Introduction

- Union Minister for Textiles, Giriraj Singh, recently announced that India’s textile and apparel sector is targeting $350 billion in annual business by 2030, which could create 3.5 crore jobs.

- However, the industry has faced challenges over the last two financial years, raising concerns about achieving a 10% compound annual growth rate (CAGR).

- India’s textile sector, valued at approximately $60 billion, is currently grappling with significant challenges. Key textile hubs, including Ludhiana, Surat, and Erode, are facing severe impacts due to increasing imports of man-made fiber (MMF) fabrics.

- These imports are perceived as large-scale dumping, which adversely affects the domestic textile industry.

- The influx of MMF fabrics from international markets is creating intense competition and putting pressure on local manufacturers, further complicating the sector’s efforts to maintain growth and profitability.

Importance of the Textile Sector in India

Production of Raw Material:

- India is a global leader in cotton production, holding a 25% share of the market.

- It ranks as the second-largest producer of synthetic fibers, including polyester and viscose.

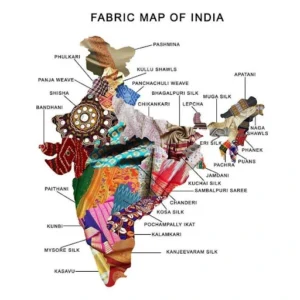

- India is also the 2nd largest producer of silk in the world and 95% of the world’s hand-woven fabric comes from India.

- The share of textile and apparel (T&A) including handicrafts in India’s total merchandise exports stood at a significant 10.5% in 2021-22.

Integrated Value Chain:

-

- The textile sector benefits from a comprehensive value chain that includes everything from fiber production to garment manufacturing within India.

Employment Generation:

-

- The sector is a major employer, directly providing jobs to 45 million people and supporting an additional 60 million in related industries.

- It ranks just behind agriculture in terms of employment.

- It is estimated that the jute industry provides direct employment to 40 lakh farm families in the agriculture, 2 lakh workers in organised mills, 2 lakh in value added diversification and 3 lakh in Tertiary and allied sectors.

- The Handloom Sector is one of the largest unorganized economic activities of India and it constitutes an integral part of the rural and semirural livelihood engaging over 35 lakh persons.

Economic Importance:

-

- India is the world’s second-largest producer and exporter of textiles and apparel.

- The sector contributes 5% to global trade and adds 7% to India’s manufacturing output.

- It accounts for 2% of India’s GDP and 12% of its exports, with a value of $40 billion.

Preserving Heritage:

-

- Initiatives like the revival of Varanasi handloom weaving help protect cultural traditions and sustain over 4.3 million jobs.

- India is the second largest producer of silk in the world and also the largest consumer. Nevertheless, India is the only country, which is producing all the four commercial varieties of silk, namely Mulberry, Tropical & Oak Tasar, Muga and Eri.

Providing Innovation:

-

- The sector is advancing in smart textiles for healthcare, with a market expected to reach $5.55 billion, demonstrating its commitment to innovation.

Boost to Related Industries:

-

- The growth in textile machinery manufacturing in India, projected to expand at a CAGR of 8% from 2019 to 2024, reflects the broader economic impact of the textile sector.

Read also: National Testing Agency (NTA)- Functions & Challenges | UPSC

Challenges in the Textile Sector

Tax:

- The imposition of a 10% import duty on cotton has made Indian cotton more expensive compared to international prices.

- The industry is repeatedly demanding removal of the import duty on cotton at least during the off-season months of April to October.

Lack of Economies of Scale:

-

- India excels in spinning but lags in weaving and apparel production.

- The average number of machines per unit in India is 100, compared to 500 in Bangladesh, affecting production efficiency.

Raw Material Availability:

-

- Variability in monsoon affects rainfed crop areas, impacting jute production.

- Competitive pricing from other crops and Minimum Support Prices (MSP) discourage jute cultivation.

Quality Challenges:

-

- Issues with fiber contamination and quality are prevalent.

- Pest attacks, such as bollworm on cotton, further compromise fiber quality.

Outdated Technology:

-

- The weaving sector is predominantly unorganized, with outdated technology.

- There is low productivity and minimal focus on research and innovation, with India holding only a 2% global share in shuttleless looms.

Declining Exports:

-

- Textile exports have decreased from 15% of India’s total exports in FY16 to 12% in FY19.

- India is falling behind competitors like Bangladesh, Vietnam, and Cambodia in export performance.

Stalled Trade Agreements:

-

- Progress in Free Trade Agreements (FTAs) with key markets such as the EU, Australia, and the USA has been hindered.

- Competitors benefit from duty-free arrangements, limiting India’s market access.

Global Competition:

-

- China: Dominates with a 51% share in cotton fabrics, compared to India’s 5-6%.

- Bangladesh: Enjoys competitive advantages due to duty-free status and China’s elimination of tariffs on many products, boosting its apparel exports.

- Vietnam: Has emerged as a strong competitor with an FTA with the EU and a growing share in cotton yarn exports, posing a significant challenge in the apparel sector.

QSOs:

-

- In the case of MMF, introduction of quality control orders (QSO) has disturbed raw material availability and price stability.

- The government has introduced QCOs on polyester raw materials, polyester fibre and yarn, and viscose fibre, making Bureau of Indian Standards (BIS) certification mandatory for these products, even if they are imported. The problem is that mill that small-scale mill owners cannot spend lakhs on testing.

E-commerce:

-

- The textile industry is facing disruptions in traditional business models.

- E-commerce is gaining popularity among garment and home textile manufacturers, with more startups entering the space.

- A report by Wazir Advisors highlights that foreign brands are prioritizing ESG sustainability in their supply chains and seeking vendors that meet these standards.

- There is also growing demand for comfort wear, loungewear, and athleisure.

- In the domestic market, rural and semi-urban consumers increasingly prefer shopping at multi-brand outlets or hypermarkets over lesser-known brand stores.

Government Initiatives in the Textile Sector

Production-Linked Incentive (PLI) Scheme:

-

- Objective: Aims to boost investment, productivity, quality, employment, and exports in the textile sector.

- Financial Allocation: Rs. 10,683 crore (US$ 1.44 billion) is allotted over a five-year period specifically for the development of manmade fibers and technical textiles.

Foreign Direct Investment (FDI):

-

- Policy: 100% FDI is allowed under the automatic route in the textile sector, facilitating foreign investment and enhancing growth.

National Handloom Development Program:

-

- Objective: Adopts a need-based approach to promote the comprehensive development of handlooms and improve the welfare of weavers.

Amended Technology Upgradation Fund Scheme (ATUFS):

-

- Objective: Supports technology upgrades in the textile sector, focusing on enhancing the efficiency and competitiveness of textile manufacturing.

Scheme of Fund for Regeneration of Traditional Industries (SFURTI):

-

- Objective: Provides financial backing to establish clusters in traditional industries such as Khadi, Coir, and village industries, aiming to revitalize and modernize traditional textile industries.

Scheme for Capacity Building in Textile Sector (SAMARTH):

-

- Objective: Focuses on skilling the youth for sustainable employment across various textile sectors, excluding spinning and weaving.

- Yarn Bank Scheme: Part of the broader PowerTex India initiative, it helps mitigate fluctuations in yarn prices.

Power Tax India:

-

- Objective: Targets the growth of the textile sector through a Yarn Bank Scheme and other supportive measures.

- Focus: Establishes centers of excellence to provide infrastructural support for the technical textiles sector.

Solar Charkha Mission:

-

- Objective: An enterprise-led scheme aiming to create ‘Solar Charkha Clusters’ that benefit a wide range of artisans including spinners, weavers, and stitchers. This initiative promotes sustainable and eco-friendly practices within the traditional handloom sector.

PM- MITRA Parks:

-

- They are envisaged to help India in achieving the United Nations Sustainable Development Goal 9 (“Build resilient infrastructure, promote sustainable industrialization and foster innovation”).

- The scheme is to develop integrated large scale and modern industrial infrastructure facility for entire value-chain of the textile industry. It will reduce logistics costs and improve competitiveness of Indian Textiles.

Read also: Jio Financial Services Ltd (JFSL) share price hits 5% lower circuit after muted listing

Way Forward

Strategic Export Promotion via FTAs:

-

- Objective: Leverage the ‘Atmanirbhar Bharat’ initiative to develop balanced trade policies and sign Free Trade Agreements (FTAs).

- Impact: Each $1 billion increase in textile exports can generate approximately 150,000 jobs, emphasizing the potential for job creation through export growth.

Capacity Building:

-

- Focus: Strengthen the weaving industry to boost the domestic spinning sector and enhance the global competitiveness of the Indian garment industry.

Technological Development:

-

- Initiative: Under the Amended Technology Upgradation Funds Scheme (ATUFS), prioritize capital subsidies for the weaving sector.

- Goal: Transform the weaving sector, aligning it with advancements in garmenting and technical textiles.

Empowering Cooperatives:

-

- Objective: Promote cooperative societies in regions with high concentrations of handloom weavers.

- Impact: Strengthen rural and semi-urban textile communities, enhancing their economic stability and growth.

Diversifying Textile Products:

-

- Observation: The COVID-19 pandemic demonstrated the sector’s adaptability, with firms producing personal protective equipment worth ₹10,000 crore from scratch.

- Recommendation: Further promote technical textiles to diversify and strengthen the sector.

Sustainability and Eco-friendly Practices:

-

- Focus: Emphasize sustainable practices, such as organic cotton cultivation.

- Benefits: Reduce environmental impact and cater to the growing global demand for eco-friendly products.

Leveraging Digital Platforms:

-

- Opportunity: Utilize digital platforms for marketing and sales.

- Example: The rise in online retail during the pandemic shows the potential for accessing new global markets for Indian textiles.

Skill Development Programs:

-

- Investment: Invest in skill development, particularly in advanced textile technologies.

- Objective: Ensure a skilled workforce capable of operating high-tech machinery and adapting to evolving industry trends.

Market Research and Consumer Insights:

-

- Approach: Conduct thorough market research to understand global trends and consumer preferences.

- Goal: Develop products that meet international standards and cater to global tastes.

Collaborations and Partnerships:

-

- Strategy: Encourage public-private partnerships for research and development (R&D) and innovation in textiles.

- Potential: Similar to successes in the pharmaceutical industry, such collaborations can lead to breakthroughs in textile technology and products.