Pradhan Mantri MUDRA Yojana Introduction

- On 8 April 2025, India marked a significant milestone with the 10th anniversary of the Pradhan Mantri MUDRA Yojana (PMMY), the flagship initiative launched by the Prime Minister to promote micro-enterprises and small businesses by providing collateral-free loans.

- Over the last decade, PMMY has transformed the landscape of Indian entrepreneurship, empowering millions of individuals in rural and urban areas, especially those with limited access to formal credit systems.

- With over 52 crore loans disbursed and ₹32.61 lakh crore in financial support, PMMY has made entrepreneurship accessible to the masses, facilitating economic growth and job creation at the grassroots level.

Key Features of the MUDRA Scheme

- PMMY is designed to facilitate collateral-free loans for micro-units. The scheme targets entrepreneurs at various stages of business development and is executed by Member Lending Institutions (MLIs), which include Scheduled Commercial Banks (SCBs), Regional Rural Banks (RRBs), Non-Banking Financial Companies (NBFCs), and Micro Finance Institutions (MFIs).

- The loan disbursements are categorized into four segments, each serving different business needs:

| Category | Loan Amount | Target Segment | Share of Total Loans | Key Sectors Funded |

|---|---|---|---|---|

| Shishu | Up to ₹50,000 | First-time entrepreneurs, nano-units | 88% of total loans | Street vendors, tailoring, petty shops, dairy, home-based work |

| Kishore | ₹50,001–₹5 lakh | Small-scale expansion, working capital | 9–10% of total loans | Food stalls, repair shops, beauty parlors, transport |

| Tarun | ₹5–₹10 lakh | Growth-stage small businesses | 2% of total loans | Manufacturing, logistics, services, retail stores |

| Tarun Plus | Loans above ₹10 lakh and up to ₹20 lakh | Designed for successful repayers from the Tarun category | N/A | N/A |

Achievements and Impact of PMMY

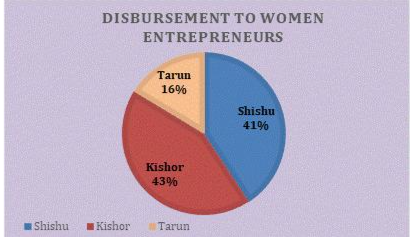

- Women Empowerment through Finance: 68% of PMMY beneficiaries are women. Their average loan size has grown at a 13% CAGR, and their incremental deposits have increased at 14% CAGR, reflecting the rising financial independence and empowerment of women. This financial inclusion has brought more women into the workforce and promoted entrepreneurial activity.

- Inclusive Growth for Marginalized Groups: PMMY has helped integrate marginalized communities into the formal financial system. 50% of the loan accounts are held by SC/ST/OBCs, and 11% by minorities, enabling these communities to engage in entrepreneurial ventures and enhancing economic mobility.

- Shift Towards Growth-Stage Financing: The Kishore loan category (₹50,000–₹5 lakh) saw its share grow from 5.9% in FY16 to 44.7% in FY25, indicating the scaling up of businesses. Similarly, the Tarun loans (₹5–₹10 lakh) are gaining traction, signaling the rising need for growth-stage financing.

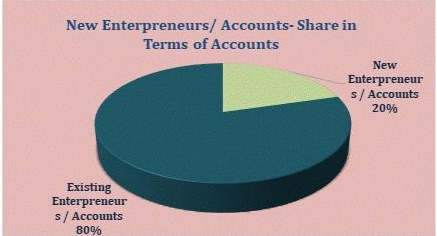

- Massive Outreach and Entrepreneurial Shift: PMMY has disbursed over 52 crore loans worth ₹32.61 lakh crore since its launch in 2015. The scheme has shifted the focus from job-seeking to job-creating, fostering entrepreneurial spirit, especially in small towns and rural India. It has empowered millions of Indians to start their businesses and pursue self-reliance.

- Surge in MSME Credit: There has been a significant rise in credit access for Micro, Small, and Medium Enterprises (MSMEs). MSME credit increased from ₹8.51 lakh crore in FY14 to ₹27.25 lakh crore in FY24. The credit share of MSMEs in total bank lending has risen from 15.8% to nearly 20%, underscoring the role of MSMEs in India’s economic growth.

- Top Performing States and UTs: The leading states in loan disbursements include:

- Tamil Nadu: ₹3.23 lakh crore

- Uttar Pradesh: ₹3.14 lakh crore

- Karnataka: ₹3.02 lakh crore

Jammu & Kashmir leads among Union Territories with ₹45,816 crore disbursed across 21 lakh+ accounts.

- Funding the Unfunded Micro-Sector: Micro-enterprises, which employ 10 crore people, form the backbone of India’s non-corporate sector. PMMY has enabled credit access to this previously excluded sector, fostering livelihoods and enhancing economic mobility.

- Increasing Loan Sizes and Confidence: The average loan size increased from ₹38,000 in FY16 to ₹1.02 lakh in FY25, reflecting growing confidence in entrepreneurship and an improved scale of operations. The 36% growth in loan disbursements in FY23 indicates that the entrepreneurial climate is becoming more vibrant and robust.

Challenges Faced by Micro-Enterprises

- Lack of Growth Orientation: While many loans are extended under the Shishu category (80%), they predominantly support subsistence-level businesses, impeding progress toward scaling. According to a SIDBI study (2023), only 5% of Mudra borrowers have expanded beyond micro-enterprises.

- Skill Development Gaps: Many entrepreneurs lack essential business management, digital, and technical skills. A NSDC Report (2024) highlighted that only 25% of Mudra beneficiaries received formal skill training.

- Policy Advocacy Needs: A lack of awareness about regulatory benefits, such as GST exemptions, limits the utilization of available resources. A CAG Audit (2022) found that 40% of beneficiaries were unaware of GST exemptions for small businesses.

- Market Development Gaps: Without structured market linkages, many entrepreneurs struggle to access organized markets. NITI Aayog (2023) found that only 15% of products financed by Mudra reach organized markets.

- Information Asymmetry: Banks lack real-time, accurate data on borrower credibility, leading to loan rejections. According to TransUnion CIBIL (2024), 35% of rejected loans were due to insufficient credit history.

- Lack of Digital Tools: Only 20% of Mudra-funded businesses utilize digital tools for payment processing, inventory management, and other operations, as reported by Deloitte (2023).

- Access to Finance: Many entrepreneurs face hurdles in obtaining loans due to a lack of collateral, credit history, or banking access. According to the RBI Report (2023), 30% of Mudra loan applications were rejected due to insufficient documentation.

- Infrastructure Gaps: Poor infrastructure, such as inadequate roads, unreliable electricity, and limited digital connectivity, affects business scalability. The World Bank (2022) found that 60% of rural MSMEs suffer from unreliable electricity, hindering their productivity.

Way Forward

- Robust NPA Monitoring: Implement AI-driven early warning systems and community loan circles to improve repayment rates and prevent NPAs.

- Formalization and Tax Incentives: Encouraging Mudra beneficiaries to formalize their businesses and avail of GST benefits by registering under UDYAM and TReDS.

- Stronger Data and Impact Audits: Conducting annual performance audits and using public dashboards to monitor the outcomes of Mudra financing.

- Regional Credit Ecosystems: Empowering District Level Consultative Committees (DLCCs) to become “Credit Ecosystem Hubs” by linking Mudra loans with local Krishi Vigyan Kendras and RSETIs, similar to Kenya’s Huduma Centres.

- From Credit-Linked to Credit-Plus Model: Integrating Mudra loans with initiatives like Skill India, Startup India, and One District One Product (ODOP) to offer mentorship, digital tools, and market linkages, as seen with South Korea’s KOSME.

- Sector-Specific Credit Targets: Setting targeted credit lines for high-potential sectors such as agri-tech, renewable energy, health-tech, and electric vehicles, similar to Germany’s KfW Bank.