Economic Survey 2025 Introduction

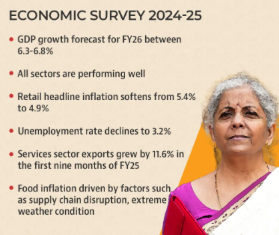

- Union Finance Minister Nirmala Sitharaman recently presented the Economic Survey in Parliament providing a detailed analysis of the Indian economy while focusing on certain key macroeconomic sectors.

- According to the survey, India’s FY26 GDP growth is expected to be in the range of 6.3-6.8 % amid global uncertainty.

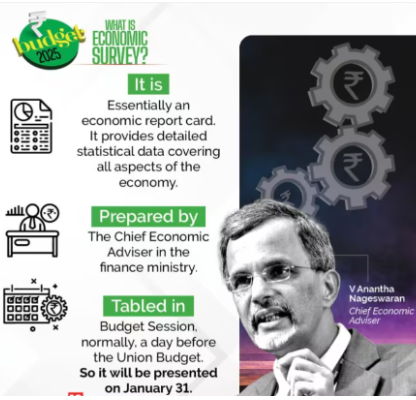

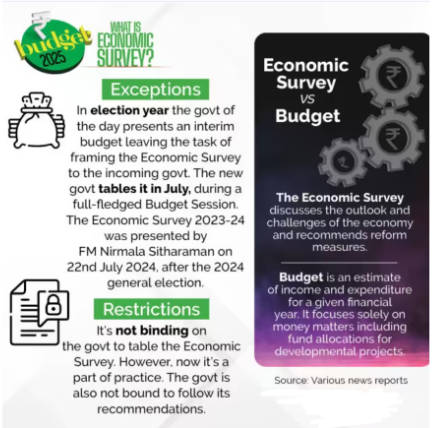

- The Economic Survey comes a day ahead of the presentation of Union Budget 2025.

What is Economic Survey?

- The Economic Survey is a document which provides a summary of the Indian economy’s performance, government policies, and outlook for the upcoming financial year.

- It is divided into two parts:

- Part A analyses economic performance, reflecting on macroeconomic indicators and fiscal trends

- Part B addresses socio-economic issues such as education, poverty, climate change, and the outlook for GDP growth, inflation, and trade.

Who prepares the Economic Survey?

- The Economic Survey is prepared by the economic division of the Department of Economic Affairs headed by the Chief Economic Advisor (CEA), V Anantha Nageswaran.

Key Highlights of the Economic Survey 2024-25

- State of the Economy: Returning to High Growth Trajectory:

- GDP Growth Outlook:

- Real GDP and Gross Value Added (GVA) for FY25 are projected to grow at 6.4%, which is consistent with the decadal growth average.

- For FY26, GDP growth is anticipated to range between 6.3% and 6.8%, factoring in potential economic risks and emerging opportunities.

- Global and Domestic Challenges:

- The global economy expanded by 3.3% in 2023, with the International Monetary Fund (IMF) forecasting an average growth of 3.2% over the next five years.

- Ongoing geopolitical tensions, international conflicts, and trade-related risks continue to pose challenges to global economic stability.

- Inflation and Investment Trends:

- Retail inflation eased from 5.4% in FY24 to 4.9% during April–December 2024, indicating improved price stability.

- Capital expenditure (CAPEX) demonstrated steady growth from FY21 to FY24, with an 8.2% year-on-year increase observed between July and November 2024, following the general elections.

- Trade and Global Competitiveness:

- India secured the 7th position globally in services exports, reflecting robust sectoral performance.

- Exports excluding petroleum products, gems, and jewellery grew by 9.1% during April–December 2024, underscoring India’s resilience in the face of global economic fluctuations.

- Monetary and Financial Sector: Ensuring Stability and Fostering Growth:

-

- Stock Markets and Capital Mobilization:

- Indian stock markets demonstrated strong performance, outperforming other emerging markets despite volatility surrounding the general elections.

- Capital mobilization in the primary market reached ₹11.1 lakh crore between April and December 2024, marking a 5% increase compared to FY24.

- The Bombay Stock Exchange (BSE) market capitalization-to-GDP ratio stood at 136%, surpassing that of major economies like China (65%) and Brazil (37%).

- Banking Sector Performance:

- Credit growth remained stable, maintaining alignment with the pace of deposit growth.

- Gross Non-Performing Assets (GNPAs) declined to a 12-year low of 2.6%, indicating healthier asset quality and stronger capital reserves within the banking sector.

- The Credit-to-GDP gap narrowed to (-) 0.3% in the first quarter of FY25, suggesting that credit expansion is occurring sustainably.

- A total of ₹3.6 lakh crore was recovered under the Insolvency and Bankruptcy Code through 1,068 successful resolution cases as of September 2024.

- Growth in Insurance and Pension Sectors:

- Insurance premiums recorded a growth of 7.7% in FY24, amounting to ₹11.2 lakh crore.

- The number of pension subscribers rose by 16% year-on-year as of September 2024, indicating increased participation in retirement savings schemes.

- Stock Markets and Capital Mobilization:

- External Sector: Demonstrating Growth:

-

- Foreign Exchange Reserves: India’s foreign exchange reserves were recorded at USD 640.3 billion as of December 2024, providing a comfortable import cover of 10.9 months.

- External Debt Status: The external debt remained stable, with the debt-to-GDP ratio at 19.4% as of September 2024, reflecting a sustainable external debt position.

- Global Market Position: India secured the 2nd position globally in exports of ‘Telecommunications, Computer, and Information Services,’ commanding a 10.2% share of the global market.

- Current Account Dynamics: The Current Account Deficit (CAD) stood at 1.2% of GDP in the second quarter of FY25, supported by robust growth in net services exports and private transfer inflows.

- Export Performance:

- Merchandise exports registered a year-on-year (YoY) growth of 6% in FY25, reflecting strong performance despite global economic headwinds.

- Services exports surged by 11.6% during the same period, highlighting India’s competitiveness in the global services market.

- Foreign Direct Investment (FDI): FDI inflows witnessed a substantial increase of 17.9% YoY, reaching USD 55.6 billion between April and November FY25, indicating strong investor confidence.

- Prices and Inflation: Trends of Moderation

-

- Inflation Projections: Both the Reserve Bank of India (RBI) and IMF project that inflation will converge towards the 4% target by FY26, driven by prudent monetary and fiscal policies.

- Domestic Inflation Scenario: India’s retail inflation eased from 5.4% in FY24 to 4.9% during the period from April to December 2024, indicating improved price stability.

- Global Inflation Trends: Global inflation showed a downward trend, declining from 8.7% in 2022 to 5.7% in 2024, as per International Monetary Fund (IMF) data.

- Long-term Price Stability Measures: The promotion of climate-resilient crops and the adoption of improved agricultural practices are identified as key strategies to ensure long-term stability in food prices.

- Medium-Term Outlook: Driving Growth Through Deregulation

-

- Importance of Deregulation: Systematic deregulation is identified as a critical driver to enhance domestic economic growth and promote greater economic freedom.

- Global Economic Challenges: Key challenges include GEF, China’s dominance in manufacturing, and dependencies related to the global energy transition.

- Focus on Ease of Doing Business: The ‘Ease of Doing Business 2.0’ initiative, along with support for the Small and Medium Enterprises (SME) sector modeled on the German ‘Mittelstand,’ is vital for sustaining growth.

- Shift in Global Economic Landscape: The global economy is witnessing a shift from globalization to Geo-Economic Fragmentation (GEF), leading to new economic realignments.

- Role of States in Economic Reforms: State governments are encouraged to liberalize regulatory frameworks, establish robust legal safeguards, and implement risk-based policies to foster growth.

- Growth Target for Viksit Bharat 2047: India requires an annual GDP growth rate of approximately 8% to fulfill the vision of becoming a developed nation by 2047.

- Investment and Infrastructure: Foundations for Sustained Growth:

-

- Railway Infrastructure: A total of 2,031 kilometers of railway lines were commissioned, and 17 new Vande Bharat trains were introduced to enhance rail connectivity.

- Road Development: Construction of 5,853 kilometers of National Highways was completed between April and December of FY25, supporting improved road infrastructure.

- Public Infrastructure Investments: Capital expenditure on public infrastructure recorded a growth of 38.8% between FY20 and FY24, indicating strong government focus on development.

- Industrial Growth: Under the National Industrial Corridor Development Program, 383 industrial plots covering 3,788 acres were allocated to boost industrial expansion.

- Rural Electrification: Electrification efforts reached 18,374 villages, bringing electricity to 2.9 crore households, promoting rural development.

- Digital Connectivity: Nationwide rollout of 5G technology was achieved, while 4G services were expanded to 10,700 remote villages, bridging the digital divide.

- Water and Sanitation Initiatives: Piped water connections were provided to 12 crore families, and 3.64 lakh villages were declared Open Defecation Free (ODF) Plus.

- Urban Housing Development: Under the Pradhan Mantri Awas Yojana (PMAY), 89 lakh houses were completed, contributing to urban housing goals.

- Mass Transit Expansion: Metro rail and rapid transit systems were operationalized in 29 cities, covering over 1,000 kilometers to improve urban mobility.

- Real Estate Regulation: The Real Estate (Regulation and Development) Act (RERA) enhanced transparency, with 1.38 lakh real estate projects registered under its framework.

- India’s Space Vision for 2047: The country has 56 active space assets, with significant projects like Gaganyaan and Chandrayaan-4 contributing to India’s ambitious space agenda.

- Private Sector’s Role in Infrastructure: Initiatives like the National Infrastructure Pipeline (NIP) and the National Monetisation Pipeline (NMP) were launched to attract private sector investments and strengthen infrastructure development.

- Port Efficiency: Container turnaround time at ports was significantly reduced from 48.1 hours to 30.4 hours, improving operational efficiency.

- Renewable Energy Expansion: Renewable energy capacity grew by 15.8% year-on-year, with renewables now contributing 47% of India’s total installed power capacity.

- Industry: Driving Business Reforms

-

- Industrial Growth Outlook: The industrial sector is expected to grow by 6.2% in FY25, driven primarily by electricity and construction sectors.

- Smart Manufacturing and Industry 4.0 Initiatives: The government is promoting smart manufacturing through the establishment of SAMARTH Udyog centers to facilitate the adoption of Industry 4.0 technologies.

- Automobile Sales Performance: Domestic automobile sales experienced a significant growth of 12.5% in FY24, reflecting a strong recovery in the sector.

- Electronics Production: Electronics production grew at a compound annual growth rate (CAGR) of 17.5% from FY15 to FY24, with 99% of smartphones being produced domestically, showcasing India’s self-reliance in the sector.

- Pharmaceutical Sector Growth: The pharmaceutical industry achieved a turnover of ₹4.17 lakh crore in FY24, growing at an average annual rate of 10.1% over the last five years.

- Patent Filings: India ranks 6th globally in patent filings, according to the WIPO Report 2022, demonstrating its growing innovation capacity.

- MSME Sector Developments: The MSME sector continues to thrive, with the launch of the Self-Reliant India Fund with a ₹50,000 crore corpus to further support the sector’s growth.

- Cluster Development: The Micro and Small Enterprises-Cluster Development Programme was initiated to encourage growth and collaboration among MSMEs across the country.

- Services: Overcoming New Challenges:

-

- Global Services Exports Performance: India accounted for 4.3% of global services exports in 2023, ranking 7th worldwide and reinforcing the country’s competitive edge in the global services market.

- Service Sector’s Contribution to GVA: The service sector’s share of Gross Value Added (GVA) increased from 50.6% in FY14 to 55.3% in FY25, reflecting its growing dominance in the economy.

- Service Sector Growth Rate: The services sector grew at 8% pre-pandemic and has continued its momentum with a growth rate of 8.3% from FY23 to FY25, signaling robust recovery and expansion.

- Growth in Services Exports: Services exports surged by 12.8% during April to November of FY25, highlighting India’s strength in the global services trade.

- Information Services Growth: The information services sector grew at 12.8% over the past decade, increasing its share of GVA from 6.3% to 10.9%, underlining the sector’s significant contribution to the economy.

- Indian Railways Performance: Indian Railways saw an 8% increase in passenger traffic in FY24, with freight revenue also growing by 5.2%, reflecting the strong performance of the sector.

- Tourism Sector Recovery: Tourism contributed 5% to India’s GDP in FY23, showing a recovery to pre-pandemic levels as the sector regained its momentum.

- Agriculture and Food Management: A Sector of Growth:

- Growth Drivers: Key growth drivers in agriculture include high-value sectors such as horticulture, livestock, and fisheries, which continue to expand and strengthen the sector.

- Kharif Food Grain Production: Kharif food grain production is expected to reach 1647.05 LMT in 2024, marking an increase of 89.37 LMT compared to the previous year.

- Contribution to GDP: Agriculture and allied activities contributed 16% to India’s GDP in FY24, underscoring the sector’s vital role in the economy.

- MSP Increases: The Minimum Support Price (MSP) for Arhar and Bajra has been raised by 59% and 77%, respectively, in FY24-25, supporting farmers and encouraging production.

- Sector Growth: The fisheries sector has grown at a compound annual growth rate (CAGR) of 8.7%, while the livestock sector grew at 8% CAGR, demonstrating robust development in these areas.

- Food Security Programs: The Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY) and the National Food Security Act (NFSA) represent a significant shift in India’s food security approach. Free food grains under PMGKAY have been extended for five more years.

- Farmer Support Programs: A total of 11 crore farmers have benefited under the PM-KISAN scheme, and 23.61 lakh farmers have enrolled in PM Kisan Mandhan, providing essential financial support to the agricultural community.

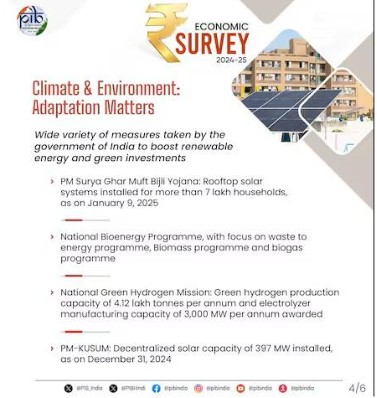

- Climate & Environment: A Focus on Adaptation:

-

- Non-Fossil Fuel Capacity: As of November 2024, 46.8% of India’s electricity generation is sourced from non-fossil fuels, with a total installed capacity of 213,701 MW, contributing to India’s transition to cleaner energy.

- Carbon Sink Creation: India has successfully created an additional 2.29 billion tonnes of CO2 equivalent carbon sinks between 2005 and 2024, supporting global efforts to combat climate change.

- Lifestyle for Environment (LiFE) Movement: India is leading the LiFE initiative, promoting sustainable lifestyles and environmentally conscious behaviors to address climate challenges.

- Global Impact of LiFE: By 2030, the LiFE initiative could save approximately USD 440 billion globally by reducing consumption and lowering prices through more sustainable practices.

- Sustainable Development Vision: India is working towards achieving developed nation status by 2047, focusing on inclusive growth and sustainable development to ensure long-term prosperity.

- Social Sector: Expanding Reach and Promoting Empowerment:

-

- Declining Inequality: The Gini coefficient, which measures income inequality, has decreased in both rural (0.237 in FY24) and urban areas (0.284 in FY24), signaling progress in reducing economic disparities.

- Government Health Expenditure: The share of government spending on health has risen from 29% to 48%, leading to a reduction in out-of-pocket health expenditure from 62.6% to 39.4%, easing financial burdens on households.

- Impact of Ayushman Bharat: Through the Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (PM-JAY) scheme, over ₹1.25 lakh crore in savings has been generated, significantly alleviating the financial strain on households.

- Expenditure Growth in Social Services: The expenditure on social services by both the Centre and States has grown at a 15% CAGR from FY21 to FY25, reflecting a strong commitment to social welfare.

- Localization of SDGs: The strategy to localize Sustainable Development Goals (SDGs) aligns Gram Panchayat budgets with these global goals, ensuring grassroots-level contributions to sustainable development.

- Employment and Skill Development: Core Focus Areas:

-

- Youthful Demographics: With 26% of India’s population aged between 10-24 years, the country is one of the youngest nations in the world, offering a significant demographic advantage.

- Support for Women’s Entrepreneurship: Various government initiatives have been launched to assist women entrepreneurs by providing access to credit, skill development, marketing support, and startup resources.

- Decline in Unemployment : Unemployment in India has decreased to 3.2% in 2023-24 (July-June), down from 6.0% in 2017-18 (July-June), reflecting improvements in employment generation.

- Job Creation in Key Sectors: Sectors such as the digital economy and renewable energy are pivotal for generating jobs, aligning with the country’s vision of becoming a developed nation (Viksit Bharat).

- Building a Skilled Workforce: The government is focusing on developing a skilled workforce to adapt to global trends, including automation, AI, digitalization, and climate change, ensuring India remains competitive.

- PM-Internship Scheme: The PM-Internship Scheme is acting as a catalyst for employment generation, offering opportunities to gain practical experience in various sectors.

- Growth in Formal Employment: Payroll additions under the Employees’ Provident Fund Organization (EPFO) have more than doubled in the past six years, signaling significant growth in formal employment.

- Labour in the AI Era:

- AI Revolution: Artificial Intelligence (AI) has the potential to automate valuable tasks and outperform humans in critical decision-making across various sectors, including healthcare, research, education, and finance.

- Barriers to AI Adoption: Several challenges, such as reliability issues, resource inefficiencies, and infrastructure deficits, are hindering widespread AI adoption, allowing policymakers the necessary time to address these concerns.

- India’s Advantage: Since AI is still in its early stages, India has the opportunity to build strong foundations for AI integration, leveraging its young, tech-savvy population to boost workforce productivity through AI implementation.

- Augmented Intelligence: The future lies in the synergy between human intelligence and machine capabilities, which can enhance human potential and improve job efficiency, fostering more productive work environments.

- Collaborative Effort: A collaborative approach between governments, the private sector, and academia is essential to mitigate the societal impacts of AI-driven transformation and ensure a smooth transition into the AI era.