GST Reforms in India 2025 Introduction

- India is poised to witness transformative changes in its taxation landscape in 2025, setting the stage for a new era of economic growth and fiscal transparency.

- The government, under the leadership of Prime Minister Narendra Modi, has announced significant reforms in both direct and indirect taxation, making this year a milestone in the country’s economic history.

What is GST?

-

- GST is an indirect, destination-based tax levied on the supply of goods and services. It operates on the principle of value addition, meaning tax is collected at every stage of the supply chain—from manufacturing to final consumption—while allowing businesses to claim the Input Tax Credit (ITC) for taxes paid on inputs.

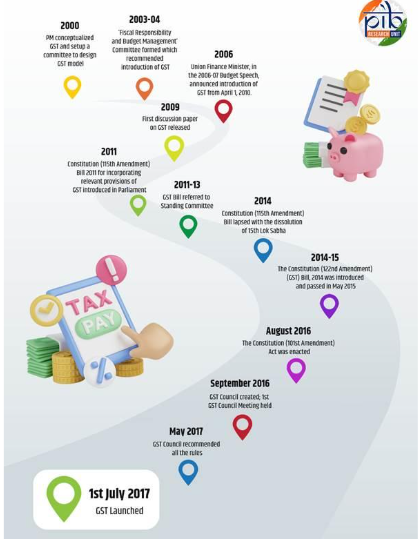

- History and Implementation:

-

- Launch Date: GST was implemented on July 1, 2017.

- Objective: To simplify India’s tax system, eliminate cascading taxes, and promote ease of doing business.

- Unified Market: By harmonizing taxes across states and the center, GST helps integrate the Indian economy and facilitates smoother trade.

- GST Rate Structure: India currently has five main GST slabs:

-

-

- 0% – Essential goods

- 5% – Necessities and essential commodities

- 12% – Standard goods and services

- 18% – Majority of goods and services

- 28% – Luxury, sin, and demerit goods

- Rate Rationalization Proposal (2021): A Group of Ministers (GoM) suggested a simplified structure with two main slabs—5% and 18%, while sin and demerit goods would attract a 40% rate. This aims to make compliance easier and reduce tax disputes.

-

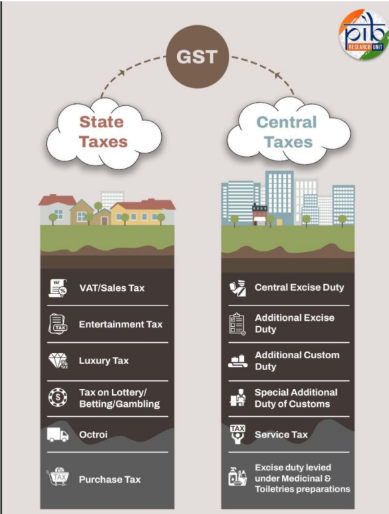

- India’s Dual GST Model: India follows a dual GST framework, ensuring a balance between the Central and State governments:

-

-

- CGST (Central GST): Levied by the central government on intra-state transactions.

- SGST (State GST): Levied by state governments on intra-state transactions.

- IGST (Integrated GST): Applied on inter-state or international trade, collected by the central government and shared with states.

-

- Key Features of GST:

-

- One Nation, One Tax: GST brought together a wide range of indirect taxes under one umbrella. It replaced levies like excise duty, service tax, VAT and others. This helped remove the cascading effect of taxes.

- Destination-Based Tax: GST is charged at the point of consumption rather than origin. This ensures a smooth flow of tax credit across the supply chain and lowers the overall tax burden on the final consumer.

- Multi-Stage Taxation: Tax is applied at every stage of production and distribution.

- Input Tax Credit Mechanism: Businesses can reduce tax liability by claiming credit for taxes already paid on inputs.

- Simplified Compliance: The dual GST system and uniform rates aim to reduce administrative burdens.

- Threshold Exemption: Small businesses with turnover below a certain limit are exempt from GST. This makes compliance easier and protects micro enterprises from excessive paperwork.

- Sector-Specific Exemptions: Sectors such as healthcare and education are either exempt or taxed at lower rates. This keeps essential services within reach for all.

What is GST Council?

- The GST Council:

-

-

- Constituted under Article 279A after the 122nd Constitutional Amendment (2016).

- Received Presidential assent: 8 September 2016.

-

- Members:

-

- Union Finance Minister (Chairperson).

- Union MoS for Revenue/Finance.

- Finance/Taxation Ministers of all States.

- Special nominee in case of President’s Rule under Article 356.

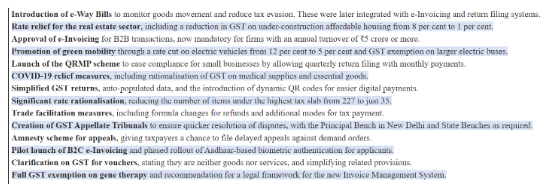

- Some notable decisions by GST Council:

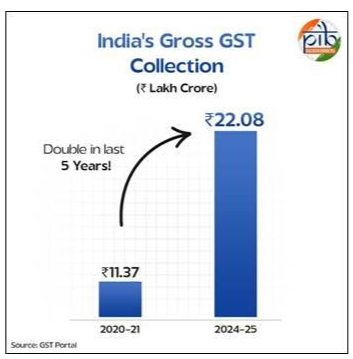

Benefits of GST

- For MSMEs:

- Raised exemption threshold from ₹20 lakh to ₹40 lakh for goods, easing compliance.

- Composition scheme for goods (up to ₹1.5 crore turnover) and services (up to ₹50 lakh) with simplified returns.

- Quarterly returns allowed for small taxpayers with turnover up to ₹5 crore.

- Facility to file NIL returns for GSTR-3B, GSTR-1, and CMP-08 via SMS.

- Access to credit via Trade Receivables Discounting System (TReDS) with 4 digital platforms, 5,000+ buyers, 53 banks and 13 NBFCs participating.

- Service providers with turnover up to ₹50 lakh can opt for 6% flat tax with quarterly payments and annual return filing.

- For Consumers:

- Lower average tax burden due to removal of multiple levies.

- Expansion of tax base from 60 lakh to 1.51 crore taxpayers.

- Essential goods like cereals, edible oils, sugar, snacks, and sweets taxed at lower rates.

- Finance Ministry study shows households save around 4% of monthly expenses under GST.

- For Logistics Sector:

- Abolition of state border check posts reduced truck queues and corruption points.

- Transport time cut by more than 33%, lowering fuel and operational costs.

- Businesses no longer need separate warehouses in every state; centralised and efficient supply chains developed.

- Highways decongested; goods move faster across India.

Problems in GST Regime in India

- Multiple Tax Slabs Create Complexity:

-

-

- India’s GST features multiple rate slabs—0%, 5%, 12%, 18%, and 28%—along with special rates for certain goods and services.

- Issue: Businesses often struggle to classify products and services accurately, leading to confusion and errors.

- Impact: The complexity increases compliance costs and exposes companies to penalties for incorrect filings.

-

- Heavy Compliance Burden:

-

-

- GST requires extensive documentation, including monthly, quarterly, and annual returns, e-invoicing, and reconciliation of Input Tax Credits (ITC).

- Issue: Small and medium-sized enterprises (SMEs) with limited resources find it challenging to meet all digital filing requirements.

- Impact: Operational costs rise as businesses need professional assistance, increasing the overall financial and administrative burden.

-

- Key Sectors Remain Outside GST:

-

-

- Certain sectors such as petroleum, real estate, and alcohol are excluded from GST.

- Issue: The exclusion creates a cascading effect, where tax is levied multiple times across the supply chain.

- Impact: Potential efficiency and uniformity of the GST system are compromised.

-

- Centre vs. State Coordination Challenges:

-

-

- India’s GST operates under a dual model, requiring close coordination between the Centre and States.

- Political and Policy Differences: Conflicting priorities delay decision-making and policy implementation.

- Revenue Concerns: Limited fiscal autonomy for states, coupled with the end of compensation for revenue losses after the initial five years, has caused financial strain and tension among some states.

-

- Tax Evasion and Fraud: Despite a digital-first framework, GST faces challenges from tax evasion and fraudulent practices, including:

-

-

- Fake invoices

- Misuse of e-way bills

- Impact: These practices lead to substantial revenue losses and undermine the credibility of the GST system.

-

- Technological and Digital Barriers

-

- The GST system relies heavily on GST Network (GSTN) and digital infrastructure.

- Issue: Small and rural businesses often lack IT infrastructure, digital literacy, and access to affordable accounting software.

- Impact: Many face difficulty complying with online filing requirements, creating a barrier to smooth implementation.

Rationalizing of GST Tax Slabs in India

- Simplification and Ease of Compliance:

-

-

- The current GST framework has five main slabs (0%, 5%, 12%, 18%, 28%), along with special rates for certain goods.

- Businesses face confusion over product classification. For instance, a food item may attract 5% tax if “unbranded” but 12% or 18% if “branded” or processed.

- Reducing slabs minimizes ambiguity, lowers litigation risk, and simplifies compliance for both taxpayers and authorities.

-

- Enhanced Administrative Efficiency:

-

-

- A simplified GST structure helps streamline filing, invoicing, and Input Tax Credit (ITC) reconciliation, particularly for MSMEs.

-

- Reduction in Tax Burden:

-

-

- Rationalizing slabs into a two-tier system—for example, a “standard” rate and a “merit” rate—can ease the financial load on consumers.

- Example: Shifting 99% of items in the 12% slab to 5%, and 90% of items in the 28% slab to 18% could make everyday goods more affordable.

- Simplification reduces administrative costs, enhances transparency, and makes the system business-friendly.

-

- Curbing Tax Evasion:

-

-

- A complex, multi-slab system encourages Input Tax Credit (ITC) fraud and evasion.

- Lowering the number of slabs, with most items taxed at a modest 5%, diminishes incentives for fraudulent practices.

- Revenue compliance improves, and government collections become more predictable.

-

- Alignment with Global Practices:

-

-

- Successful GST systems worldwide typically operate with 1–3 tax rates, facilitating easier auditing and monitoring.

- Rationalized rates make tax administration efficient and reduce the need for frequent clarifications or disputes.

-

- Boosting Consumption and Economic Growth:

-

- Simplifying GST and reducing tax rates on commonly used goods can enhance disposable income for consumers.

- Increased affordability stimulates consumption, drives demand, and encourages broader economic activity, supporting India’s growth trajectory.

Obstacles in Rationalizing GST Tax Slabs in India

- Risk of Revenue Loss:

-

-

- One of the most significant challenges is the potential short-term revenue impact. Rationalization would shift many goods from higher to lower tax brackets. While this can increase consumption, it may reduce government revenue initially.

- Example: Two years ago, the RBI estimated India’s average GST rate at 11.6%. Moving to a two-slab structure could substantially lower this rate, impacting both the central and state finances.

-

- Achieving Political Consensus:

-

-

- GST decisions are made by the GST Council, where states hold a two-thirds voting share. Convincing all states to agree to a plan that may affect their fiscal health is difficult.

- The end of the GST compensation cess has made states more cautious about reforms that could reduce revenue. Achieving political alignment is thus a key hurdle.

-

- Classification and Fitment Issues:

-

-

- Even with fewer slabs, disputes over product classification are inevitable. Deciding whether a good or service belongs to the “merit” (lower) or “standard” (higher) slab can trigger legal battles.

- Misclassification risks non-compliance, litigation, and administrative complexity, partially defeating the purpose of rationalization.

-

- Implementation and Technical Hurdles:

-

-

- Rationalizing slabs requires a major overhaul of the GST infrastructure. The GST Network (GSTN) and millions of business systems are configured for the current tax structure. Companies will need to update accounting software, pricing, and invoicing systems.

- Reconfiguring the GSTN is time-consuming and expensive, potentially causing initial disruption and compliance challenges, especially for SMEs.

-

- Inclusion of Petroleum Products:

-

- Rationalization could delay the inclusion of petroleum products, which remain outside GST.

- Petroleum is a major revenue source for states, and any reduction in overall rates reduces the fiscal space for extending GST coverage.

- Including petroleum under GST while rationalizing slabs would require careful revenue-neutral solutions, which remain politically and economically challenging.

Way Forward

- Managing Revenue Concerns:

-

-

- Revenue loss is a key worry, particularly for states. A rationalization plan must balance rate reductions with increased consumption and improved compliance.

- By lowering taxes on commonly used items, especially those in the 12% and 28% slabs, goods become more affordable. Higher demand can offset short-term revenue losses, potentially leading to increased overall tax collection in the medium to long term.

-

- Correcting the Inverted Duty Structure:

-

-

- Rationalization offers a chance to align input and output tax rates, addressing the inverted duty problem.

- In many sectors, the tax on inputs exceeds that on final products, creating accumulated Input Tax Credit (ITC).

- Realigning rates ensures smoother cash flow for businesses and reduces credit pile-ups, supporting industry liquidity.

-

- Leveraging Technology for Efficiency:

-

-

- Technological improvements can simplify compliance and help mitigate potential revenue shortfalls.

- Enhanced GSTN infrastructure, automated invoicing, and e-way bill systems can improve tax tracking and minimize leakage.

- Technology ensures a seamless transition for businesses while strengthening government revenue monitoring.

-

- Ensuring Transparency and Clarity:

-

- Clear communication of GST changes is essential to build business confidence and long-term planning.

- Announce the new slab structure, timelines, and implications for both businesses and consumers.

- Transparent policies reduce confusion, legal disputes, and administrative bottlenecks, promoting smoother implementation.