India National Critical Minerals Mission Introduction

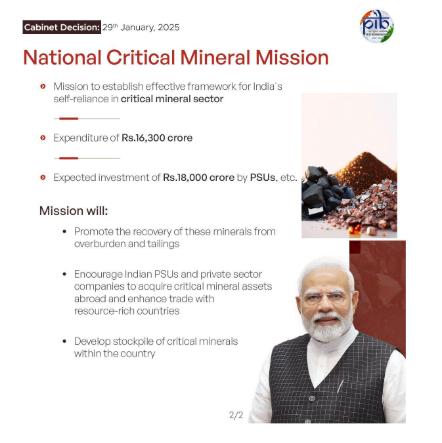

- The Indian government has recently rolled out the National Critical Minerals Mission (NCMM), with an investment of ₹34,300 crore over the next seven years. This forward-thinking initiative aims to boost India’s mineral security, reduce dependence on imported critical minerals, and support the country’s transition to green energy and technology.

- By focusing on domestic exploration, sustainable extraction, and fostering international partnerships, the NCMM is set to transform India’s mineral landscape and pave the way for a greener future.

What are Critical Minerals?

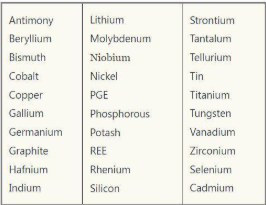

- Critical minerals are those minerals which are essential for economic development and national security.

- The lack of availability of these minerals or even concentration of existence, extraction or processing of these minerals in few geographical locations may lead to supply chain vulnerability and disruption.

- Critical Minerals Identified in India: Thirty Minerals Listed as Critical Minerals for India.

Key Objectives of the National Critical Minerals Mission

- Boosting Domestic Mineral Exploration: A significant portion of the NCMM funds will be directed toward expanding mineral exploration within India. This includes both land-based and offshore efforts to uncover untapped resources. By ramping up exploration activities, India can strengthen its mineral reserves, reducing its reliance on imports and securing resources for future clean energy initiatives.

-

- In recent years, India has made considerable strides in exploration projects. The Geological Survey of India (GSI) launched 368 mineral exploration projects over the past three years. For the fiscal year 2025-26, 227 new exploration projects are planned to be initiated, focusing on critical minerals like lithium and cobalt, which are essential for EV batteries and renewable energy infrastructure.

- As part of its focus on offshore exploration, the NCMM plans to explore regions such as the Indian Ocean and Andaman & Nicobar Islands to identify underutilized mineral deposits.

-

- Reducing Dependence on Imported Critical Minerals: Currently, India imports large quantities of minerals such as lithium, cobalt, nickel, and rare earth elements, which are crucial for industries like electric vehicles (EVs), battery manufacturing, and renewable energy technologies. The NCMM seeks to reduce this dependency by increasing domestic mining and processing, ensuring a consistent supply of these critical materials for India’s growing tech and clean energy sectors.

- India imports nearly 90% of its lithium from countries like Australia, Chile, and Argentina, with the demand for lithium set to grow by 40% over the next decade, as the country shifts towards green energy and electric mobility.

- The government is also pushing for the development of local lithium and nickel mining operations. The Karnataka State Government has recently approved the establishment of a lithium battery manufacturing plant in partnership with private companies. This plant will help meet the surging demand for EV batteries in India.

- Reducing Dependence on Imported Critical Minerals: Currently, India imports large quantities of minerals such as lithium, cobalt, nickel, and rare earth elements, which are crucial for industries like electric vehicles (EVs), battery manufacturing, and renewable energy technologies. The NCMM seeks to reduce this dependency by increasing domestic mining and processing, ensuring a consistent supply of these critical materials for India’s growing tech and clean energy sectors.

- Enhancing Mineral Processing and Recycling: The mission will also focus on developing mineral processing parks and recycling technologies. Encouraging investments in these areas will not only reduce the environmental footprint of mining but also promote a circular economy for critical minerals.

-

-

- Mineral Processing Parks such as the one planned in Chhattisgarh are being established with the aim of processing minerals like nickel and cobalt locally rather than relying on imports. These parks will also serve as hubs for research and development of more sustainable extraction methods.

-

- Encouraging Overseas Mineral Acquisitions: In addition to domestic efforts, the NCMM will encourage public sector enterprises (PSEs) and private companies to acquire mineral assets abroad. Securing mineral resources internationally will provide India with greater stability in its supply chains, helping meet the increasing demand for critical minerals in the global energy transition.

-

- India’s state-owned company NLC India Limited has already acquired mineral assets in Namibia, focusing on resources such as lithium and rare earth elements. This acquisition helps secure supply chains for future green energy projects.

- The Indian government has also signed agreements with countries like Australia and Chile, facilitating joint ventures for mining operations that will help India access the global lithium supply, essential for meeting its EV manufacturing goals.

- Providing Regulatory and Financial Support: The NCMM will streamline regulatory approvals for mining projects to accelerate their development. The government is also offering financial incentives to attract both domestic and foreign investments in the mineral sector. This financial and regulatory support will help foster a conducive environment for the growth of the sector.

Importance of Critical Minerals in Modern Industries

- Their applications span across key sectors:

- Renewable Energy Infrastructure: These minerals are key components in the production of solar panels, wind turbines, and electricity grids.

- Electric Vehicles (EVs): They are essential in making EV batteries and charging infrastructure.

- Electronics & High-Tech Industries: Smartphones, medical devices, and defense equipment all rely on critical minerals for production.

- As the world shifts toward clean energy, the demand for these minerals is increasing rapidly. Securing a stable supply of these materials is vital for India’s economic growth, technological development, and energy security.

Government Strategy and Implementation Plan

-

- The Indian government has committed ₹16,300 crore to fund the NCMM, while an additional ₹18,000 crore will be invested by public sector undertakings (PSUs) and private companies. The success of the mission will depend on effective implementation, which involves the following key measures:

- Expedited Mining Approvals: The NCMM will introduce a fast-track regulatory process for mining projects, reducing bureaucratic delays. This approach will help expedite the development of critical mining assets and streamline the process of obtaining the necessary approvals for mineral exploration.

- Strategic Stockpile Development: A critical element of the mission is the creation of a strategic stockpile of minerals. This stockpile will serve as a buffer, ensuring that India’s clean energy industries are not disrupted by fluctuations in the global mineral market. It will act as a safeguard to maintain the continuity of supply chains during crises or geopolitical conflicts.

- Reforms to Mining Legislation: The Indian government amended the Mines and Minerals (Development and Regulation) Act, 1957 in 2023 to facilitate the auction of 24 strategic mineral blocks. These legislative changes will make it easier for both public and private entities to secure the rights to mine critical minerals in India, speeding up the process and encouraging investment.

- Geological Survey of India (GSI) Exploration Projects: The GSI has undertaken significant exploration work in the past few years, initiating 368 mineral exploration projects. Over the next few years, the GSI plans to launch an additional 227 exploration projects, which will significantly increase the country’s mineral resource base.

- Customs Duty Waivers: To promote domestic processing of critical minerals, the government has removed customs duties on several key minerals in the FY25 budget. This policy will make it more cost-effective for Indian manufacturers to access these materials, reducing their reliance on imports and promoting domestic production of energy technologies.

Impact on India’s Energy Transition

- The NCMM is expected to play a pivotal role in India’s energy transition by ensuring a stable supply of critical minerals, which will support the country’s clean energy goals. Some of the anticipated impacts include:

- Securing Mineral Supply Chains: The mission will help build a robust supply chain for minerals critical to India’s clean energy sector, ensuring that the country can meet the growing demand for electric vehicles and renewable energy technologies. For example, the Geological Survey of India (GSI) has identified potential lithium reserves in the Salem district of Tamil Nadu, which could contribute to the local production of EV batteries, minimizing supply chain vulnerabilities.

- Boosting Domestic Manufacturing: With easier access to critical minerals, India will be able to ramp up the production of EV batteries, solar panels, and other renewable energy components. This will significantly reduce India’s reliance on foreign suppliers and stimulate local industries. According to estimates by the Indian Ministry of Heavy Industries, India’s EV industry could account for a $2.9 billion market by 2025. The Himachal Pradesh Government is already in talks with private companies to set up lithium-ion battery manufacturing units, which will significantly increase India’s capacity to meet EV demand.

- Global Competitiveness: India’s position in the global minerals market will be strengthened, making it a more competitive player in the global supply chain for green energy technologies. In 2023, India secured a mineral asset acquisition deal with Australia’s IGO Ltd., a leading player in the lithium sector. This deal will give India greater control over the supply of lithium, which is vital for the EV industry. It is projected that by 2030, India will account for approximately 15-20% of the global market share for critical minerals, providing India with leverage in international negotiations and trade.

- Attracting Investments: The NCMM’s comprehensive support for mineral exploration, processing, and recycling will attract both foreign and private investments, which will fuel growth in the mining and clean energy sectors.

- In 2024, private firms like Tata Steel and Adani Enterprises announced investments in mineral processing parks and green energy infrastructure within India.

- In 2023, India’s clean energy sector attracted $14 billion in foreign investments, largely due to the country’s commitment to sustainable energy and its growing role in the global mineral market. The NCMM is expected to increase these investments, with expectations for $20 billion in investments by 2025.

- The introduction of financial incentives under the Production Linked Incentive Scheme (PLI) for mineral processing units has already drawn in $1 billion in investments from both domestic and international players, signaling the confidence investors have in India’s mineral sector.

Challenges

-

- Geopolitical Risks: India’s overseas mineral acquisitions could be affected by geopolitical dynamics, such as trade wars or political tensions between countries. The government must carefully navigate international relations to secure stable and reliable access to global mineral resources.

- India’s lithium acquisition deal with Australia’s IGO Ltd. in 2023, which aimed to secure a long-term supply of lithium for EV batteries, could be affected by trade tensions between India and China, which is another key player in the lithium market.

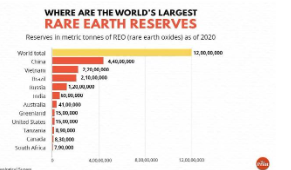

- The ongoing China-Australia trade war has led to unpredictable fluctuations in the supply of minerals, with the prices of rare earth elements skyrocketing due to China’s restricted export policies. In the past, China accounted for about 80% of the world’s production of rare earth elements, which are crucial for renewable energy technologies and high-tech industries.

- Geopolitical Risks: India’s overseas mineral acquisitions could be affected by geopolitical dynamics, such as trade wars or political tensions between countries. The government must carefully navigate international relations to secure stable and reliable access to global mineral resources.

- Environmental Concerns: Mining activities can have a negative impact on the environment. The mission must balance the need for increased mineral extraction with the need to protect India’s natural resources. It will be essential to adopt sustainable mining practices and enforce stringent environmental regulations to minimize ecological damage.

-

-

- The expansion of mining activities in states like Chhattisgarh and Odisha, which have rich deposits of coal and bauxite, could lead to destruction of local ecosystems. In these regions, mining operations have already faced environmental resistance due to concerns about water pollution and loss of forest cover.

- A study by the Centre for Science and Environment (CSE) showed that the mining sector in India contributes to approximately 1.3% of GDP, but it also poses significant environmental risks, including the depletion of groundwater and air pollution in mining areas. For instance, coal mining in Jharkhand has resulted in soil erosion and severe air pollution affecting nearby communities.

-

- Investment Risks: Private sector involvement in the mining and mineral processing sectors requires a stable and supportive policy environment. The government must continue to offer attractive incentives and ensure that regulatory frameworks remain clear and predictable to attract long-term investments.

-

- In 2021, Vedanta Resources expressed its reluctance to invest in Indian mining operations due to uncertainty surrounding land acquisition policies and delayed environmental clearances. Such uncertainties can deter foreign and private investors from committing to large-scale mining and processing projects.

- The World Bank’s 2020 report on investment climate in India highlighted that land acquisition delays and complex regulatory frameworks were among the top factors hindering investment in the country’s mineral sectors.

Way Ahead

-

- Strategic Global Partnerships: India is forging key collaborations with mineral-rich nations such as Africa, Argentina, Australia, and Mongolia. These alliances are essential for securing vital resources that will support the country’s growing energy needs and contribute to its long-term economic growth.

- Targeted Mineral Acquisition: India is focusing on specific regions to access critical minerals:

-

- In Tanzania, India is seeking niobium and graphite.

- In Zimbabwe, efforts are underway to secure lithium.

- In Congo and Zambia, India is negotiating for copper and cobalt, crucial for electric vehicle (EV) batteries and renewable energy technologies.

- Minerals Driving Energy Transition: With the global push towards clean energy, minerals like lithium and cobalt are becoming indispensable for economic development and national security. These minerals are key to powering electric vehicles (EVs), solar panels, and other renewable technologies.

- Supporting India’s Net-Zero Emission Goal: The strategic importance of minerals aligns with India’s commitment to achieving net-zero emissions by 2070. Access to critical minerals is essential for supporting energy transition technologies and helping India meet its ambitious climate targets.