Rare Earth Elements Introduction

- China has raised fresh concerns in key U.S. industries by tightening control over rare earth exports.

- The new rules, which require export licenses for important rare earth metals and magnets, are affecting sectors like defense and electric vehicles. This move could also slow down America’s long-term goals in manufacturing and technology.

What Are Rare Earth Elements (REEs)?

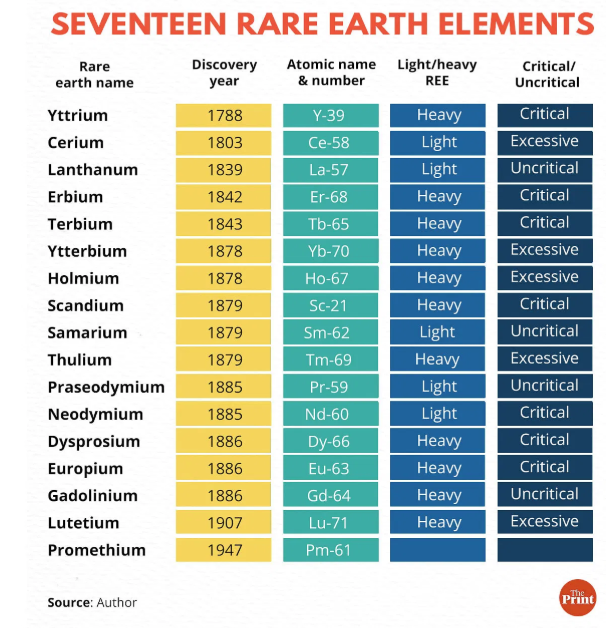

- Definition: Rare Earth Elements (REEs) are a collection of 17 chemically similar metallic elements in the periodic table. These elements comprise 15 lanthanides (including lanthanum, cerium, neodymium, dysprosium, europium, and others) along with scandium and yttrium.

- Misleading Terminology: Despite their name, REEs are not particularly rare in nature. They are found in abundance in the Earth’s crust but are scattered in low concentrations, which makes extraction challenging and expensive.

- Key Characteristics of REEs:

- High density

- High melting points

- Excellent conductivity

- Superior thermal conductance

- REEs are classified into Heavy REEs and Light REEs based on atomic weights and other physical properties.

- Sources: REEs are found in mineral oxide ores. The key sources of REEs include:

- Bastnaesite: A key source for light REEs like cerium and lanthanum.

- Xenotime: Commonly found in mineral sand deposits, contains mostly heavy REEs.

- Loparite: Found in alkaline igneous rocks.

- Monazite: A rich source of both light and heavy REEs.

Uses of Rare Earth Elements Across Sectors

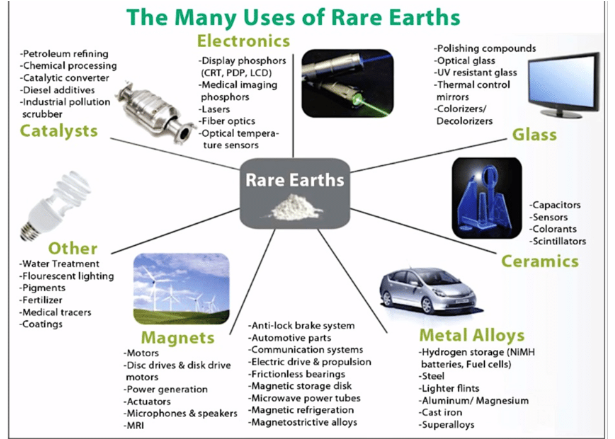

- Though REEs are used in small quantities, they are indispensable for many modern technologies and industrial applications. Here are some of the key uses:

- Aerospace & Defence:

- REEs are crucial for advanced military and aerospace technologies, such as precision-guided munitions, stealth helicopters, and high-power sonar systems used in ships and submarines.

- Healthcare:

- Medical Imaging: REEs, such as gadolinium, are essential in MRI machines and modern surgical equipment, improving diagnostic and treatment capabilities.

- Clean Energy:

- REEs like neodymium are key components of permanent magnets used in wind turbines and electric vehicle (EV) motors.

- Energy-efficient Lighting: Europium and other REEs are used in the production of LEDs and CFLs, contributing to energy savings and sustainability.

- Nuclear Energy:

- Control Rods: REEs are used in nuclear reactors to regulate nuclear reactions. They play a crucial role in the safe operation of nuclear power plants.

- Electronics:

- REEs are utilized as phosphors in cathode ray tubes, fluorescent lamps, and X-ray intensifying screens.

- Oil Refining and Manufacturing:

- REEs enhance the refining process of crude oil into gasoline and are used in specialty metal alloys for various industrial applications.

- Consumer Electronics:

- Elements like europium and samarium are essential for high-definition television screens and LED bulbs.

Current Reserves of Rare Earth Elements

- National Reserves (India):

-

- India’s Dependence on Imports: India is nearly 100% dependent on imports for most rare earths. Despite this, India possesses the 5th largest reserves of rare earths globally, making it an important player in the global supply chain.

- Minerals Found in India:

- Ilmenite, Sillimanite, Garnet, Zircon, Monazite, and Rutile are found in significant quantities.

- Monazite, the principal source of rare earths in India, is mostly found in states like Odisha, Andhra Pradesh, Tamil Nadu, Kerala, West Bengal, and Jharkhand.

- Monazite Reserves: According to the India Minerals Yearbook (2019), India holds around 12.47 million tonnes of Monazite resources. However, due to its classification as an atomic mineral, its extraction and processing are subject to stringent regulations.

- International Reserves:

-

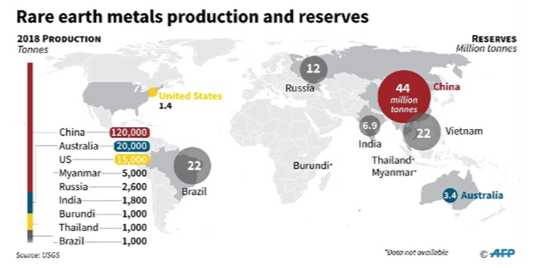

- Global Reserves: The total global reserves of REEs are estimated at 120 million tonnes of Rare Earth Oxides (REO). China dominates global reserves with approximately 44 million tonnes.

- Major Producers: China remains the leading producer of REEs, contributing around 99% of the global supply of heavy rare earth metals. Other major producers include Vietnam, Russia, and Australia.

- Intermediate Processing: REEs undergo significant refining in countries like China, Japan, and Germany, with much of the raw material refined in these regions.

Strategic Significance of Rare Earth Elements

- Multiple Uses Across Sectors: REEs are used in critical sectors such as electric vehicles (EVs), medical devices, and LEDs. The demand for these materials is expected to rise as the world transitions to clean energy and high-tech innovations. For instance, neodymium is essential for permanent magnets in EVs and wind turbines, with demand expected to rise significantly by 2025.

- Rising Demand in Emerging Technologies: The demand for neodymium alone in India is set to increase by 6-7 times by 2025 and 18-20 times by 2030 due to the rise in electric vehicle manufacturing and wind turbine installations. The growth of renewable energy and high-tech sectors is driving global demand, making the availability of REEs increasingly critical for economic growth.

- Reducing India’s Import Bill: Currently, India is highly dependent on imports for most rare earth elements, creating significant pressure on foreign exchange reserves. The rising global prices, such as the increase in neodymium prices from under US$100 per kg in 2018 to over US$200 per kg today, further stress India’s import bill. Reducing this import dependency by ramping up domestic production could ease foreign exchange pressure and reduce cost volatility in key sectors.

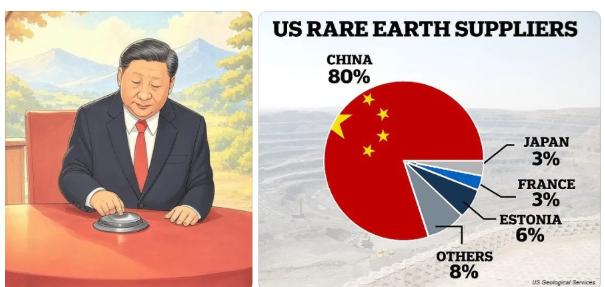

- China’s Dominance and Global Risks: China controls a disproportionate share of the global supply chain for REEs, producing 90% of rare earth magnets and 99% of heavy rare earth metals. This concentration of supply raises strategic concerns, as geopolitical tensions could disrupt access to these critical materials. In 2010, China’s suspension of rare earth exports to Japan following a territorial dispute over the Senkaku Islands exemplifies the geopolitical risks posed by China’s dominance in the REE market.

- India’s Potential as a Supplier: India, with its significant reserves, has the potential to emerge as a major supplier of rare earths not just for domestic needs but for international markets as well. India is in a strong position to capitalize on the geopolitical tensions involving China, as Russia’s current conflict reduces its role as a major producer of rare earths. Given the high geopolitical risks associated with China’s dominance, India’s role in the global supply chain of REEs could be pivotal in the coming years.

Current Challenges Hindering India’s Rare Earth Production

- India, despite possessing the 5th largest reserves of rare earth elements globally, faces several challenges that have limited its production capacity:

- Geographic Distribution and Commercial Viability: Rare earth materials are not concentrated enough in many regions, making their extraction expensive. The cost of commercial production remains high due to this limited concentration.

- Atomic Mineral Classification: REEs are classified as atomic minerals, which restricts mining to public sector enterprises like Indian Rare Earths Ltd (IREL) and Kerala Minerals and Metals Ltd (KMML). These companies have limited capacity and technological resources to meet demand.

- Limited Focus and Incentives: IREL’s primary source of revenue comes from beach sand minerals rather than rare earths, reducing the incentive to develop advanced extraction and processing capabilities for rare earths. This limits India to being a low-cost exporter of rare earth oxides, rather than moving into higher-value products.

- Fragmented R&D Ecosystem: The rare earth sector in India lacks integration with other R&D ecosystems, such as electronics or metallurgy. Government agencies like DAE and BARC dominate research, while private sector involvement and academic participation are minimal, hindering innovation and growth.

- Ban on Beach Sand Mining: In 2016, India banned beach sand mining in an effort to conserve strategic minerals, including rare earths and thorium. This has reduced the potential for increased rare earth production.

Way Forward

- India can take several steps to enhance its rare earth production and reduce dependence on imports. These measures would also help in achieving the vision of Atmanirbhar Bharat.

- Declassify REEs from Atomic Minerals: The Ministry of Mines has proposed moving rare earth elements outside the scope of atomic minerals, allowing private players and other public sector undertakings (PSUs) to mine them. Restricting thorium and uranium extraction from monazite would allow private companies to focus on rare earths production.

- Focus on Critical Rare Earths: India has an abundance of light rare earth elements (REEs) like lanthanum and cerium. The initial focus could be on extracting these elements, which are critical for electric vehicle manufacturing and wind turbines.

- Creation of a Department for Rare Earths: Establishing a dedicated Department of Rare Earths (DRE) under the Ministry of Mines would focus on policy formulation, attracting investments, and promoting research and development. It could coordinate with international stakeholders, including Quad countries, to establish strategic reserves.

- Autonomous Regulator: Rare Earth Regulatory Authority of India (RRAI): An autonomous regulator, such as the RRAI, could resolve disputes between companies, regulate production, and ensure compliance with industry standards.

- Reorganize IREL: IREL could be split into two entities. One entity would focus exclusively on thorium extraction under the Department of Atomic Energy, while the other would specialize in rare earth processing under the new DRE.

- Consolidation in Exploration: The National Mineral Exploration Policy (2016) proposes the establishment of the National Centre for Mineral Targeting (NCMT). This would replace the existing fragmented approach to exploration, improving efficiency and output.

- Private Industry Involvement in Processing: To increase domestic supply chains, private industries should be incentivized to build processing facilities beyond the extraction phase. This will help produce higher value-added products, which are crucial for India’s competitiveness in the global market.

- Establish Rare Earth Strategic Reserves: India should establish Strategic Rare Earth Reserves, similar to Strategic Petroleum Reserves. This will ensure consistent supply during global crises and provide a buffer against any future supply disruptions, particularly from China.