Income-Tax Bill, 2025 Introduction

- On February 13, 2025, the Income-tax Bill, 2025 was introduced in the Lok Sabha, signaling a major shift in India’s direct tax system.

- The Bill aims to replace the outdated Income-tax Act, 1961, which has become a complicated framework after decades of amendments.

- By introducing clearer language, streamlining provisions, and incorporating modern tax practices, the Bill aims to create a more transparent, efficient, and taxpayer-friendly system. Once approved by Parliament, it is set to take effect on April 1, 2026—ushering in a new era for India’s tax landscape.

Current Status of the Income-tax Act, 1961

- The Income-tax Act, 1961 has undergone numerous amendments over the years, resulting in a highly complex and burdensome framework.

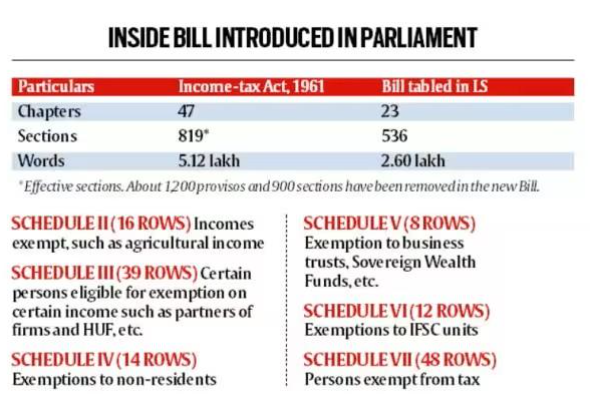

- The Act now consists of 823 pages, with 47 chapters, 298 sections, and over 1,200 provisos. These provisions, though introduced to address emerging needs, have only contributed to confusion due to their ambiguous language and numerous cross-references.

- For example, the existing system’s reliance on the concepts of “previous year” and “assessment year” has caused considerable confusion. Taxpayers need to track two separate periods, adding complexity to tax filings and compliance. These complexities have contributed to the rising number of tax disputes and lengthy litigation processes.

Key Features of Income-tax Bill, 2025

- The Income-tax Bill, 2025 proposes sweeping changes that aim to simplify the existing framework and align it with modern economic realities.

-

- Introduction of “Tax Year”: A notable change in the New Bill is introduction of the term ‘tax year’ as unit period of taxation which runs from April 1 to March 31, thus replacing dual confusing references of ‘previous year’ and ‘assessment year’. The proposed change is aligned with the global best practices and is anticipated to streamline timelines for tax filings, tax payments and other tax compliance or procedural requirements. For new businesses or professions, the tax year will begin on the date of establishment and run through the end of the fiscal year.

- For instance, if a salary is earned during the Financial Year 2024-25, the corresponding Assessment Year is considered to be 2025-26. When a tax return is filed, it is submitted for Assessment Year 2025-26, and all related forms and notices are issued accordingly.

- Similarly, if a notice is received for a default in Assessment Year 2022-23, it actually pertains to income earned in the Financial Year 2021-22. This discrepancy often leads to confusion among taxpayers regarding the applicable years.

- To simplify this, the new Income Tax Code has replaced the term ‘Assessment Year’ with a single ‘tax year,’ which is now aligned with the ‘Financial Year.’ Under this system, the ‘tax year’ is the same as the year in which the income is earned, and taxation is applied accordingly.

- Introduction of “Tax Year”: A notable change in the New Bill is introduction of the term ‘tax year’ as unit period of taxation which runs from April 1 to March 31, thus replacing dual confusing references of ‘previous year’ and ‘assessment year’. The proposed change is aligned with the global best practices and is anticipated to streamline timelines for tax filings, tax payments and other tax compliance or procedural requirements. For new businesses or professions, the tax year will begin on the date of establishment and run through the end of the fiscal year.

- Removal of Obsolete Provisions: The new Income Tax Bill has proposed to remove more than 300 obsolete and redundant laws. Some of the examples are Section 80CCA (deduction for investment in National Saving Scheme), Section 80CCF (deduction for investment in long-term infrastructure bond), etc.

- Streamlined Deductions and Exemptions: The Bill introduces clarity around various deductions and exemptions, such as for rent paid, insurance premiums, provident fund contributions, and home loans. Several outdated exemptions, such as those for capital gains under Section 54E (for assets transferred before 1992), have been removed, making the system more relevant and efficient.

- Simplified Structure: The Bill is significantly shorter, now spanning just 622 pages, a 24% reduction from the previous Act. The number of chapters is reduced to 23, while the sections are streamlined to 536. By eliminating over 1,200 provisos and 900 explanations, the Bill offers a more concise and understandable framework. Additionally, it includes 57 illustrative tables, a substantial increase from the original 18, making it easier for taxpayers to navigate.

- Inclusion of Virtual Digital Assets: With the rise of digital currencies and blockchain technology, the Bill recognizes cryptocurrencies and other virtual digital assets as capital assets and property. This marks a significant step in aligning the tax framework with the growing digital economy, providing clarity for investors and businesses in this sector.

- Digital Monitoring and Compliance: The Bill also empowers the Central Board of Direct Taxes (CBDT) to implement digital monitoring systems for more effective tax enforcement. With the inclusion of the virtual digital space (which includes social media accounts, email servers, and cloud storage), tax authorities will be able to access crucial data during tax surveys and investigations, improving compliance rates and reducing evasion.

- Enhanced Dispute Resolution Mechanism: The Bill introduces reforms to the Dispute Resolution Panel (DRP). Clearer points of determination, decisions, and reasons for those decisions are now part of the framework, which aims to reduce the ambiguity that often leads to disputes and delays.

- Streamlined provisions for TDS and TCS: TDS and TCS provisions have been made easier to comprehend for taxpayers by providing tables. Separate tables have been introduced in the New Bill in respect of payments to residents and non-residents, and where no deduction at source is required.

What is the Status of the New Bill?

- Parliamentary Review: The Income-tax Bill, 2025 was presented in the Lok Sabha on February 13, 2025 and is now undergoing a review by a Parliamentary Committee. This review ensures that the Bill is both comprehensive and in line with the needs of the public and businesses.

- Public Consultation: The Bill reflects the input of over 6,500 suggestions received from stakeholders, including taxpayers, businesses, and tax professionals. This feedback-driven process helps ensure that the Bill addresses the concerns of all parties involved.

- Interim Budget 2024: The Bill follows the Interim Budget 2024 announcement, where Finance Minister Nirmala Sitharaman highlighted the need for a comprehensive review of the Income-tax Act, 1961 to make it more relevant for modern needs.

Importance of Income-tax Bill, 2025

- Reduced Litigation: The elimination of ambiguities and the introduction of clearer provisions are expected to significantly reduce tax disputes and the need for lengthy litigation, allowing for quicker and more efficient tax resolution.

- Modernization of the Tax System: By introducing provisions for digital assets and digital monitoring systems, the Bill modernizes India’s tax framework, bringing it in line with the current economic environment. This will help India’s transition to a $5 trillion economy and bolster its position in the global economic landscape.

- Simplified Language: By using clear language and tabular formats, the Bill makes the tax system more accessible. This will help taxpayers better understand their rights, obligations, and the tax laws that apply to them.

- Taxpayer-Friendly: The Bill’s focus on user-friendly formats for deductions, exemptions, and tax rates is aimed at making the system more transparent and easier to navigate. This user-centric approach is a shift towards greater trust between the government and taxpayers.

What will be Impact of the Income-tax Bill, 2025?

- The Bill is expected to bring about several important changes:

- Improved Tax Administration: Clearer provisions and reduced ambiguity will help streamline tax administration, improving the efficiency of tax revenue collection and allowing authorities to focus on enforcement rather than disputes.

- Increased Trust in the Tax System: With a focus on “trust first, scrutinize later”, the Bill aims to create a positive relationship between taxpayers and the government. This will likely encourage greater compliance and reduce evasion.

- Support for Digital Economy: With the inclusion of virtual digital assets in the tax framework, the Bill provides clarity for cryptocurrency investors and traders, ensuring the growth of the digital economy.

- Ease of Doing Business: By simplifying the tax system and reducing compliance burdens, the Bill is expected to improve India’s position in the Ease of Doing Business Index. This will benefit businesses, especially MSMEs, which will now face clearer tax provisions and reduced litigation.

- Boost to Economic Growth: The modernized tax framework will make India an attractive destination for both domestic and foreign investments, which is crucial for the country’s ambition to become a $5 trillion economy. The simpler tax structure will also improve the overall business climate.

Challenges of the Income-tax Bill, 2025

- Digital Infrastructure Gaps: While the Bill emphasizes digital monitoring, areas with limited digital infrastructure, especially in rural and remote regions, may face challenges in adapting to the new system.

- Potential for New Disputes: While the Bill aims to reduce litigation, new concepts like the “tax year” and the treatment of virtual digital assets may lead to interpretational issues in the initial years.

- Resistance to Change: Some stakeholders, especially those accustomed to the existing system, may resist the changes. Continuous engagement and communication will be key to addressing these concerns.

- Implementation: Transitioning to the new system will require significant effort in terms of administration and taxpayer education. Tax authorities will need training, and taxpayers will need guidance on the new framework.

Way Forward

- Stakeholder Engagement: Ongoing engagement with taxpayers, businesses, and tax professionals is crucial to address concerns and ensure a smooth implementation of the new framework.

- Capacity Building: Training tax officials and improving digital infrastructure will be essential for effective implementation and monitoring of the new system.

- Periodic Review: The government should periodically assess the impact of the Bill and make necessary adjustments to address emerging challenges.

- Global Best Practices: India should collaborate with international organizations like the OECD to learn from global best practices in tax administration, ensuring that the new system remains competitive and aligned with international standards.