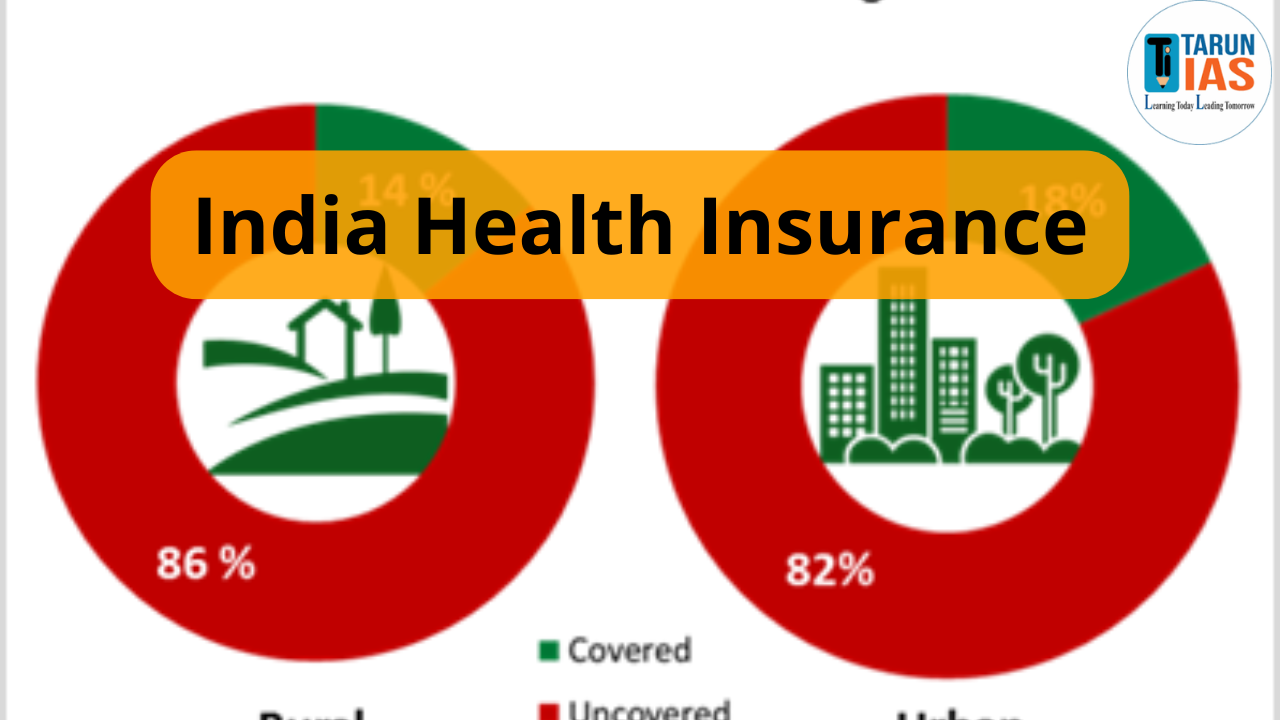

- Official statistics often paint a rosy picture of population coverage, masking the realities on the ground:

- Government claims suggest 80% of the population is insured, yet actual utilization remains far lower due to administrative hurdles, lack of awareness, and delayed reimbursements.

- The discrepancy between coverage and real-world access underscores the fundamental limitations of insurance-driven healthcare in India.

-

- Rapid Growth of State Health Insurance Programs:

-

-

- Programs in Karnataka, Maharashtra, and Gujarat have witnessed annual growth rates of 8–25% in real terms between 2018–19 and 2023–24.

- This growth reflects increasing government commitment and rising public awareness, but sustainability remains contingent on timely funding and efficient administration.

-

- Hospitals Exiting Schemes:

-

- Financial constraints and reimbursement delays have led to private and public hospitals withdrawing from insurance programs, threatening access:

- Since the inception of PMJAY, 609 hospitals have opted out due to unpaid claims and low reimbursement rates.

- Hospital withdrawals reduce available capacity for insured patients, highlighting the importance of adequate financing and timely payments to maintain program credibility.

Way Forward

- Strengthen Primary Care: Expand and modernize sub-centers, PHCs, and community health clinics.

- Invest in Public Infrastructure: Allocate sustained funding for modernization and capacity building of public hospitals and health facilities.

- Integrate Health Insurance with Care Systems: Align insurance schemes with actual service delivery, ensuring access and quality.

- Regulate Private Providers: Enforce strict oversight on pricing, billing, and quality, limiting exploitation and ensuring equitable treatment.

- Adopt Global Best Practices: Combine social insurance, universal coverage, and non-profit delivery models tailored to India’s context.

- Empower Health Workforce: Train doctors, nurses, and allied health professionals, incentivize rural deployment, and improve working conditions.