India Digital Public Infrastructure Introduction

- India’s Digital Public Infrastructure (DPI) has quickly become a leading example of digital transformation, receiving widespread praise globally, particularly during the country’s G20 presidency.

- Renowned figures, including Bill Gates, have acknowledged India for its groundbreaking work in building a digital infrastructure that not only fosters economic growth but also tackles key societal challenges.

- India’s DPI is rapidly being recognized as a model for other nations, especially in the Global South, who are looking to replicate this success in their own digital journeys.

- Structured around open-source, interoperable systems, India’s DPI is transforming the way governments and businesses serve their citizens. This article explores India’s DPI journey, its core components, benefits, global recognition, and the challenges and opportunities as it continues to scale globally.

What is India’s Digital Public Infrastructure (DPI)?

- India’s Digital Public Infrastructure (DPI) refers to a comprehensive system designed to promote inclusive development and societal progress using technology.

- According to the “G20 Task Force on Digital Public Infrastructure,” DPI is an infrastructure-based approach that utilizes technology to meet broad societal objectives.

- It aims to create a robust ecosystem that integrates technology, markets, and governance systems in the public interest while fostering private innovation within a regulated framework.

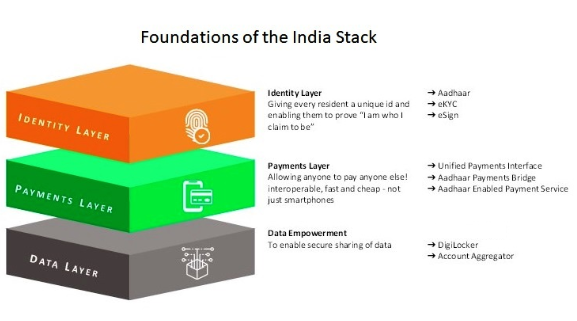

- India’s DPI is built on three foundational layers, collectively referred to as the “India Stack”:

- Identity Layer: This includes Aadhaar, India’s digital identity system, e-KYC (electronic Know Your Customer), and other systems that electronically verify identities.

- Payment Layer: This layer comprises systems like UPI (Unified Payments Interface), Aadhaar Payment Bridge, and other digital payment platforms that facilitate seamless financial transactions.

- Data Governance Layer: This includes platforms such as DigiLocker, which ensures the secure storage and sharing of documents, and the Account Aggregator, which allows users to control and share data securely.

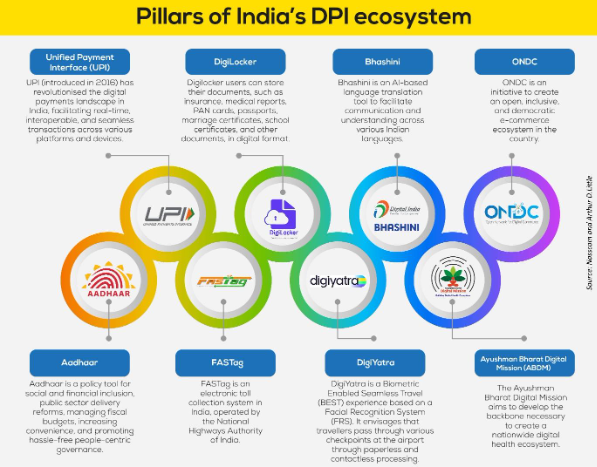

Key Components of India Stack

- India Stack forms the foundation of India’s DPI and consists of several key components that have revolutionized how citizens interact with government services and the private sector. These components include:

- Aadhaar: India’s digital identity system, allowing citizens to access services through a unique identification number.

- UPI (Unified Payments Interface): A real-time payment system that allows for instant bank-to-bank transfers using mobile phones.

- e-KYC: A digital, paperless identity verification solution that streamlines processes and enhances efficiency.

- DigiLocker: A secure digital platform for storing and sharing documents, eliminating the need for paper-based records.

- eSign: An electronic signature system that supports paperless agreements and transactions.

- Data Empowerment and Protection Architecture (DEPA): A framework that enables individuals to control their personal data while securely sharing it with service providers.

The Evolution and Impact of India’s DPI

- Origins and Expansion: India’s DPI journey began in 2009 with the launch of Aadhaar, which laid the groundwork for a nationwide digital identity system. Over time, the initiative expanded, incorporating other vital components such as UPI, the JAM (Jan Dhan Yojana, Aadhaar, and Mobile) trinity, and platforms like Co-WIN, which played an instrumental role in managing India’s COVID-19 vaccination campaign.

- Financial Inclusion Success: India’s DPI has been instrumental in achieving remarkable success in financial inclusion. The Reserve Bank of India reports that India achieved 80% financial inclusion within just six years—a milestone that, according to the Bank for International Settlements, would have taken 47 years without the integration of Aadhaar with financial services and welfare programs.

- Sectoral Impact: Beyond financial inclusion, India’s DPI has had a transformative effect on sectors such as healthcare, education, and sustainability. By enabling digital platforms to provide services in these areas, DPI has improved access to critical resources, especially in rural and underserved regions, leading to enhanced quality of life for millions.

Advantages of India’s DPI

- India’s DPI is characterized by several key features that make it adaptable, scalable, and efficient. These features include:

- Privacy by Design: Privacy is embedded in India’s DPI framework, with measures in place to protect users’ data. Platforms like DigiLocker and the Account Aggregator allow users to retain control over their data, boosting trust in the system.

- Inclusive Design and Universal Access: DPI is built to ensure that all citizens, including marginalized groups like women, rural populations, and people with disabilities, have equitable access to digital services. This design approach has played a critical role in reducing socio-economic disparities.

- Financial Inclusion: India’s Aadhaar-linked financial inclusion efforts, such as the Pradhan Mantri Jan Dhan Yojana (PMJDY), have opened access to banking for millions of previously unbanked citizens, including women in rural areas. As of 2023, over 47% of PMJDY account holders were women, showcasing the success of inclusive digital banking in promoting gender equality.

- Digital Literacy Programs: Initiatives like the National Digital Literacy Mission (NDLM) are aimed at providing digital skills to marginalized groups, including women and rural communities. These programs have trained millions of citizens, empowering them to utilize digital services.

- Accessibility Features: Platforms like Aadhaar and UPI are designed with accessibility in mind. For instance, UPI allows easy digital payments via mobile phones, accessible even to illiterate populations in rural areas. The integration of local languages and voice-based services also makes these platforms more inclusive.

- Cashless Economy: The volume of digital transactions in India continues to rise, with UPI alone processing over ₹126 lakh crore (USD 1.6 trillion) worth of transactions in 2023. These figures demonstrate the success of India’s push towards a cashless economy, with UPI driving over 40% of all digital transactions in India.

- Promotion of Innovation and Transparency: By preventing vendor lock-in and encouraging collaboration, DPI fosters a culture of innovation, transparency, and accountability, contributing to the development of a vibrant digital ecosystem.

- Fintech Startups: The success of UPI has spurred the growth of several fintech startups. For example, PhonePe and Google Pay, which leverage UPI’s open APIs, have created mobile payment platforms that allow users to make peer-to-peer transfers and pay bills seamlessly. These platforms have become integral to India’s digital economy.

- UPI-based Innovations: Many sectors have adopted UPI for innovation, such as in education, where platforms like Razorpay allow students to pay tuition fees online, and in retail, where merchants use UPI to offer cashless payments to customers.

- Blockchain-based Solutions: Innovations in data storage and security, such as the Digital Locker’s blockchain integration, help maintain transparency and security for users’ sensitive documents. These systems create a transparent and secure digital ecosystem for both the public and private sectors.

- Government Transparency: Initiatives like e-Office and e-Governance have made government operations more transparent and efficient. For instance, the Public Financial Management System (PFMS) ensures the transparent disbursement of funds to welfare programs, while Government e-Marketplace (GeM) enables transparent procurement processes, saving the government billions of rupees annually.

- Open Source and Open APIs: The open-source nature of India’s DPI ensures transparency and continuous improvement, while open APIs allow third-party developers to create innovative solutions that benefit multiple sectors.

- India Stack: The India Stack, a set of open-source APIs, includes key systems such as Aadhaar, UPI, and e-KYC. These APIs enable developers to create new solutions that integrate seamlessly with the government infrastructure. For instance, Bharat Interface for Money (BHIM) is an app that integrates UPI, enabling users to make payments using their Aadhaar-linked numbers.

- Open Government Data: The Open Government Data Platform provides access to government datasets, promoting transparency and enabling innovation. This has facilitated the development of applications in sectors such as agriculture, education, and urban planning. For instance, the Maharashtra government’s crop insurance app uses open government data to help farmers track their insurance claims.

- Interoperability: DPI’s emphasis on interoperability ensures that various systems can work together seamlessly, facilitating integration across both public and private sectors.

- Aadhaar and Welfare Integration: The integration of Aadhaar with government welfare schemes such as Direct Benefit Transfers (DBT) has ensured that subsidies, pensions, and other benefits are efficiently transferred directly to the beneficiaries’ bank accounts. This eliminates middlemen and reduces leakages, increasing transparency in welfare distribution.

- Health and Education: Platforms like Co-WIN (used for COVID-19 vaccinations) and DigiLocker allow for the sharing of documents and health data between institutions. Co-WIN’s integration with Aadhaar ensured that vaccination records were authenticated and stored securely, making it easier for citizens to access their vaccination status and get their booster doses.

Global Recognition

- International Adoption: India’s DPI has gained momentum globally, with countries such as Armenia, Sierra Leone, Suriname, and Mauritius signing Memorandums of Understanding (MoUs) to adopt India’s DPI at no cost, with open-source access. This international expansion underscores the growing influence of India’s digital framework.

- Support from Developed Nations: While initially met with skepticism, India’s DPI has gradually garnered support from developed nations.

- In 2021, the Quad (India, Japan, Australia, and the United States) included the promotion of open, transparent, and interoperable digital infrastructures in their joint statement, recognizing India’s DPI as a model for global digital governance.

- UN Global Digital Compact: In 2023, the United Nations recognized India’s DPI as a critical component of its Global Digital Compact. As part of its commitment to inclusive digital growth, the UN Educational, Scientific, and Cultural Organization (UNESCO) and the UN Development Programme (UNDP) have also acknowledged India’s efforts in developing its DPI.

- Global Recognition: India’s DPI model has earned global recognition, particularly during its G20 presidency. The G20 Declaration issued during the summit specifically highlighted India’s UPI model as a crucial tool for enhancing digital financial services in developing countries.

- Countries like France and Germany have lauded platforms like UPI, while many developing nations, especially low- and middle-income countries (LMICs), have shown keen interest in adopting India’s model to boost their own digital economies.

- India shared its success stories in utilizing Aadhaar for public welfare programs, noting that over 80% of India’s population is now linked to Aadhaar, facilitating access to social security, healthcare, and banking services.

- DPI as a Service (DaaS): India also introduced the “DaaS” (Digital Public Infrastructure as a Service) model during the G20, making India’s DPI components—such as Aadhaar, UPI, and e-KYC—available to smaller nations with limited technical resources.

- India’s partnership with cloud hyperscalers like Amazon Web Services and Google Cloud to deliver DaaS solutions was presented as an efficient way to help other countries quickly build their own digital infrastructure.

- Bhutan, a close partner of India, has adopted DaaS to integrate Aadhaar and UPI into its own payment systems, improving financial inclusion and digital services.

Challenges in Globalizing India’s DPI

- Deployment Complexity: DPI systems like Aadhaar, UPI, and DigiLocker require seamless coordination among various ministries and government departments to ensure that they work together effectively. For example, the Aadhaar project in India involved the coordination of the Unique Identification Authority of India (UIDAI) with the Ministry of Finance, Ministry of Health, and Ministry of Welfare, among others. Managing such coordination across multiple departments and ensuring alignment with national policies and priorities can be difficult for countries with less-developed administrative structures.

- For instance, Sierra Leone, after signing an MoU with India, is working to implement a digital identity system similar to Aadhaar, but the lack of strong administrative systems and a cohesive strategy for cross-departmental collaboration makes the rollout slow and difficult.

- Global Governance and Privacy: A global governance framework and standardized regulations are needed to ensure smooth DPI adoption and to address concerns regarding data protection and privacy. While privacy is a fundamental aspect of India’s DPI, addressing global privacy concerns will require international collaboration.

- In Mauritius, which adopted UPI for digital payments, the integration of UPI with local banks faced technical delays.

- Nationwide Rollout: Deploying DPI solutions requires significant infrastructure investment and capacity building. India’s Aadhaar system, for example, took over a decade to fully implement, and it faced challenges related to rural outreach, technology adoption, and user acceptance.

- For instance, Armenia signed an MoU with India to adopt aspects of the DPI model. However, the country’s low internet penetration (only 64% of the population had internet access in 2023) and a lack of trained professionals to manage large-scale data systems have slowed the implementation of Aadhaar-like digital identity systems.

- Digital Literacy: The success of DPI in India also relies heavily on the digital literacy of its population. In countries with low levels of internet literacy, such as many African nations, the widespread use of systems like UPI or e-KYC may face significant adoption challenges.

- Health and Education Systems Integration: India’s DPI includes platforms like Co-WIN (for vaccination) and DigiLocker (for document storage). These platforms must be integrated with local health systems, which can be complicated if the country does not have modern health and education infrastructures in place. In Mauritius, the integration of DigiLocker for digital document storage has faced hurdles, as local administrative systems were not initially designed to handle the secure, cloud-based storage of sensitive data.

Way Forward for DPI’s Global Expansion

- Building Trust & Confidence: Establish trust through transparent, inclusive processes that engage international partners in DPI development.

- Adaptation & Customization: Customize DPI solutions to meet the unique needs of different regions, considering local governance and cultural contexts.

- Leveraging Technology: Use cutting-edge technologies such as AI, blockchain, and big data to enhance the functionality and efficiency of DPI systems.

- Global South Focus: Strengthen partnerships and foster knowledge-sharing with developing countries facing similar challenges.

- Leadership & Collaboration: Promote India’s leadership role in DPI development and encourage international cooperation.

- Democratic Governance: Ensure that DPI development is aligned with democratic principles, safeguarding human rights and ensuring equitable development.

- Public-Private Partnerships: Encourage strong collaboration between the public and private sectors to drive innovation and accelerate the adoption of DPI solutions.

- Inclusive & Equitable Development: Ensure that DPI adoption benefits all segments of society, especially marginalized and vulnerable populations.

- Open Standards & Interoperability: Advocate for open standards to ensure seamless integration and scalability across borders.